Land

Banking On Uncertainty, Builders Brace For Rougher, Iffy Conditions

Taking a page from past cyclical practices more builders, brokers, sellers, and investors engage in 'banking' lots for demand conditions that could go either way.

Stick around long enough in a business, and things repeat. This includes jokes.

This one, for instance, about the two fellows out in the woods suddenly practically face-to-face with a bear. For residential real estate and new housing-related businesses, there are two take-aways here. One is, yes, humor – like everything else – recycles.

The other big take-away for the business community of making new homes and neighborhoods is probably more telling when it comes to expectations for the next patch.

Competing to survive is every bit a part of the game as competing to thrive. During stretches of residential real estate's parabolic wave pattern, losing less than the rest is as good as winning. It means remaining viable while others can't or don't do so, and living to thrive again when the cycle morphs some of the stiff headwinds into supporting tailwinds.

Competition in homebuilding, development, investment and related fields – whether it's when times are as good as they get or as turbulent, perilous, and adverse as they can be – is about doing better comparatively.

Like the fate of those two gents in the woods set upon by the big bear, de-risking comes down to not necessarily dodging adversity altogether, but rather out-legging other peers who get tugged into its undertow.

The relevance of the two-men-and-a-bear joke today in an business environment that has begun to weaken the pace of single-family sales and rental absorptions, a key performance indicator underlying residential land investment, as prices and rents de-couple from household incomes and payment power, for both owners and would-be renters.

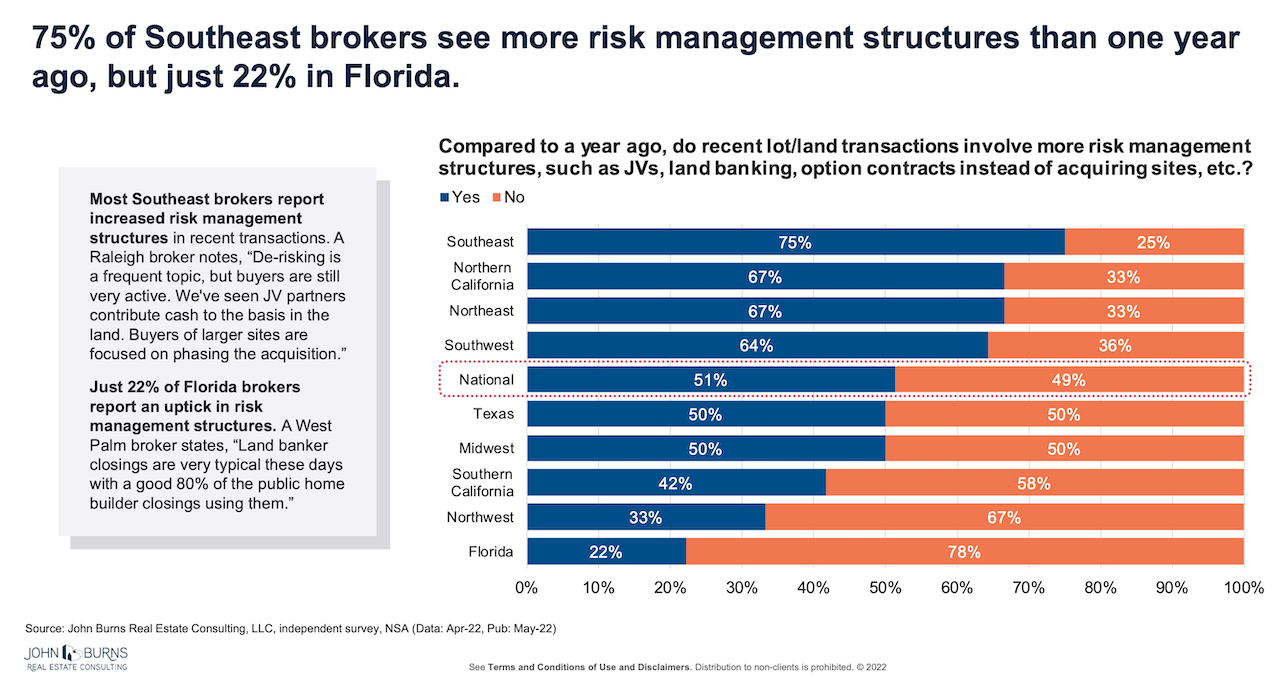

Not for nothing, a quarterly Residential Land Study from The Builder's Daily partner John Burns Real Estate Consulting, put financial de-risking into the cross-hairs of its first quarter 2022 survey of builders, investors, developers, and brokers business benchmarks and outlooks. Here's how they phrased the JBRE land survey "question of the quarter."

Compared to a year ago, do recent lot/land transactions involve more risk management structures, such as JVs, land banking, option contracts instead of acquiring sites, etc.?

Here's how brokers – agents and representatives in the middle of trading residential land deals between land sellers and buyers – responded to the JBREC question, broken out by geographical region.

Here's how, per a note from JBREC ceo and founder John Burns, the biggest buyer channel for residential land – public and private homebuilders – have stanched themselves to weather potentially worsening conditions ahead:

Safeguards against uncertainty

- Very little money has gone into land development, limiting future lot availability. This will constrain future new home supply.

- Large home builders are now developing their own land, partially financed by land bankers.

- Big builders have also taken advantage of historically low interest rates and turned to the bond market. The top seven builders have about $25B in debt, with less than half due in the next 5 years.

Prepping for the future

- A recession will more than likely occur next year given the Fed’s announcement that they are going to do everything they can to reduce inflation, coupled with supply eventually catching up to demand.

- Although the market is cooling, market conditions appear more like the conditions around 1980/1981 and 2000/2001 as opposed to 2006–2008.

Keep a close eye on these key metrics: months of supply and employment growth. Months of supply determines the direction of price. Employment losses will signal trouble ahead. - Rents will continue to grow, though some apartment and rental home submarkets could be at risk of oversupply.

In today's related news we note the kind of strategic, off-balance sheet land-banking joint venture that we've seen before as a way for an operator to engage capital partners to secure future building lot pipelines without ladening their own balance sheets with debt and owned assets.

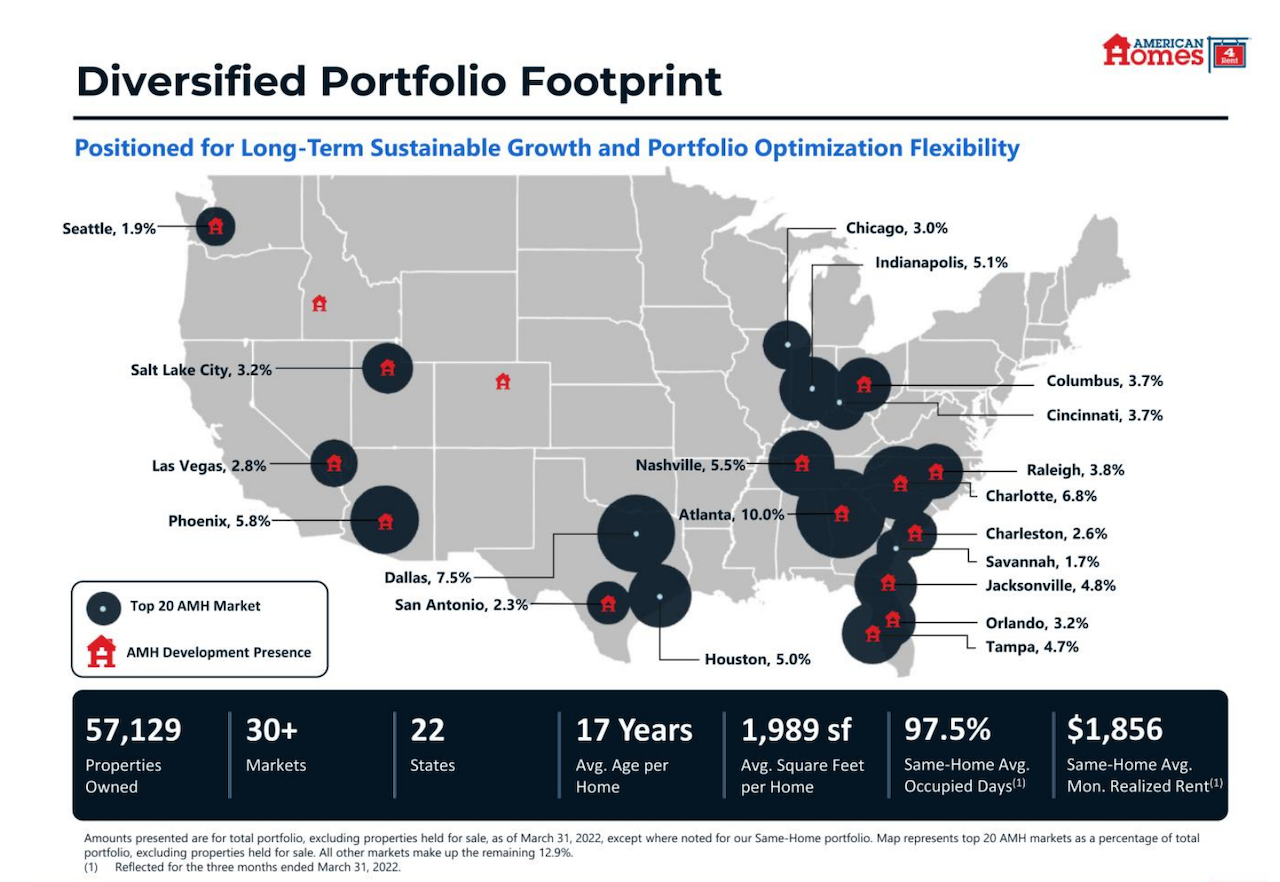

American Homes 4 Rent (NYSE: AMH) (the "Company"), a leading provider of high-quality single-family homes for rent, and Värde Partners, a leading global alternative investment firm, today announced that they have entered into a land banking facility agreement. This facility provides $500 million in initial capacity to acquire and develop new land opportunities as part of American Homes 4 Rent's internal development platform. The two firms have recently closed their first six land transactions into the facility, representing total acquisition and development costs of over $150 million, and due diligence is underway on additional sites. ...

"Our facility with Värde Partners will enable us to continue the strategic expansion of our development pipeline while also maintaining our commitment to a best-in-class investment grade balance sheet and reducing long-term risk," said David Singelyn, Chief Executive Officer of American Homes 4 Rent. "With a continued focus on our disciplined underwriting process and a robust pipeline of development opportunities, we are well-positioned to execute our three-pronged growth strategy in our diversified portfolio footprint while driving value for shareholders."

What's observable in the data now is this. The fundamentals of need for housing of all types and the fundamentals of "can pay" for housing of any type are entirely separate from one another, and the "can pay" segment is shrinking as cost-of-living and payment power go in opposite directions for so many households.

On the other side of the coin, the fundamentals of capacity to develop and build versus the fundamentals of building, developing, and selling (or renting) for profit are entirely separate buckets as well. As an industry, there's a mismatch – overcapacity in what's less affordable and under-building of what's more attainable – that cost inflation, overregulation, and lack of innovation have made more pronounced.

"Long on land" is in one way or another an issue of timing. To recognize which organizations may be long on land, John Burns says keep watch on "months of supply" as a proxy for where prices – prices paid and prices sold-for – are headed.

Another expert point of view suggests that "long on land" may be decipherable in another of builders' key metrics, pace.

Ivy Zelman, ceo of Zelman & Associates, wrote what seems like a lifetime ago, in 2005 when she was equity research analyst at Credit Suisse:

What will differentiate builders in a more challenging housing market is the quality of the land purchased during the past three years, as well as a company's ability to alter its investment strategy. As [home]buyers become less abundant and supply begins to outweigh demand, fringe investments are likely to fare far worse.

As with any land purchase, absorption rates (homes sold per period) are a key assumption to research when evaluating a parcel. While builders do not imbed home price appreciation in their pro forma analyses, the level of absorption does serve as a good proxy for the amount of maneuverability a builder has. If velocity declines from one's original assumptions used to purchase the parcel, future sales, margins, and return on capital naturally come under pressure. It won't be until the country experiences a market slowdown that builders will be punished for bad land purchases. Those who buy prudently are more apt to sustain a competitive performance trend.

[emphasis added].

What's uncanny is how well the same punchline plays as well now as it ever did. What's also uncanny is how unfunny the joke is every time.

Join the conversation

MORE IN Land

Millrose Q3 Outperforms On Tech, Discipline & Land‑Light Strategy

As many builders pull back, Millrose Properties leverages data‑driven underwriting and select partnerships to bank growth despite a softening market.

Jody Kahn: What Builders Say Now About New Home Demand

Amid slumping buyer urgency and looming policy uncertainty, John Burns Research & Consulting research guru Kahn summarizes builder sentiment trends and pain points from fresh field data.

Texas Land, Texas Spirit: A Wake-up Call For Better Neighborhoods

Scott Finfer calls for a reinvention of how communities are built—away from formulaic lot counts and toward ecosystems rooted in landscape, design, and daily experience. His essay challenges developers to deliver neighborhoods that endure and reflect the best of the Texas spirit.