Leadership

As Builders Eye Future Growth, It's Time For A 'People Pipeline'

When it comes to investing in a land pipeline to fuel future growth, it's a no-brainer for homebuilding strategists. Why not consider commitment and investments now in people resources to ignite and accelerate that growth as well?

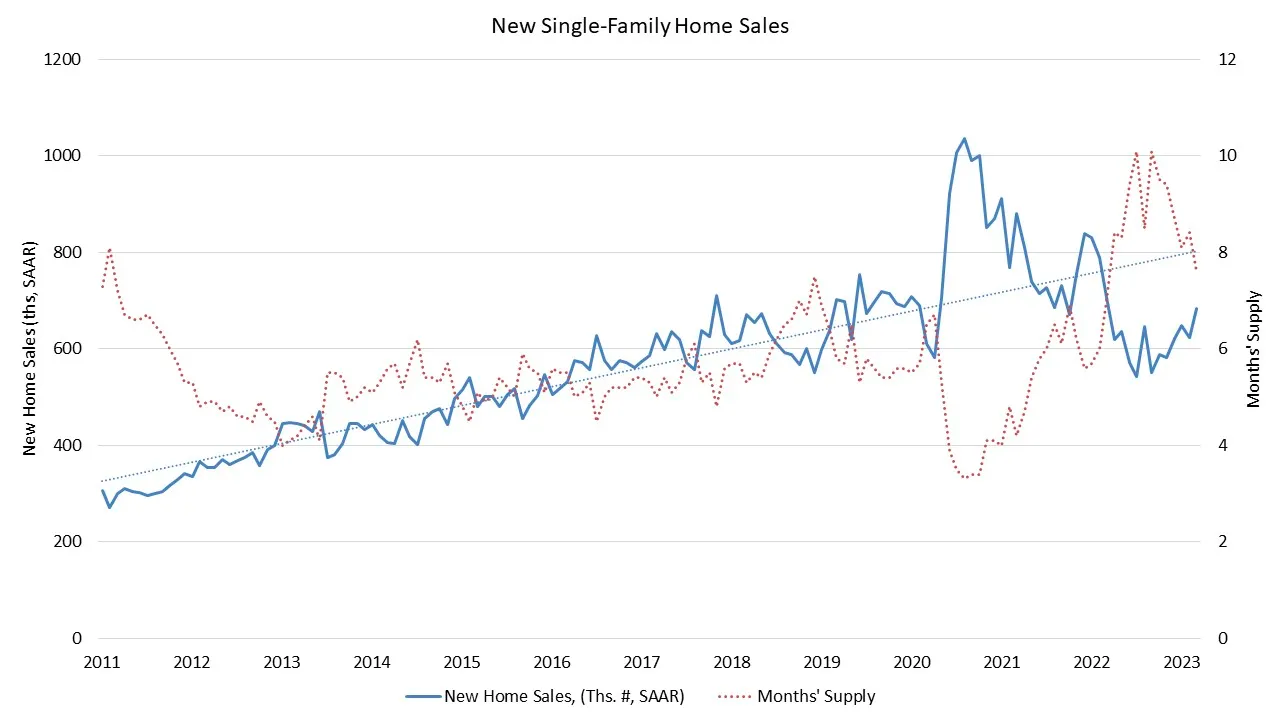

The talk-track a third of the way through the 2nd quarter of 2023 – and well into Spring Selling season – is no longer a surprise. New home sales have outpaced expectations. They've done so sequentially, and in a steadily improving trajectory, not just looking backwards, but forwards as well.

Further, a macro let-up in orders and starts pace in the back half of last year gave most homebuilders a smidge of wiggle room to catch back up up with themselves operationally. With less of a rush across the the boards, they've been able to whittle away at the stubborn vestiges of the 2021-early-'22 supply chain meltdowns and restore pathways to sustainable velocity for their new start-to-completion build cycles.

Builders by and large are finding that ready-to-move-in specs – combined with scarce existing home inventory, combined with mortgage rate magic and a few closing cost closers – have done yeoman's duty to keep absorption paces in most communities where they need to be.

New single-family home inventory fell 9.5% in March, however, it remained elevated at a 7.6 months’ supply at the current building pace. A measure near a 6 months’ supply is considered balanced. Total new home inventory peaked in October at 466,000 and has been declining since that time, with a total inventory of 432,000 available for sale in March." – Danushka Nanayakkara-Skillington, NAHB Assistant Vice President for Forecasting and Analysis, Eye On Housing

So, instead of needing to battle the weight of a stubborn overhang of new home inventory, homebuilders have strategically begun to look, plan, and invest in growth ahead even as they secure operational agility to execute well in their current neighborhood portfolios.

That means investment in future capability, and we've written about part of that challenge – new land commitments – here.

The other part, of course, is investment in people capability, now, before market asymmetries expose homebuilding organizations to a repeat of under-capacity mismatches that start the whole cycle of inefficiency and time-loss back to where operators just were – and would be loathe to return.

Positives of the present include two X factors that have not been in play for more than a decade.

- One is access to an experienced, technologically and financially skilled talent universe now streaming into the "available pool" of people thanks to four or five months of mass layoffs occurring among tech and financial organizations ... a talent-base well-matched to the data and tech chops homebuilding operations sorely need to continue professionalizing their businesses.

- The other is another rare windfall, and its timing could hardly be better:

While almost every sector of higher education is seeing fewer students registering for classes, many trade school programs are booming. Jones and his classmates, seeking certificates and other short-term credentials, not associate degrees, are part of that upswing.

Mechanic and repair trade programs saw an enrollment increase of 11.5 percent from spring 2021 to 2022, according to the National Student Clearinghouse. Enrollment in construction trades courses increased by 19.3 percent, while culinary program enrollment increased 12.7 percent, according to the Clearinghouse. Meanwhile, enrollment at public two-year colleges declined 7.8 percent, and enrollment at public four-year institutions dropped by 3.4 percent, according to the Clearinghouse.

Many young people who are choosing trade school over a traditional four-year degree say that they are doing so because it’s much more affordable and they see a more obvious path to a job." – The Hechinger Report

Further, according to The Hustle, the appeal of trade schools goes beyond the promise of employment:

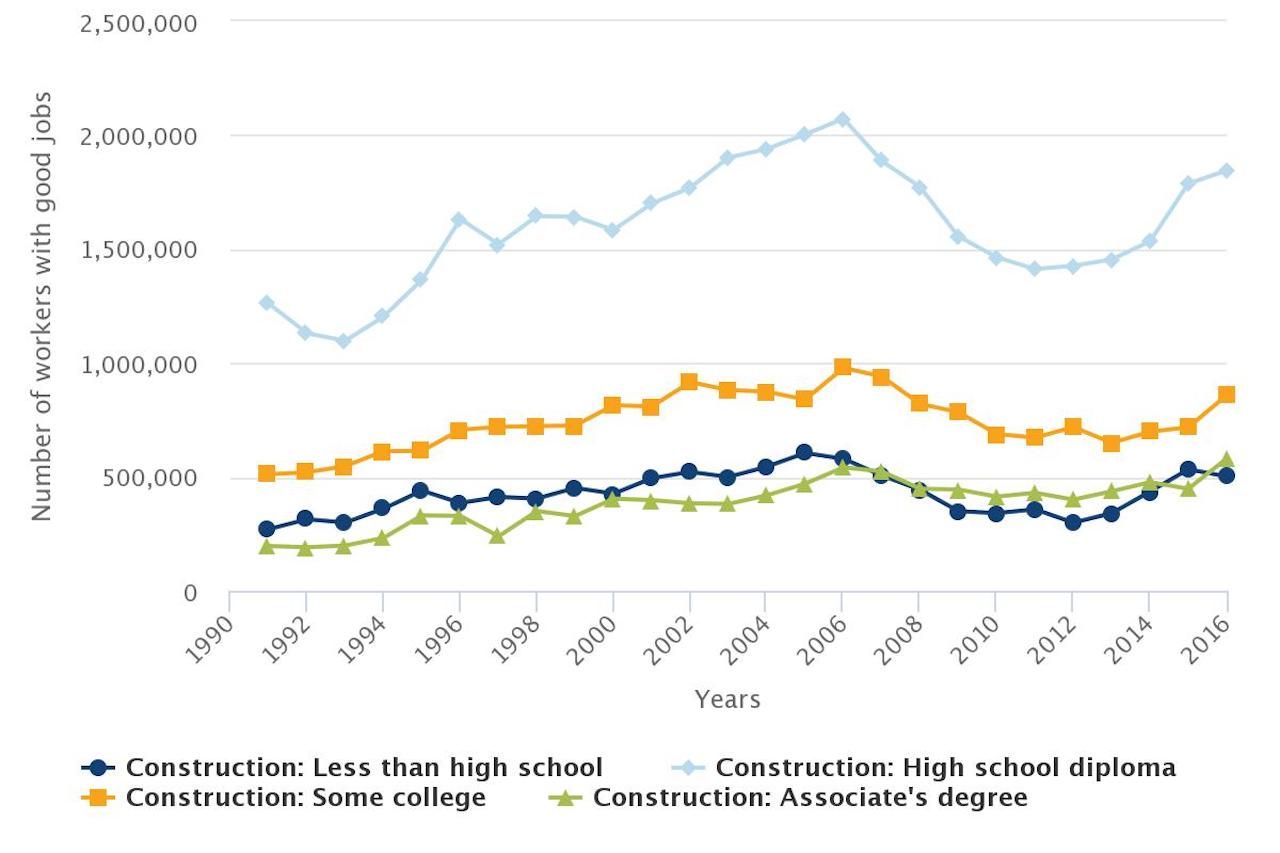

Those trade jobs are hardly paying beans. Per Georgetown University’s Good Jobs Project, many are among the 30m jobs paying $55k+ per year that don’t require a four-year degree.

Here's how that looks in the construction sector:

Now, when it comes to committing to, and investing in a land pipeline to fuel future growth, it's a no-brainer for homebuilding strategists of all stripes. Why not – if only for the sake of trying not to endlessly repeat missteps of the past – consider commitment and investments now in people resources to ignite and accelerate that growth as well?

It's an opportune moment for two really strong reasons. Go for it.

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.