Capital

'Choppy' For Some Can Be Brutal For Others As Rates Squeeze All

In a few short months, high-level perspective has shifted from macro uncertainty and volatility to the onset of a more practical riddle: What it will take builders to keep orders and deliveries pace at a level they plan to keep it.

The latest winching upward of home mortgage interest costs – to near or above 8% for a 30-year fixed rate this month – is the latest, queasiest rung in an 19-month campaign to bring down housing prices and costs, somehow, without the benefit of adding materially to housing supply amidst a generational surge in household demand.

The effects of this mass (of demand) over matter (of builders' and consumer households' access to credit and manageable financing) collision, are evolving. And they're open to debate. So far, demand among buyers of all stripes has found ways in, around, and through any and all obstacles, undeterred.

So far. But telltale clues have been strengthening that may signal a change, a further deterioration.

- home sale deals are falling through at the highest rate in nearly a year

- demand signals remained strong through Q3 '23, despite 7%-plus 30-year fixed rates

- price pressure's still sloping upward; but transaction activity is idling

Any real-time lens of insight into what's playing out as households and businesses alike absorb, ingest, and reset their behaviors in a dynamically trickier and more treacherous backdrop becomes a proxy for all residential real estate and construction firms – a way to listen, learn, prepare for opportunity and shield their teams from the worst of the turbulence ahead.

Although it's far from perfect, the Q3 2023 public homebuilding company earnings season cycle offers perhaps the best opportunity we can get to detect how pivotal an effect the latest mortgage rate spikes have had and will have on business conditions for homebuilders and their partners. Their extensive operating footprints, broad spectrum of product and location offerings, and varying approaches to sustaining sales pace through price adjustments and incentives give a generalized view of both ongoing challenges and opportunities, as well as a sense of more acute and fresh impressions of changes to operating conditions.

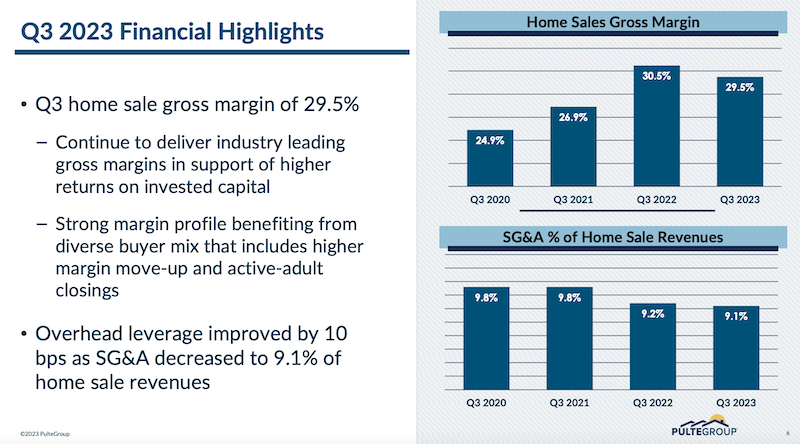

For instance, as Pulte Group's strategic executive team led Wall Street investment research analysts through the company's 2023 Q3 earnings, the performance eclipsed expectations, affirmed both the company's business model strategy and its operational execution, and reflected management's plan to do better than weather any and all economic or housing market turbulence ahead.

Seeking Alpha news editor Max Gottlich led his earnings briefing this way:

PulteGroup (NYSE:PHM) posted stronger-than-expected earnings for the third quarter as "the fundamental desire for homeownership is strong while the supply of houses remains constrained,” said President and CEO Ryan Marshall.

Q2 EPS of $2.90, topping the $2.80 consensus, fell from $3.00 in Q2 and advanced from $2.69 a year ago. Total revenue of $4.00B, trailing the $4.06B average analyst estimate, dipped from $4.19B in Q2 and increased from $3.90B in Q3 2022.

At the same time, the strategic commentary – as it focused on the first few weeks of October – made mention of "choppy" day-to-day, week-to-week, and submarket-to-submarket dynamics. In a few short months, high-level perspective has shifted from macro uncertainty and volatility to the beginnings of a more practical riddle about what it will take builders to keep selling and completions pace where they want it to be.

As has been the case for more than a year since interest rates started going haywire, the two key challenges to demand have ranged in a spectrum between mathematics and mental attitude.

Mathematics refers to households ability to qualify to purchase and then go on to pay for a home. Mental attitude covers those who can but may choose not to buy because they think now's not the time.

As rates ratchet up or even remain flat at such an elevated level for an extended period of time, they'll test and re-test tolerance levels, resolve, sense-of-timing, ability-to-qualify, and monthly payment wherewithal for the umpteenth time. That's not to mention what will happen to demand if macro-economic trends weaken, impacting income, jobs, household-, and family formation.

PulteGroup President and CEO Ryan Marshall's cover remarks on the earnings call introduced an October inflection point in the 2023 business dynamic, even as he offered evidence the Pulte team is ready to win, come what may.

Given our 43% increase in net new orders, we saw strong demand throughout the quarter. Q3 displayed more typical seasonality than we have experienced in the three years since COVID as absorption pace eased as we moved through the quarter.

Demand has been a little choppier in the first few weeks of October with more volatility in the day-to-day sales numbers. I’m sure for some buyers, higher rates have pushed affordability just that much further away, while others may be worried about their jobs. For other buyers, global unrest may simply have them thinking of other things. We are fortunate to have an experienced operating team that will make adjustments if and when needed. – Ryan Marshall, PulteGroup President & CEO

That volatility and choppiness Marshall addresses here came back repeatedly – three separate times – as research analysts tried to unpack more finely what Marshall meant and what the Pulte team would do about it.

Here's Marshall's initial "expansion" on the topic, which gives off the sense that Pulte strategists continue to see a "renormalization" of the market and the business to pre-pandemic ranges.

We’ve seen sales in October, while good, they’ve been a little bit choppier than– you know, the day-to-day kind of numbers have been a little choppier. I think the biggest thing that I’d want you to hear is that similar to what we saw in the third quarter, we actually have seen a return to what we would consider seasonal type sign-up trends that we experienced pre-COVID, and we’ve seen that continue into October.

On an absorption rate, the numbers that we’re seeing on absorptions per community are pretty similar to what we saw in 2018 and 2019 pre-COVID levels, which were pretty healthy, so all things considered, we feel pretty good about the continued ongoing desire for home ownership. It’s not lost on any of you out there listening, rates matter, and there has been a lot of rate movement over the last 30 days, and so I think the consumer, all things considered, has handled that really well."

Another question orbiting that color commentary on October centers on how the "choppiness" Marshall described may spool up to higher levels of risk at the land seller, developer, and privately-capitalized homebuilder level. Would this inflection point, in other words, open up opportunistic windows for power players like Pulte to pick up land or marketshare while competitors are back on their heels due to spottier conditions?

Marshall's response is, essentially, of course:

We’re hearing the same things that you are, particularly on maybe availability of capital or the cost of capital on the land development side. There’s definitely, I think, some strain or tightness in that arena. I think that certainly might continue to create an opportunity the longer that we stay in a high rate environment. I think it’s also a great opportunity for us to take market share. With our mortgage company, the size of our balance sheet, the ability to be active in the capital markets, I think it gives us an opportunity to do things that smaller local builders and maybe private builders can’t, so I think there is certainly a market share opportunity there as well."

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.