Policy

Capitol Close-Up: U.S. Senate Focuses On Affordability Crisis

Housing's affordability crisis, whether or not the economy weakens, shakes off its challenges, or rebounds over the next 12 to 24 months, is on pace to get worse for those in its clutches.

Stifled supply – we agree -- lies at the very crux of a historical flashpoint in American housing's affordability crisis. The crisis, whether or not the economy weakens, shakes off its challenges, or rebounds over the next 12 to 24 months, is on pace to get worse for those in its clutches.

Solutions that would reverse this course are only possible via a grand bargain that would slash away needless costs to produce homes, capture those savings – in money, time, land, political will, etc. – and return them in the form of widened and deepened access to rental and owner-occupied homes.

Likely, we're six to 10 years from a reasonable facsimile of such a grand bargain. Here's an important factor to integrate into it:

We need to leverage the successes of American capitalism by encouraging private investment in the housing sector and eliminating needless barriers that artificially restrict supply. And most importantly, we should remember that effective housing policy is driven by communities—it is critically important the federal government encourages local solutions to uniquely local problems." Tim Scott (R-S.C.), Ranking Member, U.S. Senate Committee on Banking, Housing, and Urban Affairs

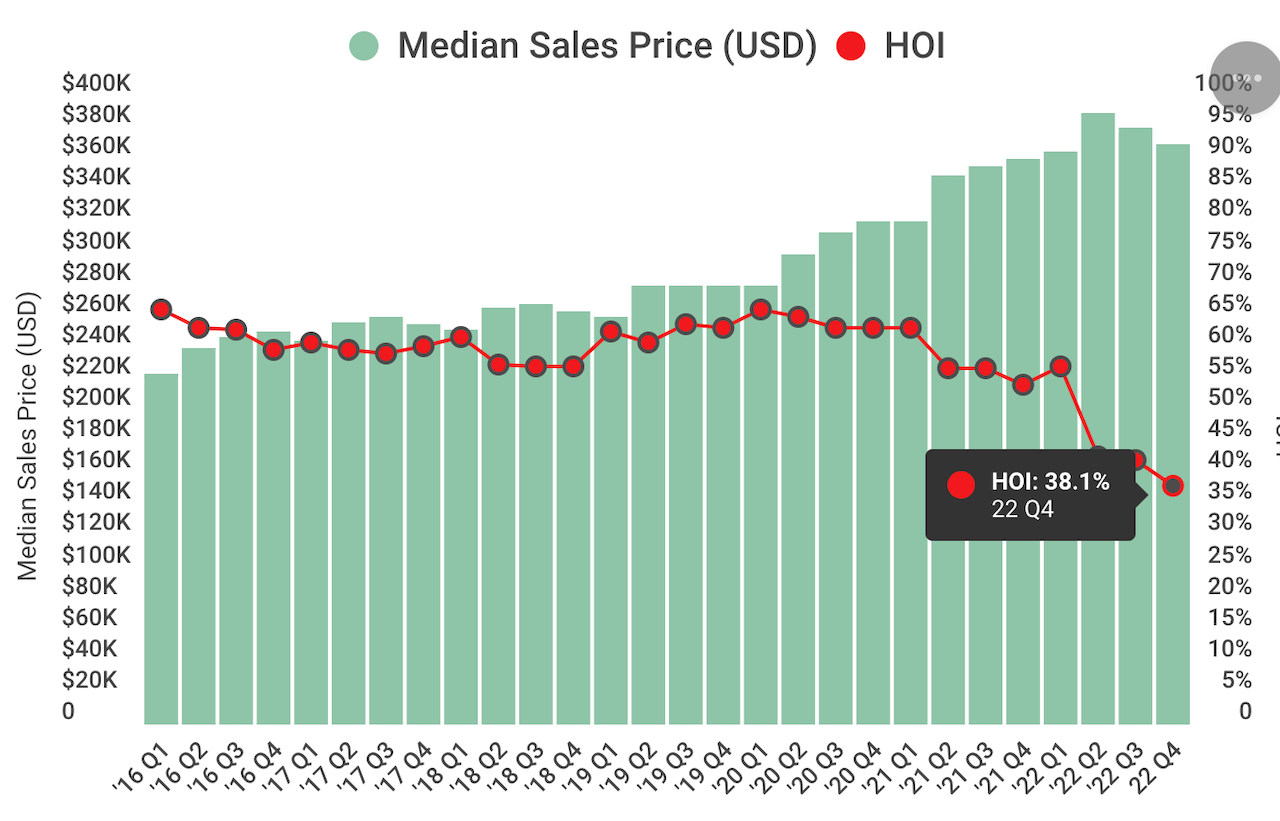

Here's one glaring measure of the path of diminishing access to homeownership as a bulwark of the American Dream.

According to the NAHB/Wells Fargo Housing Opportunity Index (HOI), just 38.1% of new and existing homes sold between the beginning of October and end of December were affordable to families earning the U.S. median income of $90,000.

Briefly, four macro causes – each with a lengthy drop-down menu of nested "reasons-why" – commonly factor into this statistical disparity between households' means and the costs to own a home.

- rising mortgage rates

- supply chain disruption

- elevated construction costs

- skilled frontline worker constraints

With mortgage rates anticipated to continue to trend lower later this year, affordability conditions are expected to improve, and this will increase demand and bring more buyers back into the market,” said NAHB Chief Economist Robert Dietz. “Ultimately, the best way to reduce housing costs is for policymakers to put into place the right policies that will allow builders to produce more affordable housing by fixing broken supply chains, easing excessive regulations and ensuring sufficient liquidity in the housing market.”

If the "best way," as Dietz describes it, is ever to become a reality as factoring into housing's crisis of affordability – who bears the brunt of it, what that means for local, regional, and national economies, and why that matters in the context of the American Dream – elected officials need to regard it both as a priority and as a matter for more than political rhetoric.

Yesterday, just as homeownership attainability's low-point came to light, it turns out that the Senate Banking, Housing, and Urban Affairs committee met for its first session, putting the affordability crisis at the top of its heap of priorities with an open hearing on "The State Of Housing 2023." Testifying as witnesses were Dr. Christopher Herbert, Managing Director, Harvard Joint Center for Housing Studies; Dr. Robert Dietz, Chief Economist and Senior Vice President for Economics and Housing Policy, National Association of Home Builders; and Mr. Lance George, Director of Research and Information, Housing Assistance Council.

Dietz put perspective on the hearing this way, after many years of work to elevate the affordability crisis as a top priority and to contextualize approaches to solutions where action on federal policy can impact the problem of supply constraint.

I think the fact that the Senate Banking Committee’s first hearing of the new Congress centered on housing supply reflects an important, bipartisan recognition that housing affordability is a top policy issue," Dietz tells The Builder's Daily.

Common ground – that attainable access to housing's moving beyond reach of more American households every day is an issue that ranks among the highest priorities lawmakers need to address, and that supply constraints are a major, and worsening barrier to that access – are a good start.

The Senate Committee Chair, Sherrod Brown (D-OH), set a tone around priorities this way.

We’re starting this Congress with a hearing on housing because it’s one of the most important issues facing families from Aiken, South Carolina, to Zanesville, Ohio. Housing determines so much about your life – how long it takes to get to work, whether you have easy access to a bank or fresh food, whether you worry about your kids getting sick from lead paint or mold. It determines your access – and your kids’ access – to opportunity. And for too many people, safe, affordable housing, and the opportunity it provides, is just too hard to find.

Ranking member Senator Scott concurred:

These ideas are common sense and shouldn’t be controversial. I sincerely believe Republicans and Democrats should be able to find common ground on many of these important matters that impact the American people.

The devil in the details for national policy action and impact will involve cutting through partisan positioning and rhetoric.

"While the Senators approached the current housing challenge from different perspectives, there are some areas of general agreement to help boost home building," says Dietz. "For example, zoning reform that helps single-family and multifamily construction is an area of agreement, albeit one that must be tackled at the local level of government. Confronting the skilled labor shortage and improving working productivity is another area of focus, and efforts by organizations like HBI are important here."

In prepared remarks for the hearing, Dietz, Herbert, and George all focused on stubbornly high and thickening barriers to building what at one time served as a bedrock of both housing economics and the American Dream: entry level homes.

Endangered Species: Entry-Level Home

Robert Dietz, Chief Economist, NAHB

The overall housing market is starved for the homes that became the hardest to build in the 2010s due to supply-side headwinds: entry-level, single-family detached homes.

In 2010, 59% of new single-family homes were smaller than 2,400 square feet, per Census data. By 2018, that share declined to 51%. The numbers are starker at smaller sizes. In 2010, 32% of new homes were smaller than 1,800 square feet. That share fell to just 24% by 2021, the latest year for which there is data.

Where National Policy Action Can Help

Robert Dietz, Chief Economist, NAHB

Improving housing affordability for renters and home buyers will help to fight inflation. With this goal in mind, Congress should pass legislation that will help the home building industry increase much needed housing supply. The lack of skilled labor, the high cost of building materials, challenging access to affordable construction financing, burdensome federal regulations, and local land use policies that restrict home and apartment construction are the main drivers of low housing supply and high housing costs. Passing legislation to alleviate these supply-side bottlenecks would increase home construction, expand housing inventory, and lower inflation. If action on these issues is delayed however, housing costs, which are roughly 40% of the Consumer Price Index, will continue to be persistent drivers of inflation, as well remain as a burden on American families."

Part of the process of the Long Recovery is rebuilding the industry’s infrastructure: its labor force and reliable sources of lending and building materials. Policy improvement is needed at all levels of government. Federal and state regulations should be examined for their impact on housing affordability. Communities need to reduce the cost of producing new housing by fighting impact fee increases and enabling building with density where the market demands it. These actions will allow more construction of housing affordable to entry level home buyers and create more equitable housing market."

Regulatory Burden

Robert Dietz, Chief Economist, NAHB

Regulatory burdens increased during the 2010s. NAHB analysis finds that approximately 24% of the price of a typical newly-built single-family home is due to the broad set of regulatory burdens imposed by state, local and federal governments11. Moreover, between 2011 and 2016, such costs increased by 29%, faster than inflation and economic growth. Such burdens are high for apartment construction as well, as an updated joint study by NAHB and the National Multifamily Housing Council found that up to 41% of apartment costs are due to regulatory costs.

Next Steps

Robert Dietz, Chief Economist, NAHB

This hearing set the stage for future Congressional debates and action. That is where the rubber meets the road. Congress can help by reviewing regulations for cost effectiveness and pursuing legislation that will help younger households attain homeownership. And of course, it is critical for the industry to be engaged and speak with one voice on the need to bend the cost curve."

As a reminder, that very abstract cost curve has a stack of very specific areas where opportunity lies in rigorously unpacking – and compromising – where the inefficiencies trap resources, and returning them to people who want, need, and pay for access to homes.

MORE IN Policy

Texas Treads A New Path Into Zoning To Battle Housing Crisis

Texas is one of the nation's most active homebuilding states, yet affordability slips out of reach for millions. Lawmakers now aim to rewire the state’s zoning laws to boost supply, speed up approvals, and limit local obstruction. We unpack three key bills and the stakes behind them.

Together On Fixing Housing: Solve Two, Start the Rest

NAHB Chief Economist Robert Dietz and Lennar Mortgage President Laura Escobar argue that the housing crisis won’t be solved by magic. It starts with a unified focus on two or three priorities—a rallying cry for builders, developers, lenders, and policy-makers.

Zone Offense: North Carolina Moves To Fast-Track By Right Housing

North Carolina legislators are pushing a bipartisan bill that could fast-track housing where people need it most: near jobs and transit. Richard Lawson breaks down what it means, how it compares to other states’ moves, and why developers are watching closely.