Land

Clayton Funds A $182 Million Land Bank For Its Site-Build Operators

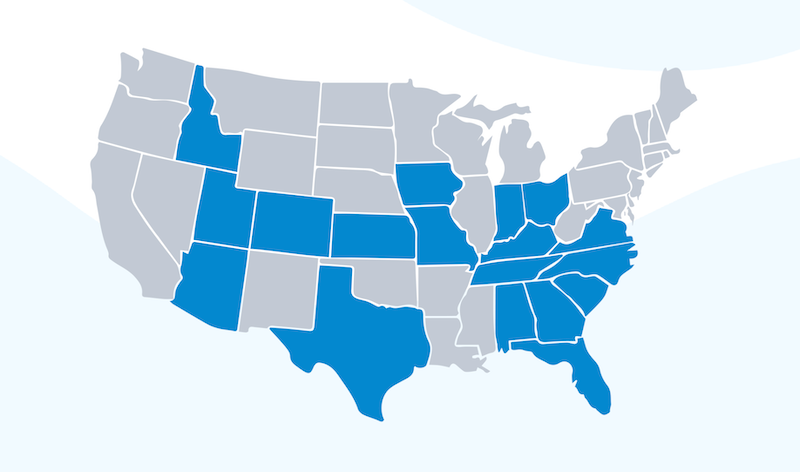

Berkshire Hathaway's Clayton Home Building Group and Properties Group finalized setting up a residential land bank aimed initially to offload land expense obligations of its nine site-build portfolio homebuilders, with development and construction operations in 18 states

Berkshire Hathaway's Clayton Home Building Group and Properties Group finalized setting up a residential land bank aimed initially to offload land expense obligations of its nine site-build portfolio homebuilders, with development and construction operations in 18 states.

The fund, said to have been initially set up for the transfer of $182 million in land obligations across the portfolio – including Arbor Homes, Brohn Homes, Chafin Communities, Goodall Homes, Harris Doyle Homes, Highland Homes, Mungo Homes, Oakwood Homes, and Summit Homes – serves two strategic aims.

- The initiative can immediately relieve Clayton site-build operators of both the financial balance sheet and operational management burden of holding land assets – with their capital and carrying costs – on their balance sheets. This effectively creates an asset-lighter operation, and encourages each operator to double-down focus on customer and team-member value creation, product design and construction efficiencies, and operational excellence. Real-time, on-demand access to building lots clears operational and leadership decks to get closer to customers and more engaged with operating team members.

- A Clayton land bank also allows the Berkshire Hathaway Clayton platform – including both site-build and precision manufacturing-assembled homes, not to mention local and regional homebuilding operators outside Clayton's owned builder group – to evolve into a strategic player in residential real estate development, using its enormous geographic infrastructure and capital heft to advance a core strategic mission around "democratizing homeownership" by bending cost barriers in favor of more working household wage levels.

Their goal is to have their homebuilder groups model the asset light approach the NVR started and now other builders use," a senior-level executive with direct knowledge of the Clayton land-bank initiative says. He says the new Clayton fund was on pace to close by year-end 2023.

Clayton executives and press representatives we reached out to declined to comment on the new initiative.

As recently as early December, Clayton unveiled a concerted roll-out of a new urban infill project showcasing two Clayton Built® CrossMod homes developed by Iron Horse Communities, illustrating Clayton's construction-as-a-solution platform for local developers and builders.

A land bank – which might be expected to be funded well beyond its initial $182 million as it opens its fund to institutional investors – could complement the building-as-a-service capability with a land and development real estate solution at a time private homebuilding operators especially need palatable new options to acquire access to developed lots to feed their operational machines.

As we've written earlier, national public homebuilders and deep-pocketed private operators sponsored by Japan- and Canada-headquartered parent companies regard smaller, bank-financed private firms as a means-to-an-end blip standing in the way of greater and deeper local and regional market scale and share.

Meanwhile, access to traditional bank capital lending for land acquisition and development has become a major pain point for private operators, squeezed by pricing and pace uncertainties on one side and by highly competitive land dealing on the other.

Here's an excerpt from an earlier focus on private homebuilders' 2024 land dilemma, starting with a quote from the Wolfe Research homebuilding and building materials team led by senior analyst Truman Patterson.

Market Share: Public Vs. Private Homebuilders

"We expect the public homebuilders continue gaining outsized share from smaller privates given their favorable access to fixed-and-lower- rate debt with long maturities (and more prevalent use of mortgage rate buydowns) as banks tighten lending to smaller private builders for land acquisition/development and spec building."

With the benefit of an even longer-term lens, Home Builders Network president Al Trellis leaves us today with this perspective:

I was discussing with one of our long-time clients how the landscape has changed for smaller builders with the rise of the national and regional builders, in a world where land is hard to come by and access to capital matters more than ever. I wrote in the 1990’s that the nationals would take a bigger and bigger share of the market and predicted in the 20-teens that they would begin to move into the secondary and tertiary markets (where else could they go to grow). I put together the chart below to show the contrast between 1995 and today."

Clayton's strategic move into a land bank that could serve not just its owned operators but other local privately-owned homebuilding players would run consistent with the Berkshire Hathaway homebuilding platform's stated grand mission, which is to make homeownership accessible to more working households.

Clayton's unequalled national manufacturing, construction, and distribution infrastructure already annually produces more single-family residences than any other U.S. builder. Further, Clayton's more recent strategic inroads into residential land acquisition and development – through the roll-up of the site-build operator group – and local and national policy competency puts the organization in a category of its own when it comes to expanding the bounds of homeownership attainability for more Americans.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.