Capability and Culture

Asahi Kasei Adds Vegas-Based Focus To Its Super-Supplier Stable

With the acquisition, operating unit Synergos Companies expands its footprint offering a multi-scoped array of construction supplier solutions, and parent company Asahi Kasei strengthens its foothold as a systems-based residential construction platform in North America.

Just shy of one year since Asahi Kasei announced its U.S. flagship Synergos Companies had acquired Arizona-based Brewer Companies, the Tokyo-based 100-year-old diversified global enterprise today revealed it has added a powerful regional operator to its growing fold of multi-scoped construction contractor-supplier services.

Per a statement today:

Asahi Kasei Homes concluded an agreement to acquire 100% ownership of Focus Plumbing LLC, Focus Framing, Door & Trim LLC, Focus Electric LLC, Focus Concrete, LLC, and Focus Fire Protection LLC (collectively referred to as “Focus Companies”), a Nevada-based residential plumbing, framing, electric, concrete, and fire protection group, on October 14, 2022 (US Eastern time), through a U.S. subsidiary, and completed the acquisition on October 31, 2022."

Focus – you may remember from a TBD deep-dive about a year ago on the reemergence in high-volume residential construction of the multi-stacked building trades-under-one-roof – is led by construction services veteran Steve Menzies, who founded the Focus Companies in 2009, and built it to its current standing, doing a reported $40 million in EBITDA in 2021, and involved in more than 15,000 new construction units over the past 12 months' time.

The press statement adds context to the $22 billion Asahi Kasei homes division's grand plan as it makes inroads in North America:

The Focus Companies have provided high-quality services for residential plumbing, framing, electric, concrete, etc. in Nevada, earning a strong reputation among builders. The acquisition of the Focus Companies was agreed based on expectation of firm housing demand resulting from a shortage of housing due to population growth in Nevada, while having positive synergies with existing businesses in the adjacent state of Arizona. Moving forward, Asahi Kasei Homes aims to provide high-quality home-building services for the construction industry in the U.S., which has many challenges such as labor shortages and long construction periods.

Ernst & Young Capital Advisors, LLC (EYCA) and Whelan Advisory Capital Markets, LLC acted as the exclusive financial advisors to Synergos and Focus Companies, respectively, in connection with the transaction.

When we talked earlier, one-to-one with Menzies, his company of 1,500-plus team members across a portfolio of turnkey residential construction services including concrete, rough framing, plumbing, electric, right through to fire sprinklers was on an expansion fast-track both geographically and operationally.

He told us:

If we had an equity partner – which it looks promising – we'd go more fully into the St. George and Salt Lake markets in Utah, and we'd be making more inroads in California and Phoenix. I'm thinking about starting a lumber yard in 2022, and getting a truss plant up and running. There's lots of ways we'd be working our way into new markets with equity capital. Our builder partners are pulling us into these opportunities."

Now, Menzies has that equity partner, and a strong operational partner as well in Synergos, which evolved out of Asahi Kasei's 2018 purchase of the Erickson Companies' framing & truss platform, and integrating leadership under former Pulte regional executive Rich Gallagher:

The stresses we face as companies, whether it's in a time of peak activity or at the bottom, are essentially the same," says Gallagher. "Those stresses separate builders and their trades – emotionally, in focus, and self-interests. What we've zeroed in on at Synergos is working to rebuild bridges of trust, based on performance excellence, transparency, alignment, and visibility."

Hallmarks of the absolutely vital performance requirements of a multiple-scoped array of contractor services, materials, installation, etc. would be greater velocity in inventory turns, less friction, and smoothed access to the 18,000 separate bill-of-materials piece-level parts that go into an average new home.

These are the details of the acquisition. Here's what to make of the latest combination in light of a rapidly shifting cyclical landscape to lower volumes and a looming reset in pricing end-to-end across the building lifecycle.

- Long-term vs. short- and medium-term business model at work, as Japan-based home construction companies look to overseas markets for sustaining new growth opportunity

- Long-term vs. short- and medium-term operational model at work, as structural simplification and streamlining of an overly complex and complicated workflow will benefit – on both the cost/affordability and the value/profitability axes – construction and real estate operators, leveraging what Asahi Kasei identifies as a core competency in "systemization know-how."

The first point to note, long-term – for a 100-year-old company – is not a euphemism, but literally an operating road-map for priorities, action, investment, commitment, and performance. In this case, Asahi Kasei is setting in place strategic and operational building blocks for a place – ultimately – as a decades-long leader in residential construction in the North American marketplace, similar to the strategies of Sekisui House, Daiwa House, and Sumitomo Forestry North America.

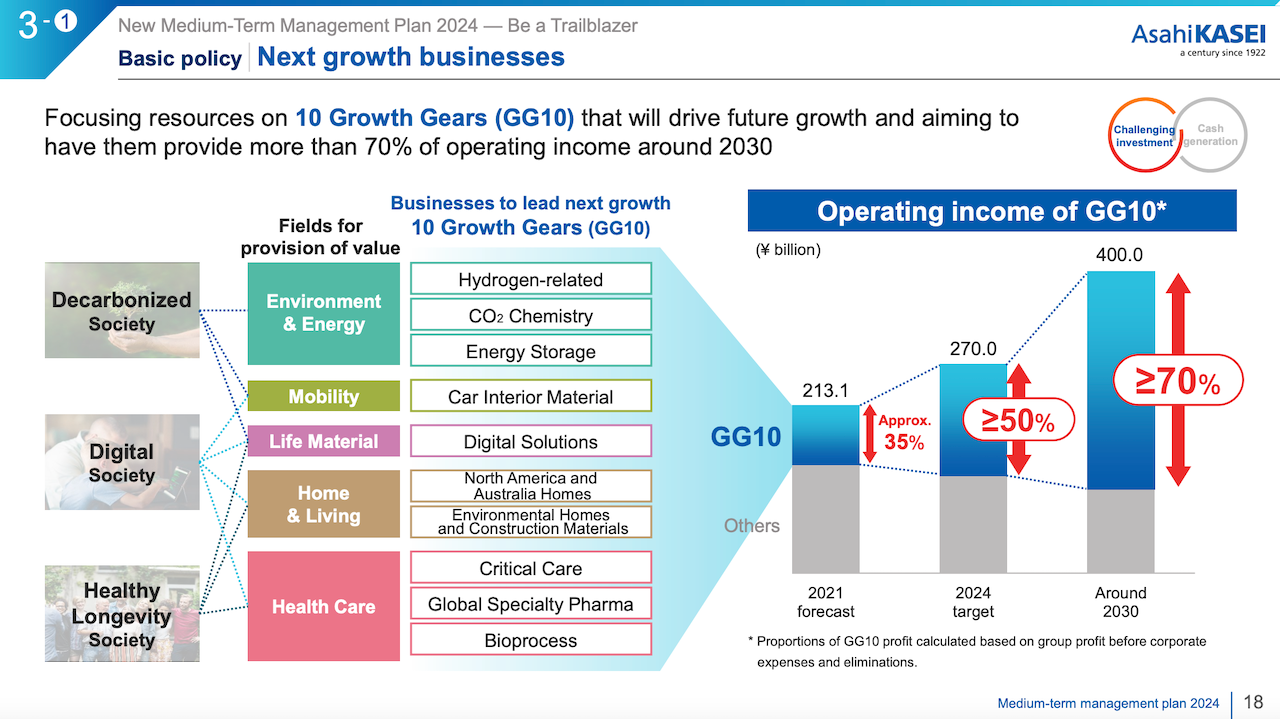

Asahi Kasei's current roadmap, which it calls its "New Medium-Term Management Plan 2024 – Be a Trailblazer," focuses on "10 Growth Gears" its strategists regard as crucial opportunity areas. Here's how that looks:

As we telescope to the North American homebuilding, residential real estate, and distribution landscape, the "pros" of multi-scoped under-one-roof contractor solutions platforms – whether or not a new residential construction downturn becomes severe and extended include:

- A builder's gotta build: homebuilders mostly don't do that – i.e. build. Rather they secure land, secure house designs, hire contractors, and market and sell completed vertical homes at a premium. Right now – think supply chain shock, labor constraint, and lot supply limits – builders need "capability" where they can get it, and super-subs, on paper, represent gate-keeper access to that capability. A "core-competency" pivot is underway.

- The labor cliff: People who "know-how" to build are an endangered species, and getting rarer, as a trickle of newcomers can't offset a stream of experienced, skilled skilled workers aging out. Super-subs – as it turns out – are magnets for reliable access to crews with track records of competence and quality. Alternatives for builders range from bleak to grim to existential.

- Follow the money: Wall Street and global investors continue – albeit cautiously -- to seek "safe haven" yield in residential real estate, and as build-to-rent new construction remains an active channel, integrated contractor solutions can add a dashboard of predictability/reliability and pricing leverage due to deep local scale and buying clout.

Capability and core competency tend to shadow each other in homebuilding, but now may have entered an inflection point where operators better choose what they're best at and draw on capability as a service for those activities they're less proficient and efficient at. Of course, when market conditions shift suddenly from highly accelerated to rapidly decelerating, the risks of an undiversified, unhedged symbiotic dependency on the new-construction housing cycle, and the staying power opportunity of diversification become evident, as we've noted here:

The question of whether this time's different forks into three correlated challenges around the burgeoning growth prospects for the super-subs.

- Fit to thrive, come what may – In the past, these multiple scoped subcontractors did well on the upswing in volumes, but coming off the peak into the downturns "they got eaten up by their overheads." They need more elastic, more bi-directional scalability, to work as sustainable, resilient pan-cycle businesses.

- Beyond the big builder – A related issue, for a future-proof business and operating model, super-subs need customer diversity, not just in new residential construction, but in commercial, i.e. multifamily, and possibly "after-market" opportunity, in which case they'd need to evolve customer support, customer care and service capabilities not currently in their wheelhouse.

- The endgame: people and tech – A design-thinking business model would elevate the architecture, engineering, construction, modular, prefabrication, componentization, industrialization, and transportation platform in such a way as to attract the highest level talent as well as the investment in both research and capital spending in rationalization of the building lifecycle.

Speaking to the cyclical challenges, here's a prepared remark from Focus Companies' owner and founder Steve Menzies on the new combination and its long-term resources and plan:

Being a part of the Synergos family gives our team at Focus Companies an immeasurable boost as we look to capitalize on upcoming opportunities and more deftly maneuver through current market challenges. We believe Synergos' development of industrialized building systems gives us a market advantage through pioneering more innovative and integrated building standards. This is a mutually beneficial opportunity to expand our multi-family business across additional markets and strengthen the flexibility of the Synergos model. Lastly, but most importantly, we recognize that the culture and vision of Synergos Companies are a perfect fit for our teams."

Here's a prepared statement from Synergos Companies ceo Rich Gallagher on the expansion of Synergos' footprint into Nevada, with strong relationships potential for later moves into Utah and Southern California:

We are thrilled to begin the geographic expansion of our Synergos business model with Focus Companies and their incredible leadership team," states Rich Gallagher, Chief Executive Officer for Synergos Companies. "The Focus group has an impressive breadth of capabilities and active projects, allowing for the Synergos model to be quickly and effectively saturated within the organization and the broader Las Vegas market. This is a strategic and synergistic first expansion step given Las Vegas' similarities to the Arizona market and its location relative to the existing Synergos companies outside of Arizona."

MORE IN Capability and Culture

Eastwood Homes, Napolitano Unite In Culture-First M&A Deal

In a rare private-to-private M&A deal, Eastwood Homes acquires Virginia’s Napolitano Homes—uniting two family-founded builders in a move that blends culture, strategic market expansion, product synergy, and generational transition.

Davidson Homes Seals Down Last Details To Acquire Evermore Homes

Due to close Monday at midnight, The Builder’s Daily brings you inside one of homebuilding’s bolder, private-to-private acquisitions of a young, rocking-and-rolling 2025.

The Smart Bet: Why Builders Must Invest More In Women

Labor shortages are strangling home construction, but the industry keeps overlooking its most untapped talent pool—women. It’s time, finally, for homebuilders to commit more broadly to change the game.