Leadership

Adapting To A "New Normal" In Home Insurance For New Home Buyers

Amid rising premiums and climate risks, homebuilders can adapt with resilient designs, embedded insurance, and smart technologies to maintain affordability and buyer confidence.

The home insurance landscape is undergoing a seismic shift. Rising premiums, increased climate risks, and insurance market volatility are redefining what it means to ensure affordability and security for homeowners.

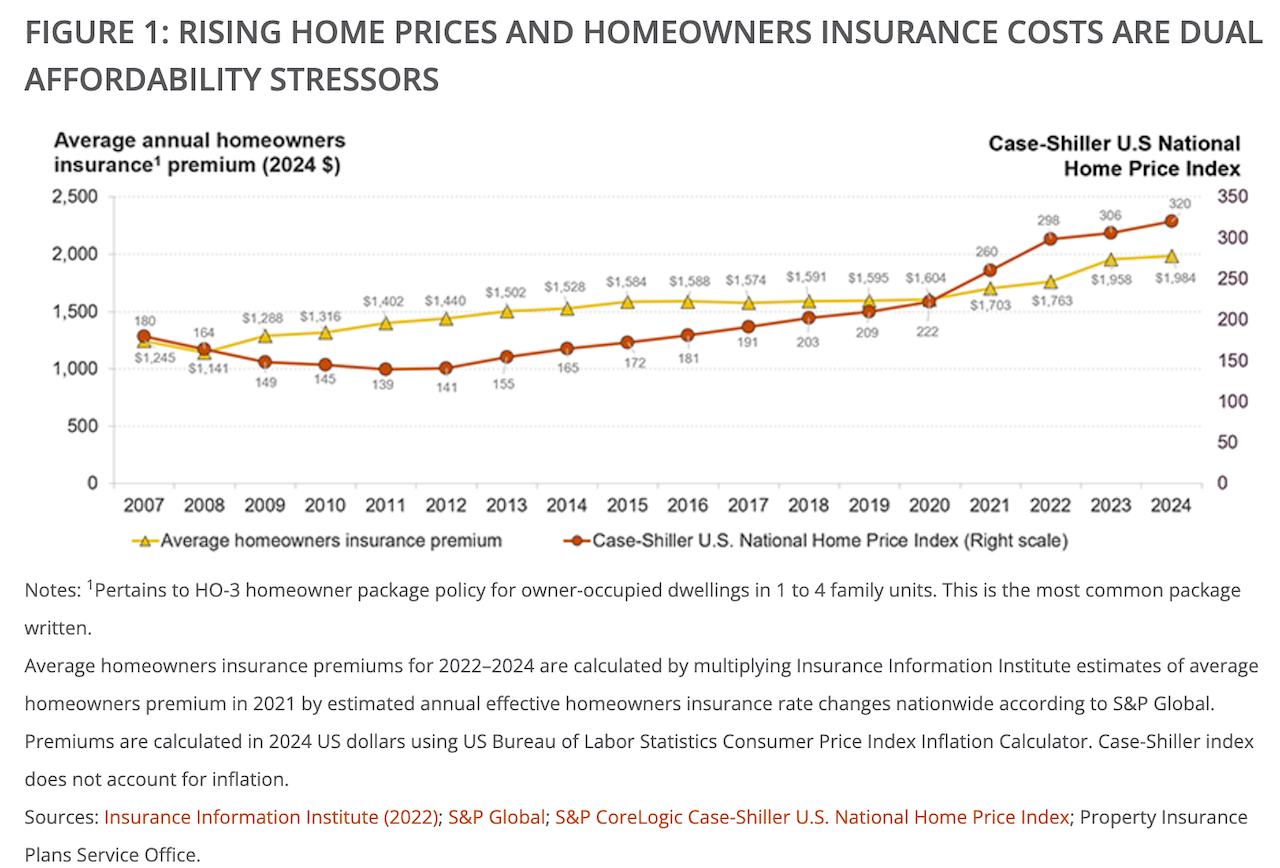

As the Harvard Joint Center for Housing Studies (JCHS) notes, homeowners insurance premiums have risen 74% since the Great Recession, with a 20% increase from 2020–2023 alone. Simultaneously, climate-fueled hazards are pushing insurers to retreat from high-risk markets, leaving a growing share of homebuyers struggling to secure coverage.

This insurance "new normal" presents both challenges and opportunities for homebuilders. Insights from Tom Kriby, Vice President of Client Development and Partnerships at Westwood Insurance Agency, offer a pathway forward. Kriby’s commentary highlights the strategies builders can deploy to adapt to this evolving landscape while maintaining trust and delivering value to their buyers.

The Role of Location-Based Risk in Affordability

Location is always the first question," says Kriby.

Builders are increasingly recognizing the importance of understanding regional risks and their impact on insurance premiums.

As JCHS data reveals, states like California and Florida have seen a surge in FAIR (Fair Access to Insurance Requirements) plans, underscoring the growing difficulty of securing private coverage in high-risk areas.

Kriby explains that builders now consult with Westwood during the land acquisition phase to assess whether insurance will be attainable.

This helps them anticipate and adjust for the affordability impacts in advance," he says.

Builders must proactively factor insurance considerations into their planning, ensuring they can offer homes that remain within buyers’ financial reach, even in risk-prone regions.

Building Resilience: A Shared Responsibility

Resilient construction practices are becoming a cornerstone of the modern homebuilding strategy. Kriby emphasizes,

When builders invest in weather-resilient, higher-performing materials, it’s not just about cost savings—it builds trust and provides long-term protection for buyers.”

JCHS research echoes this, noting that physical mitigation measures such as fireproofing landscapes and elevating homes are crucial for buying time against climate risks. Builders who integrate these features into their designs can differentiate themselves in the market while potentially securing lower insurance premiums for their buyers. As Kriby points out,

We’ve seen how improved building codes and resilient construction practices make a difference. My own house in Florida, built to updated codes, withstood 120-mile-an-hour winds with minimal damage.”

Harnessing Smart Home Technologies for Risk Mitigation

Innovation in smart home technology offers another layer of resilience. Kriby highlights water shutoff sensors as a prime example of how technology can reduce claims and influence insurance pricing.

Water shutoff sensors are game-changers for reducing claims. Insurance companies now recognize the value of smart home technology and are offering credits and discounts,” he explains.

These advancements align with JCHS’s observation that technological tools are increasingly vital for improving household financial resilience. Builders who adopt these technologies not only enhance the value of their homes but also position themselves as forward-thinking partners in the homeownership journey.

Embedding Insurance for Transparency and Trust

One of the most transformative shifts in the insurance landscape is the integration of embedded insurance into the homebuying process. According to Kriby,

By embedding the insurance process upfront, we provide builders and buyers transparency and predictability, ensuring there are no surprises at the closing table.”

This approach simplifies the insurance journey for buyers, reducing anxiety and building trust. It also reflects a broader trend noted by JCHS: the need for alignment between insurance availability and housing finance systems. Embedded insurance models allow builders to deliver a seamless experience while addressing affordability head-on.

Adapting to Market Resets

The days of low insurance premiums are over. Kriby underscores the importance of adjusting expectations:

Insurance premiums are not going back to $800. Builders need to plan for a reset where $1,500 or more becomes the norm.”

JCHS data supports this, showing that premium growth is closely tied to escalating climate risks and increasing replacement costs.

Builders must respond by rethinking their offerings. Smaller lots, innovative designs, and resilient construction can help offset rising insurance costs, preserving affordability without sacrificing quality or buyer confidence.

Communication: The Glue That Holds It Together

For Kriby, the key to navigating this new landscape is communication, timely human contact, education, and customer care.

Everything comes down to communication. If you can underwrite the home before it’s even built, it creates clarity for the builder, the buyer, and everyone involved,” he says.

This proactive approach ensures that all stakeholders are aligned, reducing uncertainty and fostering trust.

JCHS emphasizes the same principle, noting that effective communication and transparency are essential for bridging gaps in affordability and access. Builders who prioritize open dialogue with their insurance partners and buyers will be better equipped to navigate the challenges ahead.

Innovative developments in the insurance field, including technological advancements, non-profit partnerships, new parametric products, and user-friendly tools from FEMA, are providing reason for optimism. However, property insurance is not a panacea and does not directly mitigate nor avoid physical damage. Protective infrastructure along with home mitigation improvements like fireproofing landscapes and home elevations will be needed to buy time. Mortgage and lending practices, as well as local land use regulations that incentivize vulnerable development in exposed areas, must also change. Ultimately, as the costs from climate change-fueled hazards and other covered perils continue to mount, insurance will be a key mechanism for strengthening household financial resilience for some time.”

A Call to Action

The insurance "new normal" is not just a hurdle—it’s an opportunity for builders to lead with innovation and adaptability. By focusing on location-based risks, resilient construction, smart technology, embedded insurance, and proactive communication, homebuilders can position themselves as trusted allies in an uncertain market.

As Kriby concludes,

When builders work together to address issues like climate risks and advocate for better building codes, it’s not just about solving today’s problems. It creates a market advantage, making new homes more attractive compared to older ones that can’t match modern performance or protections.”

The path forward is clear: Adapt, innovate, and communicate. Homebuilders who embrace these principles will not only navigate the challenges of the insurance market but also emerge as leaders in delivering value and security to their buyers.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.