Leadership

Ear To The Ground: Why Timing Risks Impact Builders' Outlook

The problem with having been through two 'end of the world' events is you can't comfort yourself knowing 'it happened once, couldn't possibly happen again.'

It's said, when things turn in the real estate business as they're capable of turning, "the land and the price were fine; it was just horrible timing."

Google "timing and business" and the search will yield 485 million links, including this one, "In Business, Timing is Everything." Here's how that Advisorpedia piece, scripted by Alex Pirouz starts out:

Good timing can turn a mediocre product into a breakout success; bad timing can destroy an otherwise successful career."

Common sense. Now, let's apply the rule to what's going on on the ground in what – in recent memory and many, many team members' entire young career span – has become implanted and hardwired as timing that builders, developers, investors and their design, planning, manufacturing, building materials supply, assembly, installation, etc. partners in the making of homes and communities could rely on.

The best brains in residential real estate analysis and economics characterize this time – the early 2020s – with four words: "high demand, low supply." Those four words may be true. At the same time, they're no guaranty of anything close to business success. That's because these five words are also true: "All real estate is local," and these three words are also true. "Timing is everything."

Here's a few forces – none of them minor – impacting timing. Each of them involves a rate or ratio of change. In some cases that rate will moderate, and in others, it will intensify. Predictability on how much, when, and how fast those changes will occur is an unknown. Still, each of them impact timing in what is one of the more time-sensitive value chains in any business sector, because of the very large front-loaded investment required to fund home and community development's planning and building life-cycle, and the delayed, time-release capture of returns on that investment, subject to timing risks.

So, while Wall Street and central bankers keep a weather eye on key "spreads," – as measures to guide timing risk – homebuilding enterprises large, medium, and especially, small need to stay vigilant on how the following rates of change, and what impacts those rates, shift, or stray from norms, or go into atypical patterns. Already, accelerated rates of change, mostly driving prices higher and causing greater delays in the ability to produce finished homes for settlement, have hurt predictability. The question is if and when they hurt profitability as well.

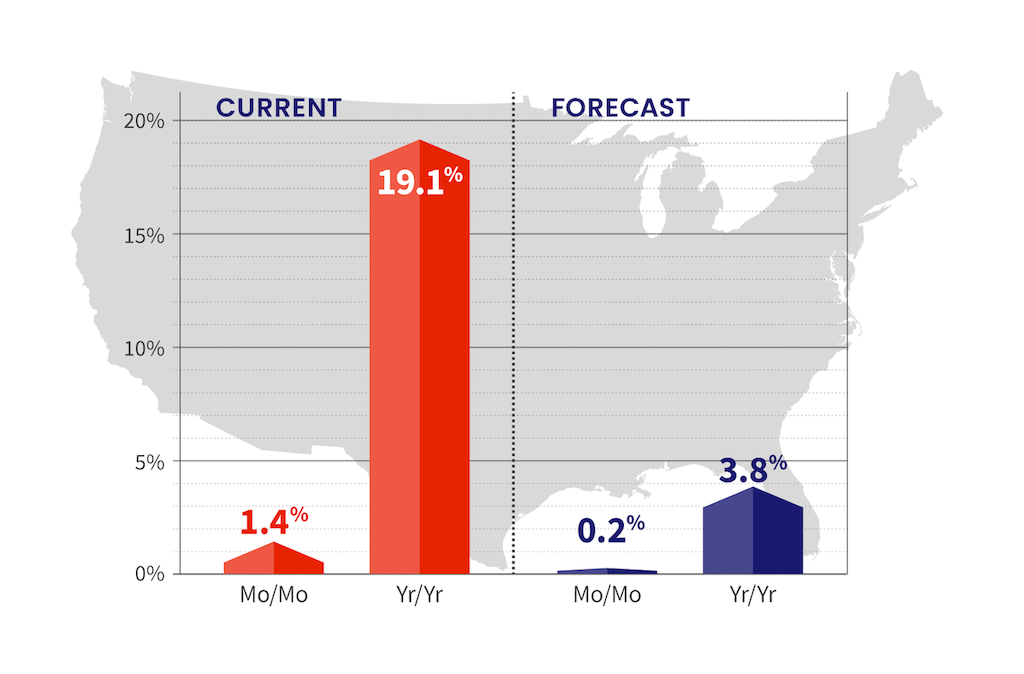

- Latest home price indices show January to January home price rise of 19.1% nationally, with a 1.4% sequential increase from December 2021.

- Dial up inflation due to continued imbalances between household and business demand for goods and services and the capacity of producers to supply them, ... all exacerbated by soaring oil prices and other cost impacts of Russia's war on Ukraine.

- Supply Chain Massacre 2.0 Last year, the pandemic backdrop that throttled transports in and out of China, the freak winter freeze in Texas, the effects of global trade disputes, the domestic standstill in available workers created by extended pandemic unemployment, the Suez Canal fiasco, and any number of other materials and people squeezes gave building's supply chain a whack-a-mole character. This year, already, Omicron and, now a newly unraveling source of disruption – Russia's military invasion of Ukraine – have seized up transport of key materials and goods through key shipping channels. Once again, the refrain, "No one saw this coming," is the explanation for "so many vessels are stuck in ports." Meanwhile, skyrocketing oil prices are driving tanker freight delivery costs to double or triple what they've been.

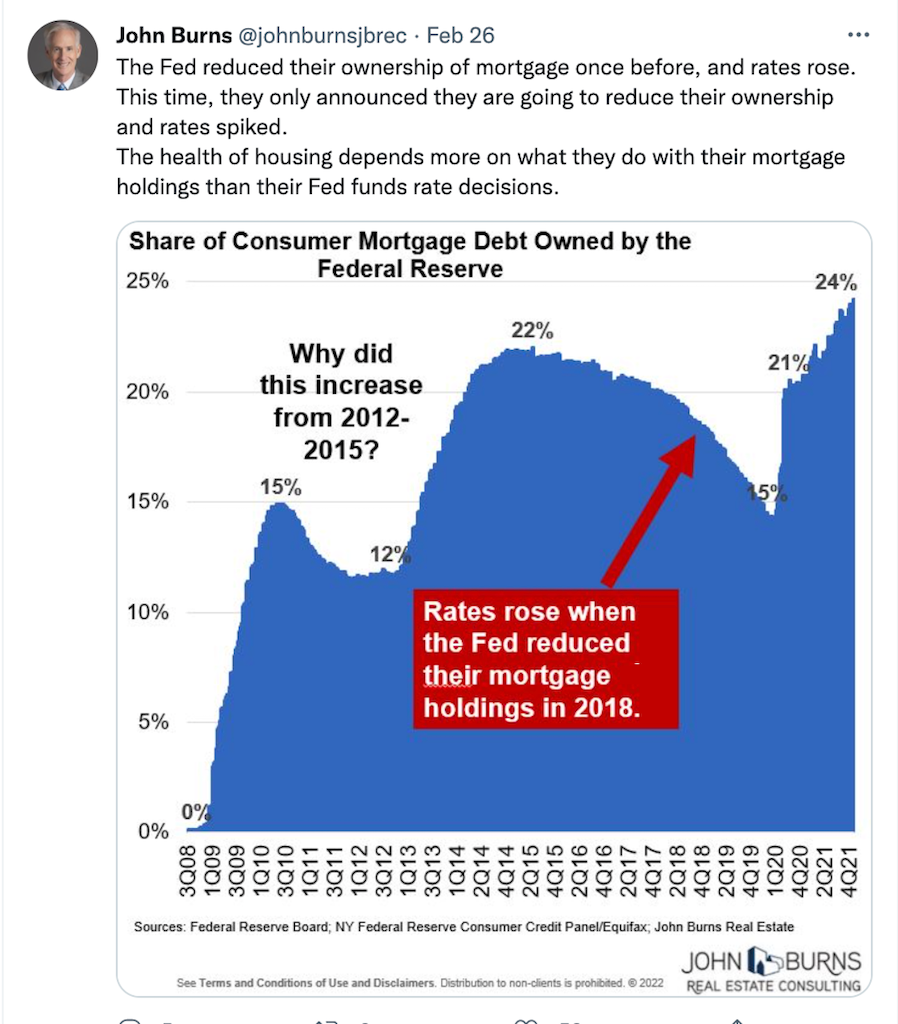

- Interest rate wildcard With most eyes on Fed fund rate hike impacts as the Federal Reserve jumps to action in its efforts to curb inflation, our partner John Burns, ceo of John Burns Real Estate Consulting, strikes a contrarian note of insight. He tweets:

The Fed reduced their ownership of mortgage once before, and rates rose. This time, they only announced they are going to reduce their ownership and rates spiked. The health of housing depends more on what they do with their mortgage holdings than their Fed funds rate decisions.

"The health of housing," in this case refers to the business enterprise vested and invested in producing and offering market rate new construction and new communities – for-sale, for-rent, single-family and multifamily.

Impacts to the health of housing, then, are subject to timing risks.

For instance, a friend in the field many regard as both a seasoned pro and a shrewd judge of homebuilding investment's critical moving parts frames out a punchlist of just some of the risks – both deadly specific and vaguely troubling – he sees in the fact that he "can't find anyone in the biz acting like they are worried about our unprecedented housing market ... except stock investors. Are they a more rational and disinterested party?" Here are a few of his other pointed observations – mostly coming back to timing:

- We traditionally worked hard to have sustainable price increases. Makes buyers happy, locks in the backlog, and moves people off the fence. This bidding process worries me. For one, we're going to have some very unhappy buyers/owners someday when the music stops and subsequent sales are materially lower. And how will we give confidence to the next buyer? With costs completely out of control (and I can't believe how much worse it got in January), not sure what the solution is. But does not feel good.

- Subs now unwilling to hold prices for no more than 30 days. Used to be six months. So even if you sell homes after you start them, you can't lock in your costs.

- The publics are doing a bit better on their cycle times and supply, privates getting crushed.

- I question the public builders saying they are underwriting to their previous gross margins. I doubt it, or rather, I don't think if you put in this morning's cost, this morning's price and the last couple months absorption, you're getting their old gross margins. You're assuming costs get better, or prices keep going up, or absorption is no longer constrained and is higher than historical norms in your market. But you are not buying dirt with current price, cost and historical absorption.

- Why have a complex option process, if SKUs evaporate constantly and any delay in delivery, costs you money with the increase in costs post sale? Everything's included on steriods? Just finish the damn things with no options and sell when literally finished? I would have thought six months ago that would be an overreaction, but now wondering. Anyone see a war in Europe helping supply chains? Probably does give the Fed the excuse they were looking for to not raise rates as much.

- I keep hearing from people "what would be the trigger to slow the market other than big rate increases?". I'm not convinced you always need a reason. Sacramento August '05, Northern Virginia Sept '05 went full stop. For no reason. Buyers just had had enough of rising prices. It's not something you can know - what's the breaking point.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.