Technology

Entekra To Dissolve And Shut Down Operations By June 30

Six-year old off-site home construction juggernaut -- lacking a big new capital investment infusion -- becomes a casualty, as majority-owner LP focuses on its core OSB, siding, and structural solutions businesses.

Entekra, one of residential offsite construction's juggernauts since its 2017 start-up in Ripon, CA, will shut down operations within 60 days, The Builder's Daily has learned.

LP, which invested $45 million in Entekra in 2018 and became a majority owner in 2021, shared this statement with TBD through a spokesperson today,

Through its off-site approach to commercial and residential framing, Entekra has offered prefabricated panelized construction systems to Northern California builders since its founding in 2017. However, Entekra’s long-term success requires scalable operations through regional expansion and greater capacity, which necessitates increased capital investment. After careful consideration of various strategic alternatives that concluded without external investment interest, Entekra’s Board of Directors has come to the difficult decision to cease operations and dissolve the company. An orderly winddown of Entekra’s operations is expected to be complete by the end of June 2023 as the company fulfills its final obligations. To demonstrate the company’s appreciation of its employees, all employes will be provided severance benefits based on their tenure and position and will be eligible for unemployment benefits. Employees will also be provided with health insurance coverage for two months after leaving the company and offered job placement services at no charge."

As many as 240 associates – 200 in the U.S.-based Modesto, CA, manufacturing and distribution operations, and 40 in Monaghan, Ireland – will be impacted in the shut-down. An array of single- and multifamily residential builders and developers, including Beazer Homes, Van Daele Homes, Wathen Castanos, A.G. Spanos Companies have been among the larger Entekra customers, with ongoing projects in the Northern California region.

The move – which came to light via federal Worker Adjustment and Retraining Notification (WARN) notice to staffers last week -- took front-line associates and clients by surprise, especially given the messaging of a glowing proof-of-concept and ambitious growth expectations in commentary to investment analysts at an LP Q3 2021 earnings call.

In that call, LP CEO Brad Southern noted that Entekra, was "gross profit positive in the quarter, and continues to gain customer acceptance and operational momentum."

In response to an analyst's question, Southern elaborated on reasons for installing longtime LP siding business executive stand-out Neil Sherman to take over as president of Entekra, after founder Gerry McCaughey's exit from the operation. Southern specifically links Sherman's appointment as a heavyweight skillset necessary to scale Entekra as a "growth engine."

Entekra is very strategic to us. I’m really pleased with the progress we’ve made in that business over this past year. But I think that they’re speaking a step change, Mark, there’s a step change needed. I believe we have validated market acceptance. I’ve said that on this call before, but we really have to bring a level of confidence in to [ad]just the overall operations of that business and the delivery of the value proposition.

So we made a couple of moves in the quarter. One that we mentioned on the call, we did one of our very experienced plant managers into the Modesto facility is now the plant manager. And then as we talked about, we’re moving Neil over there to be President. So we see this as a very significant strategic opportunity for us. We think the timing is right to really put some concentrated resources on it. Obviously, Neil has a great track record over his tenure in siding of growing that business and building a really strong team that was capable of doing that.

And we want to kind of lift and place him over in Entekra to see the same kind of rapid business improvement. And then we’re very blessed to have a strong bench... I guess the nature of your question, [is] what does this say about Entekra.

It says that we see it as a huge opportunity, and we’re really getting serious about getting a manufacturing competency so that we can continue to grow that business. We’ll probably – we’ll have revenue in the business of around $100 million this year of Entekra. We’re close to breakeven EBITDA, particularly in the second half of the year. So, I mean, $100 million from zero, 18 months ago, does show that the revenue generation capacity of this business. And so we’re excited about turning that into a growth engine that is creating value."

As everybody knows, a lot has happened since Q3 2021.

But the question is, what happened that caused a steady upward trajectory for the young company to sputter so fast and cause a "huge opportunity" to lose its appeal as a business?

A weighted combination of the following factors likely played a role in Entekra's untimely demise

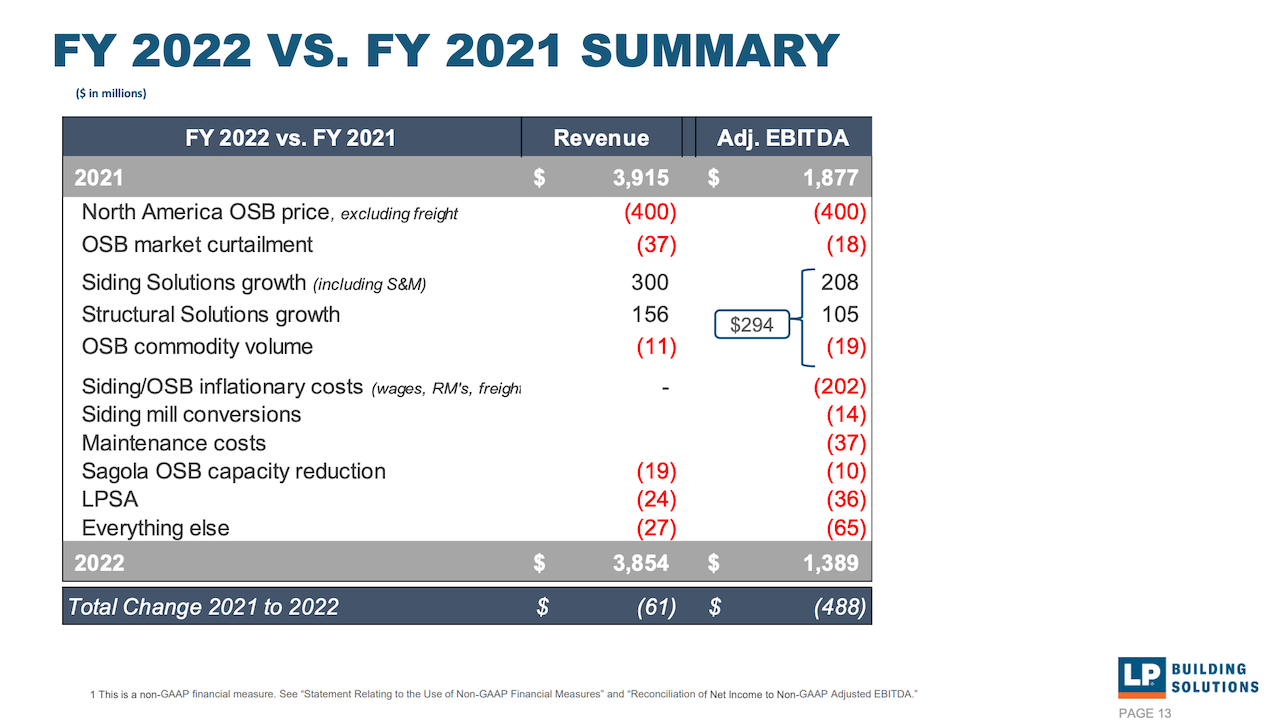

- A broad-based sharp upward turn in capital costs exposed risks to the extensive resource allocation required to scale the Entekra business, causing LP to double-down focus on its OSC and siding lines of business solutions.

- Uncertainty and volatility in residential construction demand, with an overshadowing economic downturn impacting near-term revenue.

- Micro-mismanagement of Entekra's value-creation capability, reflecting LP's lack of direct skills and experience with integrated offsite framing and distribution processes.

While LP's intention was to give Entekra a true-up in proven LP corporate strategic success in its leadership and upper management selections, it may be that those leadership team choices – lacking any direct experience in the complex value creation stream that integrated offsite construction systems – made missteps in the process of trying to find the growth path. The tireless evangelism and relationships-network-building of founder Gerry McCaughey was very likely conspicuous in its absence when it came to building the firm's book of business over the past 18 months.

We'd suggested here a little over one month ago that the end of low interest rate policy days, disrupted access to credit, higher costs of capital, and less patient capital would begin to cull residential construction's robust stream of innovative construction technology platforms and enterprises.

At that time, we didn't envision one of the earlier casualties in such a shake-out would be Entekra, which had succeeded in beginning to penetrate long-held skepticism and doubt to prove itself as a practical building enclosure production system that could scale at some level of local volume.

We'll have more about this important story over the next week or so. While it may serve as a harbinger of further shake-out in homebuilding and residential real estate's pathway to transformative building solutions, Entekra's shut-down should by no means signal a blow to full-stack offsite and modular production itself.

MORE IN Technology

Lennar Taps Into Geothermal To Power New Colorado Homes

A major homebuilder's bet on geothermal heating and cooling for over 1,500 new Colorado homes could pave the way for mainstream adoption as buyers increasingly seek sustainable, energy-saving features.

AI Crushes Missing-Middle Time And Cost Curves Toward Affordability

Developing multifamily rental and for-sale properties takes time — sometimes years -- depending on a labyrinth of zoning rules and the whims of local jurisdictions.

Brandon Elliott’s Next Big Thing: An Uber-Style Building Trades Platform

After selling Elliott Homes to Meritage, the Gulfport, Miss.-based entrepreneur sets his sights on transforming trades with a logistics-tech startup that aims to make construction faster, smarter, and more affordable—starting with siding.