Homebuilding

Firms May Be More Resilient Now Than in '06 ... It's Not Just Money

Smarter debt and more patient capital is just one of the ways homebuilders on our radar have braced themselves for a correction. They've also committed to and invested in process and practices that move them closer to customers.

Housing's news cycle runs fast and furious.

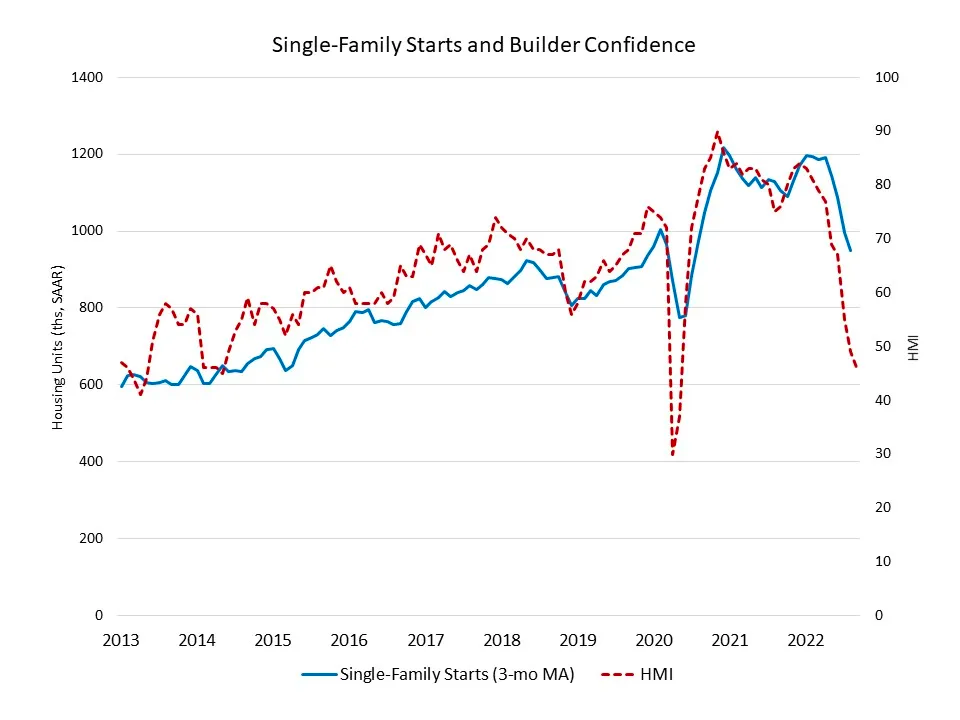

This morning, the Census Bureau released residential starts, permits, and completions data for August, reflecting an ongoing run of declines in new single-family construction.

Insight and analysis about the raft of causes for declines in housing production activity since late Winter are everywhere, as everyone's an expert. After tomorrow's pronouncement from the Fed of its next funds rate increase, expect noisy speculation to reach and remain high decibel levels. The Fed's intended consequence – 2% inflation or thereabouts – will come, no doubt with unintended ones, including jobs destruction at levels not seen since GFC days, which takes on a life of its own. But, again, everybody's an expert. I've met almost no one in the business who's not at least as smart if not smarter than the entire Federal Reserve Bank ecosystem with their mountains of data and reams of monetary and fiscal policy analysis.

The point is this.

At a high level, America's 2022 cost-of-living crisis – and what looks to be an enormous hurt it will take the central bank to end it -- is the third major upending of supply-demand dynamics within 36 months. Covid-19 circa March 2020 was the first. Construction's supply-chain meltdown circa January 2021 was the second.

This 2022 demand pivot due to inflation and interest rate fragility and the ensuing production and pricing corrections now playing out is No. 3 in the series. This means that although the current upheaval comes with its own brand of pain – lower valuations and higher financial risk – builders have by and large better prepared for these convulsions.

- There's less debt and less land on their "de-risked" balance sheets

- The terms on the debt they do hold – rates and maturities – are mostly more patient, which means lower levels of distress in the near-term

- Further, historically high gross and net margins achieved virtually through mid-year allow for wiggle-room to cut ASPs and still stay in the black

- Lastly, far fewer builders indulged in reckless "yachts and private jets" activity this time than the last (2002 through 2006), which means personal financial exposure levels are generally lower.

So, from a capital structural standpoint, homebuilding businesses today have fused far more resiliency and durability into their coffers than their 15 year-ago iterations and forebears.

What it's impossible to know is exactly how much the "pain" Fed chief Jerome Powell refers to – when he speaks about the collateral harm both the next Fed funds rate increase and the subsequent trajectory and duration of policy moves to curb causes and expectations of inflation – will inflict hurt on homebuilders' businesses.

As a collective, they're less valuable today than they were six months ago. Six months from now, will the average homebuilding business still be losing value in its land assets and homes under construction? Likely, existential challenges – at least for some percentage of privately-held homebuilders – will extend through 2023. The main reason for that lies at the core of most of their businesses.

Timing – long term-valued assets financed with shorter-term maturing debt.

That being said, what's getting too little attention during this period of macro market deterioration are some of the ways – beyond capital resiliency and somewhat more cautious speculative land-buying – going concerns bring operational capital to bear for challenges this time around.

Some of this becomes evident in wider adoption of processes that narrow the distances – operationally – between what it takes a firm to build a home and the customers meant to buy a home.

The BDX INsights Summit in Austin last week reflected a meaningful inflection point in builders operations – profoundly different than the ways organizations siloed operational groups and – on par – distanced themselves from direct relationship building and learning from customers 15 years ago.

In the same meeting rooms, corridors, and conversations were operational stakeholders in sales, marketing, construction operations, ERP, technology, design centers, IT, model home merchandising, and architecture.

The rooms exemplified what one top 50 private regional homebuilding founder and ceo once expressed this way:

Some day, I'd like to see us as homebuilders get out of our own way with our systems and processes and operations, and truly put the customer at the center of our universe."

Many of the homebuilding firms on our radar have done a lot of work, and had two prior upheavals – Covid's arrival and the supply-chain meltdown – to prepare their balance sheets and capital resiliency for heavier weather.

However, beyond that financial capital resiliency, they've also committed to and invested in operational fitness that make this time around a different prospect. Yes, they have to jump on a relearning curve in sales practices and management, but at least they've got a jump start on the cultural transformation it takes to put customers at the center of their business models rather than at the tail end of a production, manufacturing, and retail process.

Join the conversation

MORE IN Homebuilding

A $33 Million A&D Loan Propels A 494-Home NJ Deal Into High Gear

This transaction, particularly during economic turbulence and constrained traditional credit, underscores the resilience and adaptability required to navigate the current market conditions.

Risky Business: How Trust Can Offset Angst Buying A New Home

For new-home buyers – especially those experiencing the rite of passage into homeownership for the first time – trust and risk are entangled in a present full of uncertainty and volatility.

United Homes Group Strikes Again On The Red Hot Southeastern M&A Front

UHG's purchase of Coastal Carolina's Creekside Custom Homes will catapult it into the top three or four positions in a top-25 U.S. market for new home development and construction.