Capital

Expected Squeeze On Banks Tightens Credit Access For All

A "tighter-for-longer" credit and lending regime may – with an uneven-handed impact – unwind some of those benign forces pulling would-be homebuyers into the new-home demand pool, and turn them negative.

A "higher-for-longer" interest rate regime – surprisingly – wound up acting as a benign force-factor for new-home demand.

A "tighter-for-longer" credit and lending regime may – with an un-even-handed impact – unwind some of those benign forces pulling would-be homebuyers into the new-home demand pool, and turn them negative.

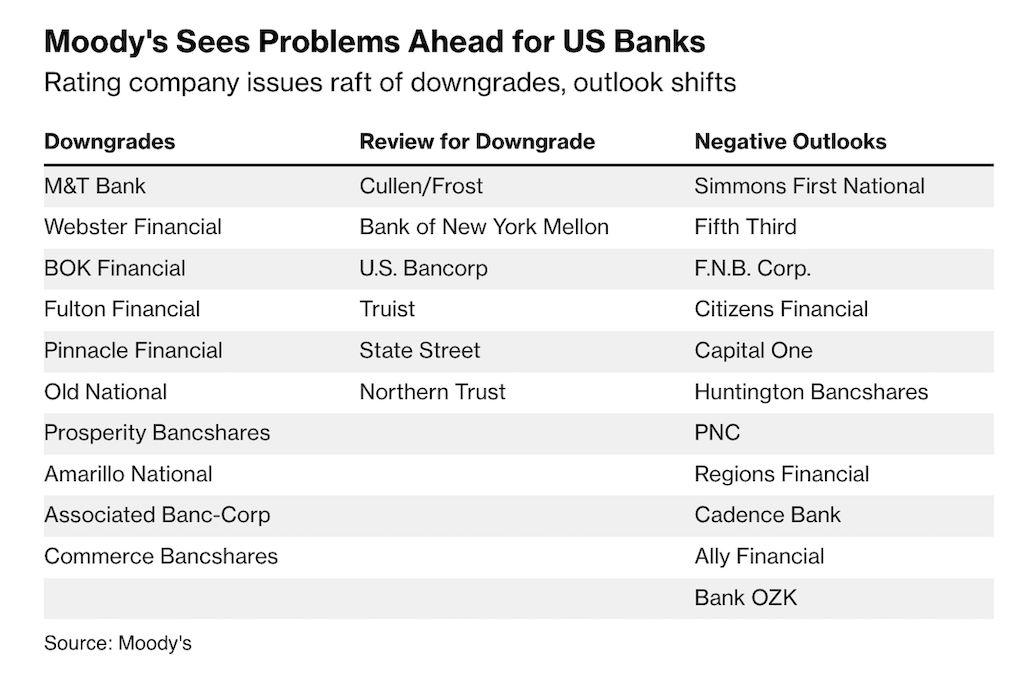

A Moody's downgrade to the debt ratings of 10 U.S. lenders and a nod toward further downgrades of an even more materially important cohort of small and midsized banks means different things for different banks, with different consequences for different customers of those banks – both builders and home mortgage borrowers.

Higher funding costs, potential regulatory capital weaknesses and rising risks tied to commercial real estate are among strains prompting the review, Moody’s said late Monday.

“Collectively, these three developments have lowered the credit profile of a number of US banks, though not all banks equally,” the rating company said." – Hari Govind and Steve Dickson, Bloomberg

Tighter credit conditions have already begun to impact builders, particularly privately held operators the lion's share of whose operating, project financing, and acquisition and development capital draws from regional banks and private capital sources.

A senior level executive from one of the nation's leading residential real estate and construction lenders noted recently that even some of the larger private, multi-regional homebuilders' access to syndicated loan capital may be impacted, as some lender participants choose not to renew for another cycle, and some drop out altogether due to tighter regulatory screws and their own re-sets on the value of deposits, loans, costs, and income.

If the builder is unable to renew or replace a lender who's dropped out of the syndication group, it can put the entire line into limbo for the builder, so there's a lot of nervousness out there about how this will roll forward," this senior-level financial services executive says.

Loan officer surveys analyzed by the National Association of Home Builders have reflected tighter credit conditions and disruptions that trace back to the failure this past Spring of several major regional banks, stemming from the rapid negative shifts to their debt costs, vs. the value of their deposits, vs. their loan liabilities once the Fed sprinted upward with its funds rate.

For bank lending activity over the second quarter of 2023—banks reported that lending standards tightened for all residential real estate (RRE) and commercial real estate (CRE) loan categories. Demand for RRE and CRE loans weakened across all categories over the quarter.

Moreover, banks expect their lending standards across all loan categories to tighten further over the second half of 2023. Expectations of more tightening were fueled by increased economic uncertainty and an expected deterioration of collateral values and credit quality of existing loans according to respondents." David Logan, NAHB Eye On Housing

While these measures primarily impact homebuilders needing access to new loans, many of them continue to work with credit and debt lines secured during a far more favorable borrowing environment. So, many such builders will look to shore up their own cash- and margin-generating monetization of current assets, as they strategize and jockey for new opportunities to revenue-finance nearer term growth while they wait for easing of credit and new capital access terms during a more accommodative credit and interest rate combination.

At the same time, however, homebuyer borrowers are finding the turf tougher-going as regional small-, mid-size, and even larger banks try to muddle through the shocks of risk-reserve resets, higher-priced deposit business, commercial office real estate distress, and greater regulatory pressure.

As if higher mortgage rates weren’t enough, it was harder even to qualify for a mortgage in July than it has been in a decade, according to the Mortgage Bankers Association.

Its monthly index measuring credit availability dropped in July to the lowest level since 2013, indicating that lending standards are tightening even further

While availability for all loan types dropped, the component of the index for jumbo loans decreased the most, as banks face increasing liquidity issues. Jumbo loans cannot be sold to Fannie Mae and Freddie Mac, so they are usually held on bank balance sheets." Diana Olick, CNBC

Credit tightening on the commercial side will have greater implications and negative consequences – especially in the vacant developed lot sweepstakes setting up to be a highly competitive scrum in many markets where builders want to ignite growth and earnings in 2024 and beyond – for private homebuilding operators than the publics, since public homebuilding enterprises avail of deep and smoothed access to capital investors in their equity and debt.

A higher- more constrained "credit box" for mortgage borrowers impacts both private and public homebuilders. Privately capitalized operators, that means, get a double-whammy blow to both their capacity to expand supply and their continued confidence in growing demand.

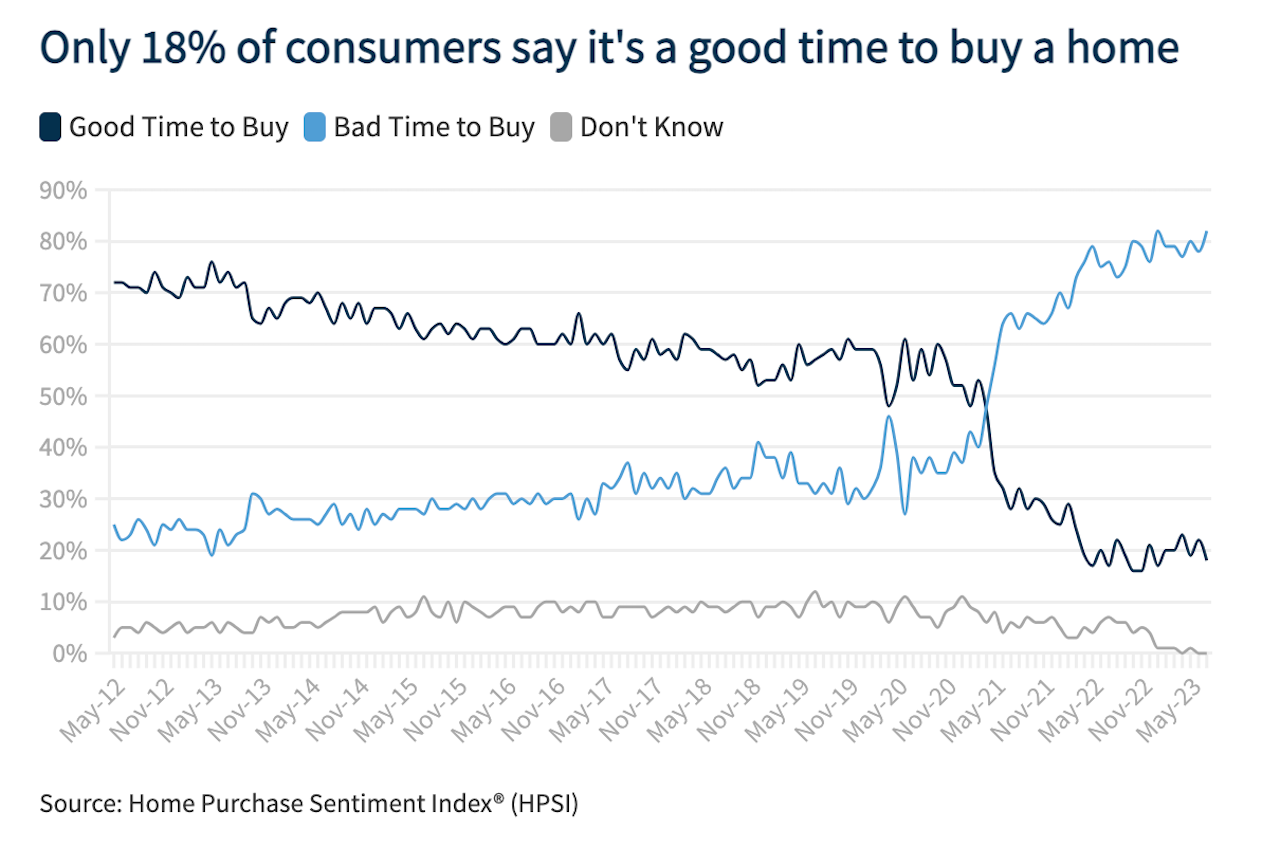

A less-than-encouraging measure on the demand front – Fannie Mae's Home Purchase Sentiment Index – indicates that

82% of consumers reported that it’s a “bad time to buy” a home, a new survey high and up from 78% in June. – Fannie Mae

With interest rates "higher-for-longer" and mortgage credit "tighter-for-longer," pricing in prospective homebuyers – especially first-time buyers – becomes a stiffer challenge.

Homebuying sentiment once again matched its all-time low, with only 18% telling us that it's a good time to buy a home. Unsurprisingly, consumers continue to attribute the challenging conditions to high home prices and unfavorable mortgage rates. Further, the share of consumers expecting home prices to continue to rise has also been on a steady climb since March, which may only add to perceptions of unaffordability. Additionally, we have not seen much movement in the ‘good time to sell’ component over the last few months, an indication that the current low levels of existing homes for sale will likely continue to persist in the near term, as also reflected in our latest forecast.” Doug Duncan, chief economist, Fannie Mae

MORE IN Capital

Impact Fees And The Missing Math That Puts Deals At Risk

Builders and developers are recalibrating every line item in the deal stack—but often overlook the 2nd-largest cost: jurisdictional fees. Carter Froelich unpacks how better modeling and collaboration on impact fees, hook-ups, and builder credits can expand land residual value.

Capital, Time, and Trade-Offs: New Realities of Builder Growth

Private builders can still scale, but not on yesterday’s formulas. Scott Cox details the pitfalls of institutional capital, the “too many hands in the cookie jar” problem, and how land partnerships, fee-building, and market positioning offer viable paths forward.

Cushman Warns Cities: Convert Offices Or Face Growing Crisis

Downtowns overweighted in office space face falling values and shrinking tax bases. Swift conversions to housing and mixed-use are essential to prevent fiscal and social decline.