Capital

A Transformational Leap In Homebuilding Strategy: Millrose Game On

How Lennar's transformative spin-off -- now in motion and scheduled to go to market in January -- creates a new blueprint for land-light homebuilding.

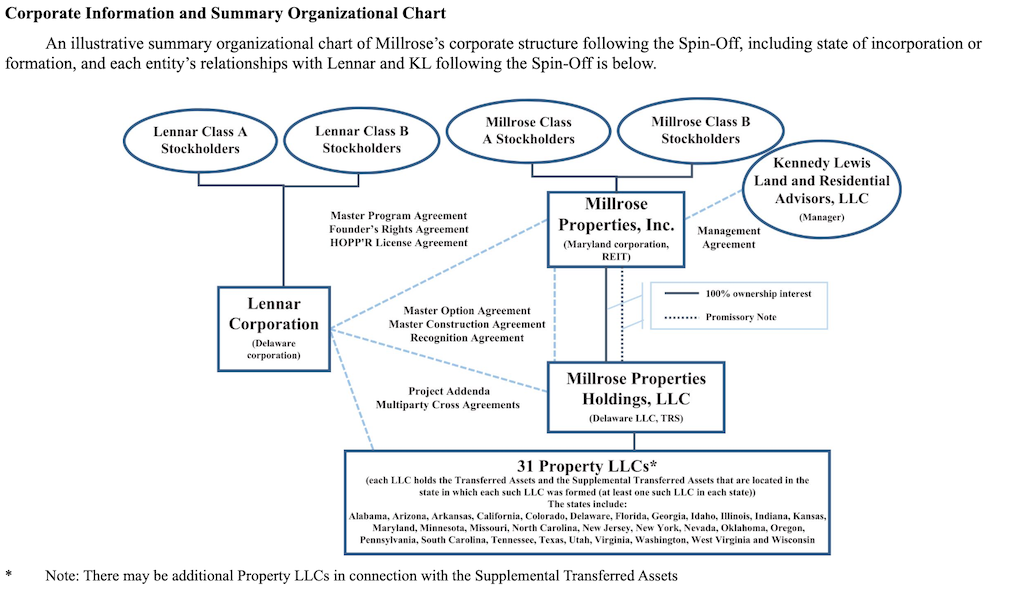

Today, Lennar Corporation officially unveiled its long-anticipated strategic pivot by announcing the filing of Form S-11 with the Securities and Exchange Commission (SEC) for the planned spin-off of Millrose Properties, Inc. (“Millrose”).

The spin-off will position Millrose as an independent, publicly traded real estate investment trust (REIT) specializing in land banking and development. This move— arguably the most significant residential real estate development news of 2024 — has wide-ranging implications for Lennar’s operations, the homebuilding industry, and the broader real estate investment community.

The Millrose spin-off reflects Lennar’s long-term “land-light” strategy and is a calculated step toward enhancing its valuation and competitive positioning. With Millrose managing a substantial portion of Lennar’s land portfolio and facilitating just-in-time delivery of finished homesites, the spin-off represents a paradigm shift in how large-scale homebuilders approach land acquisition, development, and utilization.

Strategic Context and Rationale

The announcement marks the culmination of Lennar's journey over two decades ago, refining its approach to land banking and transitioning from a land-heavy to a land-light operating model. As Executive Chairman Stuart Miller stated in the introductory letter accompanying the S-11 filing:

“The Millrose Spin-Off is a continuation of Lennar’s long-stated strategy of becoming a pure-play, new home manufacturing company for building and selling new homes to both primary buyers and institutional buyers of new homes.”

This vision emphasizes operational efficiency and market adaptability. By creating Millrose, Lennar institutionalizes its Homesite Option Purchase Platform (HOPP’R), a proprietary system for managing land development and takedown schedules, which has been pivotal to Lennar’s success in meeting production demands while mitigating land-holding risks.

Key Milestones and Timelines

- December 18, 2024: SEC filing of Form S-11 by Millrose Properties, Inc.

- Late January 2025: Expected public trading launch of Millrose shares, following SEC comment periods and final Board of Directors approval.

- Throughout 2025: Progressive alignment of Millrose’s land banking operations to provide finished homesites for Lennar and other preferred partners.

- December 31, 2025: Millrose’s first full taxable year as a REIT, cementing its structural and operational framework.

Operational Structure and Financial Implications

The spin-off process involves the transfer of land assets, up to $1 billion in cash, and the operational expertise behind Lennar’s HOPP’R to Millrose. Millrose will initially distribute approximately 80% of its common stock to Lennar shareholders, with Lennar retaining the remaining 20% temporarily.

In a conversation with The Builder’s Daily, Tony Avila, CEO of Builder Advisor Group, offered critical insight into the implications of this move.

What Builders Need to Know

- Land REIT Structure: Millrose will operate as a land REIT with a taxable subsidiary managing land development. This unique structure offers Lennar a competitive edge by lowering its cost of capital — Millrose will charge Lennar less for land holding, compared to an industry norm of 12%.

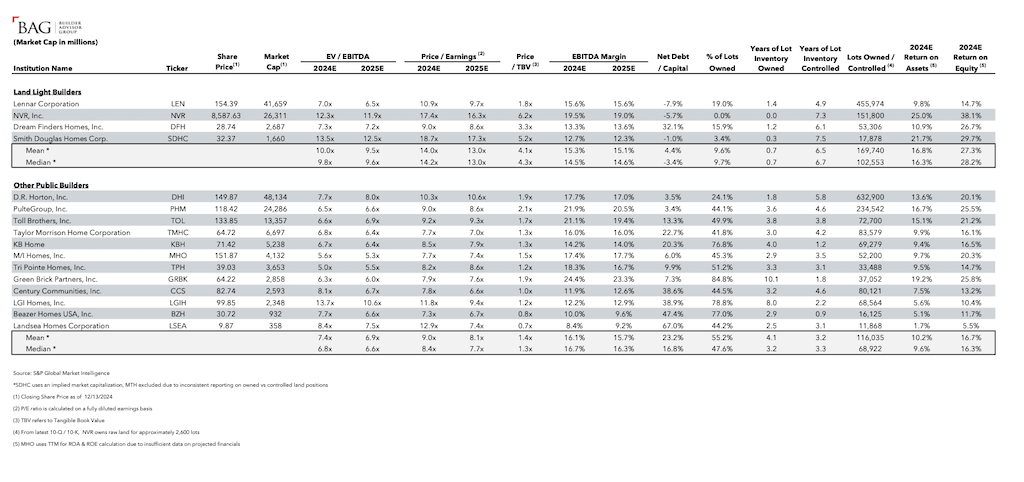

- Improved Valuation Metrics: The spin-off will likely enhance Lennar’s return on assets (ROA) and valuation multiples. Avila says,

This positions Lennar to trade closer to NVR's levels, with ROA improvement and price-to-book ratios aligning with more efficient operators.”

- Strategic Advantage: Avila highlights,

Lennar’s entrepreneurial leadership continues to find innovative ways to secure land pipelines off-balance sheet while retaining control, improving both flexibility and profitability.”

What It Means

- For Lennar: The spin-off aligns with Lennar’s broader asset-light pivot, mirroring the success of models like NVR. Avila explained,

This approach significantly enhances Lennar’s cost-efficiency and ability to close on land deals without traditional land-banking challenges.”

- For the Industry: Other public builders may explore similar structures to maintain competitiveness. Avila noted,

This could mark the beginning of a broader shift as builders look for ways to secure capital and land while mitigating risk.”

- For Developers: Preferred partners working with Millrose may benefit from lower costs and streamlined access to land, making this a win-win for both Lennar and its collaborators.

The goal is clear: to emulate the asset-light model exemplified by NVR, which commands higher valuation multiples due to its efficiency and capital discipline. Lennar’s balance sheet will reflect this transformation, with significant reductions in land assets and corresponding improvements in return on assets (ROA) and price-to-earnings (P/E) ratios.

Millrose’s land inventory will focus on shorter-term projects with limited entitlement risks. As Miller explained in his letter from the S-11:

“Millrose assets are intended to perform more like work-in-progress than like traditional land assets, because of expected shorter-term duration, very limited entitlement risk, as well as other unique contract attributes.”

Market Impacts and Competitive Landscape

The establishment of Millrose has broad implications for homebuilders, land developers, and capital investors:

- Operational Flexibility: By outsourcing land management to Millrose, Lennar gains the ability to focus on core activities such as home design, construction, and customer engagement. This aligns with Miller’s vision of treating land as an input akin to building materials.

- Enhanced Liquidity: As a publicly traded REIT, Millrose offers liquidity advantages for investors, fostering a new investment class within residential real estate.

Industry Model: Over time, Millrose could become more of an industry solution than just a Lennar solution, deploying capital to other builders in traditional land banking arrangements.

Lower Cost of Capital: Millrose is designed to provide land banking services at an option rate significantly lower than the typical 12% charged by traditional land bankers.

Broader Implications for the Homebuilding Sector

Lennar’s Millrose initiative reflects a broader trend among public homebuilders to adopt asset-light strategies. By reducing reliance on private equity land bankers and creating a durable, scalable land management vehicle, Lennar sets a precedent for other industry players.

This institutionalizes what has historically been a private market product. It provides a durable and scalable solution for land banking, reducing costs while increasing operational flexibility for builders.

This move also coincides with heightened M&A activity in the homebuilding sector. Notably, the $900 million in cash transferred to Millrose will be partially allocated to acquire land assets from Rausch Coleman Companies, LLC, a privately held homebuilder. This acquisition will bolster Millrose’s initial portfolio while furthering Lennar’s strategic objectives.

Looking Ahead

The Millrose spin-off represents a pivotal moment in Lennar’s evolution and the broader homebuilding industry. As Lennar positions itself as a “pure-play” homebuilder and Millrose emerges as a trailblazer in institutional land banking, the implications for market dynamics, operational models, and investor strategies are profound.

As the January 2025 launch of Millrose’s public trading approaches, stakeholders across the industry will be watching closely. The outcome of this innovative initiative will likely shape the trajectory of homebuilding and residential development for years to come.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.