Technology

Builders Claim Crucial Edge As ERP, In-The-Field Info Syncs Up

"Trying to align your business to the market on ‘stale’ data is not an efficient business practice and requires larger swings in pricing as you look to recapture lost revenue.” — Paolo Benzan, Constellation Homebuilder Systems

The list is long on a good day. On homebuilding's front lines, it hasn't been that for a while. When you're talking about a start-to-completion process for a 2,100 square foot, $450,000 home that normally may take 150 or so days, 18,000 separate pieces, 500 SKUs, 800 lines of code, 25 discrete subcontractor crews and processes, multiple inspection milestones, and umpteen other isolated variable issues at play, complexity often means complications, which often mean cost overruns and time delays.

Put all of these thousands of moving parts, human beings, keystrokes, and handoffs together at a high volume within a time constraint in a time of high volatility and you get the picture. Time constraints and volatility mean even more now that homebuyers – as many of them that there may be still out there across all price ranges, age segments, household compositions, and locational preferences – may be taking a moment to pause to consider, "Is now the right time?"

Common everyday missteps and hazards homebuilders can least-afford to have hit their balance sheets and operations ever, now can wreak exponential havoc. From Sept. 1, to whenever consumer household homebuyers once again find solid footing to press forward in a new-home journey, "on time" and "on budget" matter more and mean different things than perhaps at any moment in recent homebuilding memory.

Name an area, any area, in any start-to-completion homebuilding process across the 5,000 or so professionally managed homebuilding firms that build 10 or more homes a year and together account for about 90% of the nation's new-home starts, and there'll be occasion for a cost or time challenge or both. Add to the mix, the pandemic normal's high volatility, continued supply chain unpredictability, wild price fluctuations, seasonal weather disruptions, random unforeseen glitches, and any construction manager can rifle off dozens of daily pitfalls and risks in his or her sleep.

- When you get stuck paying more for a commodity or product than you should have

- When a missing $7 items stalls your ability to progress a home completion

- When a "fix" in isolation breaks three other parts of the process and dominos into major cost overruns

- When a crew shows up onsite for a dry run and the prior crew has a day or more to go before they're finished and out of there

- When an "audible" workaround on the project site either conflicts with or duplicates the net effort or cost because it hasn't clocked in at a point of control in time to override an originally-planned measure.

To name a very few. As noted above, the list runs long on a good day. However, American homebuilding's whack-a-mole reality may have begun in late 2020, but if that game has ended, nobody's bothered to tell construction teams on the job sites and front lines of a business challenged by a whole new array of economic riptides.

Now, the doozy of all doozies when it comes to trying to manage and measure this multi-beehive-like complex of concurrent systems that is homebuilding in the U.S.: Of the 5,000 separately operating companies that together build nine of 10 new homes, many, many, many of them operate out of their own, individual loosely-coupled system's standard of practice, complete with its own set of meta data tags and references for every single, distinct subcomponent, material, product, task, process, project, etc., where every new subdivision is more or less a ground-up new store with a brand new set of products on its shelves.

Although putting together a new home may look from a great distance and across a long time period as a sea of sameness – producing a box with functional rooms such as bedrooms, kitchen, bathrooms, common living areas, etc. – what varies to an astonishing degree is the number of different terms, references, vernaculars, and vocabularies for the same item, or task, or product, or material, cost code, or some other timing measure.

Complications run rampant amidst what is already a complex of moving parts for another reason – apart from the fact that basic user vocabularies vary widely from one firm to another to another – as well. That is, while enterprise resource planning (ERP) platforms, be it NEWSTAR, or JD Edwards, etc. are widely in place to lock-in data's role in the building lifecycle as a value chain, the breaks, risks, and weak links in that value chain become evident every time a field decision – and its multiplier effect impacts – veers from the ERP.

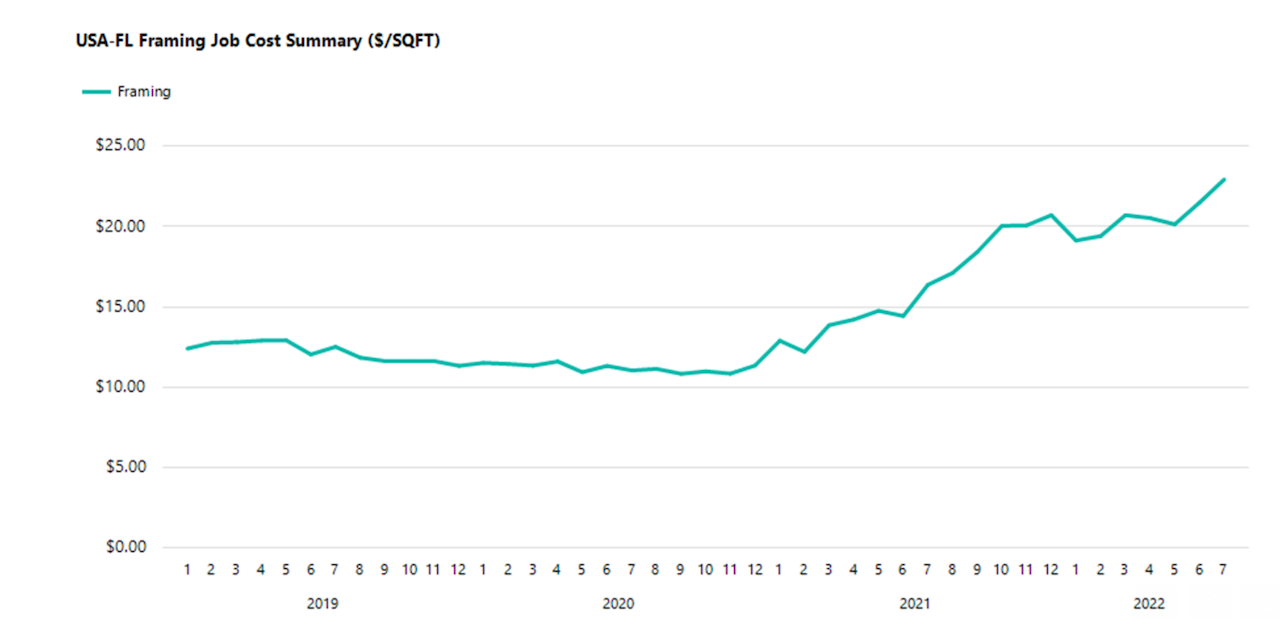

One on-the-spot, spreadsheet-based, field decision on framing lumber, for instance, could price in an overpayment for the order if the spreadsheet reflects an out-of-date, or historical cost figure. Missing a market adjustment in pricing can be costly as this chart of framing lumber job costs per square foot illustrates.

Linkages, interdependencies, interoperability, etc. of the whole end-to-end process from the time a project enters a builder's ERP – and a single-source-of-truth information and action value chain – has become a crucial factor in whether homebuilders can secure and sustain profitability at a moment when all the moving parts seem to move faster, slower, and more erratically at precisely the same time.

The primary value of collecting this data is not only realized in generating reports and dashboard, but mostly in having the ability to pivot your business based on timely, accurate, and relevant information," says Paolo Benzan, VP, Data Strategy at Constellation Homebuilder Systems. "Trying to align your business to the market on ‘stale’ data is not an efficient business practice and requires larger swings in pricing as you look to recapture lost revenue.”

Builders find today that their ERP software and platform are – like any system -- as strong as its weakest links. As they recognize and work to integrate every possible offline spreadsheet and set of marching orders, they're achieving a number of critical path gains across their enterprises by leveraging clean and consistent, real-time, single-source-of-truth data.

At Taylor Morrison we have a lot of data and homebuilding is a complex business to manage," says John Lucas, VP, Chief Information Officer, Taylor Morrison. "To ensure that we are looking at the same information, we have a rule that corrections are made in the system, not in the spreadsheet. We have worked very closely with Constellation for many years to ensure that everyone has confidence in the information they receive, that it is the full story and not something that requires spreadsheet manipulation. This allows us to set a high bar for data cleanliness and system adoption within our company. It pays off with more confident decisions and faster response times.”

These decisions and faster response times carry big implications for companies that now need to pivot on a time to reflect market adjustments in their new home asking prices, and to find dynamic cost opportunities to continue to make their homes a compelling value proposition to more wary groups of buyers.

Given the rapidly changing market conditions homebuilders face today, it is more important than ever that the leadership teams at our subsidiary builders have accurate, real-time information at their fingertips," says Randall Anderson, VP of IT, Green Brick Partners. "Over the past few years, we have emphasized leveraging our NEWSTAR systems to standardize key system processes to ensure we have clean data. The next phase in our journey will be to employ this data as we continue to develop our predictive models. We believe this will further empower our leadership teams to navigate the market and continue our efforts to grow revenues and maximize margins.”

Getting construction teams and their dozens of moving-parts partners on the same platform and page in the ERP system, and then pivoting the power of that data into improved opportunities at creating value for customers – in the backlog, or in forward pacing orders – is a non-negotiable.

An even greater competitive advantage of sync-ing up on clean, consistent, real-time data comes when respective organizations can begin to benchmark their operations to an industry standard of practice.

Now, more than ever, builders should know how their costs are changing in real-time," Bob Swainhart, VP Enterprise Solutions Group, Constellation HomeBuilder Systems. "That is the baseline for data analysis, but many builders don’t look at it as frequently as they should. The best builders know how to pick their battles and make decisions to react to changes quickly. Without good data and curiosity within the business, businesses run the risk of missing an opportunity to make timely improvements. At Constellation, we feel this is critical to the success of any business, and it becomes even more actionable when you can make financial and operational comparisons to other well-run businesses. We can provide timely regional averages for benchmark purposes and will have more to discuss on this topic in the coming weeks.”

Join the conversation

Constellation provides fully-integrated or standalone software solutions expertly engineered to manage the complete ecosystem of a homebuilder’s business functions and growth.

MORE IN Technology

Lennar Taps Into Geothermal To Power New Colorado Homes

A major homebuilder's bet on geothermal heating and cooling for over 1,500 new Colorado homes could pave the way for mainstream adoption as buyers increasingly seek sustainable, energy-saving features.

AI Crushes Missing-Middle Time And Cost Curves Toward Affordability

Developing multifamily rental and for-sale properties takes time — sometimes years -- depending on a labyrinth of zoning rules and the whims of local jurisdictions.

Brandon Elliott’s Next Big Thing: An Uber-Style Building Trades Platform

After selling Elliott Homes to Meritage, the Gulfport, Miss.-based entrepreneur sets his sights on transforming trades with a logistics-tech startup that aims to make construction faster, smarter, and more affordable—starting with siding.