Leadership

Building ... And Rebuilding: Resilience In A Volatile Insurance Market

Explore how strategic insurance partnerships and proactive risk management can help homebuilders navigate rising natural hazards and market volatility.

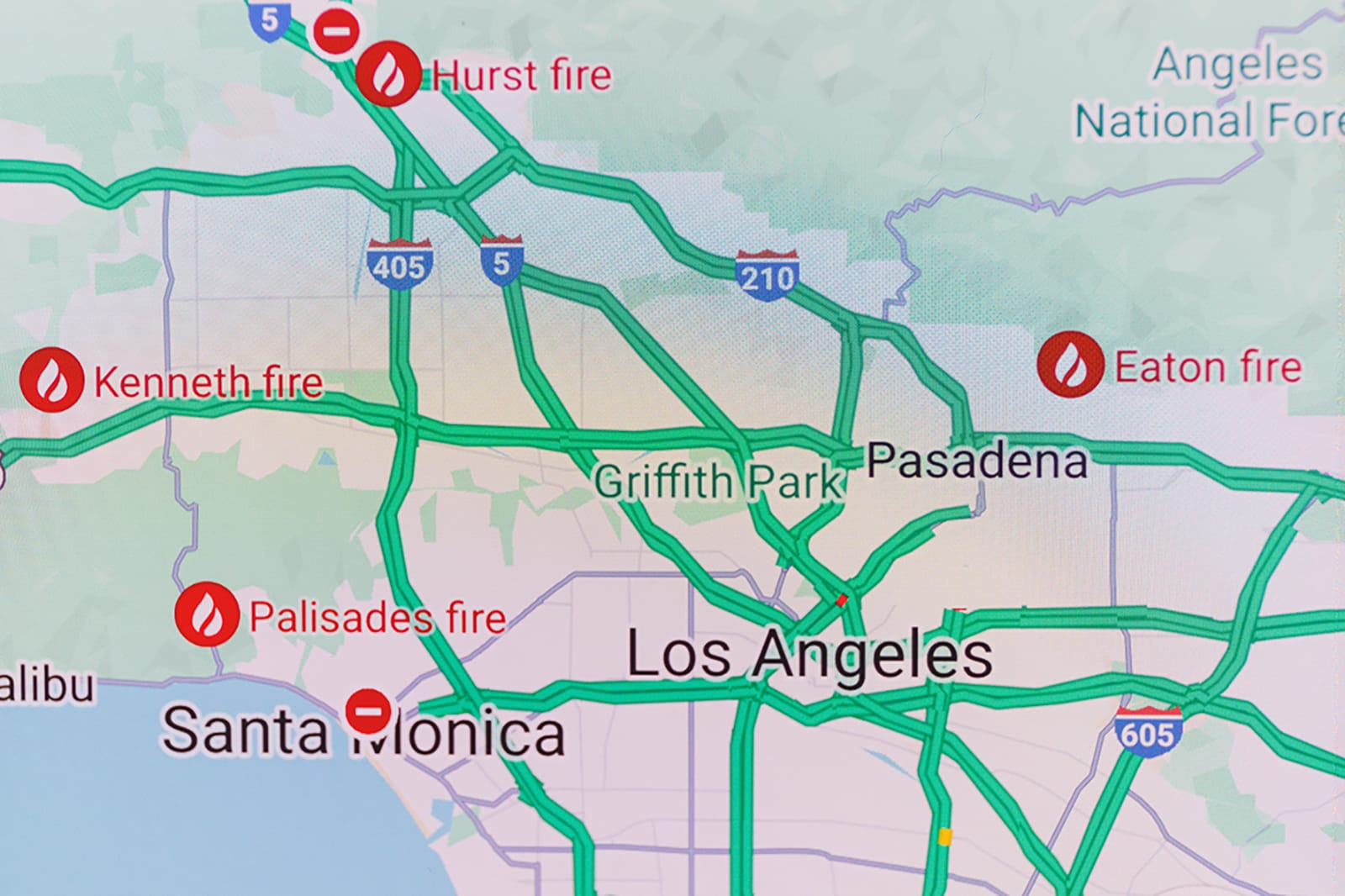

The Los Angeles wildfires continue to burn through communities, destroying lives and upending livelihoods, homes, and neighborhoods. The homebuilding industry faces a daunting aftermath that calls for resiliency and adaptation, patience, and a moment of reckoning.

The devastation underscores the rising stakes of natural hazard risk — wildfires, superstorms, floods, hail, and more — and the critical role of reliable insurance solutions in sustaining the housing market. For homebuilders and developers, these challenges are reshaping how homes are built, insured, and sold.

Christi Burkhardt, Vice President of National Sales and Growth at Westwood Insurance Agency, captures the moment's urgency.

It’s the most challenging time I’ve seen for insurance, and it’s the first I’ve seen it impact new construction,” she says. “Weather losses don’t care about the age of a home—even new closings are affected.”

This stark reality highlights why strategic partnerships between builders and insurance agencies have never been more vital. It’s no longer just about securing coverage; it’s about creating operational efficiencies, fostering trust, and navigating an increasingly volatile market landscape.

The Evolving Insurance Landscape

Rising climate risks are driving insurance premiums skyward and reducing the availability of coverage in high-risk areas. Builders who once considered insurance as a back-end concern now face the need to integrate it into their broader strategic planning. Burkhardt explains,

Our focus has shifted from working with key insurance companies to spreading risk across many insurance companies. As an agency, we continually look to add new insurance company partners to help achieve on-time closings.”

This adaptability is essential in ensuring builders can continue to deliver homes on schedule, even in the face of insurance market volatility. A diversified approach allows agencies like Westwood to address coverage gaps, work with surplus lines, and avoid delays that could jeopardize the homebuying process.

Proactive Risk Management and Land Strategy

The increasing frequency and intensity of wildfires serve as a reminder that geography matters. Builders must account for climate risks in their land acquisition strategies to avoid insurability roadblocks down the line.

Builders will benefit by factoring in insurance availability when choosing land, especially in locations with increased wildfire risk,” says Burkhardt.

Proactive measures, such as pre-mapping brush areas, collaborating with cities to clear vegetation, and incorporating fire-resistant materials, can make a critical difference. These efforts not only help maintain insurance availability but also mitigate long-term costs for homeowners and builders alike.

Operational Efficiency Through Embedded Insurance

Streamlining the insurance process has become a competitive differentiator for builders. Buyers expect a seamless experience, and embedding insurance solutions into the homebuying journey provides that.

Customers want an easy process — they like one-stop shopping for title, mortgage, and insurance,” Burkhardt notes. “Embedding insurance into the homebuying process streamlines operations and keeps builders ahead of potential delays.”

By integrating insurance into the transaction, builders can reduce friction, save time, and enhance the buyer experience. This approach also ensures that potential obstacles, such as rate changes or underwriting challenges, are addressed early in the process.

Smart Home Technology: A Path to Resilience

In the quest for both affordability and resilience, technology is becoming an ally. Smart home features, such as water shutoff sensors and fire detection systems, are proving valuable in reducing claims and improving insurance availability. Burkhardt highlights the significance of these innovations:

Smart home technologies that reduce claims, like water shutoff sensors, are starting to drive market availability and lower premiums. The key is collecting and sharing data between builders and insurance companies.”

The data-sharing aspect is particularly crucial. By demonstrating how these technologies reduce risks, builders and agencies can negotiate better rates and foster long-term partnerships with insurers.

Preparing for Market Evolution

The insurance market of the past no longer exists, and builders must adapt to its current realities. As Burkhardt explains,

Higher deductibles are here to stay, and surplus lines is becoming normalized. It’s a good idea for builders to prepare their homebuyers for more risk-sharing between insurance companies and insureds, and to stay nimble to adapt to evolving market conditions.”

This shift requires builders to educate their teams and buyers about what to expect, whether it’s higher deductibles or the need for multiple carriers within a single community. Managing expectations upfront can prevent surprises later and build trust with buyers navigating an already stressful process.

A Call to Action

The Los Angeles wildfires — like the devastating hurricanes that swept through Florida into the Southeast U.S. in the Fall of 2024 — serve as both a tragedy and a wake-up call for the homebuilding industry. While the immediate focus must be on supporting affected communities, there is an equally pressing need to build long-term resilience in the housing market. This involves reevaluating land strategies, embracing innovative technologies, and forging strong partnerships with insurance agencies.

For builders, agencies like Westwood provide more than coverage—they offer guidance through the complexities of an unpredictable market. They also provide an abundance of critical data to empower smarter strategic decision-making. By working together, the industry can mitigate risks, protect buyers, and ensure the delivery of safe, affordable, and insurable homes.

Westwood’s goals have always been aligned with our builder clients to help make the insurance piece of the homebuying journey easier,” says Burkhardt. “Despite the current challenges, we will continue to evolve to meet the needs of our clients and their customers.”

As the new home and community-development ecosystem evolves through this reckoning moment, things will not look the same as they did a year ago. But we need homes and insurance. It will all work out if we — as collaborative innovators in new home construction and neighborhood development working hand-in-hand with policymakers and local communities — stay focused on solutions.

In the face of intensifying climate risks, the industry must rise to meet the challenge with empathy, innovation, and a commitment to building a safer, more sustainable future for all.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.