Leadership

Builder Confidence Rises, But Economic Storm Clouds Hover

Optimism for 2025 grows, but affordability, rising insurance costs, and volatile market signals demand sharper focus. Stay closer than ever to your customer.

In a reflection this week on history and the uncertainties it evokes, Morgan Housel highlights a critical aspect of economic decision-making:

The past wasn’t as good as you remember. The present isn’t as bad as you think. The future will be better than you anticipate."

For U.S. homebuilders and strategic business leaders forging a path through today’s turbulent landscape, Housel’s wisdom underscores the importance of resisting overconfidence or despair, especially in a moment characterized by mixed economic signals and volatile markets.

As we approach a contentious election with significant stakes for housing policy and the broader economy, understanding the balance between optimism and caution is essential for leaders to make decisions about land acquisition, construction financing, and homebuyer engagement.

Housel’s quote can be applied directly to the new data emerging in U.S. homebuilding sentiment, particularly in the latest releases of builder confidence indices.

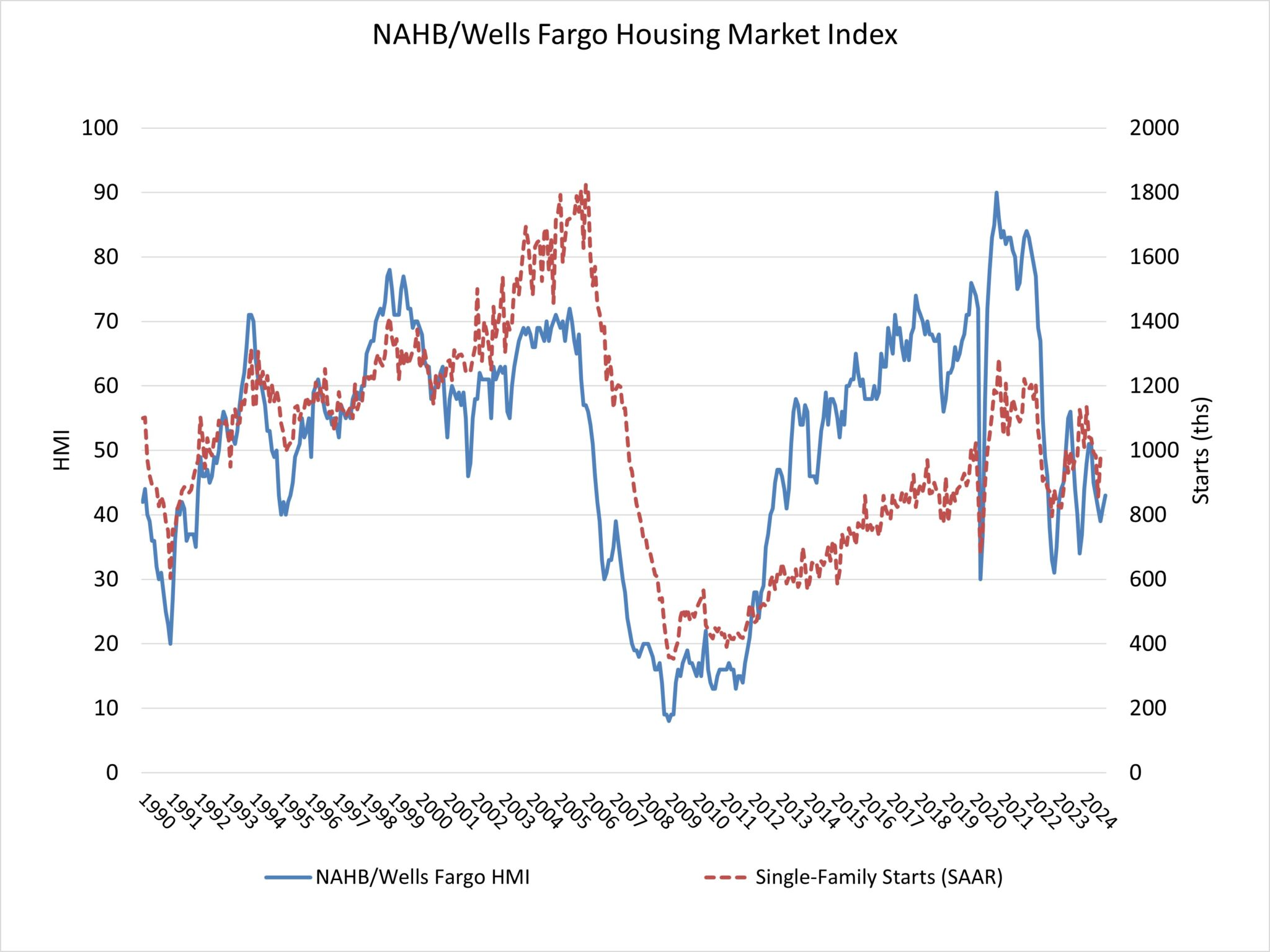

For example, the October NAHB/Wells Fargo Housing Market Index (HMI), which gauges sentiment among homebuilders, edged up for the second consecutive month, despite ongoing affordability concerns. The index moved up two points to 43, but it remains below the critical 50-point threshold, meaning more builders perceive conditions as poor rather than good.

While this improvement signals cautious optimism, it also reflects the volatile and uncertain environment builders must navigate, where affordability, mortgage rates, and shifting consumer preferences loom large.

At this juncture, overconfidence could lead to strategic missteps.

As Robert Dietz, Chief Economist for the National Association of Home Builders (NAHB), notes, builders are beginning to feel more optimistic about 2025 market conditions, with inflation easing and mortgage rates potentially declining. Dietz writes:

Despite the beginning of the Fed’s easing cycle, many prospective home buyers remain on the sideline waiting for lower interest rates. We are forecasting uneven declines for mortgage interest rates in the coming quarters, which will improve housing demand but place stress on building lot supplies due to tight lending conditions for development and construction loans. However, while housing affordability remains low, builders are feeling more optimistic about 2025 market conditions. A wildcard for the outlook remains the election."

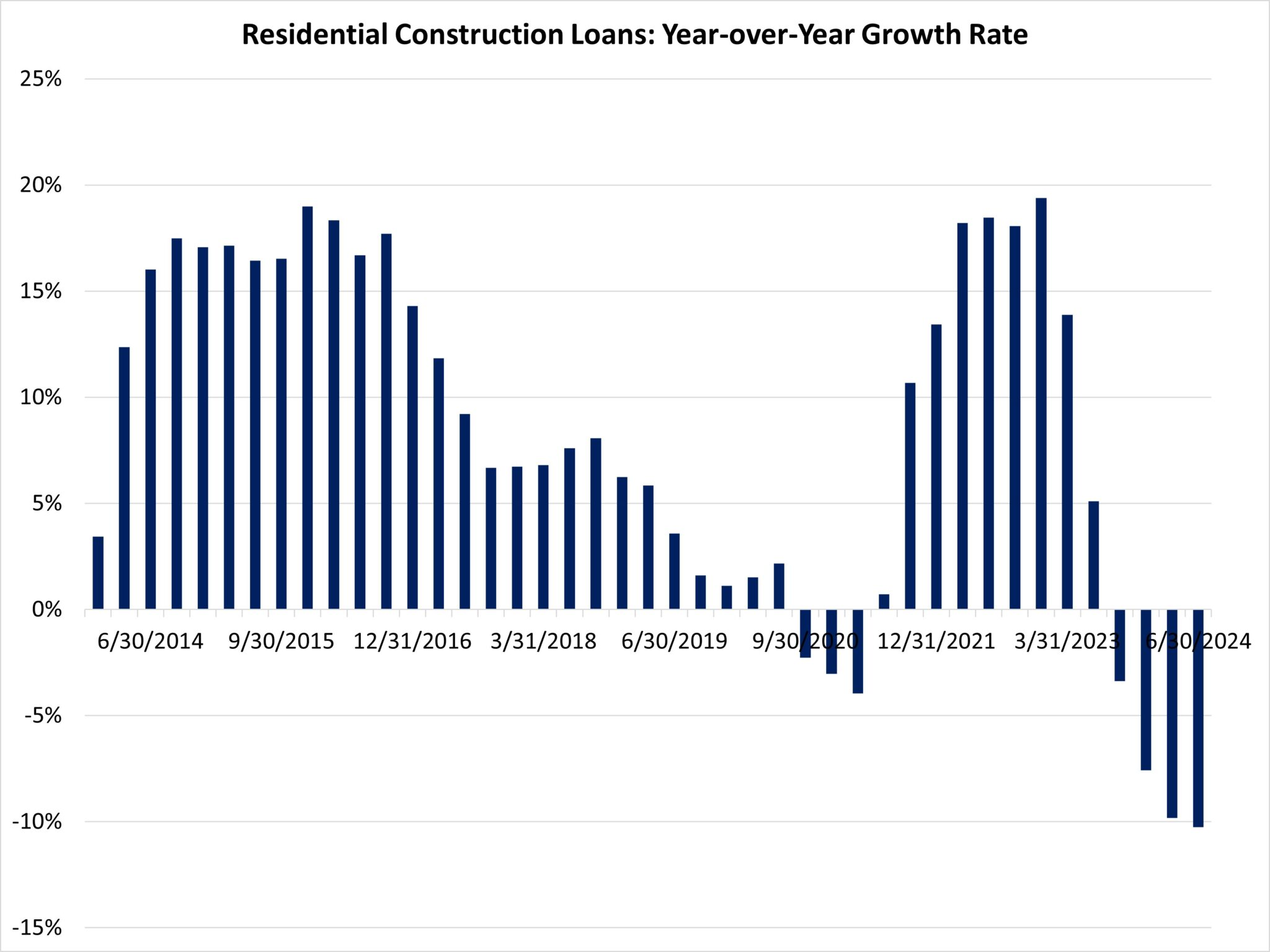

This hesitancy reflects a broader challenge: even with the Federal Reserve starting to ease its policy stance, tight lending conditions for construction and development loans are squeezing builders’ ability to replenish their lot pipelines. In another report on 2024 declines in Acquisition, Development, and Construction loans to homebuilders, Dietz notes:

On a year-over-year basis, the stock of residential construction loans is down more than 10%, the largest year-over-year decline since 2012. This contraction for construction financing is a key reason home builder sentiment moved lower at the end of 2023, even as building activity accelerated, propelled by larger builder activity."

This creates a high-stakes balancing act for homebuilders, who must navigate both a softening demand environment and financing constraints while positioning themselves for an eventual rebound.

The Wolfe Research analysis of the same HMI data offers a deeper dive into the "choppy" demand environment builders are experiencing. Trevor Allinson, an equity research analyst, emphasizes that while the rise in builder sentiment is notable, the market remains contractionary, and incentives —s uch as price reductions and sales discounts — are still necessary to drive sales.

The October HMI data reveals that 32% of builders are cutting prices, with the average reduction ticking back up to 6% after briefly falling to 5% in September. Simultaneously, the use of sales incentives increased slightly, from 61% to 62%. These trends point to a market that is still far from stabilizing, as homebuilders continue to use discounts to lure hesitant buyers amid affordability constraints and high borrowing costs.

Allinson also highlights a notable discrepancy between homebuilders' current sales and their expectations for the future. While the "Expectations" component of the HMI rose four points to 57 — indicating optimism for the next six months — current sales remain lackluster, with the index rising just two points to 47.

Furthermore, traffic of prospective buyers remains dismally low, stuck at 29 for the fifth consecutive month. This divergence between present conditions and future expectations is a key indicator of the precariousness of the current market environment, where builders are banking on lower mortgage rates to spur demand in 2025 but must continue contending with weak buyer traffic in the near term.

So, where does this leave homebuilding strategists?

Housel’s reflection on history offers a critical lesson: strategic leaders should recognize that the future may not be as bleak as it seems, but they must also remain humble and aware of the unknown unknowns.

As we look at the broader economic context, including a revised economic outlook from Fannie Mae, the importance of measured optimism becomes clear. Fannie Mae has revised its 2024 and 2025 economic growth forecasts upward, citing stronger-than-expected job gains and upward revisions to personal income data. While this paints a somewhat rosier picture for the U.S. economy overall, the housing sector remains a wildcard, particularly given the rising cost of home insurance and the persistent affordability crisis.

The Fannie Mae report does offer some positive news for homebuilders. Home prices are expected to rise by 5.8% in 2024 and 3.6% in 2025, bolstered by a shortage of existing homes for sale. This tight "lock-in effect" inventory environment will continue to support demand for new homes, even as higher mortgage rates suppress overall sales activity.

However, the report also acknowledges that mortgage rates remain volatile, and any further increases could dampen the outlook for both new and existing home sales. This uncertainty around interest rates adds another layer of complexity to builders’ strategic planning, reinforcing the need for vigilance and adaptability.

Additionally, the soaring cost of home insurance, particularly in disaster-prone areas like California, Texas, Florida, and the Carolinas, is an emerging challenge that homebuilders cannot ignore.

As the Bloomberg article "The Math Says It’s Getting Harder to Break Into the American Middle Class" reveals, insurance costs are compounding the affordability crisis, making it increasingly difficult for middle-class families to purchase homes. For homebuilders, this adds a new X-factor to an already difficult equation, further complicating efforts to attract and retain buyers in high-risk markets.

As the election approaches, housing affordability will remain a critical issue for both voters and policymakers. The stakes are high for homebuilders, as shifts in political leadership could dramatically alter the regulatory landscape, impact immigration flows that affect labor availability, and influence housing policy. Whether it’s Kamala Harris’s proposal to provide down payment assistance to first-time homebuyers or Donald Trump’s promise to reduce immigration and ease demand for real estate, the outcome of the election will undoubtedly shape at least the near-term future of the housing market and the consumer sentiment that drives it.

Ultimately, as Housel’s words remind us, leaders in the homebuilding sector must embrace both humility and resolve.

They must acknowledge the unknown unknowns that cloud the future while staying connected to the real-world experiences and needs of their homebuyer customers. Overconfidence in a volatile market can be as dangerous as paralyzing pessimism. The best way forward is to remain deeply attuned to the signals from both prospective and active buyers and the broader economic environment, while making tactical adjustments that keep the business resilient in the face of uncertainty.

Strategic leaders must keep a steady hand on the wheel, ensuring that their organizations are prepared for whatever the future holds — whether it brings lower mortgage rates, rising demand, or continued volatility and headwinds.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.