Capital

Doldrums Unsettle Builders As Sales Slow, Cancels Creep Up

A spreading belief among homebuyer prospects is that new home prices must and will come down from where they are and – in light of the growing use of concessions and incentives – that they've already started on their way down.

A reversal in new-home sales momentum flared up in late April, deepened in May, and shows no sign of relenting. This has unnerved homebuilders and their developer partners as they face a seasonally more challenging stretch.

Further, they're starting to worry – beyond widening air pockets that have begun to undercut motivation to move forward with a purchase, replacing that motivation with a growing hesitation to buy now – about an uptick in order cancellations owing to an identical root cause.

A spreading belief among homebuyer prospects is that new home prices must and will come down from where they are and – in light of the growing use of concessions and incentives – that they've already started on their way down.

Our previous report hinted at this trend, posing the question of whether it was a temporary blip or a significant turning point. With a few weeks of solid data and on-the-ground observations, the answer is becoming clear. This is a consumer-driven shift, with buyers avoiding peak prices and anticipating a decline in asking prices.

Now, remember, both in 2020 and in 2022, in the wake of an historically fast upward adjustment in the Federal Reserve's funds rate and a concurrent end to low-low-low interest rates, some big potential trouble amounted to head-fakes, as buyers regained their stride and builders met the market.

Twice, homebuilders girded to use their healthy profit margins as shock-absorbers to give themselves time and cost-discipline to regain sales pace whatever the market fell to. Twice, homebuyer resiliency and large demographic cohort numbers spared their having to put worst-case margin scenarios into play, and by and large, better-than-expected performance over the past three years has buoyed their margins and pricing power once again.

After that three-year run of better-than-expected selling conditions, plus the continued tailwinds of structurally underbuilt markets practically everywhere and an existing home market stunted by mortgage-rate lock-in effects, the late-spring, early-summer softening has interrupted what many homebuilding, development, and investment executives projected would be a straight-shot growth surge at least into 2025 and beyond. This unpredictability underscores the need for adaptability and flexibility in your strategies.

With the focus now on reigniting sales and absorption pace, it's crucial to consider the potential fallout of those pricing and deeper discounting measures. This could significantly impact margins, bank loan covenants, and a builder's ability to secure a land pipeline for business continuation into 2025 and beyond, underscoring the need for strategic planning and decision-making.

Naturally, the homebuilding firms at the highest risk in light of an overall new-home absorption pace air pocket and a race to re-spark a newly stabilized "strike price" among buyers, are smaller operators with bank-financed land acquisition and development accounts that hinge on a pre-agreed monthly sales and revenue minimum as part of the terms of loan compliance.

Recent earnings cycle strategic commentary from the nation's 20-or-so public homebuilding enterprises generally addressed and affirmed continued improving growth expectations for 2024 into 2025 despite a backdrop of volatility and uncertainty.

A widely embraced talk track underlying those expectations among C-suite executives of the homebuilding's public firms is that a vast number of existing homeowners with current mortgages below 4% would confer an extended "only-game-in-town" runway advantage for new home builders. What's more, they've become convinced that would-be homebuyers – especially ones motivated by life-stage demographic issues like household and family formation – have begun to acclimate to and accept higher-for-longer mortgages and even higher new-home prices commensurate with their household incomes and sense of a higher-bar on new-home value and quality.

Call at least some of those households the less discretionary "life happens" buyers, motivated to move into larger quarters for an expanding family, or new hybrid work opportunities, or some other reason a home purchase now might feel non-negotiable.

In those expectations, however, they may have miscalculated the impact of the wearing effect of a one-two dynamic suddenly at play. One force is the whiff of a weakening employment and macro economy evident in the latest batch of consumer spending, employer hiring and job openings, and business activity macro reports.

The other is a surge in new existing homes listings – albeit, still well under typical historical pre-pandemic levels – and, simultaneously, a noteworthy weakening in asking prices in a growing number of U.S. markets.

At the same time, a couple of months straight of underachieving new home sales – attributed to the effects of higher than 7% starting national contract rates for 30-year mortgages – and a nearly universal increase in spec inventory among both public and private homebuilders means that if the current slowdown takes hold or worsens today's would-be home buying prospects have good reason to believe that if they wait to pull the trigger on a purchase, they're more likely than not to do better than if they do it now.

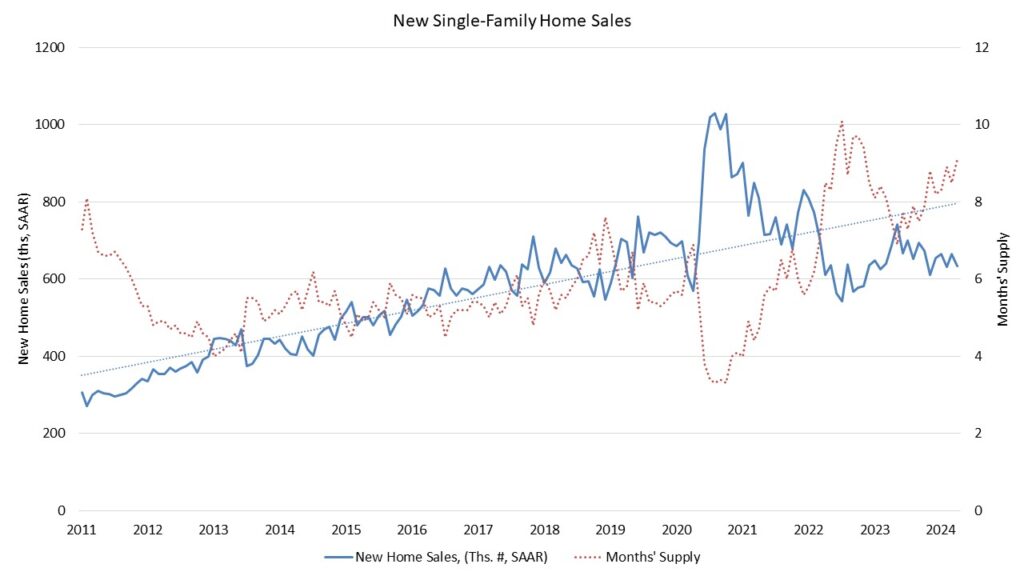

Late-May's New Home Sales analysis from Danushka Nanayakkara-Skillington, assistant VP for forecasting and analysis at the National Association of Home Builders provides data context.

New single-family home inventory in April remained elevated at a level of 480,000, up 12.1% compared to a year ago. This represents a 9.1 months’ supply at the current building pace. A measure near a six months’ supply is considered balanced.

A year ago, there were 68,000 completed, ready-to-occupy homes available for sale (not seasonally adjusted). By the end of April 2024, that number increased 42.6% to 97,000. However, completed, ready-to-occupy inventory remains just 20.5% of total inventory, while homes under construction account for 58% of the inventory. The remaining 21.5% of new homes sold in April were homes that had not started construction when the sales contract was signed." – Eye On Housing

Note that the measure of risk here is not just the unsold complement of new single-home inventory, but already-sold inventory that may be vulnerable to rising order cancelation rates.

The fact that the largest public builders typically react the swiftest and most aggressively to any cooling in their absorption pace is a function of their imperatives to do what it takes to keep their production machines running at the highest levels of operational efficiency, and to position themselves to own a greater share of every market they build in, especially in a slower market environment.

Private operators in each and every arena where publics troll for homebuyers had better prepare for turbulence ahead, because the publics are bound come at them hard and fast.

Scott Cox, in an earlier article, put numbers to this observation here.

- Public builder market share is now 45%, although this arguably understates the situation, as they do not build in all markets. Their market share in major markets ranges from 40% to 70%. Moreover, every single one of them has growth goals. As the single-family detached/townhome markets are not likely to get markedly bigger, they either fail at this – do not bet on it – or their share will come at the expense of smaller builders. And none of this counts the Japanese subsidiaries with large-and-growing scale and even larger checkbooks.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.