Land

Davidson's M&A-Organic Combo Speeds San Antonio Scale

Davidson Homes acquires the lot assets of New Leaf Homes' five actively selling neighborhoods encircling San Antonio and kicks off a handful of new organic project deals on a mission to scale fast.

Last fall, Huntsville, AL-based Davidson Homes fired up its presence and signaled ambitions as a not-to-be-ignored new competitor in the San Antonio arena by deploying a distinctive market entry model: Equal parts organic and builder acquisition.

As its latest San Antonio M&A deal and a bevy of separately obtained land buys and project options in San Antonio attest, the very hybrid model that ignited the market entry will also play a key role in accelerating Davidson's ascent from newbie status to local and regional heft, market share and scale.

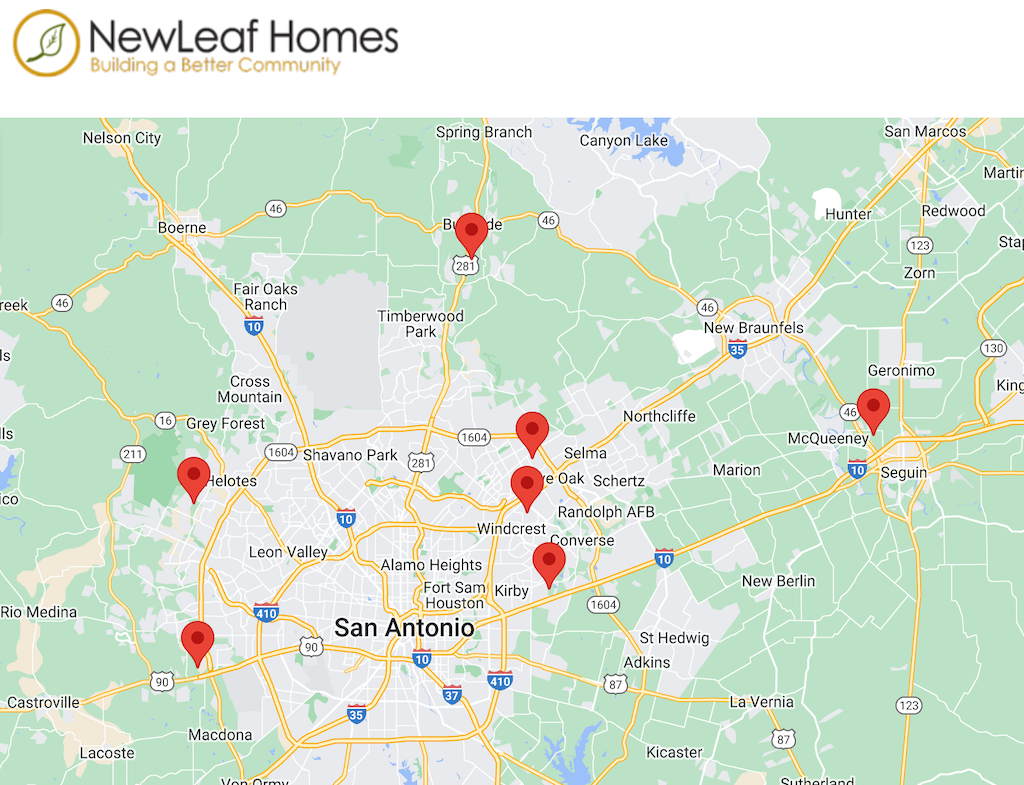

This week, Davidson Homes acquired the land assets of one of San Antonio's long-time homebuilding fixtures, New Leaf Homes, founded by real estate and land development maven Fred Ghavidal. The transaction pulled in the lots in five actively selling communities — Bricewood, Comanche Ridge, Horizon Pointe, Royal Crest, and a fifth neighborhood soon to close — and will more than double Davidson's volume and pipeline in the market.

In addition to the New Leaf Homes assets acquired, Davidson Homes Central Texas division president Rob Wasyliw describes a hive of organic activity in new San Antonio communities occurring like multiple spinning plates.

We bringing exciting products into town, to kick-start and continue to gain scale here in San Antonio," Wasyliw tells us. "The beauty is that on April 15, we are also closing on Hickory Ridge, in Elmendorf, and, like these other projects, that will be 40-foot product on 50-foot lots. Added up, you’ve four communities through the Kindred acquisition, five through New Leaf, and then two other deals we've done. That's 11 communities right there. We are also closing here next week on Agave, which is a 30-foot product on 40-foot lots.

We are also developing a deal called Cedar Heights, which will be a 25-foot product on 31- by 85-foot lots. That’s an infill location close to the medical center. We’re also very excited to do that new product. It's an emerging type of product in San Antonio, as people look to get infill locations opportunities. They're for people who want to be close to employment, entertainment, retail, and so forth but still want single-family detached homes." We’re still looking at affordable parcels, but multifamily usually chooses them. With this product line, we can also choose these infill locations and give the buyer the product they're looking for.

The race to scale, explains Wasyliw, is not simply a rush to meet one of the U.S.'s torrid housing market's growing need for new homes. It's about creating an operational relationships infrastructure, depth, and volume to drive efficiencies and predictability into as soon as the Davidson Homes team can achieve that.

We have about 1200 lots under control right now, and 16 total communities in the pipeline going forward,” says Wasyliw. “By the end of this year, we'll have about a dozen communities open, almost all on our balance sheet. I am very excited about coming into the market at scale because that adds leverage with trades, negotiating costs, and, importantly, getting talent on board to add to the team. A lot of the people we've hired are very excited to come on board, and we're up to 13 staffers in San Antonio. We can now recruit people very well based on the product portfolio and the scale we can now show we’re doing."

Davidson Homes CEO Brandon Jones says this game plan — an on-the-ground proven talent-driven incubator presence coupled with strategic rifle-shot land assets and M&A — models out as a nimble, capital-lighter market entry and scale playbook.

This is consistent with the discipline we've kept ourselves to," says Jones. We look at these emerging markets as opportunities to put that rigor into play with a combination of organically buying land and hiring people, matched up with strategic builder acquisitions to supplement the portfolio and fuel that scale quickly. That virtuous cycle allows us to get going in terms of the land assets, and then the people who joined Davidson as part of these transactions have allowed us to ramp up even more quickly."

Arriving one year ago, to supercharge those talent- and capabilities-building initiatives at Davidson Homes, former PulteGroup senior vp of Field Operations Jones, joined on with Davidson as ceo. Jones has since doubled-down on bringing public company skillsets, strategic solutions, and disciplines to a highly motivated five-division team of operators.

At the time a year ago, Jones mapped out the organic/M&A hybrid model, and how he planned to deploy it:

For example, we hired a division president [Wasyliw] in San Antonio, who is building a land pipeline. He's done an excellent job putting under contract several land deals. Based on what he's done, we can now build a team around him. For us, it starts with getting a good land person and turning them loose to acquire lot deals. At that point, we hire construction, sales, land development, and other supplementary roles to build the business. We're doing the same process you're seeing in San Antonio in Central Florida, Austin, and Charlotte."

On the organic front comes a few initial land purchases and the addition of top-wrung strategic and operational leadership – with deep local relationship roots and a track record of multi-cycle success – like Rob Wasyliw himself, whose pedigree with other high-volume homebuilders is as a big-time producer.

My goal is to do up to 500 units a year in San Antonio," Wasyliw says. "We're knocking on 350 or 400, based on what we have in the portfolio right now. But if you're at 500 units a year, you're definitely within the top 15 and knocking on the top 10. Overall, the goal is to achieve efficiency and economies of scale to provide value to the buyer with a high-quality home. To do that, you need to have scale. And then that's one of the reasons, coming into this market, we want to be aggressive and get positioned correctly on a cost structure, which leads to our overall ability to provide a valuable home to future homeowners who come knocking on our door."

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.