Policy

Energy-Efficient Tax Credit Changes Are Coming: Ready Or Not?

To comply with adjustments to the 45L New Energy Efficient Home tax credits, here’s what homebuilders need to know now.

It’s time for builders to start preparing for upcoming changes to the new energy efficient home tax credits. The Inflation Reduction Act extended the 45L tax credits through 2032 and increased the amount of up to $5,000 per home. A key change to the tax credits requires homes to be certified under the U.S. EPA’s Energy Star New Homes program or the U.S. DOE’s Zero Energy Ready Home program (ZERH).

Timing Considerations

The tax credits for the Energy Star program are based on acquisition date—meaning when the home is sold or leased—but the ZERH program is based on the permit issuance date. This important distinction means that new Energy Star Certified single-family homes completed in 2024 but not sold or leased until 2025 will need to meet version 3.2 of the Energy Star program, which takes effect Jan. 1, 2025.

Builders looking to capture the 45L tax credits need to consider their construction cycle times to ensure they can achieve the Energy Star v3.2 certification on homes that won’t be acquired until 2025. Changes to the Energy Star program will likely require adjustments to plans and specs and updates to energy models to achieve certification.

Energy Star for Residential New Homes Program v3.2

The main tenet of the Energy Star new homes program is to be more efficient than state and local energy codes. As energy codes become more stringent, the program must be updated to remain above code. On Jan. 1, 2025, 47 states will transition from Energy Star v3.1 to v3.2. Here are a few highlights of v3.2:

- Energy Rating Index (ERI) target scores—the maximum score a home can receive to comply with Energy Star requirements—are likely to be about 10 points lower, on average.

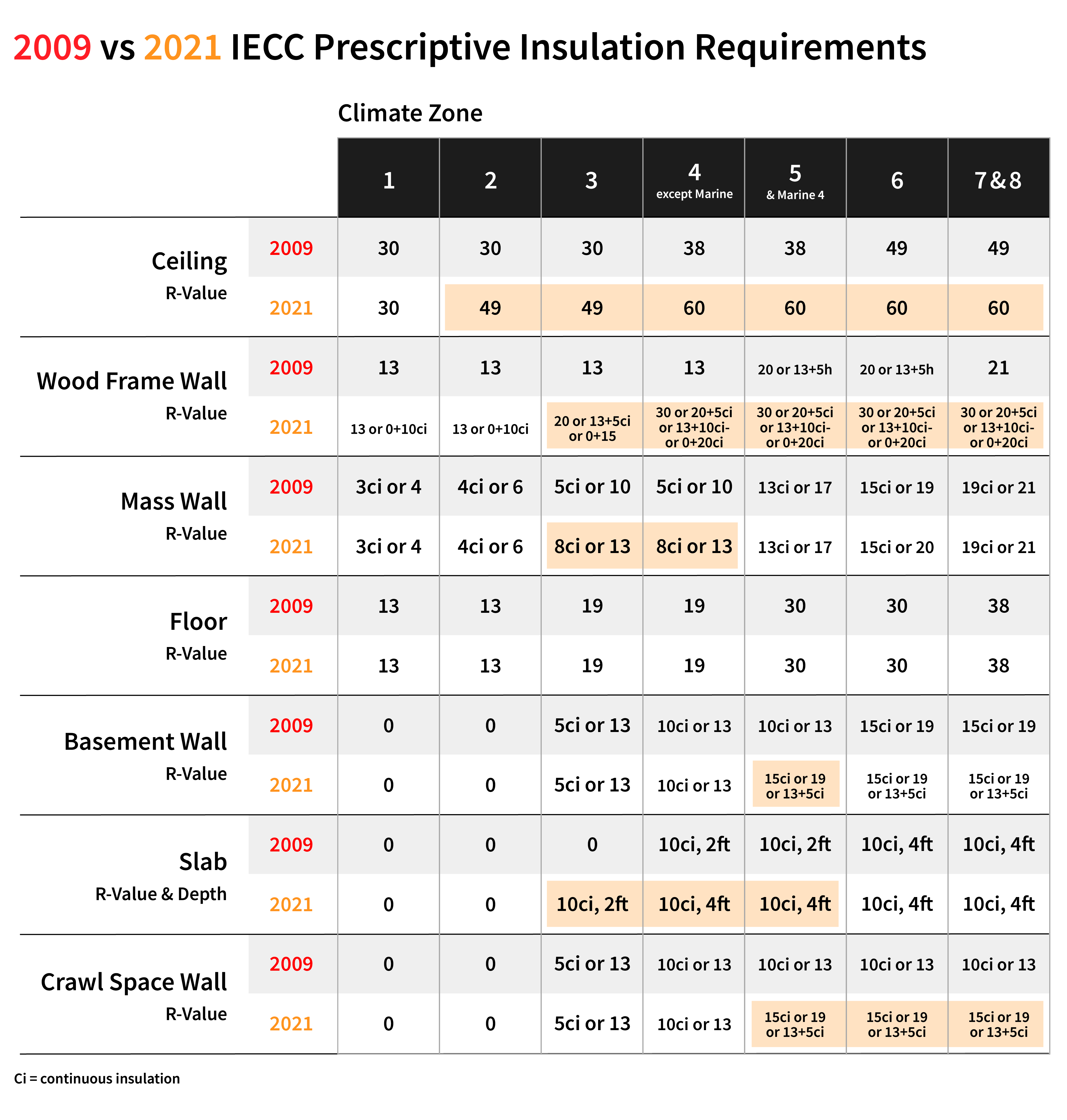

- The mandatory building envelope insulation levels are now based on the 2021 International Energy Conservation Code (IECC), rather than the 2009 IECC. However, builders can still use the total UA (U-value of the envelope components x the area), which allows some flexibility among insulation levels, windows, and doors. See the table below for a comparison of 2009 and 2021 IECC prescriptive insulation requirements.

- Although not a common practice in most states, the allowance for sampled ratings will end when v3.2 takes effect. This means builders must have a pre-drywall and final inspection on every home certified for Energy Star.

Figure 1. 2009 vs 2021 IECC Prescriptive Insulation Requirements

Zero Energy Ready Home v2

Version two of the ZERH program took effect on Jan. 1, 2024. Since the 45L tax credits for ZERH are based on the permit date, any homes permitted this year will need to be certified under the current version to qualify for the tax credit. However, since the ZERH 45L tax credits are based on permit date, homes permitted in 2023 under version one can still qualify for the tax credit even if they are not sold or leased until 2024.

The ZERH program, under version two, requires Energy Star v3.2 as a prerequisite. Whereas the Energy Star certification qualifies for up to $2,500 in tax credits, ZERH certification is eligible for up to $5,000 in tax credits. As builders consider design changes to achieve the new Energy Star certification, they should also weigh the cost of the additional requirements to achieve ZERH, such as:

- Indoor AirPlus v1 certification.ERI target scores typically in the 40s (depending on climate zone and home geometry).

- Mechanical equipment and ductwork in conditioned space.

- Achieve the WaterSense Label for Homes or meet minimum water efficiency requirements between the hot water heater and the furthest fixture.

- Solar-ready design (panel space and conduit).EV charging receptacle.Dedicated circuit for a heat pump water heater (if a gas water heater is installed).100% high-efficacy lighting.

- Builder-supplied appliances are Energy Star certified.

The Long Game

There will be additional costs for builders to transition from Energy Star v3.1 to v3.2. To ensure their homes will comply with the new requirements, builders need to work with their energy raters and get ahead of possible design changes that might be necessary. It’s also important to keep in mind that the new 45L tax credits are available through 2032, so it’s possible the long-term benefits may outweigh the initial upfront costs.

MORE IN Policy

NYC Voters Back Affordability — Now Comes The Hard Part

New Yorkers have voted for change. Four sweeping housing charter amendments promise faster reviews, digital mapping, and more affordability—but the real battle begins as City Hall, the Council, and Albany clash over control.

Connecticut Lawmakers Reboot Bid To Hurdle Blocks To Building

After a vetoed bill derailed housing reform this summer, Connecticut lawmakers are back with a compromise. Their second attempt could test whether state leaders can balance affordability goals with local control—and finally get a deal done.

NYC Targets Housing Red Tape With Ballot Measures In Vote Today

By Tuesday evening, New York City voters may know who their next mayor is and whether the city's charter is amended to improve housing affordability.