Leadership

As Buy-Downs And Incentives Drive Sales, New Product Will Jump-Start Next Upturn

It's the true entry-level buyer, and builders' typical early cycle pivot to new product, locations, and features that draw them in, that will signal the next uptick. That buyer's still priced out.

First-time homebuyers and entry-level homebuyers are often referred to interchangeably.

It's understandable, and there is always some overlap.

Most folks hunting for an entry-level home check the box for first-time homeownership. There's much less duplication among first-timers and entry-level buyers when you do a sort of the first-time homebuyer universe.

First-timers aren't by definition constrained by their wherewithal – they include households who've rented by choice (including a burgeoning market of 55-plus buyers), Millennial households later to the family-formation life-stage that goes often with a home purchase, and ones with greater access to discretionary income who looking to migrate to new markets.

Now, the wedge separating entry-level homepurchasers from first-time homebuyers is growing. This widening gap underlines challenges for new homebuilders who've thus far been navigating "clearing price" pathways that in some cases address buyers-regret psychological hurdles, and in others, the technical and financial hoops they need to jump through to carry people on the margins across to a mortgage payment they can handle.

Have a look at these two just-released data points.

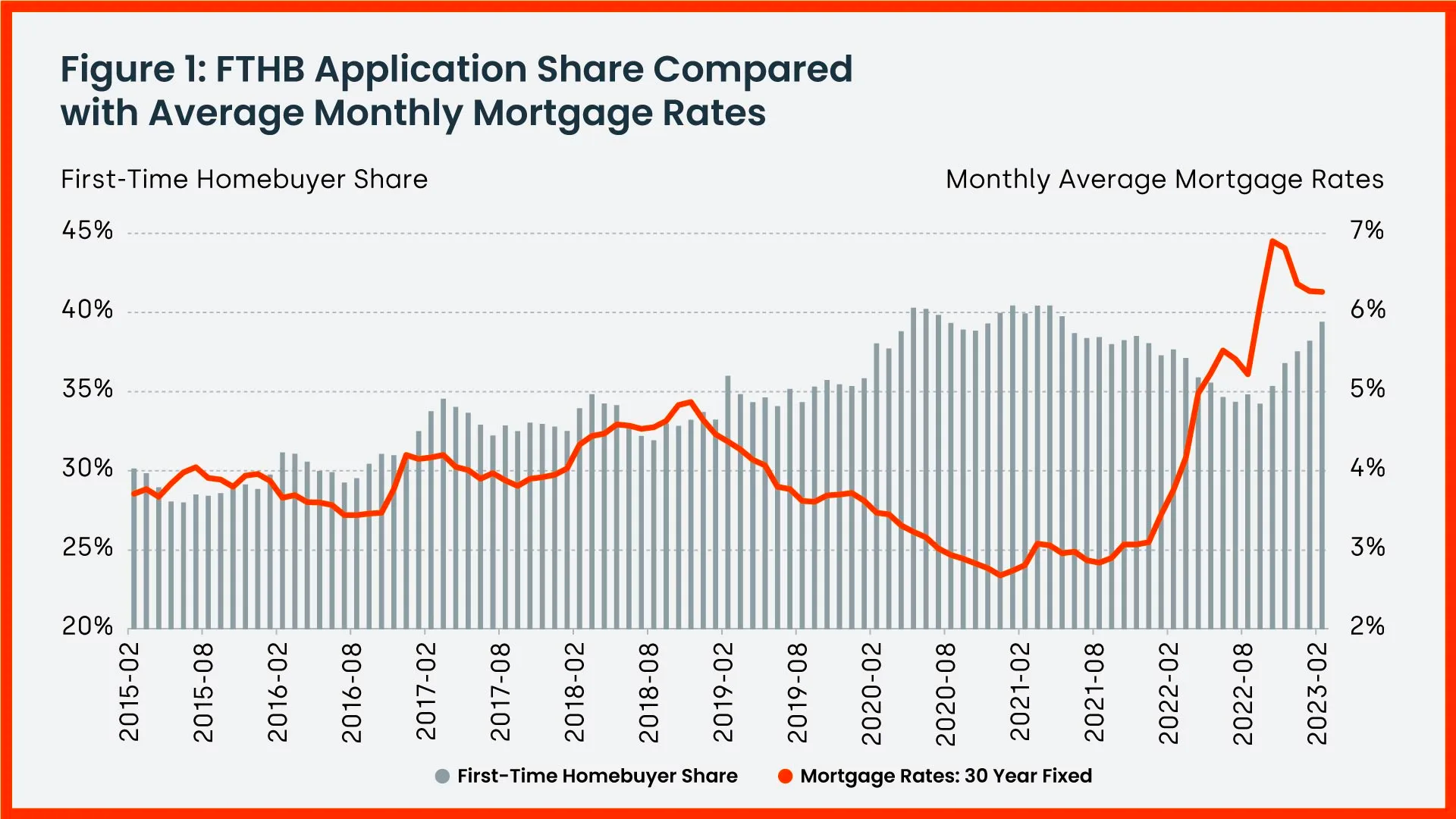

One illustrates that first-time homebuyer share – which took a big hit as home prices skyrocketed through the first part of 2022, and then got the double-whammy impact of sharply rising mortgage rates – has bounced back.

Per Core Logic principal economist Archana Pradhan:

Less competition among move-up homebuyers and slightly improving affordability conditions caused the FTHB share to bounce back in November 2022. By February 2023, the share of FTHB applications reached 39%."

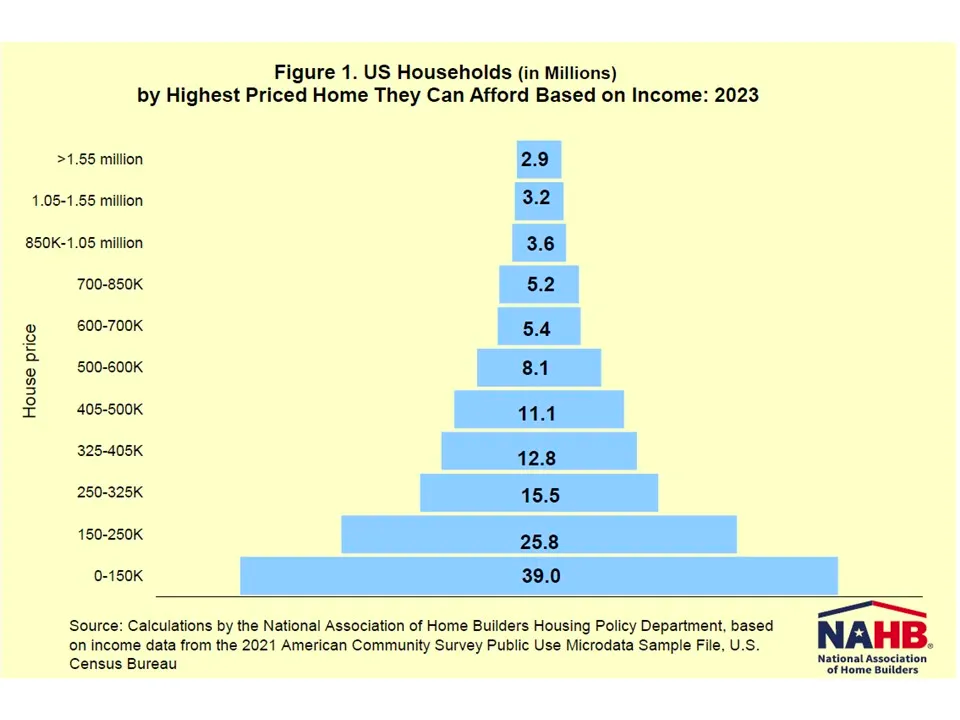

The other data point illustrates the notorious "Affordability Pyramid" the National Association of Home Builders offers as a visualization of which household income levels price in and which don't based on a range of selling price ranges.

It looks like this:

NAHB principal economist Na Zhao writes:

Based on this, the minimum income required to purchase a $150,000 home at the mortgage rate of 6.25% is $45,672.63. In 2023, about 39 million households in the U.S. are estimated to have incomes no more than that threshold and, therefore, can only afford to buy homes priced no more than $150,000. These 39 million households form the bottom step of the pyramid. Another 25.8 million can only afford to pay a top price of somewhere between $150,000 and $250,000 (the second step on the pyramid)."

As the Spring selling market progresses, it will not be first time homebuyers who define the biggest challenge for homebuilders, because some fair share of first-timers have greater wherewithal and are in the discretionary buyer group. For them, the main issue is getting them across the psychological "now's the time to buy" line, rather than to hesitate for a chance at a better rate or a lower price.

It's the true entry-level buyer – and the gigantic risk and opportunity axis of being first to reclaim the attention of that interest-rate sensitive, price-constrained, monthly payment-bound buyer segment – that will either be conspicuous by absence, or the source of sustainable sparks of momentum.

That alchemy of newly designed, smaller square-footage, more standardized product, in higher densities, on lower cost lots, that finally starts pricing more buyers in can take some time to flow into the pipeline, especially after a period of sustained over-demand for everything, everywhere, at any price.

Mortgage rate buy-downs have proven out as a wondrous catalyst for builders to get to clearing prices over the past 10 to 12 weeks.

It'll be product, entry-level product, that reignites the next housing market momentum pivot.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.