Policy

Builders' Dilemma: A Political Battle On UI, Or The Real Solution

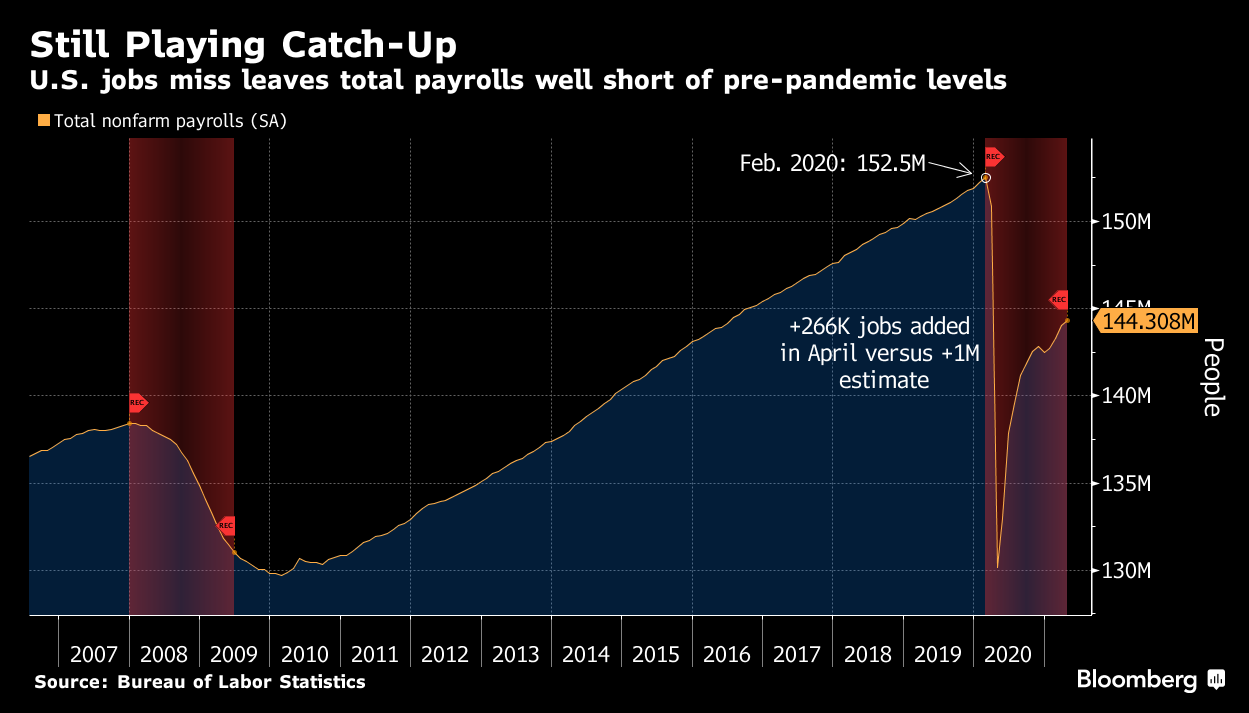

Look at the big picture on the jobs and employment front and both the actual challenge and huge opportunity come clearer than in a one-month release.

This past Friday's Bureau of Labor Statistics employment release, which showed the U.S. added 266,000 jobs in April, far short of the 1-million gain economists had forecast. The print came through as a downer and a sudden source of outsized political frisson. Not so evident though, is how sharply the report delineates both risk and opportunity for residential development and housing.

The big risk comes down to near-term, unfortunately temporary, and isolated fixes that could bring housing's leaders more comfort and confidence to this side of strategists' horizon line. The huge opportunity would be time-testable solutions. Right now, builders and their partners are scrambling mightily for immediate-term fixes to a slew of challenges. Success in finding and availing of those fixes could both delay and derail the ultimate solutions themselves.

This applies to the latest data on employment, labor participation, and unemployment and the role of pandemic-rescue unemployment insurance payments that have become a cause celebre of the moment. Builders' and their partners' measures of the very near future of hiring, livelihoods, and economic dynamism may cloud the strides they need to make into the real future of work – what is just beyond the horizon line, but encroaching.

First, a view from the macro vantage point.

The take-away from Friday's anemic jobs report is this. It's a one-month data release. It's disappointments will be forgettable except within narrow time frames of reference. Either greater disappointments or more dramatic reasons for celebration will certainly eclipse this instance, no matter how vocal and rancorous the political background noise about this data print.

The economy is recovering, fast, unevenly, unequally, and in a choppy (and in many cases, mean and nasty) way. While that rebound, since last March, has meant very good forces catalyzing strong demand for the finished and delivered durable goods people call homes, that demand comes at a cost.

Higher vaccination rates, fiscal stimulus and easing business restrictions are converging to support stronger spending across the U.S. But an economy emerging from pandemic-related disruptions is also encountering restraints on job gains and broader economic activity, as imbalances in supply and demand for goods, services and labor play out.

Some businesses are cautious about ramping up hiring, given that the pandemic and related uncertainty continues. Others are reporting they can’t find enough workers due to expanded unemployment benefits, workers’ fear of contracting Covid-19 and child-care burdens due to school closures, economists say.

Uncle Sam was so busy stoking that demand, the little matter of supply, at almost every turn, got short shrift in the grand scheme.

Still, within the tale of the tape of the April employment numbers are critical take-aways for builders and their supply-constrained partners.

One, being: Stay clear of the polarizing political fray, pick up the signal, and steer clear of the noise.

There's work to do, and the next 30, 60, and 90 days matter for individual firms – small, medium, and large – to focus single-mindedly on that work. Check out, for instance, what Bloomberg economics analyst Joe Weisenthal writes about the fundamental focus point beneath the fracas on Capitol Hill.

Regardless of what's going on, the whole debate is very revealing. It's obvious that many people (businesses owners, but also economists and general observers of the world) just take it for granted that there's always going to be a virtually unlimited supply of cheap labor. Just like people assume that when you turn a faucet water will come out, people assume that if a restaurant or a store puts up a Help Wanted sign, they will be inundated with applications. When a tech company is looking for an engineer we assume they're going to have to fight tooth and nail to fill the position. People don't make that assumption when a restaurant is looking for waiters.

The argument that $300-per-week checks disincentivize wholesale anybody who grossed in the neighborhood of $32,000 a year or less is growing louder. Everybody knows somebody who continue to opt out of reentry into the workforce, choosing instead to draw on Uncle Sam's $300-week largesse, whether by choice or necessity in a slow-to-launch broad economic reboot. But it's impact on the willingness to work may need to be reconsidered.

Here's some evidence on that front from two economic analysts at the Federal Reserve Bank of San Francisco, Nicolas Petrosky-Nadeau and Robert G. Valletta:

The findings in this Letter suggest that the $600 UI benefit supplement in the CARES Act had little or no effect on the willingness of unemployed people to search for work or accept job offers. This likely reflects the appeal of a sustained salary compared with even very generous unemployment benefits when labor market conditions are weak and virus containment measures prevent hiring. Stated more starkly, with infrequent job offers and supplemental UI payments being only temporary, job seekers do not have the luxury to be choosy and delay accepting a job in favor of continuing to receive benefits.

The limited impact on job search highlights the traditional stimulus role of UI benefits, to help replace the lost income of displaced workers in an economic downturn. Expanded UI benefits from the CARES Act appeared to be an important source of aggregate stimulus rather than an impediment to labor market improvement. When a durable labor market recovery starts, the disincentive effects of UI generosity may become more important. In the meantime, our findings suggest that a renewal of the UI benefit supplement would be an effective way to maintain economic activity without distorting search behavior and holding back job growth.

What's more, the chokeholds in the supply chain that would-be construction employers are battling have tightened the hiring spigots at least until building products and materials can resume a more normalized flow through the channel.

A Friday post-analysis from National Association of Home Builders director of Forecasting and Analysis Jing Fu summed up this way:

Employment in the overall construction sector was unchanged in April, following a revised increase of 97,000 jobs in March. Residential construction added 3,100 jobs in April, after an increase of 28,700 in March.

Residential construction employment now stands at 3.0 million in April, broken down as 869,000 builders and 2.2 million residential specialty trade contractors. The 6-month moving average of job gains for residential construction was 13,400 a month. Over the last 12 months, home builders and remodelers added 515,300 jobs on a net basis. Since the low point following the Great Recession, residential construction has gained 1,045,200 positions.

In April, the unemployment rate for construction workers declined to 6.5% on a seasonally adjusted basis. After reaching 14.1% in April due to the impact of the COVID-19 pandemic, the unemployment rate for construction workers has been trending lower for the past twelve months.

The bottom line here, for builders falling over one another right now to access supply resources to do what they do, is not to fall into a political trap about the root cause of their human talent and skilled labor access issues.

That is the matter where a near-term focus – i.e. blaming the Federal government for causing would-be workers to sit out labor participation – would impair facing up to the actual challenge: The future of opportunity and livelihoods for which home and community-building can represent a vital and vibrant career pathway.