Marketing & Sales

As Bastion Of Future Demand, Demographics' Heyday Is Over

We're seeing the beginning of the end of demographics and generational cohorts as tools to measure market size and demand drivers. Here's the X factor we see as a bulwark of business strategy for the decade ahead.

The model broke."

Three words famously summed up one of housing's most esteemed experts in 2009, to conclude a blow by blow account of recklessness, greed, irrationality, and pipedreams blended with unregulated financial products led straight off the cliff into freefall.

We all know that on 2022 eve, that's not where we are. Household balance sheets are not where they were then; credit derivative swaps and unravel-able subprime loan tranches are now under far greater risk-reserve scrutiny if they're around at all; and using the house as an ATM to buy boats, fund vacations, and pay for other extravagances are largely bygone.

Still, although the forces that broke the model in 2007, 2008, and 2009 may not be around now, what's the guarantee that today's model – for what it's worth – is not vulnerable to stress, shock, ... and, possibly, rupture?

Last time we checked, recklessness, greed, irrationality, and pipedreams continue to enjoy robust and fertile ground at both the household and the business sector level. Fewer financial markets may be unregulated, and debt ratings agencies may be on the hook for greater accountability than in the decade of the aughts, but that hasn't entirely ruled out possibilities of sophisticated chicanery, quixotic get-rich-quick schemes, or outright risky miscalculations that could domino and ripple outward.

Models, you see, break. Because they're constructs made of estimates, assumptions, historical patterns, etc. assembled to act like the real thing, but the real thing is messier, and the real thing tends to disclose where assumptions and wishful thinking look very much like each other in our models.

Who's to say that a stubbornly clingy virus – you know, the one that's really calling the shots on today's economy at the global, continental, national, regional, state, municipal, community, block, and home address level – can't wreck models as ably as toxic CMBS stacks back in the day?

Right now, there's a virtually indestructible model in many of our minds for the state of housing demand. It starts with scarce supply, adds population and generational demographics, folds in a healthy economy producing jobs and reducing unemployment, sprinkles on generous amounts of income growth, introduces the secret-sauce ingredient of historically low interest rates, turns on the heat of a global health contagion, and voila: Demand, writ large.

We model demand for housing mostly with blunt tools – demographics, job formations, household formations, family formations, income trajectories. The crudest of demand inputs is this: You're a person; you need shelter. Everybody does.

These tools prove to work well for markets that spool up, tugged by a tide of fundamentals and I-knew-it-all-along self-reinforcing virtuous circles of collective behavior.

They also prove to be effective – much later – as the basis of explanation as to what went wrong that impacted what should have happened. For instance, based on sheer demographics and historical patterns and recovering economic momentum and favorable interest rates as a full suite of demand drivers, a Millennials boom in housing demand by all rights should have begun 10 years ago.

When it didn't, the current template of models showed that student debt levels and stagnating wage growth may have conspired to delay what's now looked at as an unstoppable juggernaut.

So, here comes our fifth bold assertion in our ongoing series – The 2020s: 10 Trends That Will Change Home Building Forever. (If you missed the first three, here are links to our earlier installments).

- Women in building

- The need to "stand for"

- Beyond-transaction community partnership

- New Measures of success

Transformation Trend No. 5: The End of Demographics

Assertion: Raw demographics – i.e. population, households, generational cohorts – lose luster among business tools as both market drivers and predictors. More specifically, advantages to business at the entity level from longtime proxies for demand will fritter away. Instead, those raw demographic inputs will at best serve as table stakes, with competitive and business edge going only to those who design and execute around household motivation rather than household composition.

What builders need to know

By 2030, expect an inflection in how people match up discretionary decision-making – especially for this highest-ticket consumer durable they'll buy – with the new home of their choice. Amid greater standardization of locational characteristics relative to lifestyle choice and work, product design and functionality and physical features, how will one builder stand apart from rivals for that discretionary buyers' choice?

The COVID-19 pandemic's significance as a health, economic, societal, business, educational, and cultural game-changing phenomenon includes one of its most underappreciated calling cards: More to come.

When we try to factor in a reckoning with that notion – that life as we knew it and life as we now know it with a "living with the reality" of ever-iterating versions of contagious infectious disease may never again meet – motivation begins to trump sheer numbers, especially as market-rate new home construction's universe of potential buyers shrinks.

What it means

To get it, consider motivation in its earliest use. Then, a Latin verb "movere" – meaning, to move – had its past participle stem Englished in the 1500s. It evolved into its current sense "that which inwardly moves a person to behave a certain way, mental state or force which induces an action of volition" over the next 100 years.

Here's a pandemic era business thesis homebuilders may feel immune to but shouldn't.

Reimagined consumers will abandon brands that don’t support their new values—and pay more to those that do."

This thesis presupposes a condition it's popular to sneer at, because it suggests that the time now is unprecedented. Yes, the term may be overused, but does that make it meaningless as a way to try to understand how you – as a homebuilder – match the value you create with the value in a consumer's mind and pocketbook?

What are the motivators?

Per Accenture's research:

72% of the Reimagined expect companies they’re doing business with to understand and address how their needs and objectives change during times of disruption—versus 27% of the Traditional.

50% of the Reimagined say that many companies disappointed them by not providing enough support and understanding of their needs during challenging times—versus 14% of the Traditional.

Why it matters

What we've begun to hear from strategists in the field is that customer segmentation models that align product development, pricing, design features, even location, no longer helpfully distinguish among traditional generational cohorts. Young, mid-career, 55-plus – it doesn't seem to matter – all gravitate to similar characteristics, designs, price points, etc. at the more standardized level of home and community development. By 2030, generational cohorts will mean very little, especially as the Baby Boom's aging population begins to transfer its $60 trillion in wealth across to the other generations.

A Century Complete, a D.R. Horton Express, a Pulte Centex, an Ashton Woods Starlight, etc. ... they've stopped only appealing to classically-described entry level buyers. The kicker here is this:

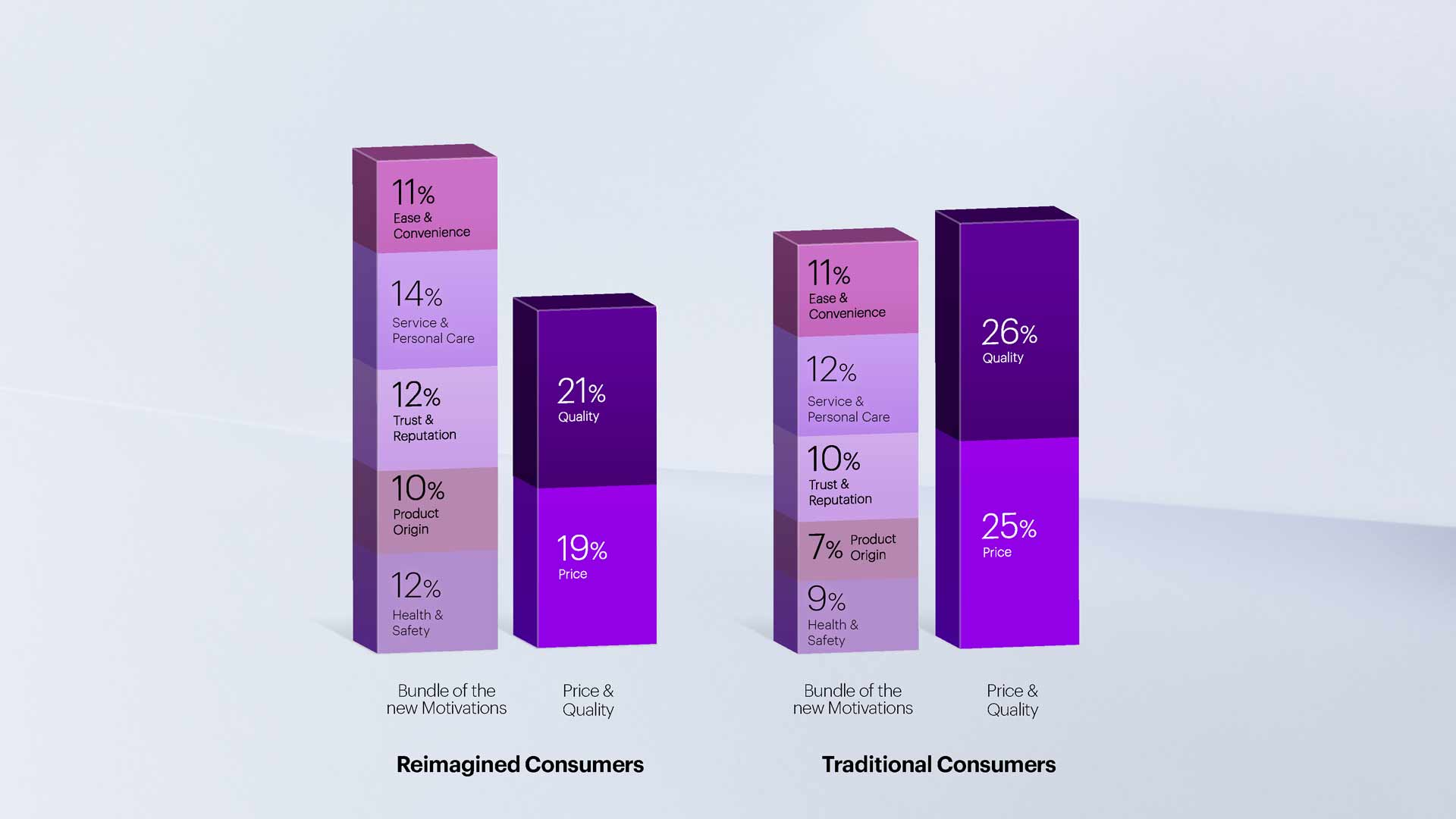

Among the Reimagined, our research reveals five distinct purchasing motivations oriented around the desire to feel better and have confidence in the products, services, and companies they patronize. These are: Health and safety; Service and personal care; Ease and convenience; Product origin; and Trust and reputation.

You see, what motivates people – when it comes to spending $375,000 or more – is not a roof they need over their head, is not shelter, is not a house. What motivates people – in an era the Covid pandemic has defined as how life is going to continue to be for foreseeable future – are solutions, holistically, cohesively, intentionally addressed and sustainably evolved. The other model, we'd contend, has broken.

Join the conversation

MORE IN Marketing & Sales

How Homebuilders Can Fix Broken Buyer Conversion Now

New Home Star’s Chris Laskowski breaks down what’s stalling new home conversions in today’s market—and what to do about it. From weak webpages to ignored AI search, he lays out a builder’s to-do list for turning traffic into buyers.

Do Homebuilders Waste Money On Marketing No One Trusts?

To build rapport with buyers, homebuilders need to be upfront, shift from selling to educating, and evolve their marketing strategies. Marketing strategist Barbara Wray shares time- and cycle-tested secrets.

Research: Supply Constraint Is Not No. 1 Driver Of Housing Crisis

Findings imply that constrained housing supply is relatively unimportant in explaining differences in rising house prices among U.S. cities -- suggesting that easing housing supply constraints may not yield the anticipated improvements in housing affordability.