Land

CastleRock To Add The Jones Co., Nashville, To Grow Footprint

On the heels of last week's blockbuster deal for Osaka-based Sekisui House to purchase M.D.C. Holdings, Daiwa House's ambitions for its strategic operations in the U.S. remain hardly less epic.

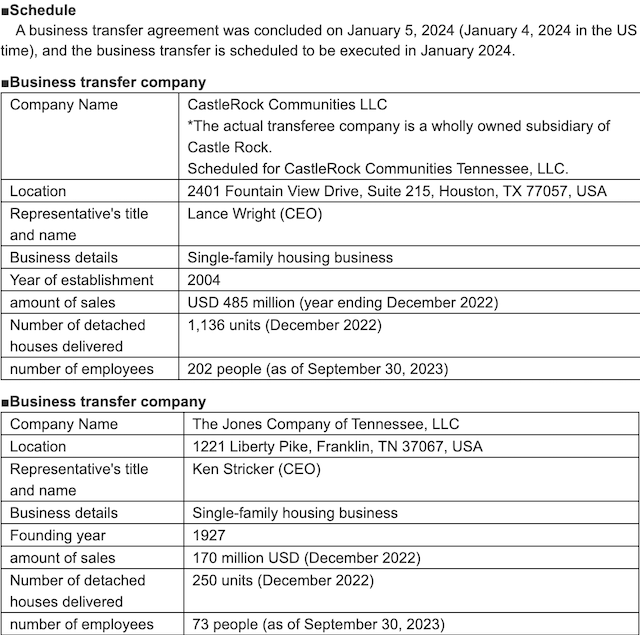

CastleRock Communities – one of three U.S.-based operators majority-owned by Osaka, Japan-based Daiwa House USA – is prepared to announce it has acquired most of the assets and operations of The Jones Company of Tennessee.

CastleRock's deal for Jones, 60-year-old, top-10 homebuilding stronghold in Nashville, comes at virtually the same moment Century Communities announced it has purchased Landmark Homes of Tennessee, a testament to the strategic importance of Nashville in a rapidly concentrating national homebuilding enterprise landscape.

Editor's update: Word of the CastleRock Communities purchase of The Jones Company was confirmed via a press statement from Daiwa House, following The Builder's Daily's report on the deal.

Whelan Advisory served as financial advisor to the sellers.

With the addition of The Jones Company, Daiwa House's investment in CastleRock's growth into the torrid Southeastern U.S housing market complements and connects with a footprint Daiwa House operator Stanley Martin Homes has established from the Mid-Atlantic States, through the Carolinas, Georgia, and Florida. Trumark recently acquired Wathen Castanos, extending its presence in Western markets, including Colorado.

On the heels of last week's blockbuster deal for Osaka-based Sekisui House to purchase M.D.C. Holdings, Daiwa House's ambitions for its strategic operations in the U.S. remain hardly less epic.

Ironically, in mid-2022, M.D.C. announced a deal to acquire The Jones Company for $117 million, but two weeks later, scratched the agreement and pulled out of the deal.

At the time, we noted that The Jones Company and its team had earned recognition as one of the "best in class" operations in the region.

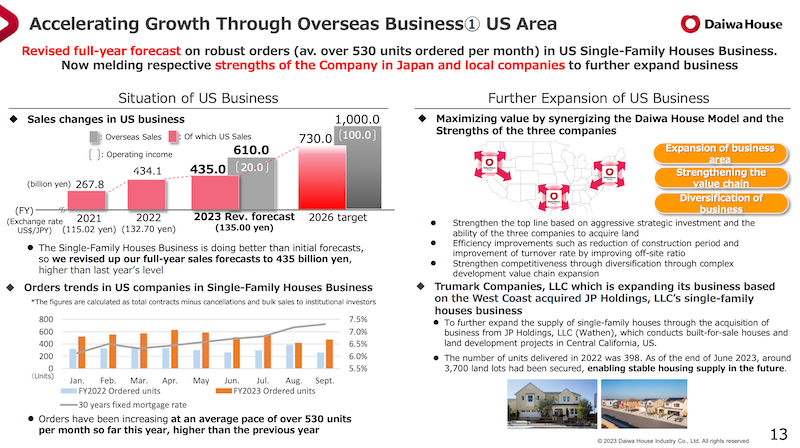

In November 2023 commentary to investors regarding Daiwa House operating companies' U.S. performance and expectations, president and CEO Keiichi Yoshii, noted that the U.S. portfolio would hit $2.93 billion in revenues for the full year, last year. In turn, Mr. Yoshii said, the company's 7th Medium Term Management plan calls for aggressive investment and growth through 2026, to revenue levels of $4.9 billion in that two-year time period.

For FY2023, the US business will have roughly JPY435 billion in sales.

Last year's total was about JPY434 billion, and although it was initially thought that the situation would be very difficult, it has remained almost flat, and we believe that we will be able to make a slight increase in the future.

Overall, we are aiming for sales of JPY1 trillion in the 7th Medium‐Term Management Plan, and we will achieve sales of approximately JPY610 billion in the current fiscal year, probably slightly exceeding this amount, and are now looking ahead to the next fiscal year, so I think we are very close to achieving this goal.

We also have three locations on the right side of this [image above], three single‐family housing companies in the United States, one on the East Coast, one on the West Coast, and one in Texas in the middle of the country. I am currently receiving business transfers again in various forms, and these three companies are receiving these transfers, not creating new companies. Trumark has also acquired the recently acquired business of Wathen, so these three companies are just the basic form.

We have been meeting with each of the three companies this year, and we often have meetings in the US, and I think we have finally reached a consensus on the Single‐Family Houses Business. We have them working for us with the expectation that they will not only grow by building single‐family houses, but also by using DAIWA HOUSE as a model for their future growth strategy, and we think it is time for them to take the first steps in this direction."

In 2021, with the purchase of 80% of CastleRock, Daiwa House set in place its geographical hub-and-spoke system – based on strong business cultures and resilient operators in Stanley Martin, Trumark, and CastleRock.

At that time, we talked with CastleRock executive VP, Lance Wright (now CEO of CastleRock Communities, about what to expect in terms of growth opportunities across Daiwa House's coast-to-coast, single-family network. His comments serve as harbingers of explosive growth ahead.

Greg [Yakim - board chair], Kirk [Breitenwischer - senior executive VP], and I have about 29 years working together, and we've always been focused on growth, for the company and for our people," CastleRock executive VP Lance Wright tells The Builder's Daily, as the deal was nearing its goal line. "The folks at Daiwa House made it clear they want to grow, especially along the Southern belt line, and we're looking forward to their strength playing into what we see as another 10-years-plus of growth opportunity."

We wrote here in our analysis:

Now that Daiwa House has added its high-volume Texas puzzle-piece, it may have established an effective hub-and-spoke network with Stanley Martin, Castlerock, and Trumark serving as the hubs within which to nest further additions to the operational and geographic footprint.

As Daiwa House, Sumitomo Forestry, and Sekisui House invest deeper and more extensively into U.S.-based homebuilding enterprises, a cultural, technological, and environmental pivot – toward the more advanced processes, practices, and principles Japanese homebuilding and real estate companies have had as core strategic and operating modes for decades – could reframe American homebuilding operations in the next decade. Now, more than a dozen U.S.-based operators have become subsidiaries of Japan-based global corporate enterprises, together representing tens of thousands of U.S.-built houses and communities, and a operational cultural shift in the offing.

Japan- and Canada-based acquirers of U.S. homebuilding operations have emerged as an M&A force factor over the past six or seven years, even as Berkshire Hathaway-unit Clayton Homes, and, more recently institutional capital investment entities have entered the acquisition fray.

This puts more upward pricing power on valuations for privately-held single- and multi-market firms, particularly as publicly-traded strategic homebuilding enterprises need to feed their inventory-turn machines, meet quarterly volume and revenue expectations, and scale their operations more profitably amidst a homebuying demand surge whose duration and power show continued signs of strength – but only if volume and pricing don't stretch beyond price-elasticity limits.

MORE IN Land

A Contrarian's Take On Tariffs And Market Share Opportunity

Our man on the ground in Texas, long-time land acquisition strategy guru Scott Finfer, sees a window of opportunity opening for nimble, agile, private homebuilding power players able to counterpunch while big builders grapple with tariff blowback.

Meritage Boosts Nashville Presence With 2,500-Lot Deal

A land acquisition from Willow Branch Homes strengthens Meritage’s strategy in a market where demand outpaces supply.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.