Leadership

Another Monday In Homebuilder Land: The Fed 'Pause' Edition

At this point, either the good news or the bad is masking what's really going on and what's due next.

If paradox is not your thing, what a baffling time!

But if mixed-signals don't faze you, what better time to redouble focus, action, and discipline on people and internal operational improvement as a business staying-power strategy while all the externals – the matters you don't control – are so diametrically opposite, volatile, adrift.

- A debt ceiling crisis hovers

- A banking crisis still very well could mess with both consumers' and business's access to credit

- The economy's showing signs of wear and tear

- Interest rates and inflation continue to amount to a cost of living crisis for too many households, including some that have not yet gotten the memo

- Consumer confidence shows a stretch of weakness, with a hint of recent improvement

- Consumer households expect they'll spend less in the months ahead, to the lowest reading in more than 16 months. Their expected income growth is 3.1%, below a 12-month trailing average of 3.6%. Further, "year-ahead expectations deteriorated slightly with fewer respondents expecting to be better off a year from now."

- Not to mention a sudden real-world likelihood of ever more pervasive – near-, mid-, and long-term – impacts of generative AI on liveihoods and household wherewithal.

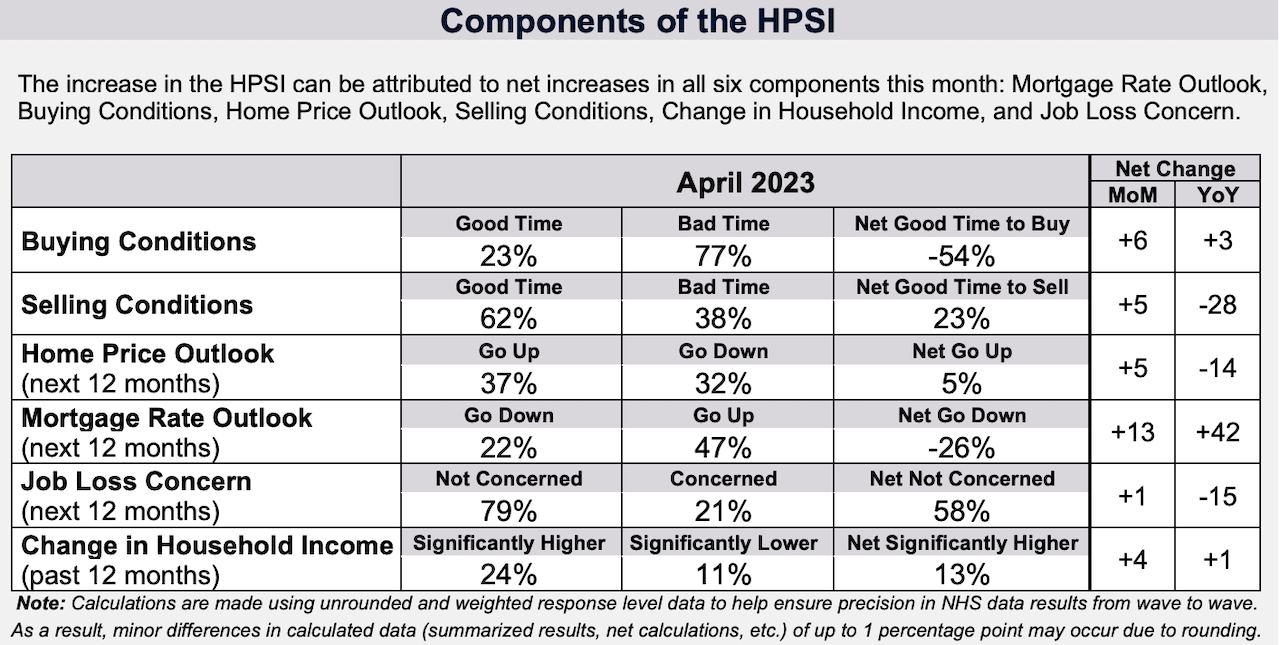

- And yet, Fannie Mae’s Home Purchase Sentiment Index (HPSI) increased in April by 5.5 points to 66.8. The HPSI is down 1.7 points compared to the same time last year.

The numbers – in sync with real-time commentary from among public and large privately held homebuilders around the country – show unambiguous improvement vs. recent most-negative benchmarks across a spectrum of factors in home purchase decisions:

At this point, either the good news or the bad is masking what's really going on and what's due next. So, again, focus internally on what you can control.

Even industry sectors laying off lots of people are also hiring even more. How can both be true?

April employment held up in the tech, finance, construction and manufacturing industries, the Labor Department said Friday. Hiring expanded in other fields such as restaurants and hospitals that have led the hiring boom ... Tech companies have announced a string of layoffs, including Facebook parent Meta Platforms, Google parent Alphabet and Microsoft. Those cuts have been offset by hiring elsewhere in the industry.

“Now that they’re not hiring at the same rate, it gives the small and medium-size companies a chance,” said Becky Frankiewicz, chief commercial officer of staffing firm ManpowerGroup." – Wall Street Journal

Patience and persistence tend to be regarded as second-class business and strategy skillsets these days. Not without reason.

- Technology has made some unimaginably difficult things unimaginably easy, eroding a formerly widespread view that some things have been, are, and will forever remain hard.

- Technology has also taken some processes that once took tedium and time and added exponential velocity to them, disrupting formerly widespread acceptance that despite more processes occurring at warp-speed, some take the time they take.

We're so impatient to arrive at the peak of a challenge or the nadir of a slump, and lean into the explosion of growth that must certainly soon follow. That rush to commit to and invest in the next scenario fuels a risk, not only on the timing of a recovery swing, but the direction it takes, and the opportunity it offers.

Sometimes a pause could be just that, a pause. It could contain uncertainty and continue to wear the mask shutting off clarity as to whether more of a menace or more of a momentum turn upward is already taking shape.

In this market, it's said, capital is king because it affords optionality to pounce or let others do so and lose. As the character of homebuilders large, medium, and small has forged itself against backdrops of volatility, uncertainty, complexity, and ambiguity throughout decades, we learn that while capital may be king, enough capital means different things to different players. A lot of capital can buy optionality, but nimbleness and agility tend to be less a function of a minimum quantity of capital, and more a function of character and wisdom.

Some things in homebuilding, as in every investment, manufacturing, distribution, and consumer durable sector, are hard, and will stay that way.

Some things, like recoveries, tend not to be pretty, but messy and at times ugly.

Some processes take time, no matter how much technology, data, and neural network empowering people carrying them out have at their disposal.

And this excites us to no end, and is at the core of the beauty of the business.

MORE IN Leadership

United Homes Group’s Board Crisis In Compliance Countdown

United Homes Group is running out of time to rebuild a functioning board and avoid a Nasdaq compliance breach. CEO Jack Micenko says day-to-day operations continue, but governance uncertainty and market headwinds now threaten the company’s stability.

Smith Douglas Homes Doubles Down On Pace And Growth

Smith Douglas Homes Corp. (SDHC) remains defiant amid a slowdown by prioritizing pace over price. The builder's rapid cycle time and focused expansion strategy could serve as a blueprint for competitors that serve the strained entry-level segment.

After An Involuntary Pause, Orders Matter Again For LGI

In a market where affordability is collapsing, LGI’s disciplined, spec-first model is proving its worth. A year after seizing ground from private builders, the company’s focus on land control, cost precision, and first-time buyers is paying off.