Leadership

Crystal-Balling 2023 Amid A Dizzying Array Of Unknowns

Can you withstand an $81 billion swing to the negative in homebuilding revenues in 2023? Here are 5 'what-ifs?' we'll need to stay tuned on before we make predictions about how homebuilders may fare in 2023.

Housing's 2023 forecast fest is in full swing. Already, there's a menu of house-price landing points for the next 12 to 24 months, suited to gut instincts on a spectrum from rose-colored glasses to fairly pronounced pessimism.

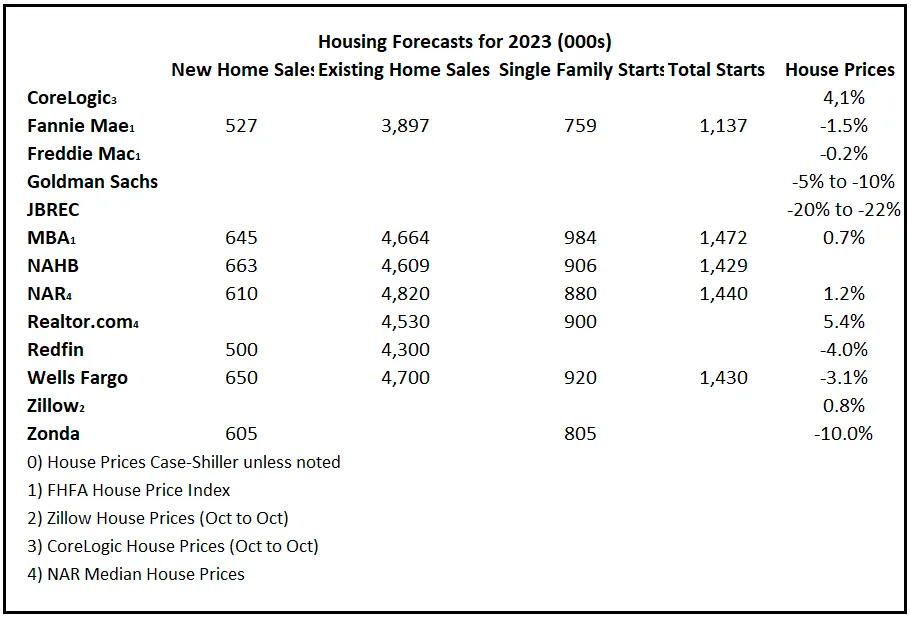

Calculated Risk housing and economics analyst Bill McBride today publishes a work-in-progress chart of housing forecasts for 2023, here.

The spectrum of best-to-worst-case scenarios spans a gamut, from a slower rate of price growth, to a relatively-mild low-single digit price drop, to a dramatic 20% to 22% look into the chasm – relatively.

McBride writes:

There is an especially wide range in the forecasts for house prices and shows the difficulties in modeling this housing cycle. My view is house prices will decline in 2023 and will fall 10% or more from peak-to-trough.

This reflects a "dodge-the-bullet" view. Why? Well, a 10% all-in price decline would take home prices back to circa 2021 – a level most sellers, particularly among the new homebuilder set, could probably live with.

Even, the hawkish 20% all-in declines projected by John Burns Real Estate Consulting and Zelman & Associates (seen here) could hardly be viewed as show stoppers. This is especially true in a new-home construction operational front where builders have begun to leverage dramatically lowered starts activity to wrest reduced input expenses among their early phase, front-end "rough" trades and suppliers.

The issue always is the genuine possibility of a gap between modeled worst-case scenarios and an actual worst-case scenario that may reflect a broken model or one that fails to account for "the unthinkable."

Who knows what that might be? And you can't plan your business on an unimagined force factor. What you can do strategically, and as a leader, is add – investment, commitment, priority focus, and time – to your margin of error.

Room for error is underappreciated and misunderstood. It’s usually viewed as a conservative hedge, used by those who don’t want to take much risk. But when used appropriately it’s the opposite. Room for error lets you stick around long enough to let the odds of benefiting from a low-probability outcome fall in your favor. Since the biggest gains occur the most infrequently – either because they don’t happen often or because they take time to compound – the person with enough room for error in part of their strategy to let them endure hardship in the other part of their strategy has an edge over the person who gets wiped out, game over, insert more tokens, at the first hiccup. – Morgan Housel, Collaborative Fund

Why widen the margin of error? By many lights, strong household balance sheets, sounder lending practices, more equity, strong economic fundamentals, extremely scarce for-sale inventory, and still-surging population, household, income, and family-formation demographics – not to mention a potentially momentum-changing Fed pivot on its policy rates to slower, more sensitized tightening – all point to reasonable expectations of a stabilized demand stream during the next four to six months.

Here are some "what-ifs" we believe will factor into the 2023-24 runway, particularly for the homebuilding, residential development, and investment cohort of strategic decision-makers.

- A big, big, big overhang of permitted-but-unstarted, under-construction, and standing inventory of new homes to clear, the unknown-unknowns cloud informed speculation on when, how, and for how much these homes will sell and close.

- New-home-sales – per McBride's forecasts note – on pace to fall 17% in units year-on-year in 2022, and projected to be down more than 22% from 2021 actuals in 2023. In dollars, that would amount to an $81 billion-plus swing to the negative in two years in homebuilding operators' revenues, with a daisy-chain of opportunity-cost negative multiplier effects.

- Employment and unemployment – Signs, even in the latest BLS employment report, were of weakening – but still strong – hiring trends. However, a criss-cross point from growth, to slower growth, to flat, to declines in payroll positions becomes more likely as macro-economic activity slows, corporate earnings outlooks weaken. What has been a pandemic era K-Recession and recovery could spread from more-vulnerable households to ones that up-to-now the economy has shielded from most of the hardship.

- Loan vintages – Combine increased unemployment trends with home-purchases ranging from high-price-high-mortgage vintages in 2022 to high-price-low-mortgage rate buyers in 2021, and you may see distress-creep start to raise delinquency, default, and foreclosure rates even though the original loan qualification criteria were sound.

- The work-from riddle. Stars aligning – Covid, a super strong economy, a super tight labor market, super low interest rates, and a supercharged tech-enabled distributed talent platform – put secondary, tertiary, etc. metro markets on the map and drove the rush for affordable locations of choice for the past two years. Was it a supernova? Or – even as employers re-secure the reins on their in-person attendance policies in an economy with increasing labor slack and less team member leverage on their work-from-home options – will those stars start to fall out of alignment?

The remote work revolution – if it's not a couple of year blip – has to prove it has legs if it's to continue to impact strategic land positioning and community development trends that the Covid pandemic suggested is the future.

Housel, as usual, has wisdom to spare for us all when the unknown-unknowns cloud the horizon:

The only truly sustainable sources of competitive advantage I know of are:

- Learn faster than your competition.

- Empathize with customers more than your competition.

- Communicate more effectively than your competition.

- Be willing to fail more than your competition.

- Wait longer than your competition.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.