Land

Beyond The 'What-Inning-Is-It?' Question: 2024-'25 Land-Spend

To feed the machine, public, private, large, medium, or small builders need lots out ahead of them. To keep that machine hungry, builders need those lots to pencil in an environment that's getting tougher and tougher for a larger and larger portion of would-be home buyers.

I been in the right place, but it must have been the wrong time." – Dr. John

In bygone simpler times a meeting of business folks in homebuilding and residential real estate inevitably devoted at least part of the conference focus to a sports metaphor.

What inning are we in?"

Innings of a baseball game, of course, stand for the beginning, middle, and end sequences of each housing cycle. Each inning carries its own set of behaviors, implications, explanations, and business imperatives – especially as regards risk and rewards of investing capital in land positions. Some smart, experienced, and data-evidence-driven people characterize late 2023 as the early innings of a strong, new residential real estate cycle.

Others of equal skills, wisdom, and access to real-time knowledge on the ground might argue that these Q4 2023 months are part of the very tail end of a long gradual boom cycle, due at last to capitulate.

Since it's now early October post-regular season, we'll self-indulge in another metaphor – in hopes of capturing this particular mixed-signals moment in business and marketplace conditions – from what in bygone simpler times we knew as America's favorite pastime. In this one, we'll focus not on an inning, but rather a single play within an inning.

To describe the level of potential risk, potential reward, frenzy, uncertainty, and big-time consequences, imagine two players caught in a rundown on the base paths with one base as the point of safety. Depending on feints and dodges, speed, quick-decision-making, teamwork, and blunders, the number outcomes includes one out, two outs, no outs, or even one or two runs scored. Any fan of baseball for a few years may have seen all of those eventualities or scenarios occur.

One player susses the play and sees a green light to dash forward; another reads the same circumstances entirely the opposite. All hell breaks loose, and both can wind up either wrong or right depending on how the infielders react.

And anybody who's put time in making homes and neighborhoods for people to live in knows that it's never simply been about an "up" or a "down" time, simply because timing, and location, and home, and everything that is relative supply and demand are values constantly in motion.

We like to think of current conditions in terms of seven economically-distant cousins of the Grimms' original seven dwarfs.

- Bumpy

- Lumpy

- Choppy

- Spotty

- Schizy

- Flippy

- Iffy

I'd have said the right thing, but it must have been the wrong line." – Dr. John

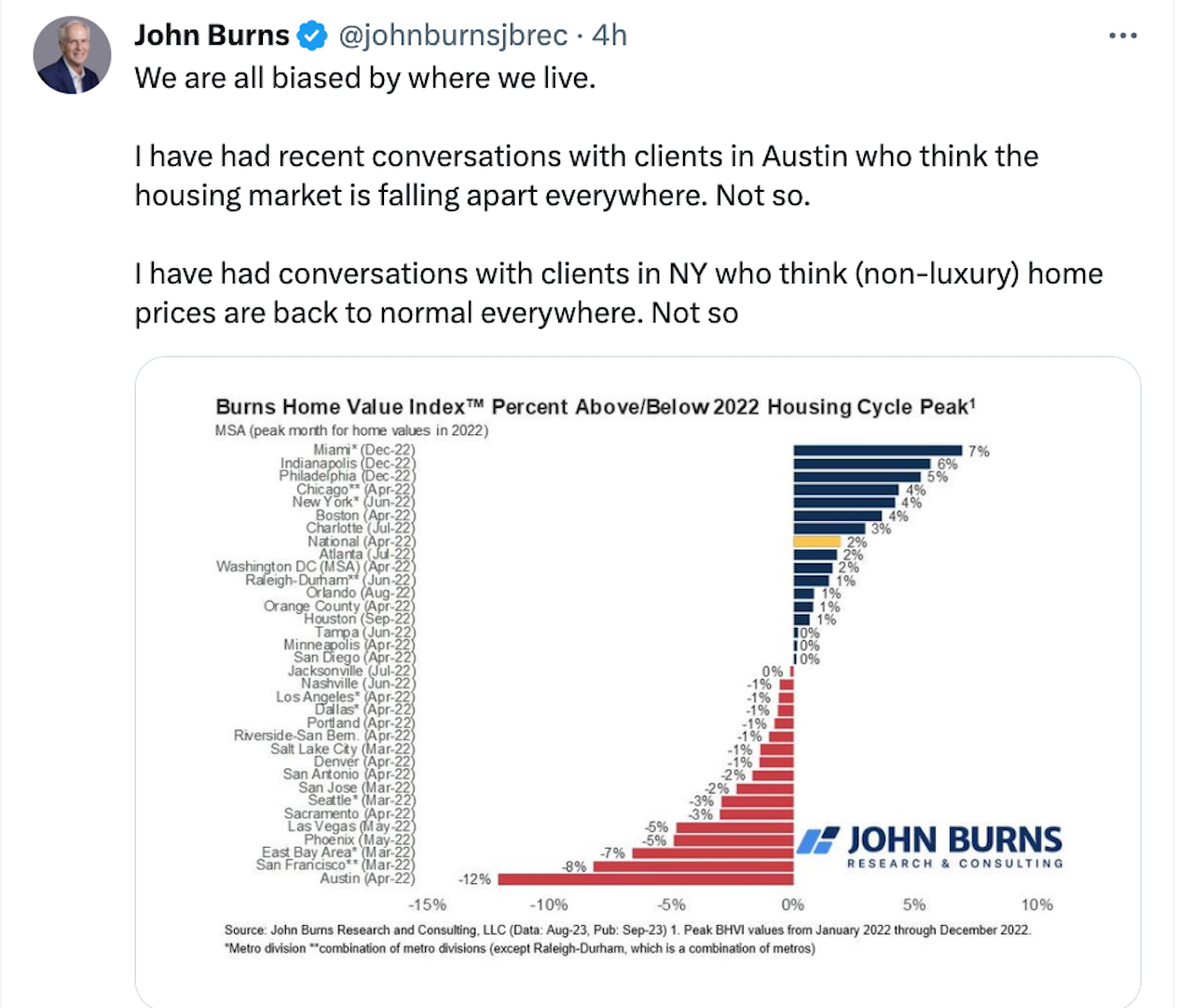

John Burns, eponymous founder and CEO of John Burns Research & Consulting, "xes" this morning:

We are all biased by where we live.

I have had recent conversations with clients in Austin who think the housing market is falling apart everywhere. Not so.

I have had conversations with clients in NY who think (non-luxury) home prices are back to normal everywhere. Not so.

In this context, it's well worth considering two lines of analysis Truman Patterson and his homebuilder and building products research team at Wolfe Research focus on in a recent "The Wolfe Byte" report.

Outside of the typical Owned versus Optioned land splits, the two most frequent questions investors ask regarding a builder’s land quality often pertain to 1) which builder has the healthiest lot/land pipeline for continued growth into 2024? and 2) which builder has an advantaged legacy land vintage that supports ’24 Gross Margins on a relative basis?"

These two questions would be the same ones lenders, investors, friends and family partners, etc. would also be most interested in were the operator a local, regional, multi-regional, or national private builder.

How many lots do you have out in front of you, as a measure of the volume you need to pull your overheads through to sustain and possibly grow the business next year and the year after that? Are they for your own vertical development or for sale? What "vintage" are they in light of current and potentially even greater future pressure on prices?

Patterson writes:

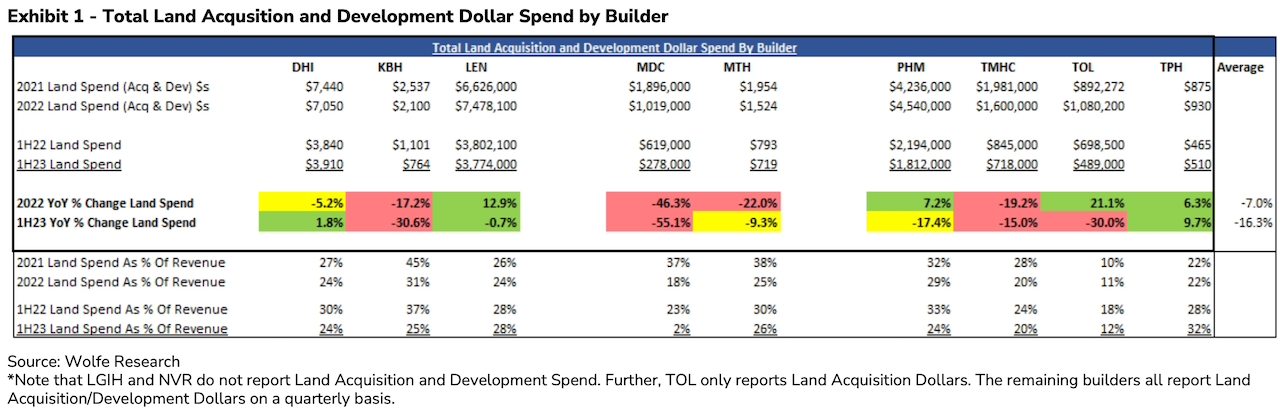

Land Acquisition and Development spend is the lifeblood of a homebuilder and periods of accelerating land investment typically leads to an improved active lot/community count in future years, and vice versa in periods of decelerating land spend. As shown in Exhibit 1, the HB group cut land investment by -7% YoY on average in 2022, while 1H23 land investment has dropped -16% YoY—we note there are large swings based on individual builder strategy.

Timing, location, product, and pricing are all the spinning plates, and under each of those forces in motion stands a calculation of internal rate of return that can expand or compress, but its elasticity and tolerance can only bend just so far down.

As Patterson notes, answering the question about the likelihood that a legacy land pipeline will produce greater or lesser gross margin opportunity in 2024 gets difficult:

For our analysis, we view land acquired or tied up prior to 2021 as relatively healthier with a lower cost basis, and land acquired/optioned in 2021 and beyond as having a higher cost basis—hence, we anchor our starting point to each builder’s lot count ending 2020."

To feed the machine, builders – public, private, large, medium, or small – need lots out ahead of them. To keep that machine hungry, builders need those lots to pencil in an environment that's getting tougher and tougher for a larger and larger portion of would-be home buyers as cost-of-living, mortgage rate, and high home prices price more out each day.

So don't be surprised – especially as operators thrash to nail down financial and operational budget projections for 2024 – if some participants are dashing ahead to advance a base, while others turn on their heels and rush back to the safety of the base behind them.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.