Marketing & Sales

Believe Millennial Home Demand Is Unwaverable At Your Own Peril

Homebuilders can no longer count on macro economics, pandemic panic, and Fed policy to pull Millennial households into their force-field. Classic competitive marketing, selling, and customer focus are going to have to do that job now. Who's up to the challenge?

This is a homebuilding and residential real estate development marketing and customer care and focus story nested in a macro-economic context this second-week-of-July, when new inflation headlines are on tap.

Strategically, most of residential real estate development and construction's leaders are operationalizing course corrections to volumes, revenue, and profitability with confidence in four key assumptions:

- The U.S. economy is on sound, solid, sustainable footing.

- Current downward spikes in trends around home purchases are a function of reflexive reactions to steep changes in mortgage rates impacting payment power, and ultimately a mean reversion to pre-pandemic levels.

- The odds of a Fed policy error – i.e. the possibility the Fed will "overtighten and cause an actual economic contraction" – are low.

- And, 45 million Millennial adults remain in the "sweet spot" to make a change in their homes, either buying or renting.

Confidence in those pillars is well-founded in a general sense, although turbulence and tactical response at the submarket and market level may vary widely, and has begun to do so.

The view – saving for the fact that now, a big deep gap yawns between the end of historically dirt-cheap mortgage rates and the moment the Fed may deign to ease up on them again at some indefinite point in the future – is that, broadly, the 2022 homebuilding enterprise cohort of well-capitalized, financially de-risked, stress-tested operators believe they're capable of weathering the bumps and bruises that will come during that gap.

They rely pretty heavily on those four assumptions above, though.

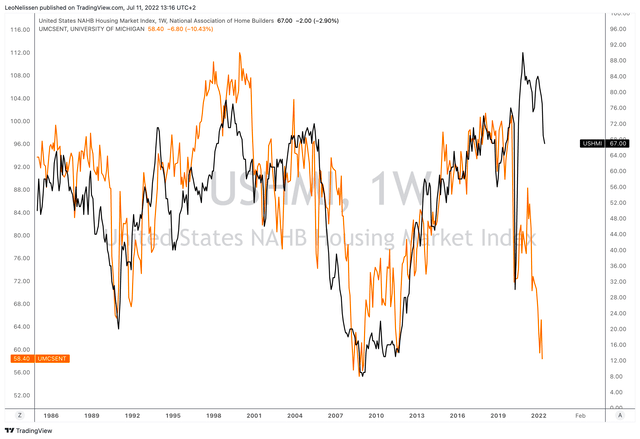

A chart from Trading View macro expert for Intelligence Quarterly Leo Nelissen pinpoints where this story stops being sheerly an economic forces analysis and, instead crosses into being a story about customer intelligence, focus, care, and satisfaction.

Have a look.

Nelissen notes:

Unfortunately, for now, it seems that the pressure on housing sentiment is only growing as the divergence between Michigan Consumer Confidence (orange) and NAHB Housing Market Sentiment (black) is widening to a degree that makes me very uncomfortable.

Consumer confidence and homebuyer behavior are not the same, but they relate, and at times consumer sentiment's role as a leading economic indicator carries more weight than others.

That widening "divergence" between homebuilder confidence and consumer sentiment may – or may not – contain risks to that bedrock bullet-point assumption mentioned above regarding 45 million Millennials in market-rate housing's sweet spot – the oldest Millennials, at age 42, in the "prime time" of typical adult first-time home-buying ages.

Still, census data analyzed by Apartment List shows just how big an error it would be to regard Millennial households' – even the younger adults streaming into household, family, and higher-income formations – as low hanging fruit.

- According to the most recent Census data, the Millennial homeownership rate stands at 48.6 percent, more than 20 percentage points lower than the rate for Gen X and almost 30 percentage points lower than Baby Boomers.

- Millennial homeownership lags even after adjusting for age. Among older Millennials who have hit age 40, 60 percent own homes. At that same point in life, 64 percent of Gen Xers, 68 percent of Baby Boomers and 73 percent of Silents owned homes.

- With each passing year – and accelerated by the pandemic – an increasing share of Millennial renters say they will never own a home. 22 percent of Millennial renters view themselves as “always renters” in 2021, and preliminary data from 2022 shows that share increasing.

- As Millennials age, affordability becomes increasingly important to their housing choices. Other factors in the “rent or buy” decision (e.g., lifestyle flexibility) have become less important to Millennials as they age.

For those households, "historical rates" mean nothing, particularly if they're first-time buyers. Their point of focus is on their own payment power. They trying to cope with what's happening to their cost of living, especially as it would pertain to a principle, interest, taxes, insurance, energy, and travel-to-work matrix, not to mention other monthly household essentials, and very possibly student loan debt, etc.

Historically, collective homebuyer psyche and behavior learn not to be fazed by 6% or 7% 30-year fixed mortgages.

The risk to homebuilders is the very construct of 45 million adults in an age group comprising a business "sweet spot." Yes, Millennial adult households need shelter.

So?

Then, there's the reality facing the households they're forming now:

But the majority of millennials aren’t yet married, let alone having children. One reason, of course, is lack of money. They are contending with a student debt crisis and staggering racial wealth inequities. Kneecapped by the Great Recession, the average millennial in 2016 was earning about 20 percent less than baby boomers did at the same stage of life.

That wage gap casts a long shadow over what millennials can save and invest. By 2019, Americans born in the 1980s were 11 percent behind wealth expectations based on previous generations. (And that was good news; the deficit was 34 percent just three years earlier.) Meanwhile, loans rule their lives: The debt-to-income ratio of Americans born in the 1980s is higher than any other birth group, making them especially vulnerable to financial setbacks. Now that most millennials are in their 30s, a point when many of their parents were able to own homes, they’re squeezed between the worst inflation rates of their lifetimes, eye-watering housing prices and the precarious fallout of the pandemic.

If the 24 or so months between June 2020 and June 2022 did not convert pent-up buyers and pull forward Millennial buyers from the future, what that means is that the widening divergence between homebuilder sentiment and consumer confidence is a gap only marketing, sales, and precise, household-by-household customer centricity can fill. That's why this is not so much an economics story.

There could be bigger bogies of risk than a lot of the business community's leadership is counting on having to deal with. Those leaders' differential calculus and the calculus at the household level are in two parallel mathematical universes.

Join the conversation

MORE IN Marketing & Sales

11,000 Buyers Turn 65 Each Day, Here's How Homebuilders Win

Even in a hesitant market, 55+ buyers hold the keys to growth. Deborah Blake shows builders how to win their trust—and unlock their equity—with empathy, lifestyle, and design.

The AI Revolution is Here: The Implications For Homebuilders

Artificial intelligence and automation are changing the rules of competition. Builders that invest now—in systems, culture, and people—will gain a lasting advantage in efficiency, customer experience, and profitability.

How Homebuilding Sales Became A Strategic Center Of Gravity

Dave Rice and New Home Star help turn homebuilder sales associates into data-powered business strategists and a linchpin to critical customer feedback. Here’s why that matters now more than ever.