Leadership

Affordability Gap Widens But Sales Go On. Who's Buying? Who’s Sidelined?

Affordability challenges persist despite lower mortgage rates; wealthier buyers dominate sales while entry-level demand struggles amid rising home prices, monthly payment, and downpayment challenges.

Mortgage rates have slowly ticked down over the past few weeks, dropping below 7% on average. If rates hold, homebuilders have a better chance to sell more houses this spring than they did a year ago when rates were higher.

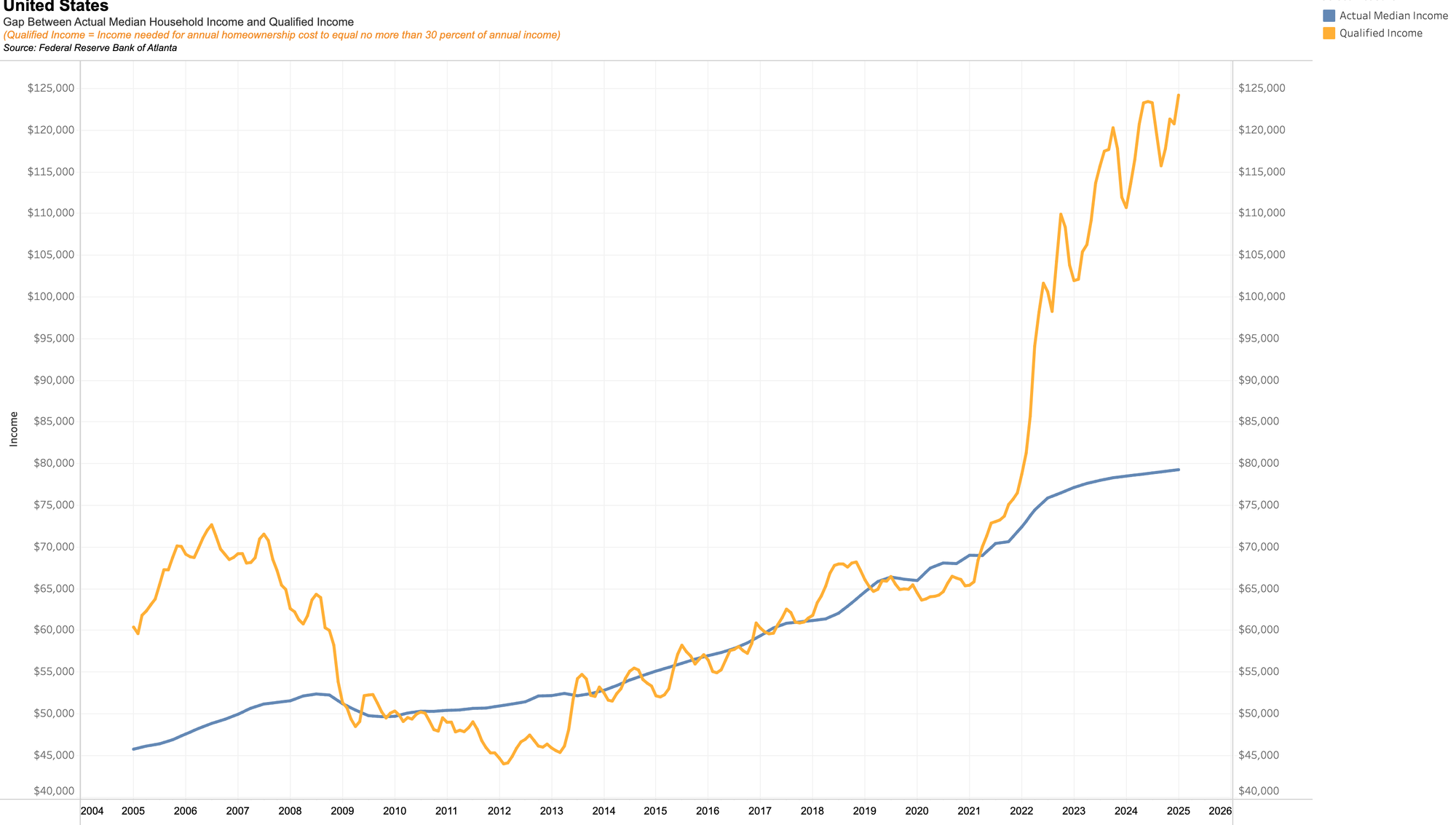

Lower interest rates, however, may not solve a growing affordability gap that remains stubbornly wide and reached the highest level in January on the Atlanta Federal Reserve’s Home Ownership Affordability Monitor, which tracks data back to 2006.

Still, new homes sold last year at roughly the same level as in 2019 when interest rates were in the high 3% range. Meanwhile, existing home sales haven’t yet reached pre-pandemic levels.

While entry-level buyers are largely missing, affluent first-time buyers, buyers with cash from the rapid rise in home values and empty nesters with equity to rollover have been driving much of the sales activity. All are less sensitive to mortgage rates.

The Growing Affordability Gap

There wasn’t much of an affordability gap from February 2009 until April 2021 as the COVID-19 pandemic raged. The necessary income for annual homeownership roughly equaled 30% of annual income, except from 2011 to 2013 when the gap was negative. Home values favored buyers as the country still dealt with the effects of the 2008-2009 housing bust.

Domestic migration during and after the pandemic to the South, West and Northwest drove a buying frenzy that sent home prices soaring as builders couldn’t build fast enough to meet demand.

The affordability gap began in 2021 when home prices started to outpace median incomes to grow by a large margin over the next nearly four years.

In March 2021, the qualified income to buy a home was $68,354, with median household income at $68,941, according to the monitor. There was no affordability gap. The median home price was at $290,667.

By January this year, the gap between qualified income and median income hit 56.7%. The median home price has increased to $390,333. To afford a house at that price, a household would need to have a qualifiable income of $124,150. The median income is at $79,223.

Median home prices grew 34.3% while household median income rose 14.9%.

Lack of affordability has put some pressure on home builders. To close deals, they have been using incentives such as mortgage buydowns to help close deals.

Who is Buying?

Lennar Corp.

The company’s homebuilding revenues declined roughly $1 billion in its fiscal fourth quarter ended Nov. 30, 2024, from the previous year’s $10.5 billion.

“While there continues to be considerable traffic of customers looking for homes, the urgency to actually transact has quieted as customers adjust to a new normal,” Stuart Miller, Lennar Corp.’s CEO, told analysts on its December earnings call. “Of course, affordability has been a limiting factor for demand and access to homeownership for some time now. Inflation and interest rates have hindered the ability of the average family to accumulate a down payment or to qualify for a mortgage.”

When sales stalled during its quarter, “that necessitated increased incentives, interest rate buy-downs, and price adjustments to activate sales and avoid increased inventory build-up,” Miller said.

Diane Bessette, the company’s chief financial officer, said that the company expects to deliver 17,000 to 17,500 homes in its fiscal first quarter that started December 1 and a $410,000 to $415,000 price point “as we continue to price to market to meet affordability.”

PutleGroup

In an earnings call at the end of January, Robert O’Shaughnessy, PulteGroup’s chief financial officer, said that “fourth quarter net new orders decreased 14% for first-time buyers, increased 15% for move-up buyers and decreased 1% for active adult buyers.”

O’Shaughnessy added that “these activity levels reflect the continued interest of consumers for new homes but also show the impact of the affordability challenges consumers face particularly for first-time buyers.”

Its homebuilding revenues grew from nearly $15.6 billion in 2023 to $17.3 billion last year.

First-time buyers were 40% of closings in the quarter. Move-up buyers represented 40% of closings, with active adult buyers covering the remaining 20%.

Its average selling price in the quarter increased 6% to $581,000, “due primarily to the increase in the relative proportion of our closings from move-up customers,” O’Shaughnessy said. “We currently expect the average sales price of closings to be in the range of $560,000 to $570,000 in each of the four quarters of the year.”

PulteGroup’s Texas developments showed a slight decline in orders for new homes, Ryan Marshall, the company’s CEO, said on the call.

“That's really reflective of what we highlighted with our first-time buyer business being down in the quarter, mostly driven by affordability concerns, and we've got a lot of our business in Texas oriented against that first-time buyer business,” Marshall said.

Toll Brothers

For Toll Brothers, sales among move-up and first-time luxury buyers were up while sales to empty nesters declined. Home sales revenues dipped in the quarter ended January 31 to $1.8 billion from $1.9 billion from a year ago.

“While demand has remained healthy in many of our markets and particularly at the higher end, affordability constraints and growing inventories in certain markets are a pressure in sales, especially at the lower end,” “We continue to see the long-term outlook for the new home market to be very positive, particularly for our luxury niche,” Douglas Yearley, the company’s CEO said on an earnings call last week. “Demand for our homes continues to be supported by our affluent customer base. Over 70% of our business is luxury move-up and empty-nester, which serves a wealthy cohort that has benefited from years of home price and stock market appreciation. The remaining 25% to 30% serves the more affluent first-time buyer, many of whom are older millennials buying their first home later in life when they have higher incomes and are more financially secure.”

Taylor Morrison Home Corp.

Taylor Morrison’s home closings revenues increased in 2024 to nearly $2.2 billion from $1.9 billion in 2023. It delivered 3,571 homes in 2024’s final three months with an average price of $608,000. The company said it plans to deliver fewer this quarter, about 2,900 homes selling between $590,000 and $600,000.

“Tertiary markets are facing the most pricing pressure from rising inventory as well as greater sensitivity to affordability constraints among first-time buyers attracted to such markets,” Sherly Palmer Taylor Morrison Home Corp.’s CEO, said on the company’s earnings call on February 12. “Alternatively, our prime location strategy continues to benefit from attractive underlying fundamentals by serving well-qualified homebuyers in our entry-level, move-up and resort lifestyle segments. When we look at the move-up in the resort lifestyle, we just don't see the same need on the incentive side on rates because they're taking smaller loans. And obviously within our resort lifestyle, we're still seeing a great deal of cash.”

D.R. Horton

The home builder that targets the entry-level buyer saw its revenues dip some in the final three months. In its January earnings call, Mike Murray, D.R. Horton’s chief operating officer, said the company’s average selling price was at $374,900, about where it was the year before and 1% lower than the previous quarter.

Murray said D.R. Horton’s mortgage company handled 79% of homebuyers, and those had an average loan-to-value ratio of 89%. “First-time homebuyers represented 60% of the closings handled by our mortgage company this quarter,” Murray said.

Paul J. Romanowski, D.R. Horton’s president and CEO said broadly that “although both new and existing home inventories have increased from historically low levels, the supply of homes at affordable price points is generally still limited. To help spur demand and address affordability, we are continuing to use incentives such as mortgage rate buy-downs, and we have continued to start and sell more of our smaller floor plans.”

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.