Capital

Even As Builders Nod To More Headwinds, They're Upbeat

Which builders' capability gives them a lead in the race with time? Which will get left behind? Everybody doesn't win this time.

Sometimes the challenge we'd rather have than its opposite is actually that opposite challenge in disguise.

Put another way, homebuilders, any day, would rather deal with a pressure-cooker of demand they're having problems keeping up with, than to have plenty of capacity to meet demand squeezed down to a trickle.

These seem like either-or conditions. But life and the dismal science of economics are messier than that. Sometimes not meeting demand increases the odds of that demand funneling – from frustration, from shifting household "real wage" wherewithal variables, from tighter lending conditions, etc. – into radio silent, on-paper demand that's now gone dark. Phantom demand.

Then the problem builders would rather have morphs suddenly into the one they preferred not to find themselves up against.

Hindsight is 20/2o and we're well shy of the luxury of knowing how a serious dark cloud of inflation, a tighter money supply, a war, and at least some measure of unfinished business for the COVID-19 pandemic might together conspire to disrupt what looks, feels, and acts like a demand stream that won't quit.

No one can say whether the so-called gathering headwinds will seriously wallop 150 million-plus Millennial and Baby Boomer households making a decisive housing preference move over the next 12 months to eight years, for any number of a dozen valid reasons.

What's coming clear though is that whoever can seize a capability edge – that is, a competitive advantage in the relentlessly challenging start-to-completion cycle – has less risk exposure to the whipsaw of impacts on demand. And the rest, well, shoulder more of that risk exposure.

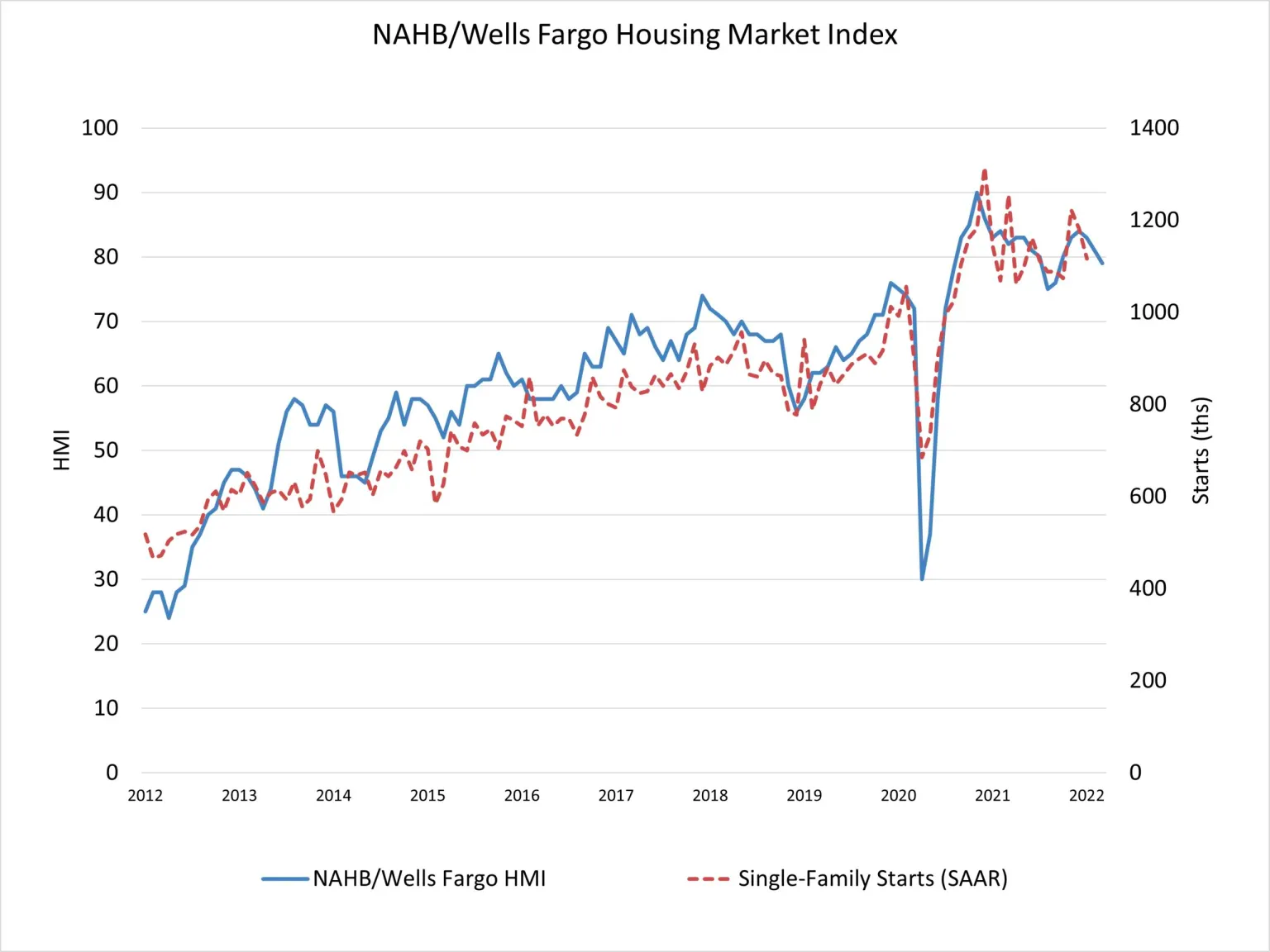

This past month's cull of homebuilder sentiment, a homebuilders blinked as they looked forward.

Peering past the swiftly delivered price shocks, the spinning plates, the inertial supply traps, and the moving targets of inflationary spasms, a Fed monetary policy highwire act, pandemic ripples, and a global Black Swan humanitarian horror-story unfolding in Ukraine, a consensus of builders gut-checked their forecasts, and recognized, "something's got to give."

Not much, mind you. Maybe a bit of a trim around the edges.

Commentary from National Association of Home Builders chief economist Robert Dietz characterized the outlook describing builders own sales expectations for six months from now as a "whopping" fall-off, from an index of 80 to 70. Nevermind, that any index over 50 reflects more builders feel positive about conditions, versus negative.

So, a 70 suggests that, although the nod to "something's-got-to-give" factor dims unbridled irrational exuberance regarding risk to demand, the bottom-line optimism ranges far, far above the cautious level.

As best builders can – with their ears to the ground and their algorithms of price and pace still feeding a stream of data that supports a constructive view that they continue to face the challenge they're rather contend with: constraint to their ability to meet demand.

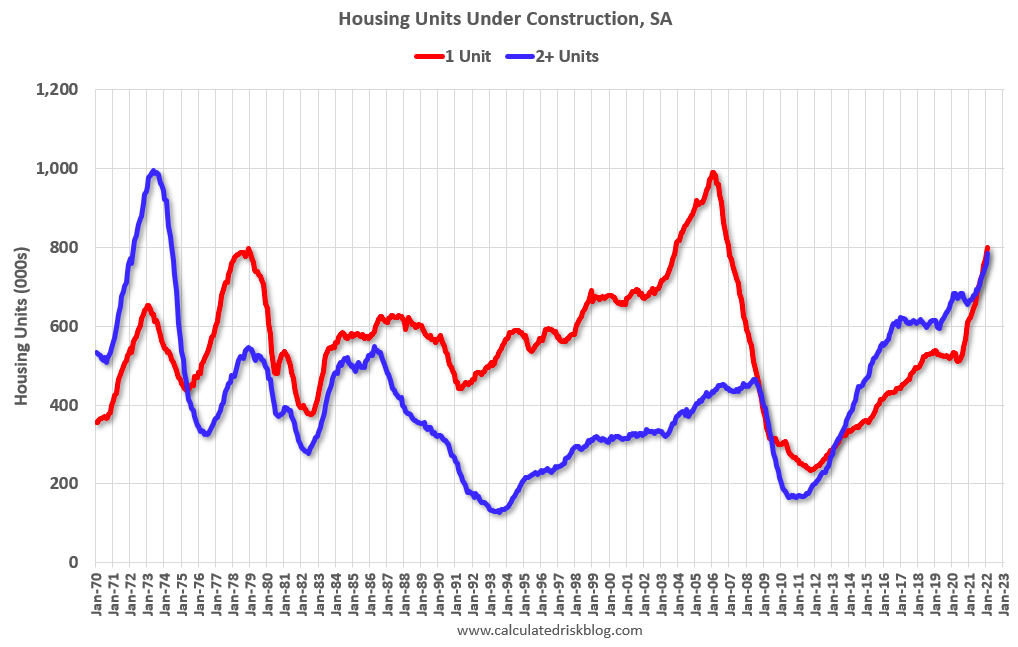

Calculated Risk's Bill McBride zeroes in on a gauge of that challenge, commenting on this chart:

Currently there are 799 thousand single family units under construction (SA). This is the highest level since December 2006.

For single family, many of these homes are already sold (Census counts sales when contract is signed). The reason there are so many homes is probably due to construction delays. Since many of these are already sold, it is unlikely this is “overbuilding”, or that this will impact prices (although the buyers will be moving out of their current home or apartment once these homes are completed).

Blue is for 2+ units. Currently there are 784 thousand multi-family units under construction. This is the highest level since June 1974! For multi-family, construction delays are probably also a factor. The completion of these units should help with rent pressure.

Combined, there are 1.583 million units under construction. This is the most since August 1973.

The inflection point – where the [low inventory-high demand] problem homebuilders would rather have tips into the problem they'd really rather not encounter [inventory vs. weak demand] – may be camouflaged in the funnel storm of tailwinds and headwinds.

Maybe not. As soon as we hear "soft landing," however, we flinch. In the wake of the Federal Reserve's first hike of its federal funds rates, NAHB chief economist Dietz notes:

Given this expected path of monetary policy, we reiterate our policy recommendation with respect to a soft landing. Clearly, elevated inflation readings call for a normalization of monetary policy, particularly as the economy moves beyond Covid-related impacts. However, fiscal and regulatory must complement monetary policy as part of this adjustment.

Higher inflation in housing is due to a lack of rental and for-sale inventory and cost growth for building material, lots and labor. Higher interest rates will not produce more lumber. A smaller balance sheet will not increase the production of appliances and materials. In short, while the Fed can cool the demand-side of the economy, additional output on the supply-side is required in order to tame the growth in costs that we see in housing and other sectors of the economy. And efficient regulatory policy in particular can help achieve this goal.

The big take-away here is, the good problem to have is the problem you can resolve to solve. Winners in today's tough and uncertain markets will be the ones that put time on their side, while everybody else battles against its relentless pitch forward.

Join the conversation

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.