Leadership

D.R. Horton's 2023 Performance Gives It More Room To Run In '24

"Our strong balance sheet, liquidity and loan leverage provide us with significant financial flexibility to meet changing market conditions and continue aggregating market share." -- David Auld, Vice Chairman of the Board, D.R. Horton

In the 1980s, hotshot madmen types created award-winning, memorable, fiendishly comedic ads that pitched soft drink producers Coca-Cola Company and PepsiCo as arch rivals in the "Cola Wars."

Sergio Zyman, a Coca-Cola marketing guru at the time, was having none of it.

We don't compete with Pepsi," Zyman once famously said. "We compete, as the source of refreshment, with tap water."

In its bid to own refreshment in the minds of its consumer, there was no such thing as Cola Wars for Coca-Cola.

Fast-forward to a different moment and a different industry sector – the business of making new homes and new neighborhoods for people – and, arguably, the name D.R. Horton stands as a competitor like no other.

A year-and-a-day ago today, we wrote on the heels of D.R. Horton's Q4 and full-year-fiscal 2022 results the following:

A bullet-proof balance sheet, strong liquidity, and low leverage. That's table stakes for dealing with rougher externalities buffeting the market and clouding the depth and duration of a downturn that's still trying to find a bottom.

What the Horton team has and has invested in and has earned beyond those table stakes is flexibility, optionality, the ability to prioritize volume and set its own destiny – whatever it takes – with confidence it can reconstitute and smooth margins once it has established a pace it can reliably predict.

That makes competitors fragile not just to macroeconomic disruptions and stress, but to dynamics that grow more adverse, faster, and with more uncertainty as to the stamina it will take to work through to better times.

At a high level, what the D.R. Horton team accomplished during these past 12 months – and has the better-than-expected financial and operational performance measures to back that up – include rising to two challenges, as Executive VP and COO Mike Murray puts it during the strategic team's call with Wall Street research analysts on a Q4 and full-year 2023 earnings call:

- Solving for supply chain chokeholds that elongated build-cycles and fogged out deliveries and closing dates

- Once the Horton team could pin-point those dates, it could unleash its full, precisely-timed array of incentives, mortgage buy-downs, and concessions to drive pace predictably.

In other words, the team – as it does perennially – seized its own destiny despite turbulence, tricky signals, and uncertainty stalking the market underneath all year long. And it came out ahead and here's what that looks like in two slides:

Here's how Jessica Hanson, D.R. Horton VP of Investor Relations, gives color to those figures.

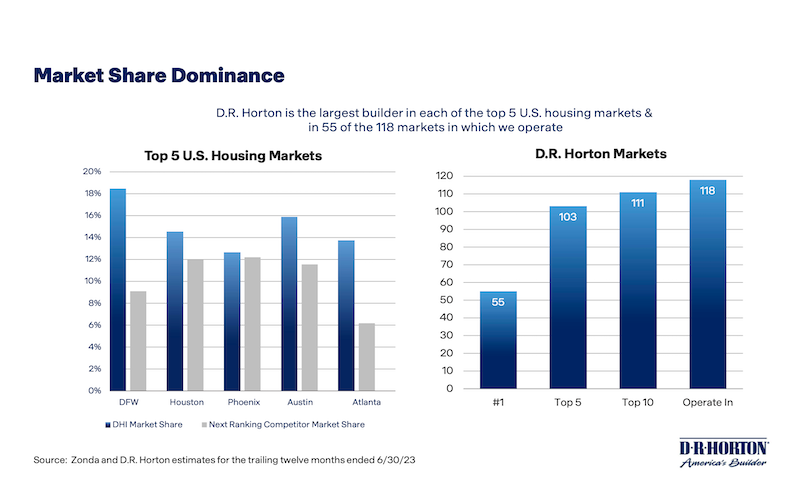

Out of the 118 markets we're in today, only 7 we're not top 10 in and we went through those last night and they are all markets that we essentially have just entered within the last year or two. So we would expect to be top 10 very quickly and then move up into the top 5 and certainly continue to work on becoming number 1."

So, let's go back to our lead-in thought about competition and market share and reflect on what that means in a year ahead that D.R. Horton strategists view as challenging on both the pricing power and margin front.

"Market share," as a matter of fact came up in 12 separate instances during the Horton team's prepared comments and in dialog with the cohort of analysts. The big take-way – and we'll come back to this after we share some of the verbatim references to market share because they're full of implications not just for D.R. Horton, but for every homebuilding operator within competitive range of Horton's 118 markets – is that whether the total pie of new home deliveries shrinks, stays the same, or grows, D.R. Horton will be taking bigger slices where ever its "flags" fly.

Data indicate that, D.R Horton's the No. 1 builder by volume in the top five most active U.S. new home construction markets, and is No. 1 in 55 of the 118 markets it operates in. For Horton team members, those 63 markets where Horton is not No. 1 is all opportunity.

And in the new markets it has just entered or will enter, where it's not in a top 10 position, local competitors may view themselves as engaged in some sort of "builder wars," but Horton and its team focus rather on competing with every form of home – for sale, for rent, etc.

Let's look at a few of the instances of focus on market share as an operational bulwark that will consolidate more capability to drive gains in 2024, and ignite a potentially record-breaking 2025 in returns.

David Auld, Vice Chairman of the Board

We are focused on consolidating market share by supplying more homes at affordable price points to meet homebuyer demand, while maximizing the returns and capital efficiency in each of our communities.

With improvements in both labor capacity and availability of materials, our cycle times are decreasing, positioning us to improve our housing inventory turns. We are well- positioned with our experienced operators, affordable product offerings, flexible lot supply, and strong capital and liquidity positions to generate strong cash flows and produce consistent returns.

... In closing, our results and position reflect our experienced teams, industry-leading market share, and broad geographic footprint across 118 markets. Our strong balance sheet, liquidity and loan leverage provide us with significant financial flexibility to meet changing market conditions and continue aggregating market share."

... everybody is talking about returns, cash flow, deleveraging and derisking their land pipeline. I don't see that changing. The industry has matured, the market share consolidation by the publics, the difficulty of putting lots on the ground, the difficulty of building houses, restrictions on capital, all of those things are forcing a discipline on the industry and allowing the national builders to gain market share quarter after quarter after quarter after quarter."

So our internal focus is going to continue to be project by project, driving improvements to efficiency, simplifying product, making it – even as overall individual component price increases, the availability of housing to the first-time homebuyer continues to be there."

Michael Murray, Executive VP – COO

To adjust to changing market conditions and higher mortgage rates, we have increased our use of incentives and are reducing the size of our homes where possible to provide better affordability for our homebuyers. We expect to continue utilizing a higher level of incentives in fiscal 2024, particularly rate buydowns in the current interest rate environment.

Our sales volumes can be significantly affected by changes in mortgage rates and other economic factors. However, we will continue to start homes and maintain sufficient inventory to meet sales demand and aggregate market share.

... Forestar had approximately $1 billion of liquidity at year-end with a net debt-to-capital ratio of 5.5%. Forestar is uniquely positioned to capitalize on the shortage of finished lots in the homebuilding industry and to consolidate significant market share over the next few years, with its strong balance sheet, lot supply and relationship with D.R. Horton.

Jessica Hanson, VP of Investor Relations

We anticipate a financial services pre-tax profit margin of between 20% and 25%, and we expect our income tax rate to be in the range of 24% to 24.5% in the first quarter.

We are well positioned to continue consolidating market share in both our home building and rental operations. Our fiscal 2024 home closings volume, pricing, and margins in our homebuilding, rental, financial services, and Forestar businesses will be determined by market conditions and our efforts to meet the market by balancing pace and price to maximize returns.

... we still really like over half of our business being first-time homebuyers because despite what's happening with interest rates, those buyers need a place to live. They don't already own a home, so they're not a discretionary buyer. They're in the market looking at buy versus rent opportunities. So, if we can stay competitive with the rental market on that front, we're going to continue to capture first-time homebuyer market share."

Market share. As a competitor, you're either on the winning or the losing end of market share gains. That's what's likely to be a recurring theme in the business in 2024.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.