Leadership

Early '23 Uptick Buoys Private Builders Who Expected Worse

Midway through February, we're well past a "dead cat bounce" dismissal. Instead, days have become weeks, and weeks now a month plus, shouldering into the realm of cautious – closely guarded -- optimism.

The question of whether January will go down as a spasmic "head fake," a seasonal uptick, or the bona fide onset of a mid-2020s triple-cohort market-rate housing juggernaut gets tricker by the day.

Especially, now. We've hit mid-February, after days of eye-opening new-order activity that bookended the final weeks of 2022 and the first weeks of the new year have now exceeded a month.

This takes the market well past a "dead cat bounce" dismissal. Instead, days have become weeks, and weeks now a month and a half, shouldering into the realm of cautious – closely guarded -- optimism. We've been hearing about improving order and closing trends in real-time commentary from strategic executives from the public homebuilding enterprises in the vanguard of Q4 and full-year 2022 earnings performance calls with equity research investment analysts.

Recently, too, an early-year gust of new orders per community absorptions, lower cancellations, sensitive response to incentives, buydowns, downward 30-year-rate trends, etc. has begun to buoy the outlook for privately-held homebuilding firms as well.

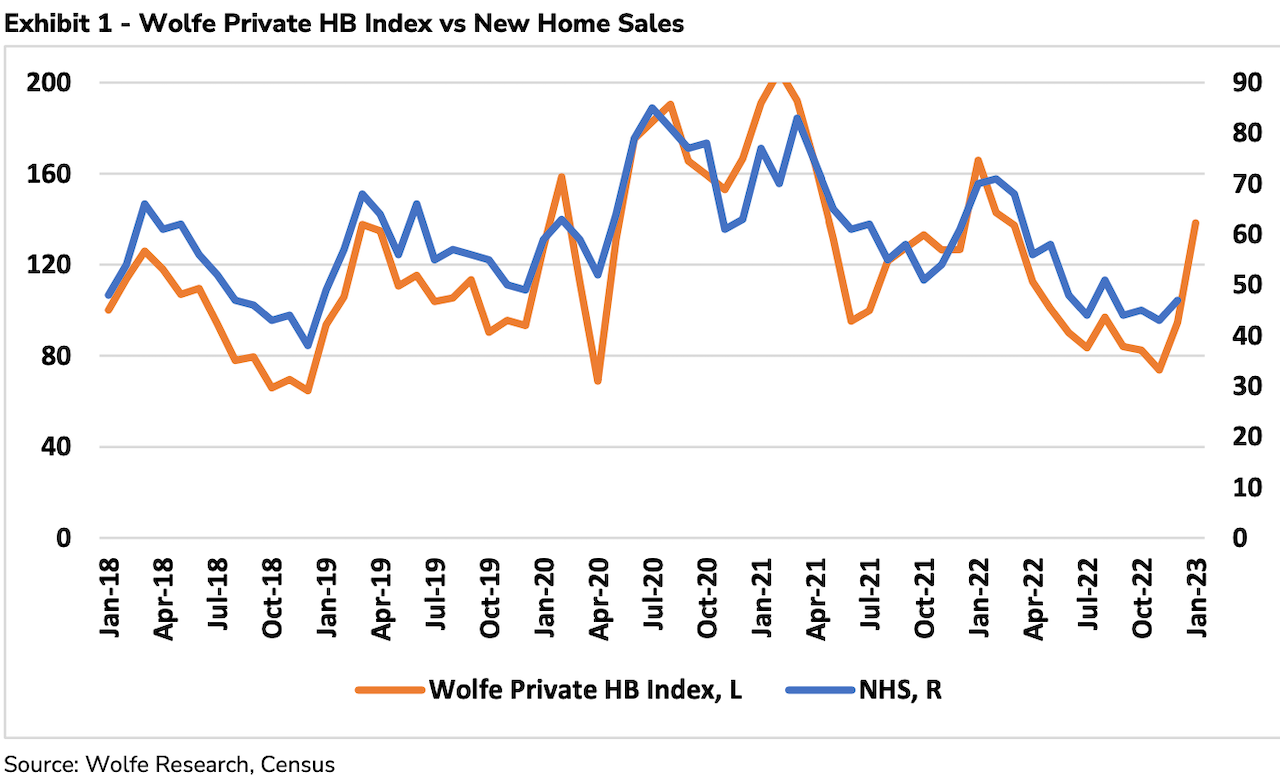

This past week, the Wolfe Research team led by Truman Patterson, director/housing equity research analyst summed up a strong report from private homebuilders it surveys each month, with specific statistical questions on net orders, new community counts, pricing, gross margins and costs, as well as a few open questions.

Top line the Wolfe private homebuilder survey for January marked a two- or three-stroke swing in both performance measures and a pulse of what builders expect in the Spring Selling season – despite a heavy pall of uncertainty as a given.

Net Order Units

Our contacts’ January Orders increased +46% sequentially, materially outpacing New Home Sales’ near +10% average historical sequential performance, and have returned to levels last seen in March/April 2022. If NHS follows the sequential improvement of our survey, it would mark one of the strongest January MoM changes on record, albeit coming from an easy Dec comp. January’s sequential improvement follows December’s +11% MoM improvement in sales activity. Further, contacts’ January Orders fell -17% YoY, a marked improvement from the -40% to -45% YoY range the prior several months."

Patterson and the Wolfe team caution that one month a trend doesn't make. The analysis notes that what appear to be "green shoots" of an incipient new home demand rebound may owe to one or a combination of the following forces:

- a quick demand snapback as mortgage rates dropped ~80 bps in Nov and

- unsustainable 4Q pent-up demand as we have heard in the field that certain prospective buyers had delayed purchasing until after the holidays.

Net, net, however, whatever may become of the well of demand bubbling up early this year, the Wolfe team says they'll take it.

We anticipate a healthier spring selling season than expected a couple months ago—our field work suggests that potential buyers are generally beginning to 1) accept the higher rate environment, which by our work, usually takes about a year to occur and 2) recognize builder price cuts and no longer feel they’re purchasing at peak pricing. It appears the limited resale/existing home inventory sitting at a scant 2.9 Months’ Supply and under 1.0M units continues pushing consumers to the New Home Market and weighing on the aforementioned MBA Purchase Apps metrics/Existing Home Sales."

At the same time, a gap may be widening now between the areas that appear to represent the greatest risk to homebuilders' business in the months ahead and at least the possibility of other issues and challenges demanding greater focus and priority.

We suspect this comes through in data and analysis the National Association of Home Builders release each year, based on a poll of its universe riding along with the January 2023 survey for the NAHB/Wells Fargo Housing Market Index.

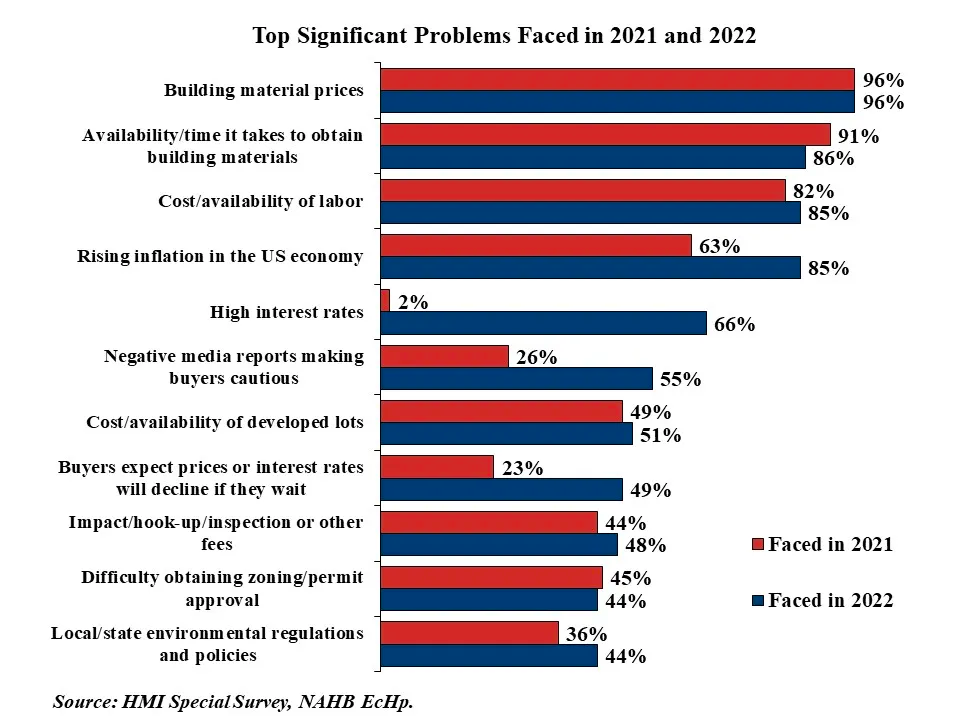

Supply constraint reigns supreme among issues homebuilding firm respondents identify as the biggest risks to business.

The NAHB analysis leads off this way:

The price and availability of building materials again topped the list of problems builders faced last year, while interest rates (along with general inflation and negative media reports) moved considerably up the list.

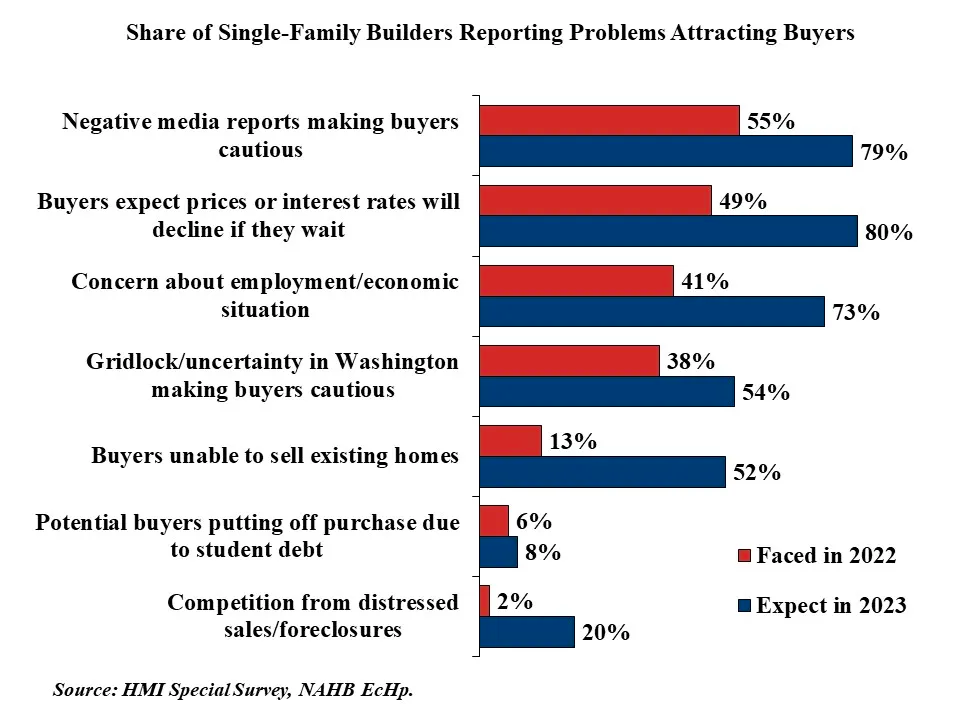

It's not until Part 2 of the report that focus on demand, on customers, on the consumer get play among the primary concerns and challenges to homebuilders' 2023 outlook.

The report notes:

Problems attracting buyers have not been as widespread, but builders expect many of them to become more of a problem in 2023.

So, while it's tempting to lean into hope, especially as now that Super Bowl LVII has conferred the crown to the Kansas City Chiefs, and homebuilding's Spring Selling sweepstakes has officially begun, it will probably be the period between April 1 and the end of May before there's definitive word on how good, bad, or ugly the year still may be.

Speaking of crowning, many might be ready to crown "uncertainty" the word of the year at this early stage of business prognostication and assessment. We'd say "patience" that almost-forgotten capacity to choose to wait, learn, endure, harden, and survive might well eclipse "uncertainty" when the course if finally run.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.