Marketing & Sales

As Many As 32 Million New Home Buyers Priced Out In 36 Months

Greater risk to order backlogs and interest risks may come to light as consumer household incomes fail to keep pace with mortgage and price increase impacts.

Cheering news on the jobs front sends a new spasm of pain across the market-rate housing firmament. Builders – the people who run and comprise the heart and soul of the nation's residential construction and real estate ecosystem – say they're prepared for the other side of the coin of an economy that won't quit running too hot.

Admitting it makes me a dinosaur. Still, an early 1970s Springtime anthem comes like a bolt from the blue: "Compared to what."

Here's why.

This week, Hovnanian Enterprises chairman, president & ceo Ara Hovnanian and two of his corporate finance braintrust, executive vp and chief of finance Larry Sorsby and senior vp and chief accounting officer and treasurer Brad O'Connor were the latest in a series of public homebuilding company executives to face quarterly earnings-related questions from Wall Street investment analysts.

Since late February, investment analysts have prising for clues of what's changing in new-home sales as Fed tourniquets sacrifice limbs of housing market demand in an effort to save the life of an economy that's overheated, imperiled by inflationary forces.

They ask each time for any glimpse possible at the latest real-time measures of shifting trends. Where? How fast? How deep? The same three questions, phrased in all the variations you can think of, try to get at a new calculus. As investors' eyes and ears on the ground, the analysts are anxious to apply changing data sets to map a mathematical look at where things will head.

The guessing game concerns the slope of the trajectory and the duration of a housing activity downswing before it finds a floor and then turns upward.

The three analysts on the Hovnanian call stayed in step with all the prior quarterly earnings calls in the Fed-tightening, post-Ukraine invasion cycle starting in February or so.

They asked execs in each case about the most recent field reports from the extended operational footprint of each firm in an effort to pick up signals on two crucial business health measures for opportunity and risk.

- The solidity of homebuilders' billions of dollars in 2022 and 2023 order backlogs.

- The pace of new orders as they relate to building lot investments put in place when absorption rates were running hot and pricing power was an assumption.

In the Hovnanian call, three investment analysts participated: Zelman Associates' Alan Rattner, Housing Research Center's Alex Barron, and Goldman Sachs' Kwaku Abrokwah. In opening comments, Ara Hovnanian spoke to two slides his team had prepared in an effort to get out ahead of the pace, price, and cancellations questions.

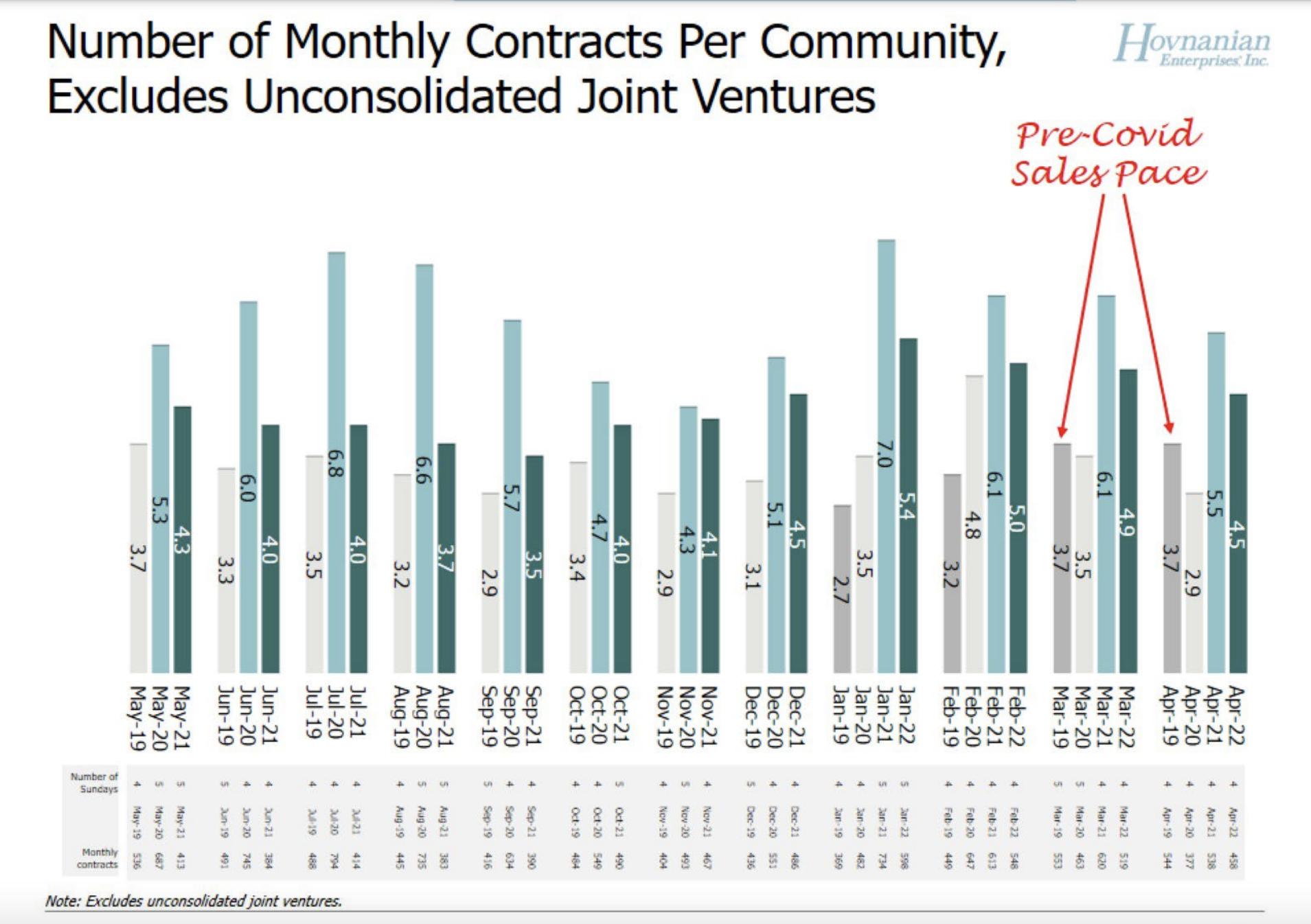

One of them highlights current [order] absorption rates per community, showing the way current activity through April compared – on a seasonal monthly contracts basis – favorably with pre-Covid order trends.

Logic would say, on looking at the data, that April 2022 – despite intensified headwinds of interest rate increases and signs of payment power inelasticity – a builder might with confidence allow for a "normalizing" and "stabilizing" downside scenario from the giddy heights of 2021 to a more workmanlike level of 2019.

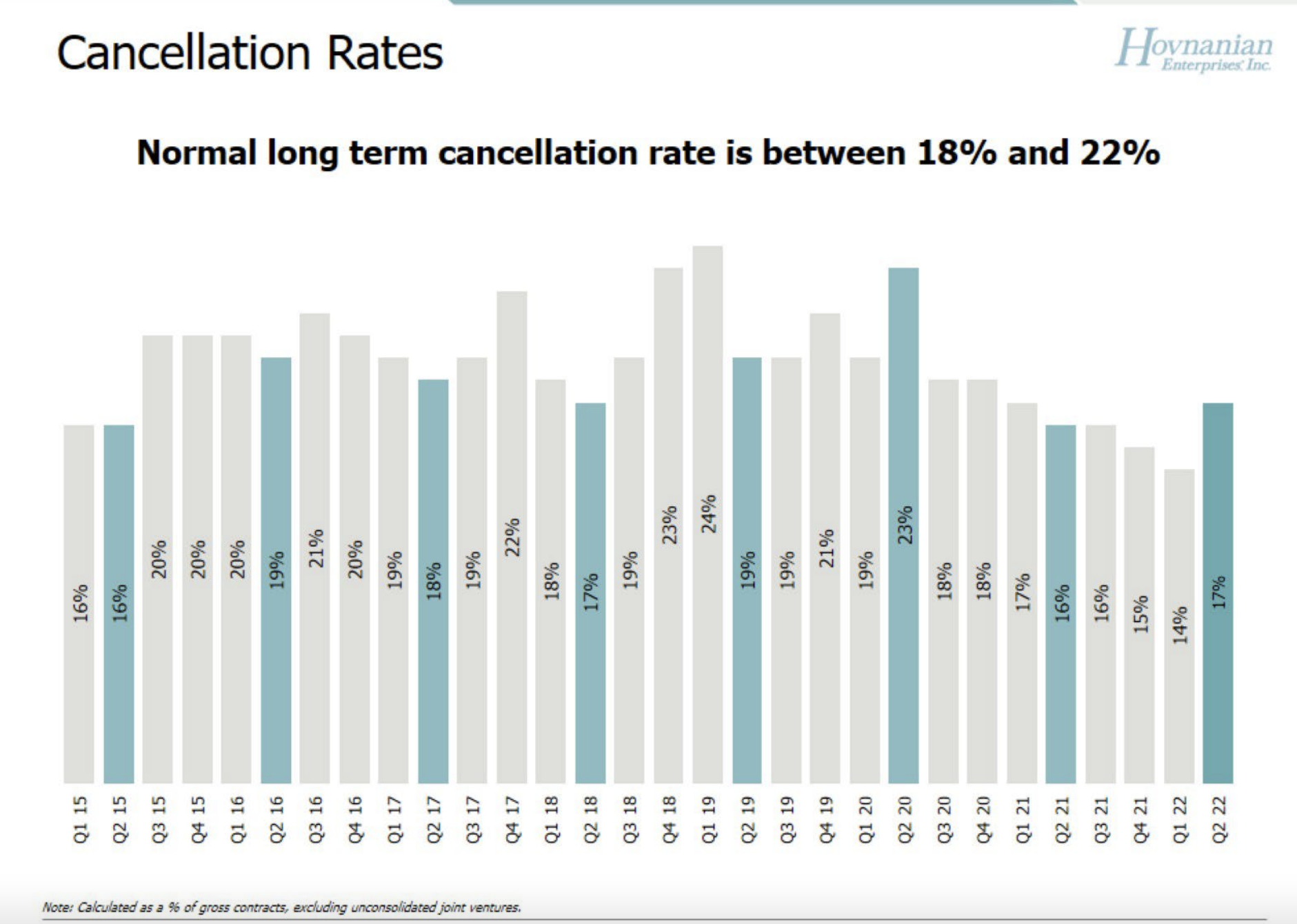

A similar headwinds-adjusted scenario comes through in Hovnanian Enterprises' read on its cancellation rates, i.e. nothing to worry much about here. Here's how the data presented in the earnings call looks:

Beginning with the first question Rattner addressed to the Hovnanian strategic leadership team, each took a swing at trying to get the builder executives to tip their hand on the – post April, post first calendar quarter – most up-t0-date intelligence that would color interpretation of historical, three-year, year-over-year, and sequential performance indicators. Here's the way Rattner came at the question:

Hey guys, good morning. Thanks for taking my questions. And I appreciate all of the color and comments so far. First, just on the May activity, and thank you for that disclosure. When you look at the sales pace and kind of the cooling you saw in May versus the second quarter, can you talk a little bit about whether there were any notable differences, either across price points or across your various markets where you saw a greater pullback in demand? And adding to that, can you just talk about cancellation trends in the month as well, and whether that contributed to the sequential pullback?

Pace, price, cancellations. Cancellations, pace, price. Price, cancellations, pace. All the imaginable combinations, variations, nuances, mutations, etc. of the same three basic KPIs arose as questions over and over across the span of executive discussions in the latest earnings season. Ara Hovnanian's dutiful response to these questions largely echoed the hedge each of his CEO peers expressed in their answer on roughly the same matter:

I’d say, from a big picture perspective, the active adult segment has been stronger, and the uber entry level has been slightly weaker, and everything in between has been around the same. And regarding cancellation rates, no, May has been very solid. I mean, we’ve -- our mortgage team and our divisions have been working diligently to make sure that the backlog we have is qualified or can qualify for alternative mortgage programs. So, at this stage, as Larry commented, we’ve been pretty good as far as cancellations.

Hovnanian's and every other of his peers' responses to the what's-going-on-now? and what're-you-doing-about-it? questions from analysts can neither be faulted as false nor misleading what with all the ways they've factored "uncertainties" into their narratives.

Still, the slides, their framing of time horizons, and their conclusions that in each case land on a narrative of a "normalizing" home buying and selling marketplace after an abnormally elevated year-and-a-half run beg a question. That question is why that early-1970s song gnawed its way into consciousness.

"Compared to what?"

The big dumb question now really is, if April and May data tell ceos, strategists, and homebuilding company principals that market conditions are heading to "normal" and "stable" and "historical" levels, are they looking at the correct data?

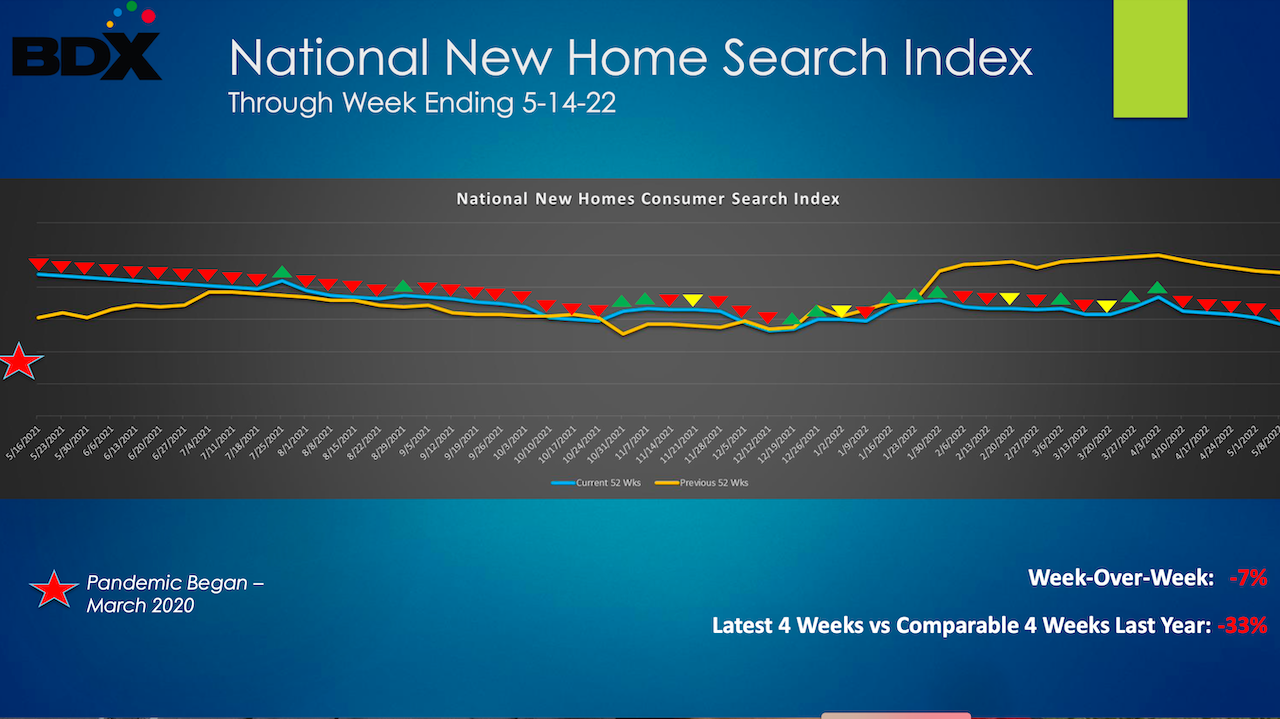

Have they looked, for instance, at data from the team at BDX, which has rolled up impacts of a "tandem impact of interest rates and increasing demand eroding demand?"

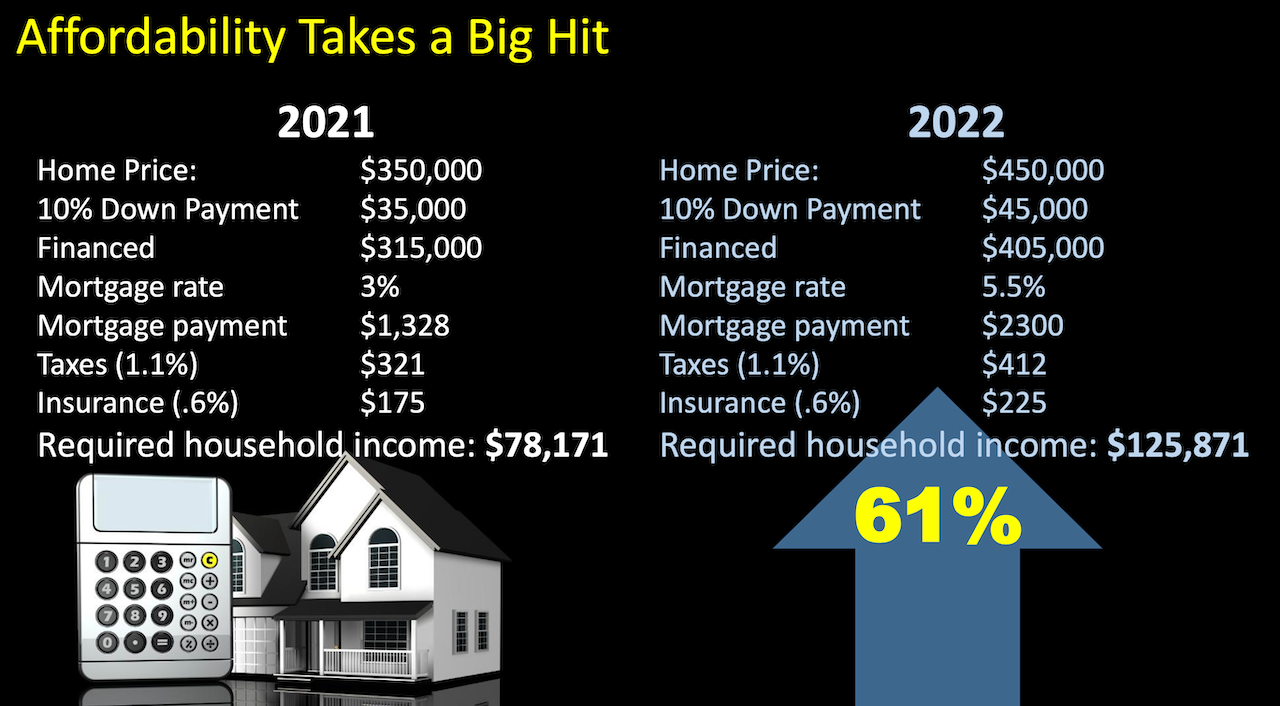

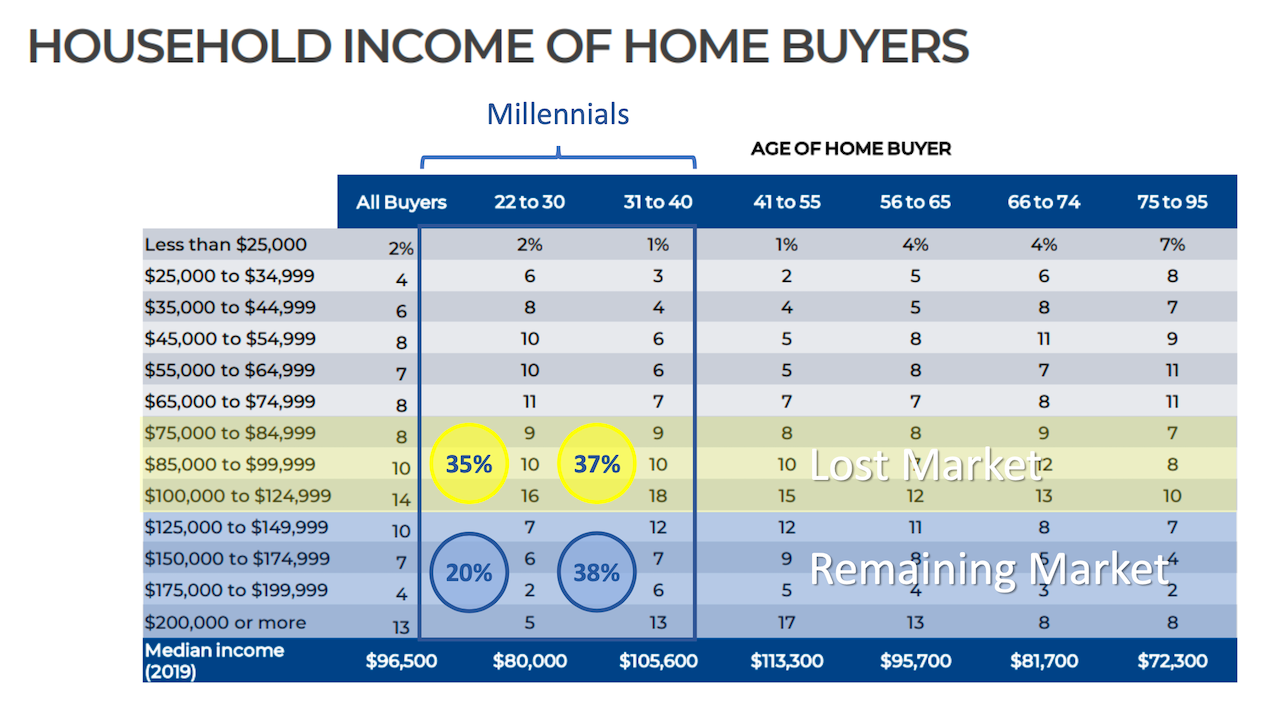

Factored together, impacts of several months of 30-year mortgage interest rate increases and price hikes are taking a bigger toll than many may appreciate. Interest rate run-ups have priced out 13 million or more would-be buyers. An $80,000 price increase on a typical new home between 2019 and 2022, which lops off another 15 million from the buyer pool. As a result, the total market of households with means to buy a new home has shrunk by 58% – from 48 million to 16 million, according to BDX chairman and ceo Tim Costello.

Net, net, we're down to only 20 million households that can afford to buy our homes," says Costello. "What that translates to in the real-world is that for new homebuilders to sell a million homes in a year, 5% of the ones with the means to buy would have to plan to move, and would have to be a new-home buyer. This sudden, dramatic shrinkage in the buyer pool is the manifestation of the two-headed hydra of interest rates and prices that has narrowed the field."

Among Millennial households, the biggest pillar of new-home demand over the past several years, the impact of lost payment power tells a dramatic story of a suddenly decimated pool of prospects.

Wall Street equity analysts – seeking more real-time sensitive data readings on the speed, rate-of-change, and statistical comparables to understand where pace, price, and potentially cancellation rates are heading – may want to pay more attention to BDX's new-home search index, an aggregate portfolio of 500 homebuilders' web traffic site activity and engagement.

New home search online is down 33% for the 4 weeks ending 5-14-22 vs. the comparable period last year, says BDX senior director Jay McKenzie.

The conclusion Costello reaches looking forward through the back half of 2022 and into 2023 has a tenor that's quite dramatically different than the one homebuilding company ceos have been willing to share with the Wall Street investment community:

Here's how Costello bullets out the business challenges that lie ahead:

- the tandem impact of increasing home prices and interest rates is eroding demand

- selling skills and consumer experience have eroded in a climate of escalator clauses, contract cancellations, mid-contract increases, etc.

- builders will be forced to "sell dirt" rather than models, specs, almost completed WIP as they replenish 5,000 new actively-selling communities

- they're selling to a new buyer – undeterred and less price and interest rate sensitive

- consumer experience expectations have accelerated and elevated

Costello would likely beg to differ with views that housing activity is "normalizing." Rather, he's convinced that pre-Covid 2019 levels may look overly optimistic if conditions deteriorate as they well might over the next several months into next year.

Remedies, Costello would argue, mean looking differently at the data, and looking at different data to make the kinds of tactical, operational, and customer-centric adjustments the market seems to be signalling.

To succeed in today’s rapidly cooling real estate market, builders must make data-driven decisions – based on real-time homebuyer behavior and focus on forward-looking indicators of demand, not what happened in the past," Costello says. "The key data are available. It’s time for data science, enabling smart builders to turn information into actionable insights and competitive advantage – even in a slowing market."

Step one – given the odds that adverse conditions may in fact do some harm to those solid order backlogs and interest lists upon which builder executives are staking their confidence – is build new interest lists of current shoppers who qualify at sharply higher home prices and mortgage rates.

Comparing current KPI trends to the past three years, or even the past 12 years since the Great Recession ignores one of the key lessons-learned of '05, '06, and '07. Sometimes, comparing with the wrong measures can be extremely costly.

Join the conversation

MORE IN Marketing & Sales

11,000 Buyers Turn 65 Each Day, Here's How Homebuilders Win

Even in a hesitant market, 55+ buyers hold the keys to growth. Deborah Blake shows builders how to win their trust—and unlock their equity—with empathy, lifestyle, and design.

The AI Revolution is Here: The Implications For Homebuilders

Artificial intelligence and automation are changing the rules of competition. Builders that invest now—in systems, culture, and people—will gain a lasting advantage in efficiency, customer experience, and profitability.

How Homebuilding Sales Became A Strategic Center Of Gravity

Dave Rice and New Home Star help turn homebuilder sales associates into data-powered business strategists and a linchpin to critical customer feedback. Here’s why that matters now more than ever.