Leadership

Destiny Manifest: D.R. Horton Sets A Course To Control Its Future

The Builder's Daily dives into strategic and tactical positions the No. 1 builder's executive team lays out for the near-term, and what those positions mean for competitors in 106 U.S. markets.

Thousands of homebuilding operators in more than 100 markets in 33 states got notice today that an already stiff headwind – not mortgage rates, not flagging buyer confidence, not stubborn input costs, nor crashing home prices, not a weakening economy, nor a weakening professional class job market – just got a whole lot stiffer.

D.R. Horton – as the late military strategist and former U.S. Secretary of State Donald Rumsfeld might say – right now ranks high among private local and regional homebuilders everywhere as their "known unknown."

"Limited visibility" going into 2023 is roughly the equivalent of D.R. Horton getting the sniffles and practically everybody else – save a few top-5 homebuilding enterprises who'll magnify the impact on smaller, more fragile players – getting a bad cold or worse.

Why? The new homes – in backlog, or permitted, or under construction, or due to come on line to comply with bank loan covenants – private or smaller public homebuilders want or need to finish, sell, and settle in those scores of markets over the next stretch of "destabilized" conditions stand in the way of an enterprise bent on taking homebuying customers away from any and all rivals. Further, this "known unknown" has no stated plans to slow down a whole lot from its current pace of production.

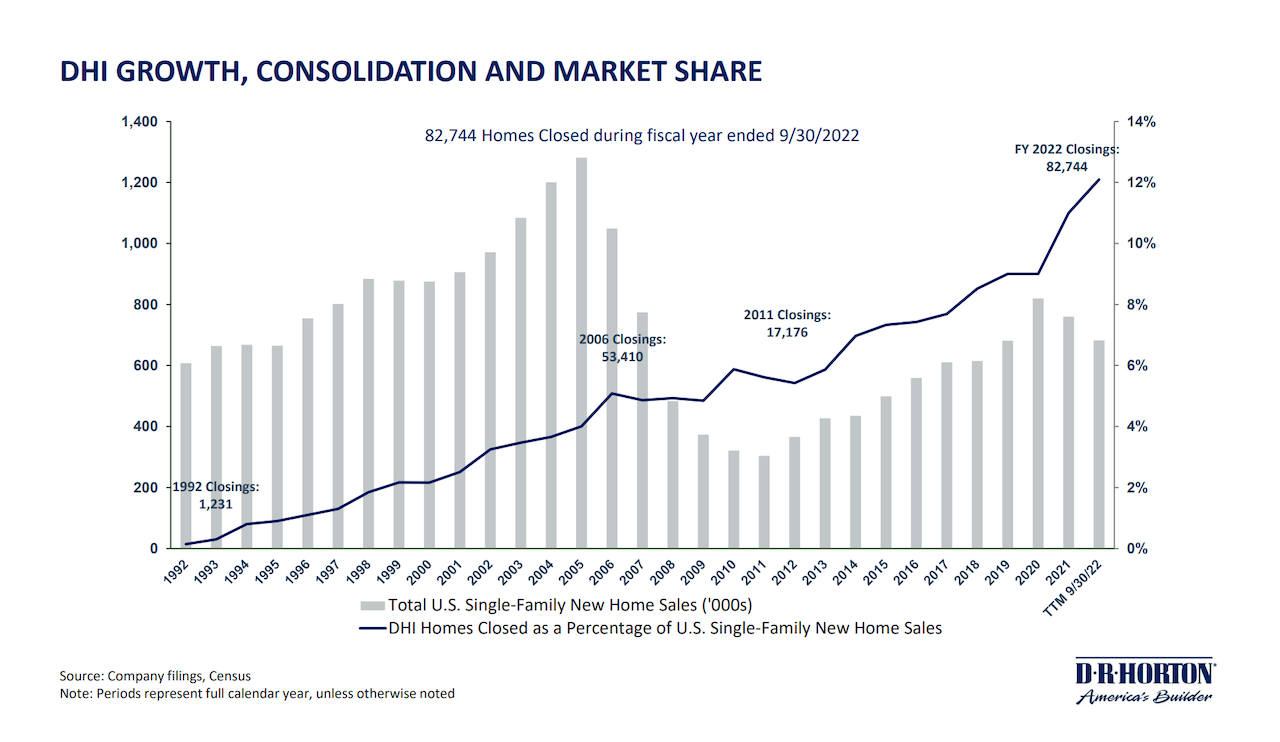

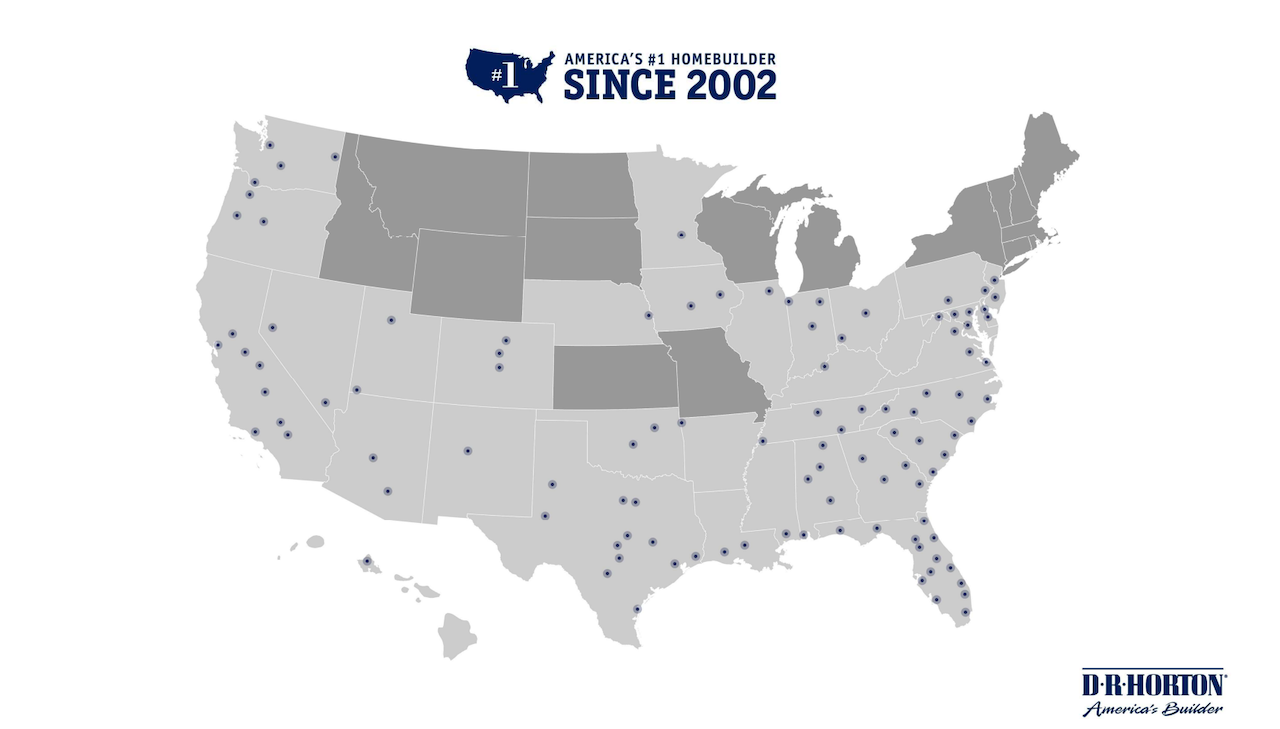

Even among America's 50 most-active new residential construction markets, D.R. Horton is No. 1 in 15 of them, ranks among the top five in 39, and as a top-10 builder in 44 of them. The nation's largest site-build homebuilding enterprise's teams of operators closed its fiscal year 2022 ending Sept. 30, on a company record high 82,500 homes, generating homebuilding revenue of $32 billion in its fiscal 2022 12-month period – a rate of 9.4 homes an hour – which catapulted Horton to a record high 12% market share for the period.

D.R. Horton's 106-market footprint and operational juggernaut has empowered the unique position of selling more than 1 of every 8 new homes that come online, all with an SG&A of a record-low 6.8% and a homebuilding return on equity of 42.8%.

Be warned if your operating area is within striking distance of one of these dots.

A bullet-proof balance sheet, strong liquidity, and low leverage. That's table stakes for dealing with rougher externalities buffeting the market and clouding the depth and duration of a downturn that's still trying to find a bottom.

What the Horton team has and has invested in and has earned beyond those table stakes is flexibility, optionality, the ability to prioritize volume and set its own destiny – whatever it takes – with confidence it can reconstitute and smooth margins once it has established a pace it can reliably predict.

That makes competitors fragile not just to macroeconomic disruptions and stress, but to dynamics that grow more adverse, faster, and with more uncertainty as to the stamina it will take to work through to better times.

In today's conversations with equity research investment analysts on the company's Q4 and full-fiscal-year 2022 results, D.R. Horton executives David Auld, president and CEO, Jessica Hansen, VP-Investor Relations, Michael Murray, executive VP-co-COO, Paul Romanoswski, executive VP-co-COO, and Bill Wheat, executive VP-CFO responded to questions regarding pricing and incentives, land and capital resource allocations, construction operations, and current and near-future.

In a high-level macro-environment that continues to set destabilizing forces into play at varying degrees of impact, here's a glimpse of the nation's No. 1 builder's positioning with respect to staying its own course. That's of course a big headwind for almost everybody else trying to build and sell homes near any of the D.R. Horton flags.

Keep these three capabilities in mind:

- Flexiblity

- Agility

- Control of one's destiny

When president and CEO David Auld exhorts his D.R. Horton at the close of the presentation, "Stay humble, stay hungry, stay focused, go compete and win every day," that's a headwind.

On Product Mix Shift And Value Engineering

Michael Murray, Executive VP- co-COO

In most of our communities across the country, Steve, we'll be able to start back smaller homes primarily and change specification levels in those homes. That we start -- have been starting in the most recent quarter and will be starting in the first quarter.

There are some communities that are a little more locked in on product and planned neighborhood phases that it may take 3 to 6 months to work through some changes in the product offerings. But by and large, most of our communities, those changes are starting today, and we'll continue to see that roll out through the next 6 to 9 months.

David Auld, president and CEO

And even with product lines that we've been offering as a spec builder, we release certain houses every month. So when the market is running red-hot like it was first half plus of last year. You have a tendency to release the bigger houses because your that dollar-profit-per house is higher.

Now when a price point becomes much more important to the buyers, the homes we release, go from the 2,300 square foot 2-story down to the 1,600 square foot ranch, which drops the overall ASP of the community without really changing the product or impacting valuations within the community.

Incentives Cadence In A Destabilized Outlook

Bill Wheat, EVP-CFO

At the end of the last quarter, mortgage rates were still in the low to mid-5s. And by the end of the quarter, they're in the high 6s.

And subsequent to the end of the quarter, they've now stepped into the 7s. And so we have been adjusting to reflect that. A lot of our incentives have been on the financing side with interest rate locks and buy downs to try to address the payment shock there from the interest rates. And that has increased sequentially through the quarter and has continued into October. So the levels have continued to increase.

We were focused on ensuring that we could close our backlog because we did have a lot of homes scheduled to close in September. And so we believe we did hold off on some price adjustments to ensure that we could close that backlog. And so price adjustments have started to fold in a little more commonly as we've stepped into Q1. So it's been a sequential increase along the way. And then what it will be going forward will depend largely on what happens with rates in the market and then our efforts to meet the market.

We are looking community by community to make adjustments in order to hit our sales pace and turn our inventory and maximize our returns. And so we're looking to find the market and find that pace community by community.

On Land Option Write-Offs, Possible Impairments

Michael Murray, Executive VP - co-COO

With the option write-off cost, as we evaluate projects at various decision points, we'll be working with various land sellers and developers and where we can't reach an agreement on our accommodation, we're not going to move forward with a bad deal. So if it doesn't make sense and what we expect the market conditions are or will be over the life of the project, that's the reason we have the option arrangement.

So we may have an increase in those costs, but we do take a pretty accurate look at those things, very realistic expectation, and we'll be very quick to move on those.

David Auld, president and CEO

Both when the market was accelerating and now at the [current] pause, we are very disciplined in how we approach every economic decision on the land side. It's all about creating optionality and efficiency of capital. And that's been our program, and it's going to continue to be our program.

Jessica Hansen, VP-Investor Relations

We're still projecting for our gross margins to remain at very healthy levels that would signify that we're a long way off from any sort of broad-based impairments. We're also in a completely different financial position mid-cycle to prior cycles, which allows us some flexibility in terms of how we look at the land that we have on our balance sheet and what we plan to do with it going forward.

That being said, we do expect there to be some impairments along the way in weaker submarkets. But right now, I don't expect anything broadly based in the near term.

Underwriting For Single-Family Rental

Paul Romanoski, Executive VP-co-COO

We have certainly seen from that buyer base in the credit markets and their ability to borrow soften, but there's still plenty of buyers out there. Like our buyers on the homebuyer side, they're taking a bit of a pause in some cases, just to evaluate the market.

But we've got about 7,400 homes in production on the single-family for rent side, and that's from beginning to those that are complete. We still expect to see people in that market. Not everyone needs to be in the credit markets or borrowing to purchase. And our single-family rental communities tend to be on the lower end side relative to apartment sizes.

And so we still feel good about that business, but we certainly did see communities that we expected to be sold and closed in the fourth quarter pushed into the second quarter.

We have been very conservative on our underwriting. We are really looking at each of those communities as we would on the for-sale side. And so the performance we saw on the ones that we sold in the market a year ago and through the last year, were far outperformed our underwriting. And so we still feel good about the position in the active communities that we have, and we will adjust as the market adjusts in terms of that business on a go forward.

Are We There Yet? The Floor?

David Auld, president & CEO

It depends on what the capital markets and interest rates do. I mean it's -- if we see stabilization in interest rates, I feel very optimistic about what we can do this year. if we continue to see 100 basis point increase quarter-to-quarter to quarter, I think it's going to be a very challenging year.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.