Marketing & Sales

Demand As Builders, Developers, And Investors Knew It, Is Evolving

Economics housing demand, and consumer demand for homes have begun to decouple, and by 2030, demographics-as-destiny will be a bygone business and investment pillar.

Imagine. You're selected to co-host an in-person "ask-the-experts" luncheon discussion among eight conference participants, and you way-find your assigned table number to where a mini-posting reveals to you – for the first time – the discussion topic.

That vaguely impostor-syndrome sense takes full hold as the table fills up with people who've each chosen this as the topic they've come to talk, listen, and learn about for the next 30-40 minutes. A look around the table makes one thing clear to me. Their eagerness to dive in on the subject of nudge choice architecture is only matched by the totality of my own ignorance about the topic.

Or so I'd thought.

To my relief, the around-the-horn discussion started clock-wise exactly one person to my left, which meant that my turn would come last. At about mid-way through each person's introduction and explanation of why they were interested in the subject, a person – my savior – said the words.

What is nudge architecture?"

The answer is the answer. It, roughly, traces to a term behavioral economist and author Richard Thaler and co-author Cass Sunstein coined in their 2008 book Nudge to describe design, engineering, construction, planning that helps humans filter information and choose a path. They describe it better:

A nudge, as we will use the term, is any aspect of the choice architecture that alters people’s behavior in a predictable way without forbidding any options or significantly changing their economic incentives. To count as a mere nudge, the intervention must be easy and cheap to avoid. Nudges are not mandates. Putting fruit at eye level counts as a nudge. Banning junk food does not.”

I had been familiar with the book and its behavioral economics application. So, as opposed to nudge architecture being a matter of an unknown unknown, for me, it turned out that I knew more about the topic than I'd realized – an "unknown known."

Here's today's The Builder's Daily focus, and why we start with something to know, something to learn, something we need to get a grip on – like nudge architecture – that we didn't know, or at least didn't know we knew.

The focus is an offset to today's turbulent, roiling context: the firmament of economics, policy, and distribution and supply are in such a mess, challenged by uncertainty, volatility, doubt, risk of inflation, delay, and a host of adverse business impacts that go together with the loss of visibility:

The focus is consumers.

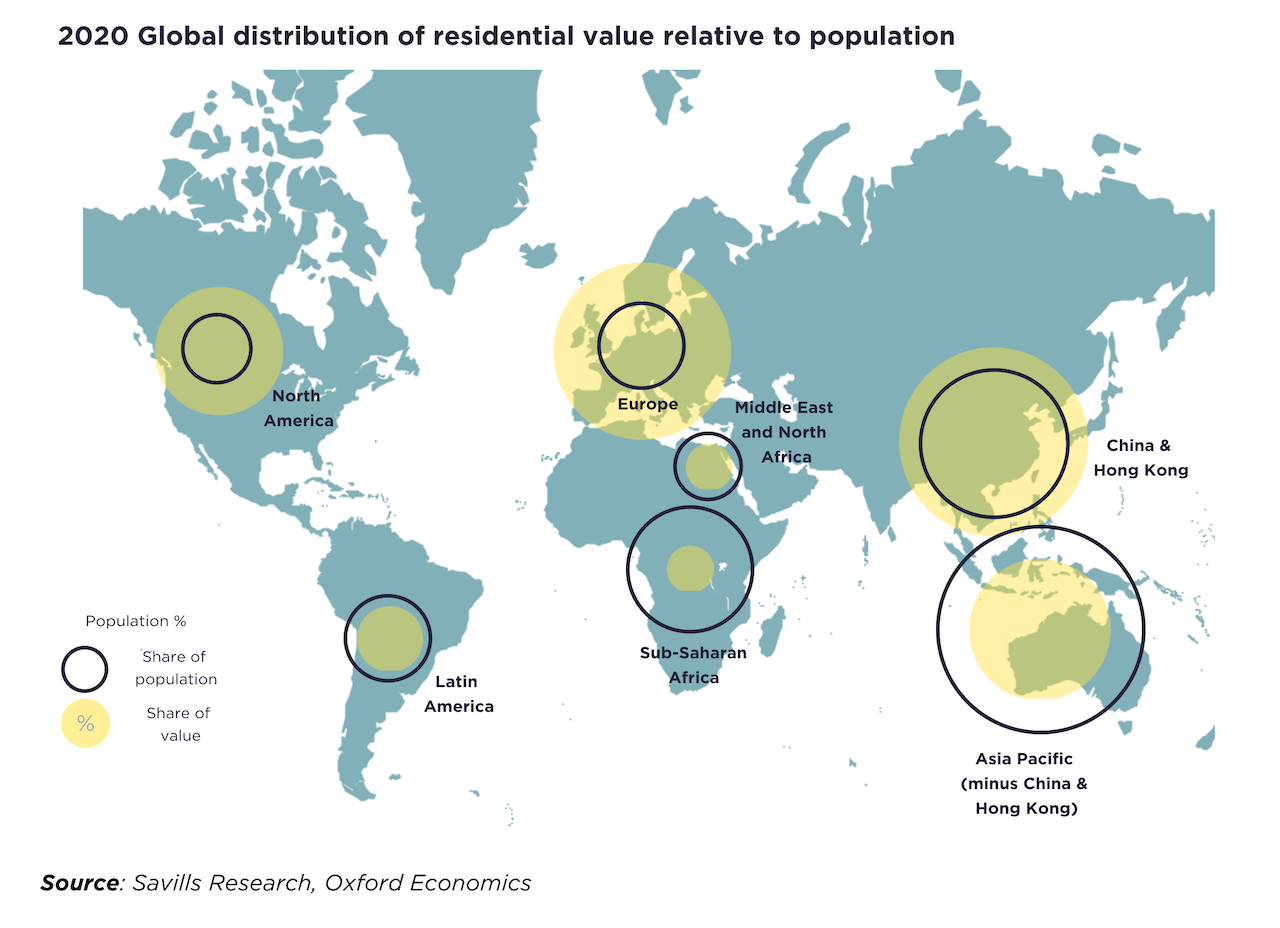

It's a 2020s matter of business urgency for the global $258.5 trillion world of residential real estate and property values – it's the one and only bridge between sheer population, family formations, and households, which are flattening, and new real estate, development, planning, and construction. The U.S., per Savills World Research, accounts for 11% of the world's total in residential real estate value, seeking, as we've witnessed a surge in both capital appreciation and income yield opportunity.

The truism, "everybody needs shelter," worked wonders as a foundational assumption, and helped to build enormously successful empires in the past. The truism serves today as a likely bulwark of the reason residential property is worth upwards of $260 trillion.

Fact is – as adaptations, evolutions, and new iterations of what people call "home" emerge, particularly in a living-with-the-pandemic era – demographics can no longer be counted on as destiny. At best, vital statistical demographics pillars like job formations, household formations, marriage rates, birth-rates, wealth-trajectories, even educational attainment patterns and their income-generating implication, will bear less and less direct correlation with construction and real estate enterprise level success and value creation in the very near future.

Homebuilding, residential real estate investment, and development business arcs have largely shaped their upward trajectory around the pairing of what people need with what they have means – present and future – to finance.

Right now, there's a debate raging. How many homes – new construction of for-sale or for-rent properties – does America need to build to catch up to a level of supply that would make more shelter more attainable to more people?

Smart, experienced, informed, and reasonable people differ – dramatically – in their view of both how to count the deficit and how to factor in current production to arrive at a correct number. There's no consensus. The debate will rage on.

At the same time, critical priority focus goes missing. Focus on consumers, and their discretion, and their preference for agency and self-service, and their objections to force, to no-choice, to no-leverage, to unhelpfulness.

The cause-effect relationship between more people, more jobs, more households, more marriages, more babies etc. and a residential developer-homebuilder's business fortunes once-upon-a-time was a bankable assumption.

By the end of the 2020s, not only will the cause-effect relationship have gone by the wayside, so too will be some of the stronger correlations that connect demographic patterns to business success.

Consumers – those with sway over their household means, both in income and spending – are seizing the reins, and they mostly refuse to be told what they're going to have to do.

For helpfulness – the nudge architecture of this story – here's a glimpse at how some of the large consumer packaged goods and retail marketers look at the challenge of consumer and customer focus in a post-pandemic near future of consumer household sway and what that means for business opportunity.

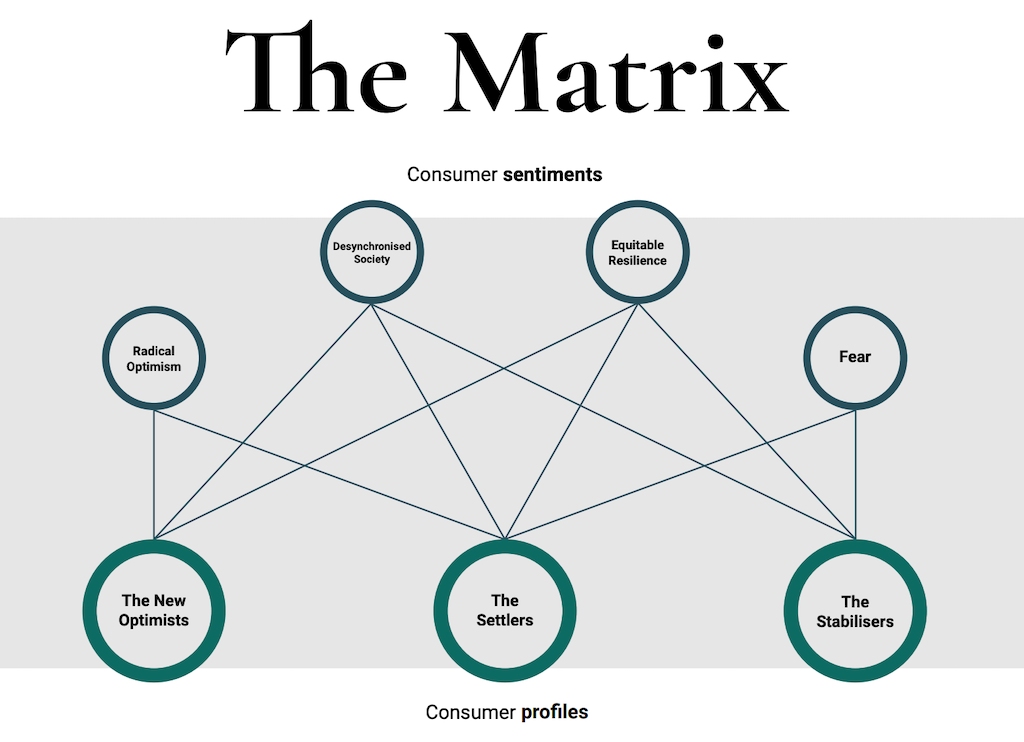

The challenges might add up this way:

- Fear

- Desynchronized society

- Radical optimism

- Equitable resilience

And, in response a marketer – a masterplanner or homebuilder or developer – might focus, even nudge, your customer by appealing to how he, she, they approach today's household-level, kitchen-table style challenges, as a "stabilizer," a "settler," or as a "new [realistic] optimist."

- Simplicity matters: Consumers are increasingly overwhelmed. Declutter.

- Living in livestream. Conversational commerce is here to stay. Invest in branded livestream.

- On-demand evolution. Provide platforms for group ordering/delivery and focus on hyper-local, last-mile experience.

If this is where retailers and consumer goods and services marketers have leaned-in, this is the context for consumer expectations, experience, and demand.

The nudge here is this. Focus at your peril on either macro-economics housing demand based on new construction production, replacement of old stock, population growth, immigration patterns, etc.

Focus instead on consumers behaving – even as regards the shelter they choose to pay for – the way they want to behave, not as you believe they have to.

Join the conversation

MORE IN Marketing & Sales

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.

Bad Data Bleeds Homebuilder Profits —Time to Stop the Loss

Hidden errors, fragmented systems, and outdated processes are eating into homebuilder margins. Industry experts reveal how better data can save time, cut costs, and boost profitability.