Policy

Confidence Or Not, Now's Time To Look At Challenge As Opportunity

As builder sentiment finds its floor, here's a longterm-ist look at where to focus.

Opportunities – in residential real estate and construction, as in life – come in challenge-sized aliquots.

Dimensionally, they fit hand-in-glove. That the pathways to opportunity can narrow and filter, especially at times such as the present moment, means that fewer can and will grasp it. More will miss out.

The spoils of opportunity, then, go to a few. A vicious-circle gravity of challenge gnawingly depletes or demoralizes many of the others' pool of resources.

Challenges are mounting up from all sides.

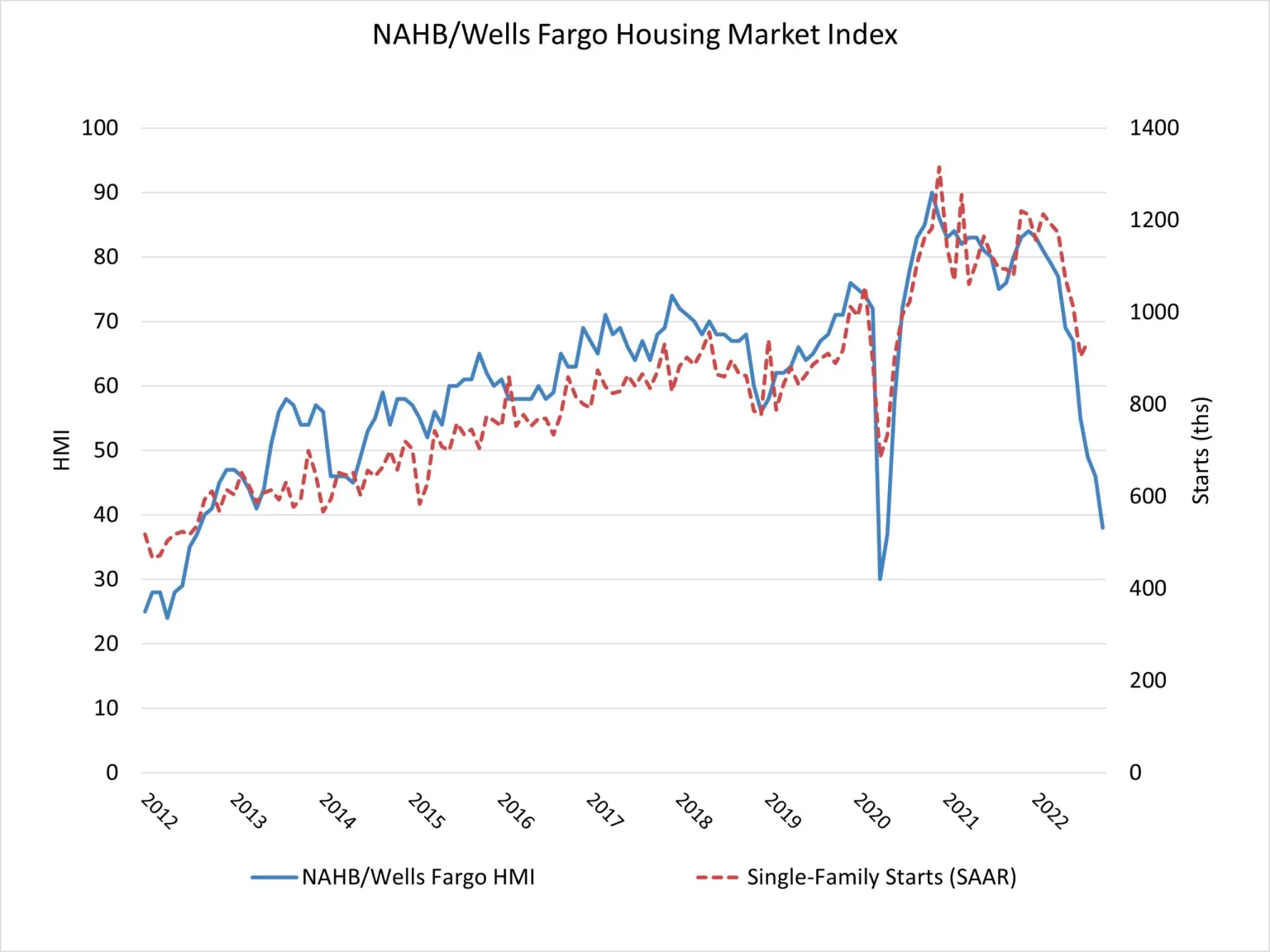

- The October 2022 National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) hit its lowest confidence reading since August 2012, with the exception of the onset of the pandemic in the spring of 2020.

- Microsoft Corp. this week joined other tech companies in announcing staff layoffs, prefiguring a rise in unemployment as the economy weakens that – in contrast with the Covid convulsion in Spring 2020 that took out mostly lower-paid services industry payroll positions – will come after a professional class that has been largely immune to shocks since the Great Recession.

- Incidence of weather-related shocks – hurricanes, wildfire, drought, tornados, etc. – have become a drumbeat in real estate agendas. A recent Freddie Mac research brief outlines a huge challenge-sized opportunity here.

Another factor here, is that while it may be correct to say that 5,000 homebuilding firms build 9 out of 10 new homes in the U.S. each year, a host of varying characteristics that make up each of those 5,000 companies nearly defies quantification. Many of them are just different from one another, so when it comes to the impact, effects, or consequences of either challenge or opportunity, the risks and rewards seldom work out equally for all.

In many cases in this business, the largest 20 players find themselves both shielded from the brunt of the challenge and more apt to be able to take advantage of the opportunity than those whose capital resources draw on bank finance and loans.

As one of our experienced strategic executive sources tells us ...

The most likely end result of this is a significant gain in market share by publics. They will keep building and selling, and will return to buying lots sooner than privates, because they can buy when lot prices are fair, whereas cash-strapped privates will need good enough deals to attract outside capital. Fair [market lot prices] won't support double promotes. And with reduced private builder volumes, it will be even harder to retain people. I fear this accelerates the trends against private homebuilders."

This comes from a wizened executive who's worked through at least four boom-and-bust real estate cycles and "seen it all."

What can't be discounted, however, is that the gestalt reflex of seeing and "attacking" challenges as though they're opportunities in disguise.

Since it really does not exist today, who is really to say which rules – capital structure, operational model, customer model – need to apply to solve for housing's biggest challenges, whether the economy is good or full of volatility or reeling?

- Make homes and places that are affordably priced for more rather than less working people

- Make places safe from natural disaster that contribute positively to their local environment

- Make places where people, communities, and their locality flourish and prosper regeneratively

- And, finally, make the livelihood of planning and making people's homes and communities one that magnetically draws the best and most committed talents into career paths.

Break the rules. See the challenge as opportunity. And don't waste a good downturn not getting started.

MORE IN Policy

Homebuilders Urged To Invest In Frontline Jobsite Workers Now

As homebuilding slows, workforce investment becomes the make-or-break factor for long-term capacity. Building Talent Foundation CEO Branka Minic warns that cutting training and career-path spending now will deepen the industry’s structural labor crisis for years to come.

NYC Voters Back Affordability — Now Comes The Hard Part

New Yorkers have voted for change. Four sweeping housing charter amendments promise faster reviews, digital mapping, and more affordability—but the real battle begins as City Hall, the Council, and Albany clash over control.

Connecticut Lawmakers Reboot Bid To Hurdle Blocks To Building

After a vetoed bill derailed housing reform this summer, Connecticut lawmakers are back with a compromise. Their second attempt could test whether state leaders can balance affordability goals with local control—and finally get a deal done.