Leadership

Customer Focus Point: Mind The Growing Gap Impact On Demand

The simple math of market-rate demand that is cushioned from a new raft of X factors has suddenly gotten more complicated. Simple rule: Take no customer for granted.

Mind the gap. It's that growing space between what makes builders confident and what worries everyday people as they veer toward decisions about where and how they will live.

Wall Street investors focused on havens amid the storms and shoals follow algorithmic paths to calm if they can, and they're trying mightily to do that now.

A household, however, enjoys far less optionality in its key buckets of goods and services – usually, spending more on some essentials means having less to spend on other, discretionary expenses. Households add up to a third of GDP, and they haven't gotten the memo that a strong economy, a sizzling jobs market, a pivot to employee power, and a limitless blue-sky of career opportunity should buoy them, and drive them willy-nilly into the new home market.

The teachable moment here. Investors and investment and lending capital-fueled homebuilding enterprise leaders and their quantitative systems obey economic rules. Households obey them too, but it may be that a gap separates – and divides – them. As confident as they are in the fundamentals of demand for what they're doing, builders have to start asking themselves, "Am I feeling lucky?"

Consider a Wall Street Journal report this morning from staffers Danny Dougherty and Andrew Barnett:

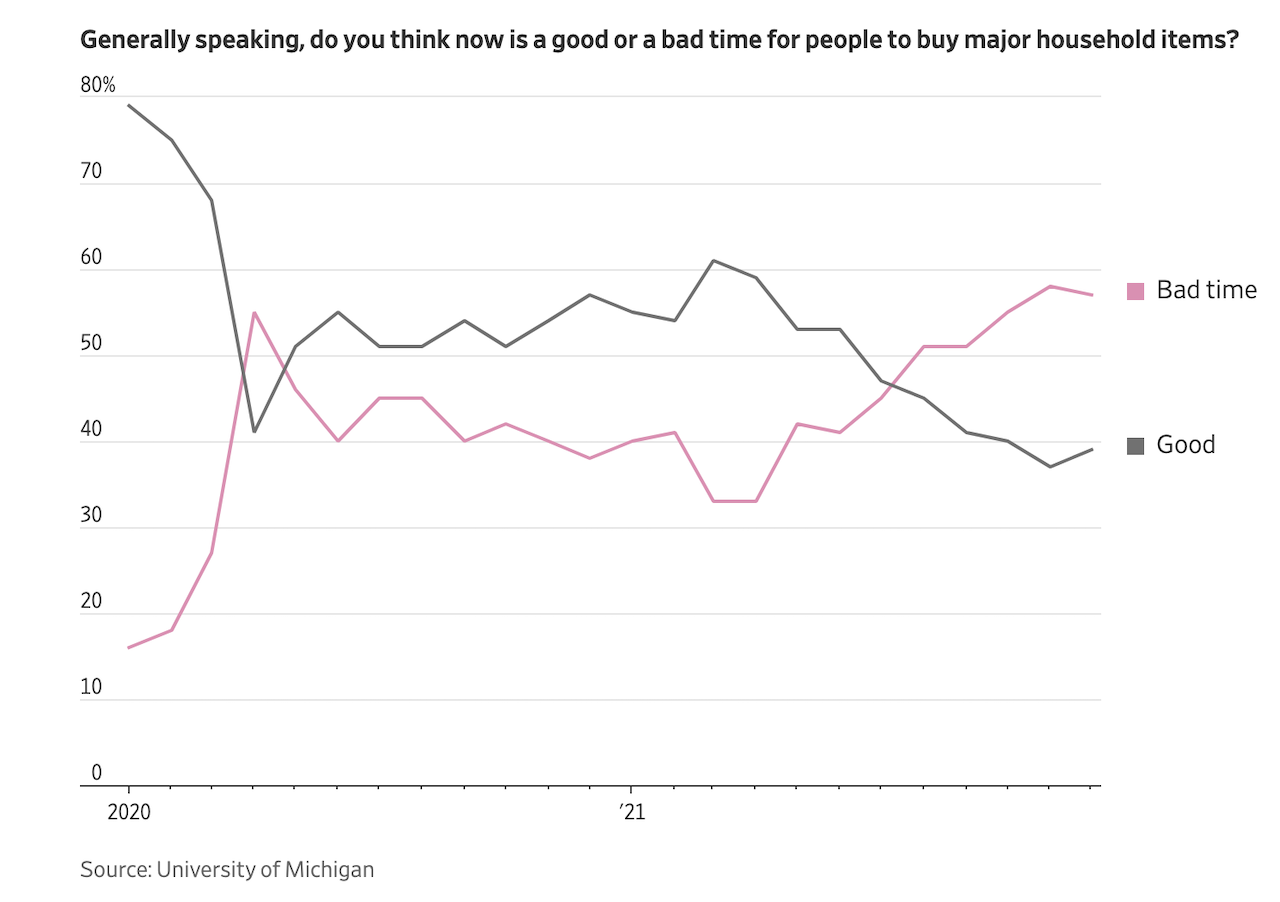

Consumer perception of current economic conditions in December was almost even with April 2020 levels, when sentiment bottomed out following the first major restrictions to control the coronavirus pandemic.

While Americans’ feelings about their personal finances slid through much of 2021, concerns about buying conditions—amid continuing worries about inflation—fell drastically for much of the year.

Call it confidence, sentiment, mood, Animal Spirits, or what you will, a household, by and large, will obey its own laws about when and if it's time to buy a home. So, mind the gap between the economics of supply and demand and the economics of the near-future of a household.

A stand-off – that household in one corner of the ring, and an effervescent group of homebuilders that look at at each household's income-earning resident as funneling into an inescapable spillway that pours into their customer pool in the other – defines the high-stakes game leading to what traditionally brings Spring Selling 2022 alive the moment the Super Bowl LVI clock runs out a week from this Sunday.

The stand-off's ultimate resolution won't come overnight. Nor will its verdict come within the earliest six-to-16 week period that typically sets the tone of a Spring Selling season for new home construction's year ahead. An interest rate lift-off that could impact – pull-forward, or set-back – monthly payment power and mortgage qualification, and an ongoing spiral in household costs remain unknown risk factors even as economic indicators support the view of a solid demand stream ahead for 2022 and beyond.

Over, and over, and over again we hear and see evidence of underlying steady, even solidifying, strength in housing demand, and a bright outlook for the homebuilder market in 2022. It sums up like this, from Fisher Investments' The State of Real Estate:

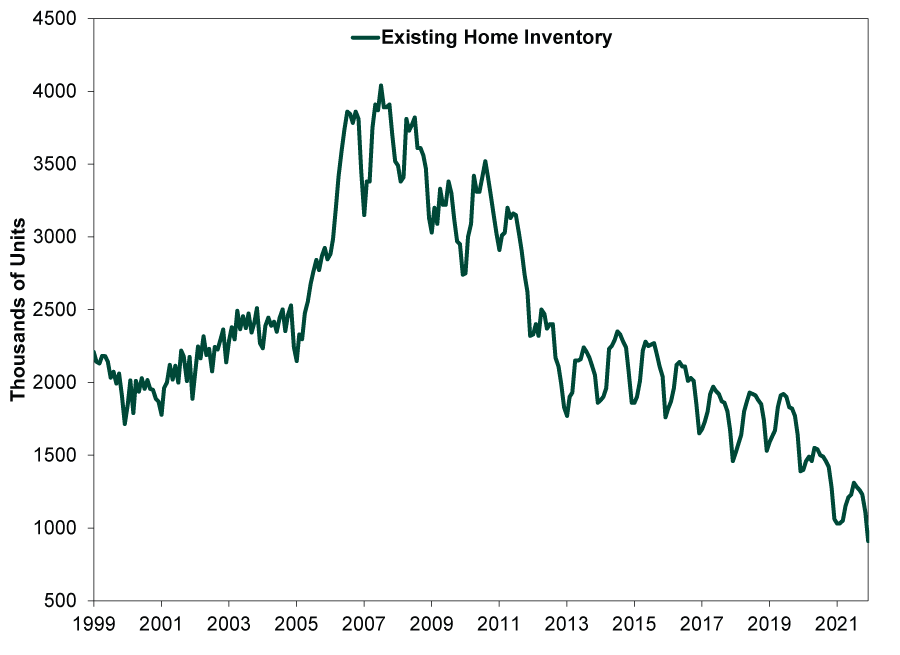

Today’s spiking prices stem from extremely limited supply and steady, if not elevated, demand as the pandemic and remote working spur people with the means to do so to upgrade, move to the suburbs or relocate to a new state—or all three. At fewer than a million units in December, inventories are at their lowest in at least a couple decades. (Exhibit 1) Now, this series isn’t seasonally adjusted—hence the regularly recurring jagged pattern in the line. Inventories normally dip in December and January. But looking at the year-over-year percentage change eliminates this skew, and inventories were still down -14.2% y/y in December.

Lack of available homes for sale supports pricing, and it is no secret how we got here: Lockdowns halted construction, then resource shortages delayed efforts to reboot it. Hot markets where supply can normally grow easily to meet demand, like the greater Houston area, suddenly had an influx of new buyers bidding for a finite supply of existing homes. Construction couldn’t respond quickly enough. Contrast this with 2005 – 2006. Housing inventory rose from just over two million starting in 2005 to almost four million near 2006’s end.

But now construction appears poised to catch up. Homes under construction are at their highest level in almost 50 years. (Exhibit 2) Part of this is a catchup effect. But also, new building permits for privately owned housing hit their highest point since May 2006 in December.[ii] For full-year 2021, the Census Bureau noted 1.7 million units were permitted. No shock, then, that builders started construction on 1.6 million new housing units last year.

That's what's going on at the macro level. At the household, street address, mailbox, kitchen table level, it's a different story.

Here's a way the National Association of Home Builders economics team minds that gap in two ways. One is a survey measure of adult householders who plan to buy a home within the next 12 month period. That number began falling in early 2021, and now stands at one in six U.S. adults. The downward drift in that "intention" group – a proxy for homebuyer demand – ties in the data to a fall-off in the number of households who earn enough to say they can afford half – or more --of the homes available for sale in their market of choice.

Think of the suppressors of new home demand.

- Soaring ASPs stressing price elasticity

- Interest rate increases whacking monthly payment power, and cutting the qualified mortgage borrower market

- Wall Street market volatility impacting investment portfolios

- Ongoing pandemic disruptions that overshadow wage security

Each factor by itself might not impact what many homebuilding executives characterize as a juggernaut of demand that simple mathematical rules make self-evident and sustainable.

As they add up, however, one of the late-Senator Everett Dirksen's quotable quotes comes to mind:

A billion here, a billion there, and pretty soon you're talking real money."

That was when a billion dollars really meant something too.

The teachable moment in the light of this widening gap between what everyday people are saying about how they're feeling, and what companies contend that those consumers will buy because they have to centers on a thought from one of today's consumer intelligence quote meisters, Seth Godin.

Why are some industries so irrational (when seen from the point of view of the customer)?

So many things about college, funerals, real estate, hotels, weddings and the contractor trade are frustrating and opaque to customers. It almost seems as though they’re organized with a long-term, industry-wide focus away from customer satisfaction.

No one chooses to regularly have a party as expensive, isolating or stressful as a wedding is. We don’t view the pricing or activities of a funeral as natural or affirming. If someone tried to build an institution like college today, there’s no way it would be structured the way it is now. If you think about the rituals of most of these industries, they don’t make sense.

That’s because customers come and customers go. Sometimes quite literally, but always.

You might have found elegant solutions to remove friction from homebuying's purchase process. And then there's removing friction that prevents more and more from starting that process. If you were starting with a blank page and re-inventing the human construct of shelter and well-being and safety and health and community, could it look and work quite differently than it does today?

So, mind the gap.

Join the conversation

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.