Leadership

ESG: Opportunity Or Bane As Wall Street Ups Its 'Investability' Ante?

In the first of a special report series, The Builder's Daily dives into the challenge — especially during a downturn housing market — and opportunity of operationalizing stakeholder capitalism as a business use case.

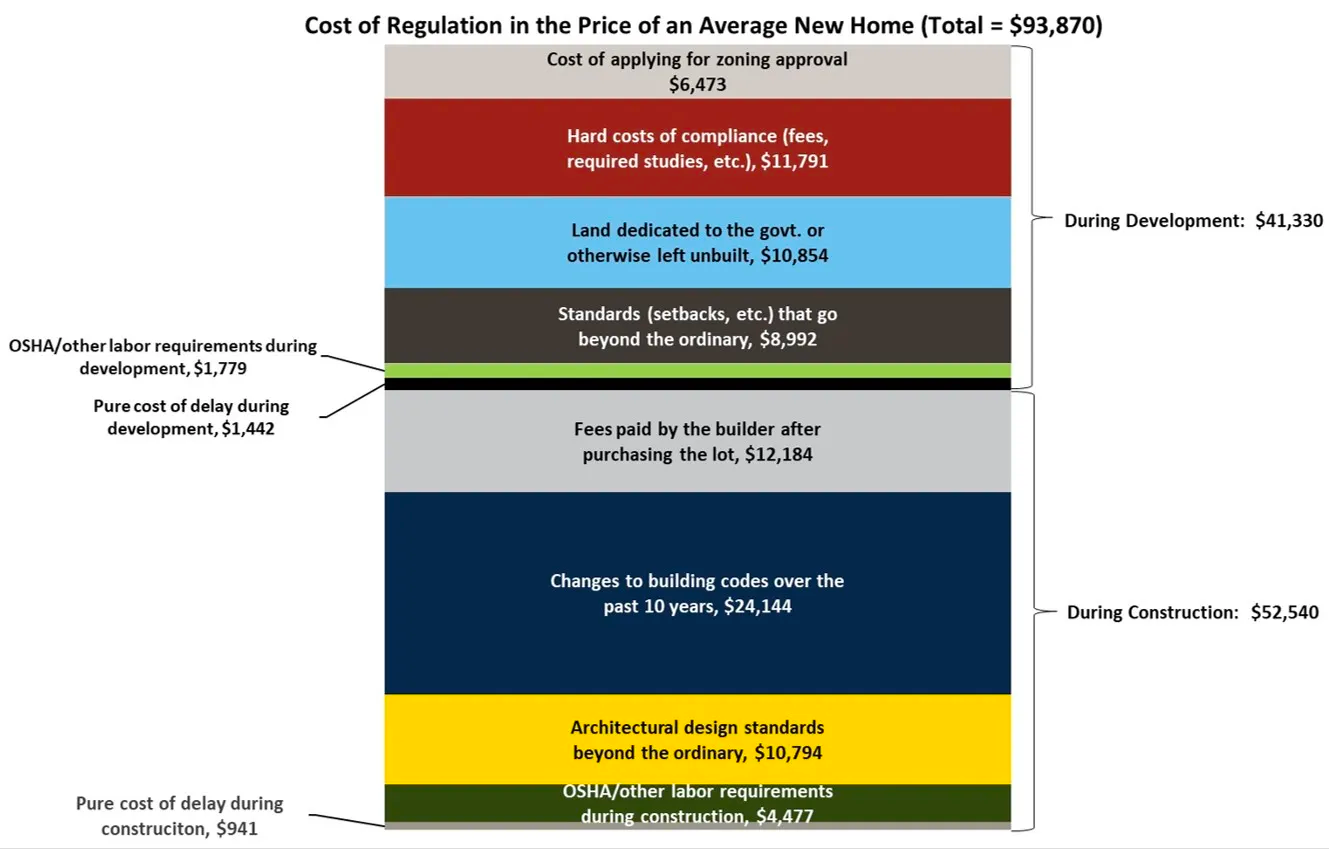

In ancient history – May 2021, to be more precise – new home selling prices across the United States averaged $394,300, and 23.8 cents of every one of those $394,300 went to pay for one form of regulatory fee or another.

The hurdle for buyers now is higher across the board, as everybody well knows. The latest available data, from the Census' late-July 2022 New Residential Sales release, notes on average newly built homes cost buyers $456,800. That price tag increase of 16%, of course, is less than builders' all-in cost increases during the same time period, which are up over 20%.

This all comes down to a reality that even if regulatory fees, taxes, hook-up costs, inspections, code compliance, duties on imports, and other non-construction, materials, land, and associated costs were to have remained flat during that 13-month time period – a real-world impossibility – the better part of a quarter of every purchase price dollar would add up to $108,718.

A paper napkin calculation might add up this way. If a buyer puts down 20% [$91k for the average-priced home], a third of the time he, she, they would spend paying off a 30-year mortgage loan – a decade or more – would go exclusively to what builders refer to as regulatory burden.

Add to all that what it now costs to make a monthly principal and interest payment, rising property taxes, higher insurance, utility bills, transportation, food, healthcare, and on and on. A full-on cost-of-living crisis – complete with an array of unknowns about whether things will get better or get worse before they get better – is slamming up against both wherewithal and basic "is-now-the-right-time?" instinct.

It's understandable then that leaders of homebuilding firms – battling an ongoing unrelenting cost-consequence Whack-a-Mole of both materials and price inflation layered on top of construction schedule delays – should eye that quarter of every ASP dollar siphoned into the stack of regulatory financial onus and declare, "enough already!"

The last thing builders can absorb now is taking on more cost that does not purely and simply drive value in customers' minds, and in ways that impact their purse-strings. Especially now, when they're facing a daunting challenge of having to "clear" a historically-high number of started "under construction" homes – i.e. standing inventory – so that they can reset their starts, sales absorption, completions, closing models in a new-normal reality versus prior conditions that have now run their full course.

This may come across as a strange way of prefacing a focus on homebuilding enterprises and their current efforts to make progress on Environment, Social, and Governance commitment, investment, and measurable progress.

Broadly, this generational pull on pocketbooks and pursestrings, all at once, when so much economic and financial uncertainty hovers over the near-term future makes for an odd time to lean into pillar principles and values of what many refer to as "stakeholder capitalism."

New York Times correspondent Ron Lieber writes:

The current gut check comes at a point in the evolution of the investing industry when assets in so-called E.S.G. funds have risen 38 percent in the past year, to $2.7 trillion by the end of March, according to Morningstar Direct. Professionals overlay all manner of rules and screens for the investments they pick, using climate, diversity or other data to construct what are now over 6,000 funds worldwide.

There is a cost for consciousness: The funds often have high fees that can reduce returns if the investments don’t do better than whatever alternatives you reject. And there’s a fair bit of confusion about what the term E.S.G. — short for environmental, social and governance — means in practice.

More recently, Javiar Blas, Bloomberg opinion columnist, covering energy and commodities, clocked in with this:

ESG won’t disappear, having grown into an estimated $35 trillion business. But as long as energy and commodity prices remain high, it has moved far lower in shareholders’ priorities. Most institutional investors will pay lip service to the fight against climate change. And then, quietly, ask Glencore why it isn’t boosting coal production.

Lastly, here's John Goddard, partner and vice chair for sustainability at London-based L.E.K. Consulting, in a contributed essay in Harvard Business Review:

We found that 51% of leaders reported that they were willing to trade off short-term financial performance to their achieve long-term sustainability goals. But 58% report their organizations are unable to agree on what the tradeoffs should be.

In fact, we've just nearly completed a full cycle of public homebuilding company earnings reports, taking stock of financial and operating performance during calendar 2nd quarter 2022. Sales slowdowns, order cancellations, price-cuts and other incentives, and standing inventory counts, and planned inventory reductions – in one form or fashion – were top of mind among both the strategic and financial company executives and the equity research analysts following the firms. The important questions – and responses – to what's going on to secure the company's business model for the short- and mid-term future looked carefully at current financial benchmarks, ongoing operational KPI, and future tactics and strategies for resiliency.

Not one question on one homebuilder's ESG strategies, tactics, and accountability surfaced in all the hours of investment analyst challenges and questions. When it comes to responsibility for what counts most to most invested shareholders, ESG ranks as an afterthought.

Still, the ceo of one of the nation's top-5 ranked publicly-held homebuilding firms said earlier:

Whoever cracks the code on ESG is going to win; it's a goldmine."

With that said, here's four things we know about ESG and homebuilders right now.

- Although all of the publicly-held homebuilders and their privately-owned counterparts pride themselves as firms founded on bedrock principles of "doing the right thing," and publics now adopt ESG terminology in Investor Relations tabs – either explicitly under ESG headings, or under Governance navigation links – many of the business decision-makers are unconvinced of the business case for proactive commitment and investment.

- Homebuilding business strategists we've talked to regard the term, ESG, as has been described here, as "just playing with magnetic refrigerator letters." Others look at those letters and what they stand for as a "woke" scam attacking American business dynamism. Most of the business leaders we talk with look at ESG as a form of "writing on the wall" that signals now's the time to take steps to both do more and to tell a better story of what they are already doing in keeping with "doing the right thing" by their customers, employees, business partners, capital sources, and local, regional, and national regulators.

- If the spigot of working capital were free from influence and impact among shareholder blocks and activists pressing quid pro quo on "investability" hot buttons that require ESG gains in accountability and forward-improvement, most homebuilding operators would rank its array of commitments, investments, responsibilities, and accountability points as a low-to non-priority item.

- In a trillion-dollar-plus-per-year "loosely-coupled" ecosystem made up of tens of thousands of enterprise, medium-sized, and small firms, where no single entity can by itself sway the practices other firms pursue to make money, the future of ESG is far-off (5 to 10 years) at best, and iffy at worst. Either way, hundreds of millions [and more plausibly billions] of dollars will trade before any promise of these pillars roots itself in practice and reality.

Part of the hazard of attempts at cultural transformation in homebuilding's community of practice "loosely-coupled" system is an often show-stopping dilemma. Unless one company makes the transformation first, none of the others will. At the same time, it's not until most of the other thousands of companies adopt the transformation that it will truly pay off for that single first-mover entity.

This vicious circle of interdependence deters transformation. But it doesn't altogether halt it.

Now, fully a half dozen publicly-traded homebuilding companies have invested in extending their environmental impact statements into a full-blown Environment, Social, and Governance communications, operationalization, and early-innings benchmark for self- and third-party measurement.

Since some of the companies committed earlier on to strategic integration of environmental impact and performance goals, and no two companies uses precisely the same array of ESG measurement and reporting platforms, it's too soon to say anything more than that they're "all over the map" on ESG.

That's okay, and, realistically, given the respective cultures of competition and entrepreneurialism, it could hardly be any other way. All this to say that we will look on a micro basis at what each of the companies is doing vis a vis a growing "investability" imperatives all of them face to get on a single page of organizational initiatives, investments, measurements, and accountability.

As HBR contributor Goddard notes:

The stakes for sustainability performance are high. Expectations — on the part of investors, regulators, partners, customers, consumers, and the community — are only going to intensify. Leaders who understand the opportunity, as many seem to do, now need to take the next steps, definitively connect sustainability to strategy, and reap the tangible gains in growth and value that a fully operationalized sustainability program can deliver.

All this to say that we will look on a micro basis at what each of the companies is doing vis a vis a growing "investability" imperatives all of them face to get on a single page of organizational initiatives, investments, measurements, and accountability. In tomorrow's The Builder's Daily, we'll drop into the work the team at Tri Pointe Homes is doing to align its dual missions of listening to customers and advances on the environmental impact of its construction and new home operations, as a robust, come-what-may brand differentiator of value creation.

Until then... think alignment.

Join the conversation.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.