Marketing & Sales

Demand Without Wherewithal Is Either Pent-Up Or Priced Out

The tale of the housing demand tape is invariably a function of a household's payment power proximity versus a gap whose quantifiable size is as a down payment plus monthly payment baselines.

A good new home features memory points, an entry way that inspires welcome, a kitchen that speaks to a hub of life, a living or spa area that makes the magical feeling of comfort happen at first sight.

They instantly release dopamine, a reflexive good feeling. But rather than fade, memory points in a good home linger. Over time, they burrow deeper, settle in, and do their work from inside out. Those memory points attach, in fact, to our best memories from the past and to our future's new capability to make more of them. They meld together.

It makes for the big exception to rules that dopamine is a fleeting brain chemistry rush, and why a home – a new home with memory points – flourishes renewably in the economy of physical things and the experience economy.

The origins of a memory point – architects and designers know – use material world space and light and air to trigger via the senses that initial dopamine pulsation. Those origins tendril then into time and imagination and become the regenerative memory-makers that are the essence of a home.

This is a raw material of demand. It has nothing and everything to do with population demographics, life-stage, family-formation, income level and prospects, scarcity of available alternatives and vacancy rates, borrowing costs, etc.

And like a good house, a good story about this business of those whose livelihoods stem from making homes and neighborhoods for people has its memory points too. They work similarly.

In Scott Cox's story, Housing's Environment Has Changed. How will we adapt? there are few of them in different places, like in a good home. One of them is here:

Demand is impacted by price. Price does equilibrate. Move up the price curve, move down the demand curve. We need to stop saying “they have to live somewhere.” When they can’t afford it, somewhere is not what we produce."

Models for demand, Scott observes, are curves that bend. A lot of people in an age group, or the absence of existing homes listings, or an arithmetic difference of new construction from one period to another do not by themselves make up a tale of the tape for housing demand. Prices that are high and rising drive down demand. Prices dropping – some way or other – are the beginning of rekindling it.

That tale of the housing demand tape, at the beginning, middle, and end of the day, is invariably a function of a household's payment power versus a gap that's quantified by down payment plus monthly payment baselines.

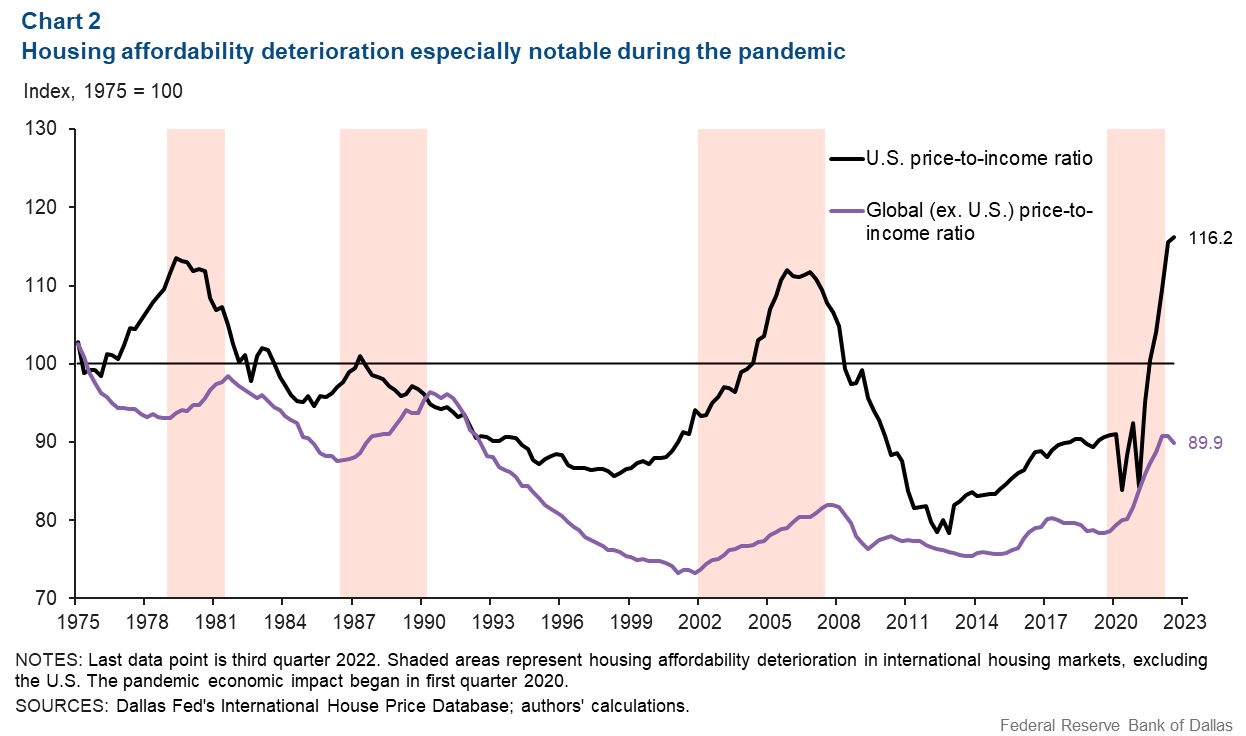

Something like this, which illustrates the direction and steep trajectory of that gap, not just domestically but, directionally, globally:

Signs of diminished affordability in the U.S. have usually preceded global deterioration. However, during the pandemic boom, the U.S. and the world largely aligned. The U.S. price-to-income ratio reached a peak not seen since 1975, while the global price-to-income ratio increased at its fastest rate and by its largest amount. Signs of moderation emerged globally in second quarter 2022."

The threat of a severe housing slide, not just in volumes but in prices is, according to the Dallas Fed, suddenly "everything, everywhere, and all at once."

This all comes around to a couple of thoughts and a conclusion.

One thought comes from the notion that it's human and corporate organizational nature to solve for the last crisis and believe that that has prepared us for this one.

Working with greater margins, stronger balance sheets, less debt, and less exposure to land risk puts most homebuilders in far better state of preparation this time around, but only if the convulsion's severity and duration run similar to the GFC.

The other, related, thought is that since real estate cycles have always not necessarily repeated but rhymed, the question is – especially as regards demand – will this cycle look more or less or nothing like downturn and recovery cycles past.

What if – given the magnitude and nature of volatility and uncertainty running at an accelerated speed these days, on top of the intractable vicious-circle aspect of the affordability obstacle – recovery gets stuck in a protracted series of false starts and halfway there periods. What if a nascent recovery gets going, only to slip back into air pockets of confidence and purchase activity?

Will housing be the engine or the caboose through this next very tricky patch?

- Jobs – a juggernaut – may finally be showing signs of weakening

- Debate continues on monetary policy moves to try to land the economy without tanking it.

Some KPIs continue to run hot, while some that have been strong are cooling fast. What if a nascent recovery gets going, only to slip back into air pockets of confidence and purchase activity?

This scenario – quite a sharp contrast with a typical parabolic sustained cyclical rise leading to the next cyclical downturn – is plausible, especially in light of an affordability gap that no one's yet got the best answer for.

The conclusion, then is this. Demand is not – in the real world – a function of "underbuilt homes" or age generational cohort sizes or new homes as a percentage of population or any other technical model. All of demand – when it comes to the purchase of a family's most pricey consumer durable – is fundamental.

For a very bumpy 2023, at least, demand will be what you make of it rather than what it's modeled to be.

That means, as always, property locations, products, and prices that provide pathways in rather than roadblocks.

Memory points, too, will matter as a bridge from wherewithal across an abyss of hesitation and doubt. They work from inside out.

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.