Land

Are Master Plans Shaping Up As Safer Havens For Builders In '23?

Further, what will be MPCs' role setting a pricing floor from which homebuilders can reboot reliably predictable absorption pace models?

Photo source: babcockranch.com

As the 2022 new home marketplace seized up in the clutch of an interest-rate spike on top of soaring asking prices, masterplan communities – many of which blended in a trifecta of affordability, remote-work refuge, and fairer clime – warded off the worst of the forces of gravity that caused sales to vanish and cancellation rates to spool upward.

The best of MPCs are conceived, designed, and engineered to twist and bend a bit in periods of turbulence, but by and large, historically they've held up as bridges that span housing's up and down cycles.

A question in the face of 2023 Selling Season – a blurry timespan starting roughly around the clock ticking to zero at Super Bowl LVII in Phoenix on Feb. 12:

Will MPCs continue to buffer the hardest blows of a 2023 housing market girded for a rough ride ahead? Further, what will be their role setting a pricing floor from which homebuilders can reboot reliably predictable absorption pace models?

Two already-pronounced dynamic drivers – geography and price – account for a good part of the plus-minus swing in sales activity. A third driver – the wildcard of remote work trends and their stickiness – will impact 2023 and beyond in terms of the re-divvying of demand to MPCs regionally and nationally.

At last count, new home sales were down 15.2% on a year-to-date basis, comparing November 2022's 11-month tally and the same time period in 2021. They're on track to lose nearly another full percentage point once full-year data gets reported, revised, and locked.

So, compare that national measure of deterioration with masterplans – at least the best-selling ones that could leverage placemaking strategies, continued migration from expensive urban areas as companies extended work from anywhere policies through most of 2022, and demographics-fueled household and family formation impetus.

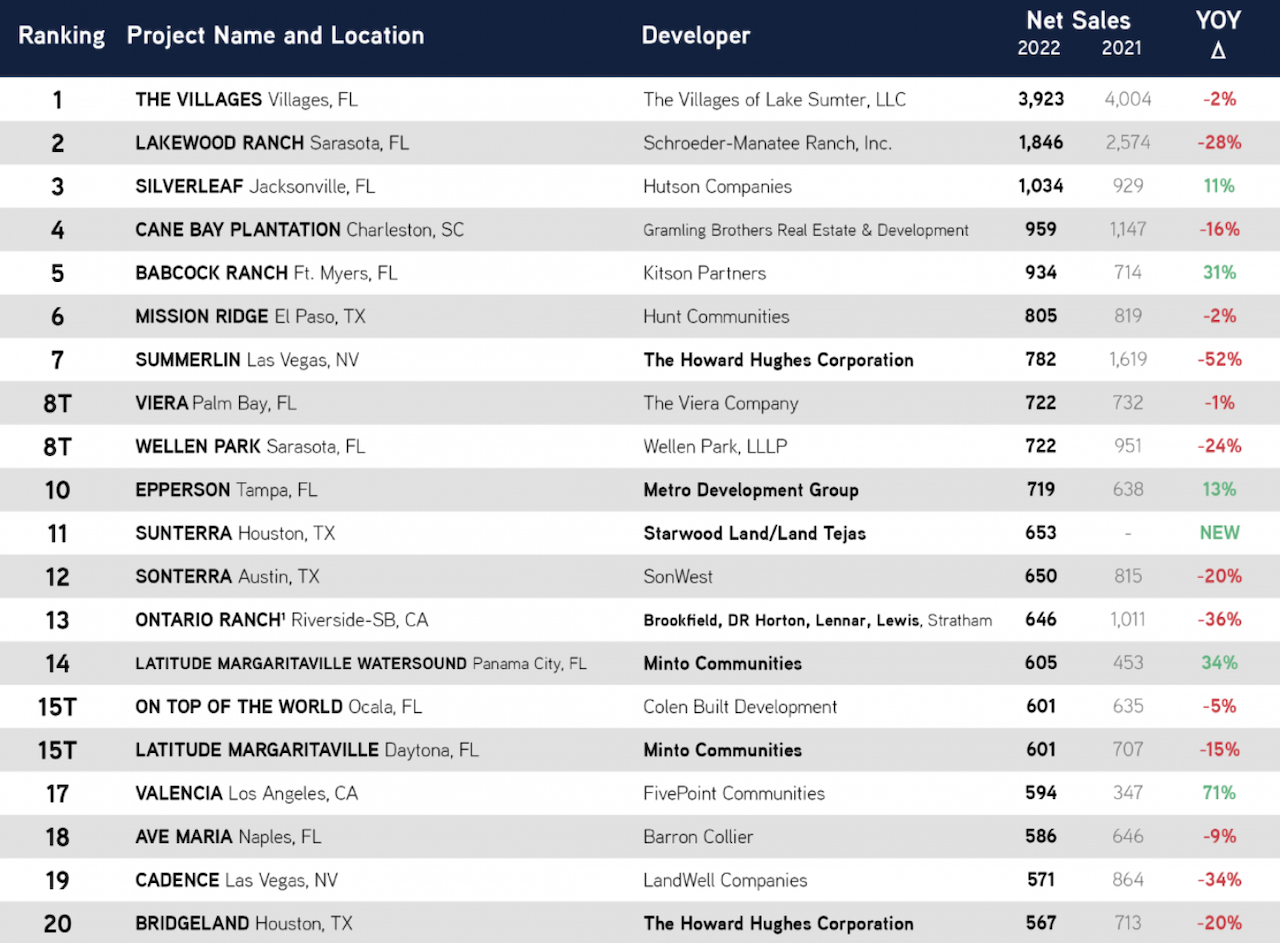

According to the latest data from John Burns Real Estate Consulting, which last week unveiled its Top 50 Master-Planned Communities ranking, MPCs may have lost a step, but relatively, they're holding up.

Over 31,000 home buyers purchased new homes in the Top 50 master plans in 2022, reflecting a -11% decrease from roughly 35,000 home sales in 2021 and trailing the 37,000 sales captured by the Top 50 master plans in 2020." – John Burns Real Estate Consulting

Even the top 20 MPCs' 2022 performance serves to illustrate that geography and relative affordability played an important part in neutralizing deterioration in sales pace year over year, and, likely will outperform most markets and submarkets in 2023 as well.

The devil, you see, is in the details. As the research team at JBREC notes:

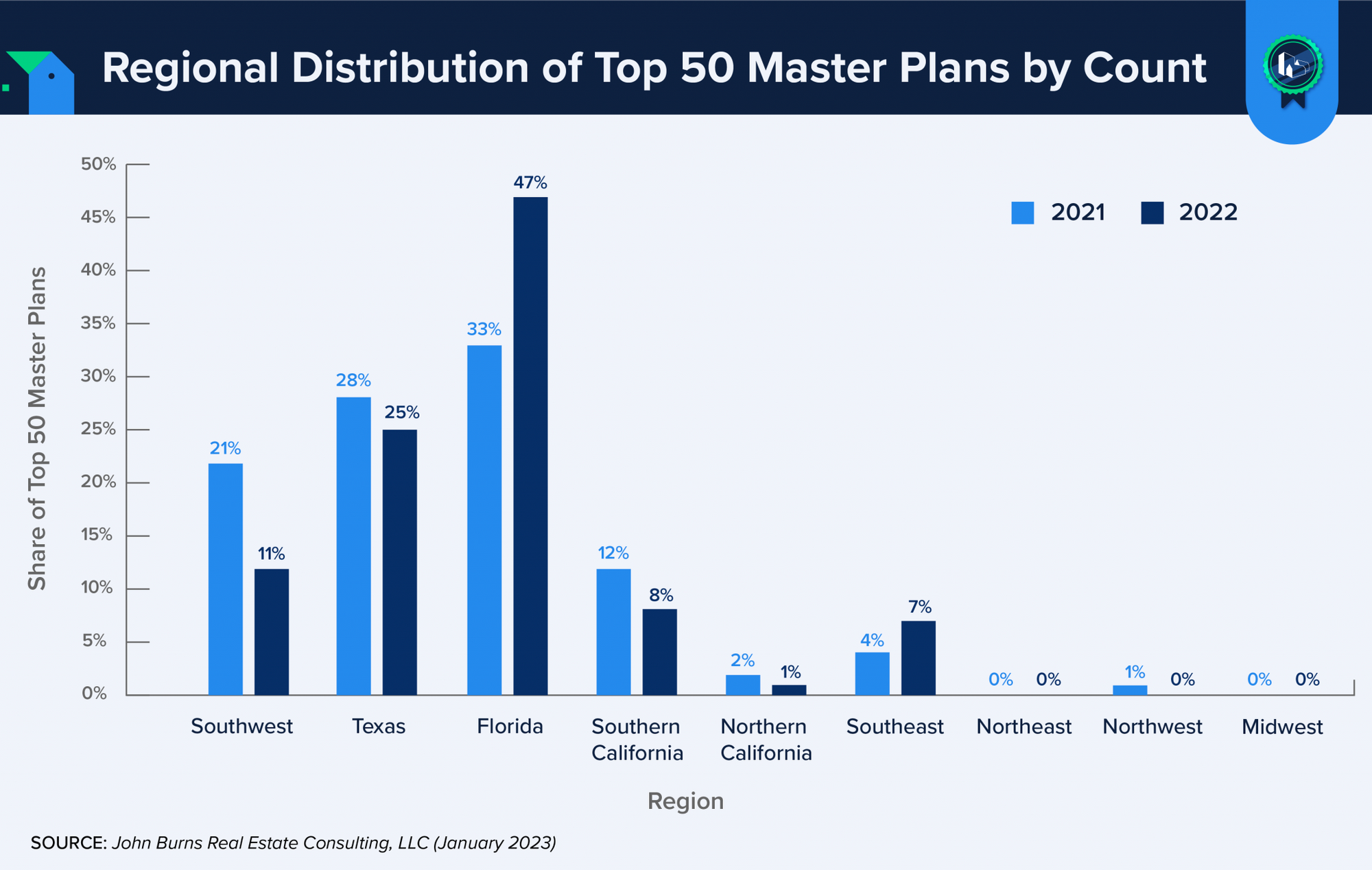

The substantial slowdown in new home demand started on the West Coast and has steadily flowed across the nation to finally include the Southeast and Florida regions. Builders in the western and central regions encompassing the Northwest, Northern and Southern California, Southwest, and Texas, began reporting slower traffic and sales in late spring/early summer. By June, 27% to 38% of builders in these regions were reducing net prices month over month (MOM), mostly through incentives. In comparison, Florida and Southeast builders did not report MOM pricing declines until August. Even now, we still rate a few Florida markets as Normal based on our analysis of new home sales and pricing ratings.

The shift in the regional distribution of top-selling master plans also exemplifies the west-to-east trend described above. Florida and the Southeast show healthy growth year over year in the number of master plans achieving top 50 status while fewer master plans in the western regions reached the sales threshold. In fact, 80% of the top 10 MPCs are located in Florida or the Southeast, where sales and pricing have held up relatively better than in other regions."

Bracing for soft – and perhaps, worsening -- market conditions through at least the mid-band of 2023 has resulted in some MPC reprogramming on densities, rent-or-sale product offerings, and, potentially, mothballing some phases as a way of conserving upfront and carrying costs until momentum reignites.

The JBREC team notes that resilience measures cut both ways, for MPC developers and for builder partners, in anticipation that even if history doesn't quite repeat in terms of the duration and depth of the downturn and its effects, it will at least rhyme. Consensus among the cycle-tested experts is that a "short recession," and a "green shoots" fed confidence boost will spark a return of momentum next year.

Here's the key measures both builders and developers are taking in anticipation of a tide-turn in the middle to last third of next year, according to JBREC.

What developers are doing:

(1) Smaller lots and homes: Developers areprioritizing sections with smaller lots to enable builders to sell more affordable homes.

(2) Rental sections: A growing number of top-selling master plans are welcoming built-to-rent communities offering detached or attached homes.

(3) Reevaluating development plans: Some developers will continue to invest in future sections of their master plans to have lots ready when new home demand recovers; others will delay development in the short term.

What builders are doing:

(1) Incentives: Home builders are offering a wide range of incentives to boost sales, including contributions to closing costs; discounted or free options and upgrades; paying for rate locks; reducing, or eliminating lot premiums; and paying for rate buydowns. View our article explaining rate buydowns for more insight.

(2) Price reductions: Builders are reducing home prices on a broad array of homes, including fully or nearly completed homes that can close quickly.

Managing backlog and cancellations: Many builders are offering incentives to buyers waiting for delivery to avoid cancellations and support closings. These incentives are often comparable to those offered for new sales being written currently.

(3) Reducing starts: Builders are aligning their starts with the lower sales rates to avoid building too much inventory. Single-family starts have declined year over year for eight consecutive months.

Consider these tactics the A position, assuming at worst, a moderately negative scenario, but not the worst. Under the hood of all of these tactics, reterming of take-down schedules, pricing, and co-marketing spend that might be regarded as "variable" costs if builders' balance sheets get hit harder than they currently anticipate.

And as for the remote work wildcard, it remains to be seen whether the leverage pendulum might swing back in advantage to employers. Some, like the Disney Company under the rebooted leadership of Bob Iger, will test the waters of calling all employees back to the office, save for one day a way.

Many employees will hang on as long as they can for at least two work-from-anywhere days.

That's going to have a structural impact on continued demand through the middle part of the 2020s decade up to 2030.

One way or another, MPCs will likely remain as a bedrock of higher volume homebuilders, particularly in a post-pandemic society that values space, privacy, discretionary connectedness, work-life balance, health, and well-being as part of residential community living.

That doesn't mean there won't be an indefinitely turbulent time ahead that will affirm both strategic shrewdness and operational excellence to mitigate risks that could be show-stoppers.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.