Leadership

Signs Of Mojo: Time To Declare Victory Or Brace For More Bumps?

Pace has begun to show up, perhaps ahead of schedule. Now what?

Worry in these uncertain times is going around. So is its opposite. You get to pick.

Some worry that homebuilders, developers, and their partners may prematurely be declaring victory over the 2022 housing correction. A good number, on the other hand, worries that – with such clear signals homebuyers have ventured back out from hiding and dialed into a market of elevated-but-not-demoralizing interest rates and better deals on price – those who drag their feet rather than to embrace a Spring rebound may stunt its momentum and provide needless fodder to doomsayers and the media.

You might say this: Whether you're an optimist about an incipient recovery – and place your bets that way – or a pessimist who believes that what looks to be a glimmer of hope is in fact a fleeting mirage, and wagers accordingly, risk is on.

What better time then for a nugget of author Morgan Housel's business wisdom!

YOLO’ is just as good a reason to not do something." – Morgan Housel, Risk and Regret

For the kind of 20/20 vision required to grasp what is going on in the present, it's going to take hindsight rather than belief that the twin forces of undersupply and demographics can and will overcome an ugly raft of headwinds, the strength and duration of which remain unknowable.

What we do know reminds me of a saying we'd hear from an old friend replying to a question, "How are things going?"

They're better than when they were worse," she'd say.

In that light, the job we choose to do in an effort to provide value now is to listen, learn, challenge people who are sure about their assumptions with skepticism, and try to appreciate strong, teachable practices when we get glimpses of them in action.

At a high level, what we've learned as we've digested remarks and color commentary from both public and private homebuilding company strategists, priorities have focused their balance sheets, operations, and selling platforms – following a classic downturn plot line – on crushing the gap in attainability and desirability between a new home and an existing home for sale.

That gap amidst gale-force volatility and uncertainty is mathematical for some, mental for others, and a blend of both for still others. What homebuilders – large, medium, and small – have strived to do as sales lost their tailwind and doubts spiralled more intensively into the mix is to secure what was in hand, flush out their weakest prospects and orders, and focus on a strategy for pace come Spring.

Pace, however, aided by favorable externalities – interest rates coming down off their peaks, a historically low supply of resale homes listed for sale, strong economic data, and at least come measure of "crisis-fatigue" – started to show up ahead of schedule.

This means one of two things or both. (1) Builders are doing the right thing to continue to crush that gap between new and existing houses, or (2) those externalities are tilting the playing field towards ground-up residential construction.

Tactics and strategies among builders, to date, include a toolbox they'd well prepared to put to use, with stronger balance sheets, less debt/leverage, trimmed exposure to speculative land supplies, and sounder financial profiles among prospective buyers:

- first-mover low price in the market to kickstart pace and pull market share away from others in the local arena

- pivot to specs to remove "uncertainty friction" in the order-to-close timeframe

- secure and scrub backlogs to lower cancels, protect margins and maintain perceived value

- further lighten land expense risk and slow starts until an evenflow equation emerges – i.e. one start for each settled new home

Nested within all of these are a multi-streamed operational fire-drill – cut all unnecessary variable costs, take hard looks at every overhead expense, drive savings into future contracts with vendors, optimize cost of sales at every turn – and the homebuilders have been putting on a clinic in operational and executional discipline.

What they don't yet, and can't yet know has to do with "air pockets."

They can occur for any number of reasons – rate hikes, mass layoffs, an economic Black Swan, an industry-sector meltdown, etc. – or they may not occur at all.

If they do, it will be a reach-deeper period. Some – although they hope not to have to – are ready. Some are back on their heals.

So let's – proverbially – listen in on some of the color the Taylor Morrison strategic team of Sheryl Palmer, Chairman, CEO, Lou Steffens, CFO, and Erik Heuser, Chief Corporate Operations Officer offered as they spoke with equity research analysts during their Q4 2022 and full-year 2022 earnings call yesterday.

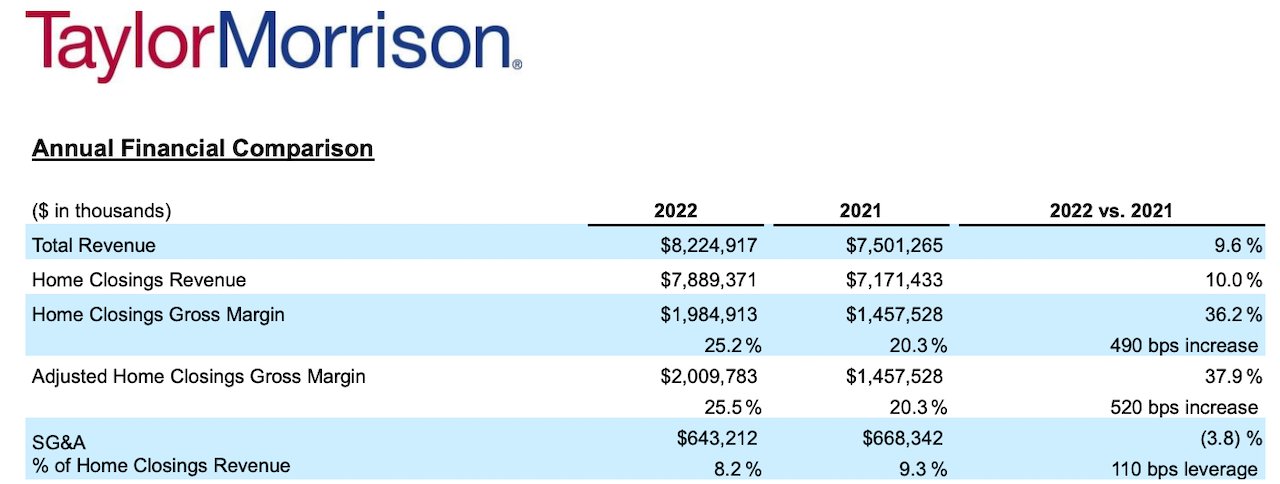

A good number of the homebuilding firm executives who've preceded Taylor Morrison this earnings cycle broadly adopt a pace-and-volume-over-profit-margins strategy as their opening gambit for handling a market undergoing Fed rates-sensitive turbulence. Some would say it's an either-or choice, to focus on holding margins or to drive volume, which also means capturing market share in a race to the floor on a strike price that starts predictable absorptions.

The Taylor Morrison team tends to beg to differ, believing with the right product, location, and market segmentation programs, pace and margin can be a "both-and" strategy, and they mean to lean into that as we hear in commentary from their executive team:

'23 Vs. '22: Affordability & Buyer Psychology

Sheryl Palmer, Chairman, CEO

If I were to go back to the start of the year, it was much more about sentiment and affordability with what was happening to the rates and the fear of paying top dollar on both price and rate.

Today, I would say that has moved to making sure they can secure the right home in the right community. I really do think we’re doing a wonderful job overcoming some of the affordability concerns with our finance programs and giving them that peace of mind. It could be our 3-2-1 buy down for some consumers, it could be that forward Buy Build Secure program that I just spoke of, so I think we’re helping them overcome that.

The other thing I’d say is just the mix of consumers that we’re seeing across the board is really changing, and so it’s really sitting down and making sure that we have the programs in place to help them get to the end game, but it’s very different. I think the lack of confidence that we saw at the end of last year, where people really – you know, if you go back six months -- there were a lot of people that wanted houses that ended up not buying them. They pulled back. I think we’re seeing those folks come back into the market today. It’s about working with each of them individually."

Cohorts: Millennials & Active Adult/Resort

Sheryl Palmer, Chairman, CEO

If I were to talk about a shift in the overall portfolio, I think it would be about the continued presence that we’re seeing of the millennials. Nearly half of our sales in the quarter were from millennials, and when I look at the financial stability of that consumer, it’s actually stronger than the consumer at large.

It’s an interesting group - like I said, about 50% of our borrowers within our finance services company were millennials. Many of them are buying their second home, so they’re not really first-time buyers but in some communities, they may look like first-time buyers. They have extremely strong credit profiles with average credit scores in the mid-700s. As I mentioned before, they’re also a little bit more racially diverse."

... when I look at the overall split between the different consumer groups, our second move-up was our strongest pace in the quarter. Then when I look at our resort lifestyle, they really start picking up in the shoulder season, and we’ve seen continued improvement in the new year. As you know, when we look at that buyer, they generally come with some of our strongest margins. There might be some exceptions to that - I don’t think we’ve seen that same return in Houston, for example, that we’ve seen throughout Florida. When I look at the active adult shoppers, just period over period, we’ve seen something like a 500, 600 basis point improvement.

Honestly, looking at our inventory, our biggest challenge in that buyer set in Florida is we just can’t keep any inventory on the ground, but it hasn’t slowed them down. They’ve just continued to buy the to-be-built. As you know, that buyer is a little bit less rate sensitive, but they’re more sophisticated so they’ve been looking at all the economic indicators.

Spec Vs. Build To Order

Sheryl Palmer, Chairman, CEO

There’s somewhat of a misnomer that every consumer wants something that’s move-in ready. We actually really do once again like the balanced approach of specs for certain consumer groups and the opportunity for to-be-builts, especially when we look at the margin profile. Once again, certainly a couple years ago, we saw for the first time historically specs perform at a very different level, but I think the reason we don’t have the margin pressure that you’re seeing with others is our more balanced approach to to-be-builts, so we’ll continue to keep that balance in front of the business."

Pace Vs. Margins

Lou Steffens, CFO

There’s definitely puts and takes in terms of the margin profile going forward. As you know, we have a decent sized backlog going into ’23, so homes sold earlier in ’22, very strong margin profile, plus our 60/40 split of specs to to-be-builts, we still are seeing really strong margins on the to-be-built side where our customers are building their dream home, and as you see in our deposits, really strong deposits that they’re putting up.

In terms of our vintage land bank, which we’ve talked about in the future, I think that’s also a source of good margin for us going forward. Then as you mentioned, the operational enhancements since the beginning of ’21, we reduced our options by over 50%, simplifying our business and our plans over 20% in addition to putting our Canvas initiative almost fully into place now, so we have those operational enhancements and simplification that helps us and, as other builders have talked about, favorable lumber tailwinds into ’23.

We do have cost reduction opportunities that we’re seeing on the front end. Most of those, though, unfortunately will help us more in ’24, but we’ll see some small opportunities there. Then on the take side, with the softening demand environment, we have had elevated incentives on our spec homes specifically, and with the lower mortgage rates until more recently, it’s been helpful as we’re prioritized our incentives towards finance, the cost of buying down those rates had come down a little bit, as you’ve seen in the last week or so. Our rates have gone up slightly again, so I’d say there’s put and takes, but we feel very strong about the opportunities for us this as we guided, I think, a really strong margin in Q1.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.