Leadership

How Tri Pointe Homes Aligns Its Customer Centricity With ESG

Part 2 in The Builder's Daily's multi-installment special report series on market-rate housing's trillion-dollar embrace of a future of stakeholder value creation.

[Editor's Note: While market-rate housing experiences near-term turbulence, leaders in residential real estate and construction face crucial crossroads today that will impact their position and strength when a next recovery finds its footing. We're looking over the next couple of weeks at pull-forward transformational market forces, such as ESG, and those who're seizing leadership in stakeholder capitalism as a business opportunity.]

Of the 19 pure-play publicly-traded U.S. homebuilding companies – producers of about two of every five of the nation's new-construction single-family owner-occupied homes – all save three firms spell out specific, public-facing Environmental, Social, and Governance policy and practice commitment and investments.

This is not to say that the three organizations – Dream Finders Homes, Landsea Homes, and NVR – that don't profess their positions with dedicated Investor Relations site tabs and annual reports, and disclose measures of ESG progress do not apply their core strategic corporate values, principles, codes of ethics, and cultural practices relatively aligned with ESG goals.

ESG's fate and future as business and strategic bedrocks are no slam dunk. Just a week ago, the Wall Street Journal appeared poised to call for an end to the transformative effort when it's hardly begun.

The risk is that ESG measures that Mr. [BlackRock CEO Larry] Fink and others claim are voluntary will become standard in corporate America with almost no debate. The next step is likely to be regulatory mandates. The Securities and Exchange Commission has already proposed a climate-change rule that would impose a vast new mandate across the U.S. economy for reporting CO2 emissions.

Will free-market-drivers win out over false-flags

What's clear is that if they are to fuse themselves one-day into fully operationalized practices across homebuilding, foundational ESG stretch-goals of positive climate impact, broadly reimagined social sustainability, and still-evolving governance standards are many, uphill steps from where companies are at present.

Further, it's also clear that hard, soul-searching, and financially consequential work needs to go into each homebuilding organization's approach to matching up what is ironclad on one hand – management's fiduciary duties to drive shareholder value – with, on the other, a set of broader stakeholder imperatives that don't easily fit into a quarter-to-quarter performance template.

No executive management team will, nor can be expected to bend to adopt new practices – however a la mode they appear to be – that run counter to their essential fiduciary responsibilities to stockholders. That said, homebuilders – which by nature are organizations that funnel a couple of dozen expertise areas ranging from manufacturing, to retail, to personal finance, to logistics, to construction contracting, etc. – can tend to get a jump start on many other industry sectors, at least when it comes to the overriding spirit of ESG.

That's because, at core the need to align the needs and values of customers who pay hundreds of thousands of dollars for the durable good that is a home, a property, and a community often squares directly with both fiduciary duties to generate shareholder value and with ESG's meta imperatives of contributive impacts, socially, environmentally, and as corporate citizens.

So, in a sense, just by being customer focused in the evolving way customers needs and preferences and values move, homebuilders get that head start in being on the beam with what stakeholders are going to value the most.

Nowhere is the effort of individual homebuilding organizations and the group of 19 as an industry cohort on sounder footing of matching ESG's elevated ambitions with aligned and notable first steps of progress than in their environmental sustainability initiatives.

As a first case in point that focuses on how builders have been able to mine the sinews of their corporate mission and purpose to muscle up and take control of the ESG narrative, we had a conversation with Kevin Wilson, Tri Pointe Homes national VP for strategic sourcing and sustainability on the Tri Pointe ESG integration strategy.

Clearly, from Wilson's perspective, Tri Pointe's full operationationalizing of ESG starts and finishes with customers and the way the firm, the experiences it offers, and the products it sells imprint value – both immediately evident and promised into the future.

Our ESG efforts spring directly out of wanting to take a leadership position with our customers, built on our four core pillars," says Wilson. "They are Best of Big and Small, Customer Driven, Premium Lifestyle Brand, and Passion Culture. We've woven these pillars into our LivingSmart solutions branding now for nearly a decade, and this next round of LivingSmart – our 3.0 version, which bakes in third-party programs such as LEED®, ENERGY STAR® and Indoor airPLUS – reflects our deepest commitment to study our customers closely and carefully.

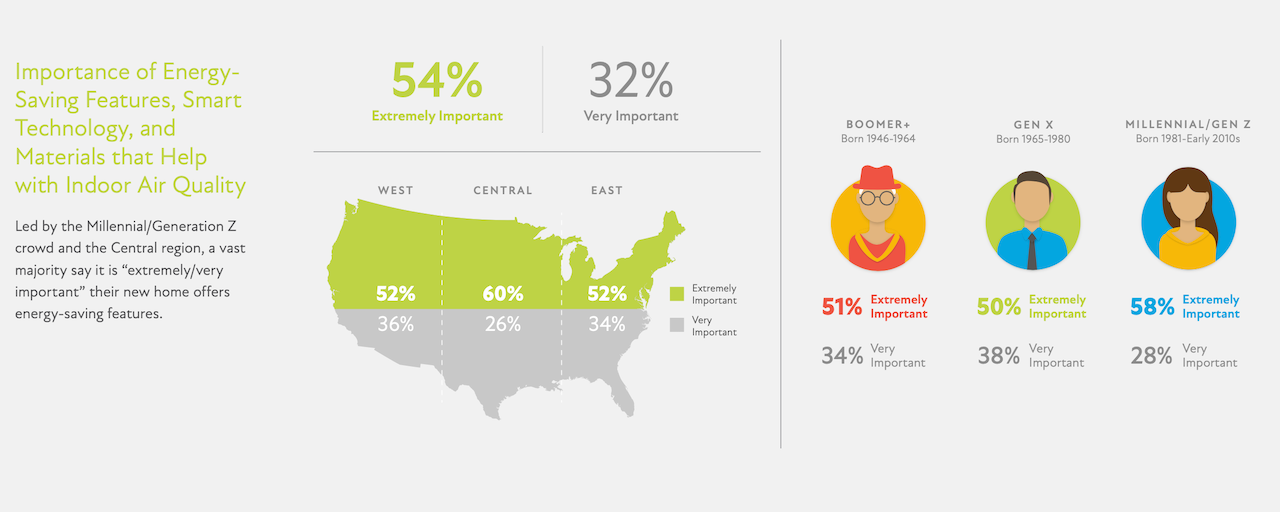

Tri Pointe invested in research in 2021, gathering insights from more than 200 homeshoppers who'd visited Tri Pointe neighborhoods in each of the firm's three regions, totalling more than 600 first-hand survey participants.

That research became the basis for the business use-case Tri Pointe could make, that its investments in environmental impact contributions would be rewarded in the marketplace by its homebuying customers.

After listening to them, we can understand how we can push them to be the best customers they want to be and how they can push us to help them get there," says Wilson. "That's perfectly aligned of course with saving them money, but it also syncs right up with our foundational focus on the E in ESG and runs through our relationships with business partners, sourcing, land-use, and financial, informing our social sustainability practices as well."

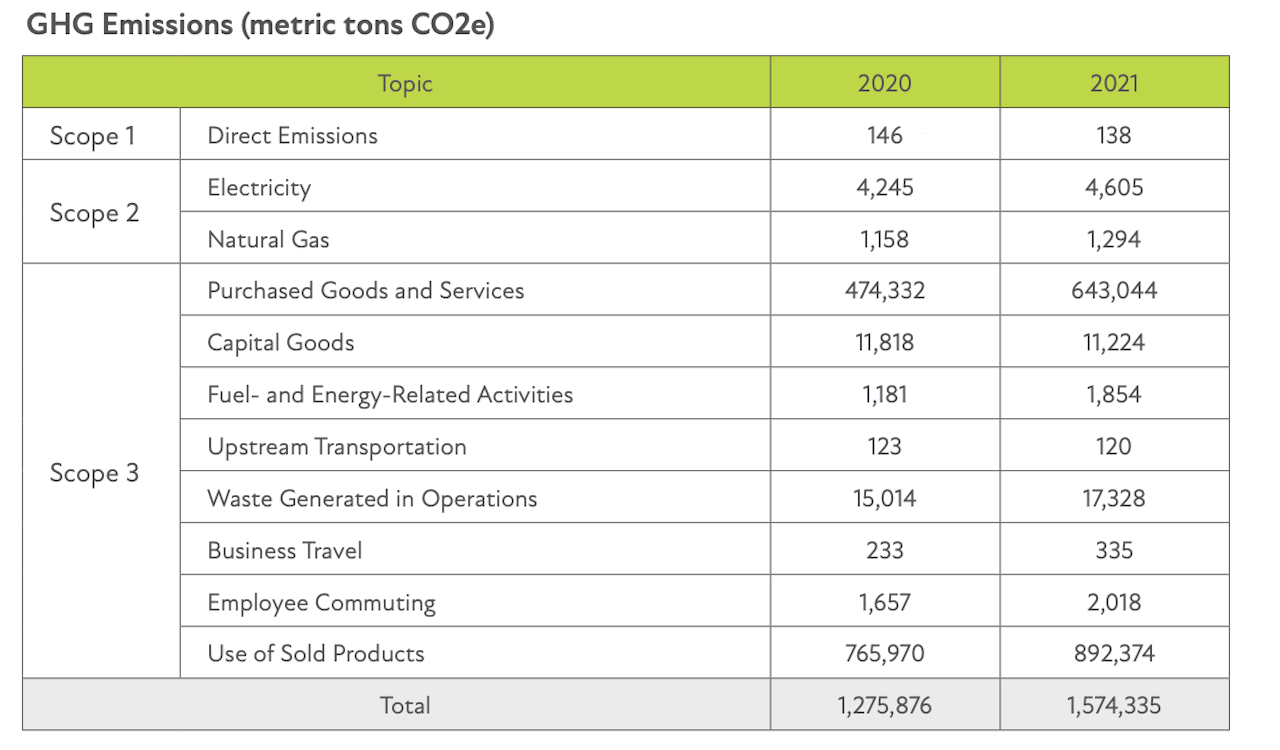

With that deepening of customer-driven value creation setting Tri Pointe's bar of ambition, the company this year engaged a third-party consultant to help calculate its first series of greenhouse gas (GHG) inventories, measuring the enterprise's 2020 and 2021 emissions across Scopes 1, 2 and 3 in accordance with the GHG Protocol Corporate Accounting and Reporting Standard. Calculating the carbon footprint is an important step in efforts to better understand the impact of our business operations on the environment. It also allows greater transparency regarding current GHG emissions, which Tri Pointe strategists believe will prepare the organization for future sustainability-related exercises and regulations.

The refrigerator magnet alphabet soup of standards, measures, protocols, disclosure requirements, and accountability – TCFD, SASB. GRI, GHG, UN SDG, etc. – is all in its early innings, which means clarity as to what drives "investability" along these platforms has yet to find firm footing.

I don't know that we have complete visibility on where all of these measures will settle," says Wilson. "Investors do want to select good companies that are making the right decisions now, and finding ways to make better decisions going forward in how we source more locally, build more efficiently, and make a more positive environmental impact. Even without that visibility, we want to align with those principles because it's consistent with what our customers tell us they want and will pay for. As the ESG standards get more refined, and there's more consistency in how companies apply them, like everything else, they'll be table stakes. If you don't measure up, you won't make the consideration set – whether it's among customers, team members, business partners, investors, etc. Bottom line, we're shooting for something that comes down to shrinking the impact and increasing the value."

In Kevin Wilson's view, the ultimate impact of any organization or business sector's initiatives, investments, and commitments to ESG will owe in part to those enterprises' actions and the way they speak for themselves. Almost equally important, Wilson asserts, is a company's capability when it comes to owning the narrative.

We're in the life-changing business, and we're all making some really good decisions out there, making beautiful homes for families," says Wilson. "Sometimes we're not good storytellers inside our companies and among our close business partners and among our investor partners. We've got a DNA that's all about value, and we're trying to align as leaders with the principles behind ESG, which at base, are about striking a careful, connected balance between pushing the envelope and doing the best we can with our customer's dollar."

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.