Marketing & Sales

Come What May, A New Emerging Generation Of Adults Awaits Solutions

It's time now to look at affordability through two lenses: Bending cost curves downward and bending payment power, and motivation upward to meet at a new, more expansive level of attainability.

You're 25, a newly minted adult at the leading edge of a generational cohort of 69 million Americans, the youngest of whom is 10 years old, and you wake up this morning to this:

US mortgage rates topped 7% for the first time in more than two decades, extending a string of steep increases that have stymied housing demand.

The contract rate on a 30-year fixed mortgage rose 22 basis points to 7.16% in the week ended Oct. 21, marking the 10th-straight increase, according to Mortgage Bankers Association data released Wednesday." – Bloomberg

A shocker to many, and the root of a rapidly decelerating market-rate housing economic ecosystem as payment shock collides with the cost-of-living crisis. Unfortunately, however, this news on one of the mainstays of access to the American Dream comes as just another day in the life for a young adult Generation Zer.

As cohorts go, young people aged 10 to 25 have seen the best and the worst of times, a tale of two sharply contrasting economic, cultural, social, and health force-fields spanning the gamut from halcyon to hell on earth.

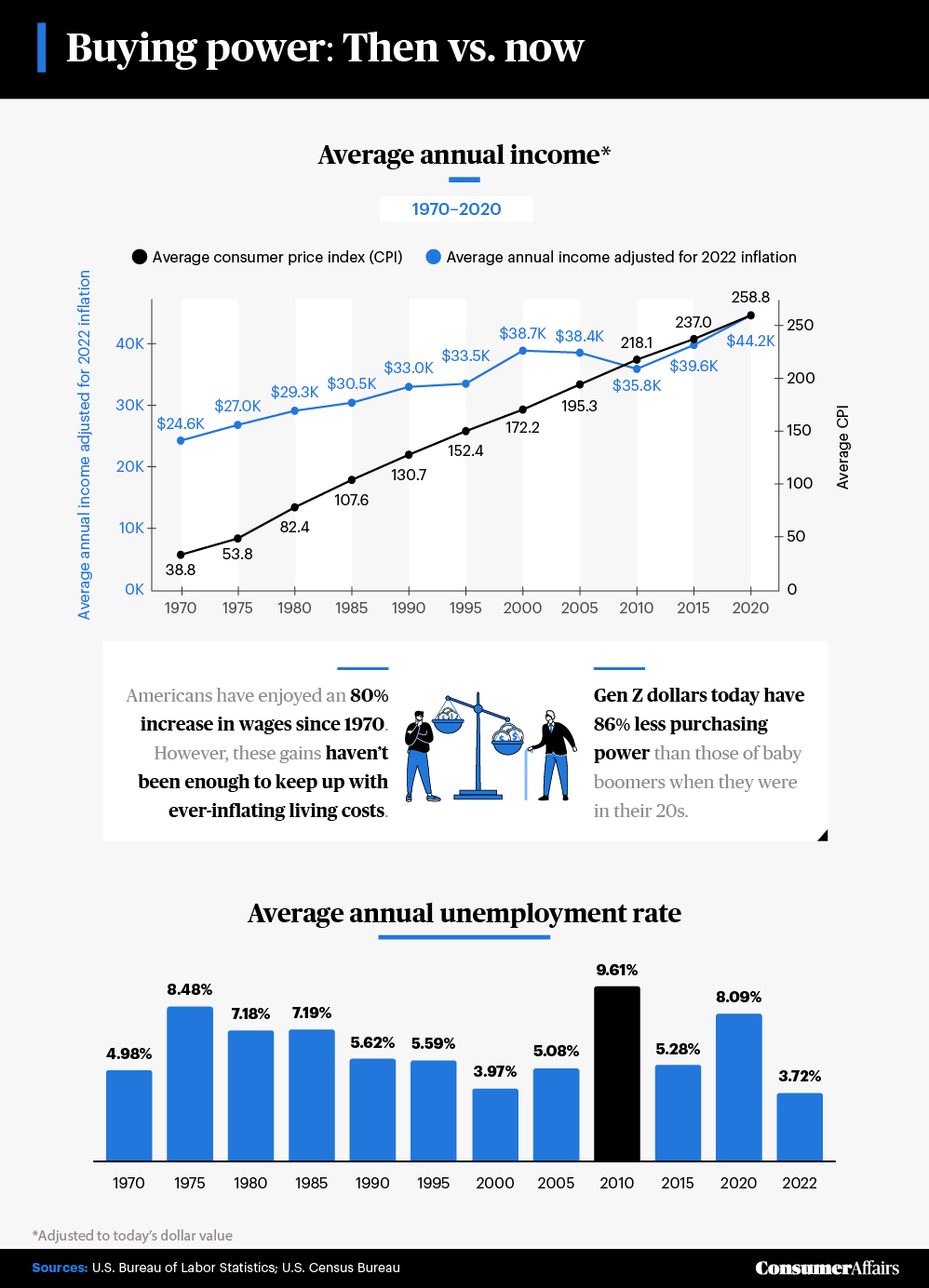

Still, consider this [ConsumerAffairs.com]:

- Gen Z dollars today have 86% less purchasing power than those from when baby boomers were in their twenties.

- The cost of public and private school tuition has increased by 310% and 245%, respectively, since the 1970s.

- Gen Zers and millennials are paying 57% more per gallon of gas than baby boomers did in their 20s.

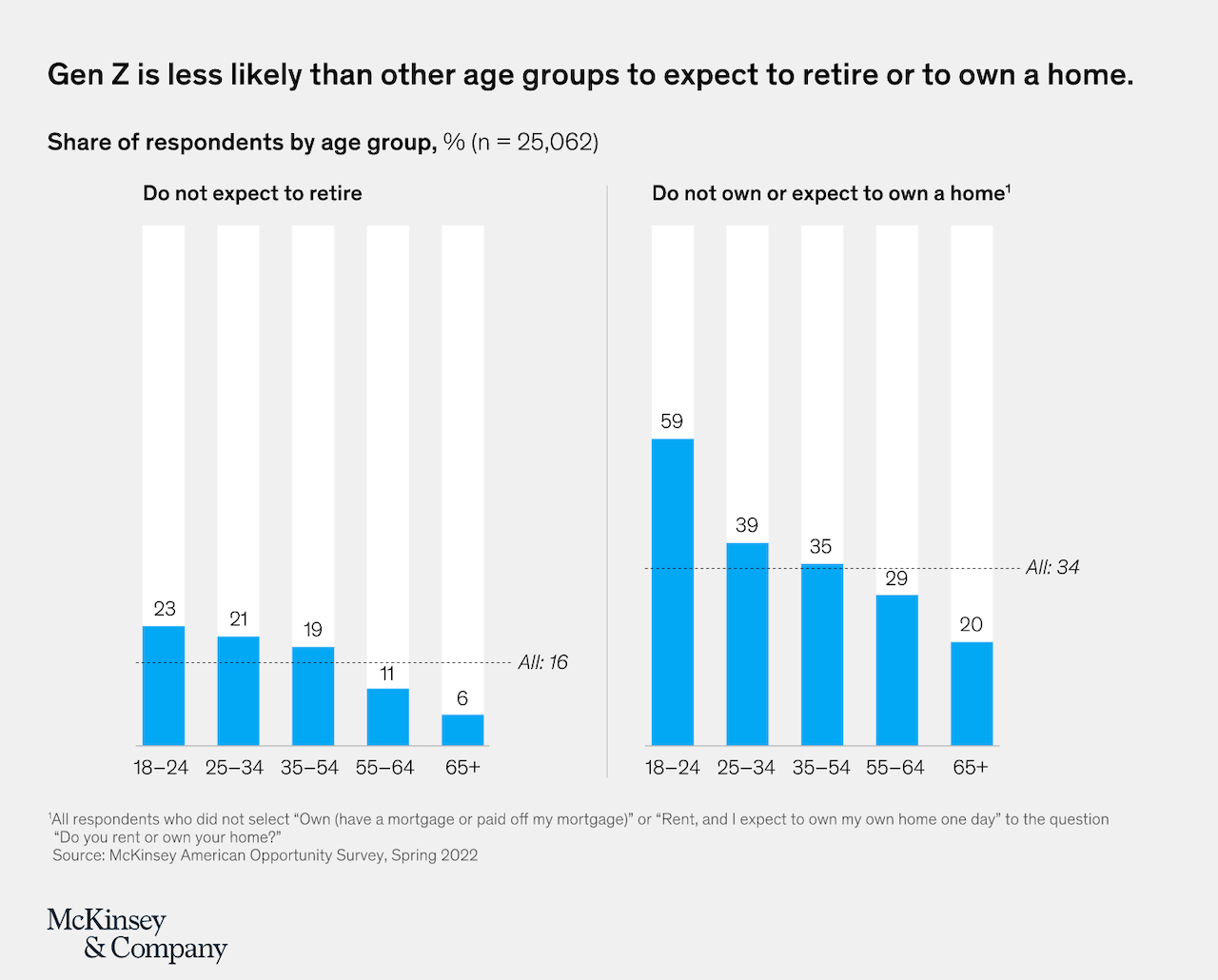

Further, a new McKinsey & Co. research piece paints a picture of a generation of young adults not only back on their heels, but – worryingly – resigned to a future of either being priced out or tapped out of career's and life's rewards.

Almost a quarter of Gen Z respondents do not expect to retire, and only 41 percent expect to own a home one day.

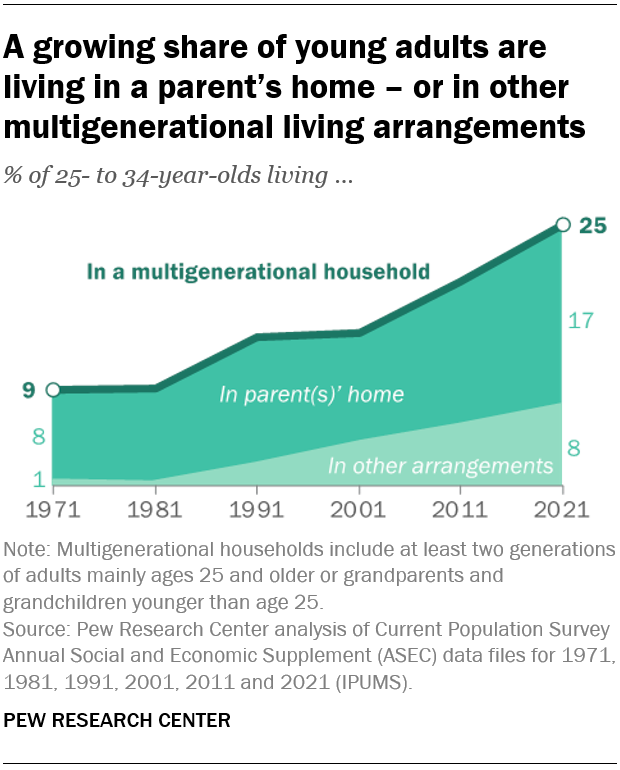

Already – as young adults who'll set the course of both the future of work and the future of housing – their behaviors, at a statistically material level, have altered basic demographic household formation patterns, as Pew Research Center notes here. These adaptive household preference and formation patterns will rewrite a lot of business, and impact many profit-motive organizations who're counting on people now to behave like people in the past.

As successive generations of young adults in the United States cope with rising student debt and housing costs, multigenerational living is increasingly providing a respite from the storm. A quarter of U.S. adults ages 25 to 34 resided in a multigenerational family household in 2021, up from 9% in 1971.

Now, mind you, they're not doubling up and/or living in Mom and Dad's basement, or delaying forming their own households because they want to. At least in many cases, the reason for their living situation choice checks the box "for financial reasons," even though most Americans think it's a "bad thing."

In July 2022, half of adults ages 18 to 29 were living with one or both of their parents."

The issue is this. Housing affordability, for what it's worth, depends on bending not one, but two curves towards one another.

Everyone focuses most on the "cost curve," and why not? Given that many inefficiencies and wasted resources add layer upon layer of price barriers into the cost of offering a new home, whether it's to buy or rent, a push to reduce cost is definitely . There are known and still unknown opportunities to subtract those inefficiencies and wastes from the process and bend that cost curve downward by, some estimate, 30% or 40% of the total input expense of a house.

Few, however, focus on the other curve – raising payment power through education, training, apprenticeships, and lifelong learning and reskilling – gets short shrift in most discussions of access to attainable housing.

And as we go forward, the promise of data needs to become the necessity of data.

Lennar executive chairman Stuart Miller told us in 2018 that his vision for the enterprise as a pure-play builder – which it's still on course to become as it effects its plan for a spin-off – amounts to a simple rule that in the real world means having and understanding data:

Remove every part of the expense in our process that doesn’t offer value to our consumer."

Before concluding, however, that GenZ should not be your target because their expectations regarding homeownership are so low, think of this line – quoted from Morgan Housel's Collaborative Fund post.

What’s your secret to living a happy life?” 98-year-old Charlie Munger recently replied:

'The first rule of a happy life is low expectations. If you have unrealistic expectations you’re going to be miserable your whole life. You want to have reasonable expectations and take life’s results good and bad as they happen with a certain amount of stoicism.'"

What's likely is that Generation Z – by virtue of the adversity greeting their coming of age in America at a tumultuous time – will cause a good thing to happen in homebuilding, which is that, thanks to data's role in enterprises like Lennar learning about people, homebuilders will "remove every part of the expense" in all of their processes "that doesn't offer value."

That process can kickstart now, while expectations are low.

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.