Leadership

A Tilted Playing Field Favoring New-Home Sales Spurs Rosier Outlook

Why is homebuilder confidence bouncing back with such conviction when the backdrop of economic, household, spending, and employment near-future-outlooks contains so many wildcards? It's complicated.

Goblin mode was the Oxford word of the year for 2022. If 2023 had a punchline of the year, it might well be another two-word combo you see in response to questions, challenges, and predicaments begging for a simple explanation.

It's complicated."

It's a reason-why catch-all that crops up below an ever-expanding array of perplexing business, social, and cultural riddles and paradoxes.

Like this one.

Why is homebuilder confidence bouncing back with such conviction when the backdrop of economic, household, spending, and employment near-future-outlooks contains so many wildcards?

Cue the punchline, please. [I'm sure that ChatGPT has gotten its mitts on this as an opener to a fair few of its own responses to today's bigger business and economic dilemmas].

It's complicated."

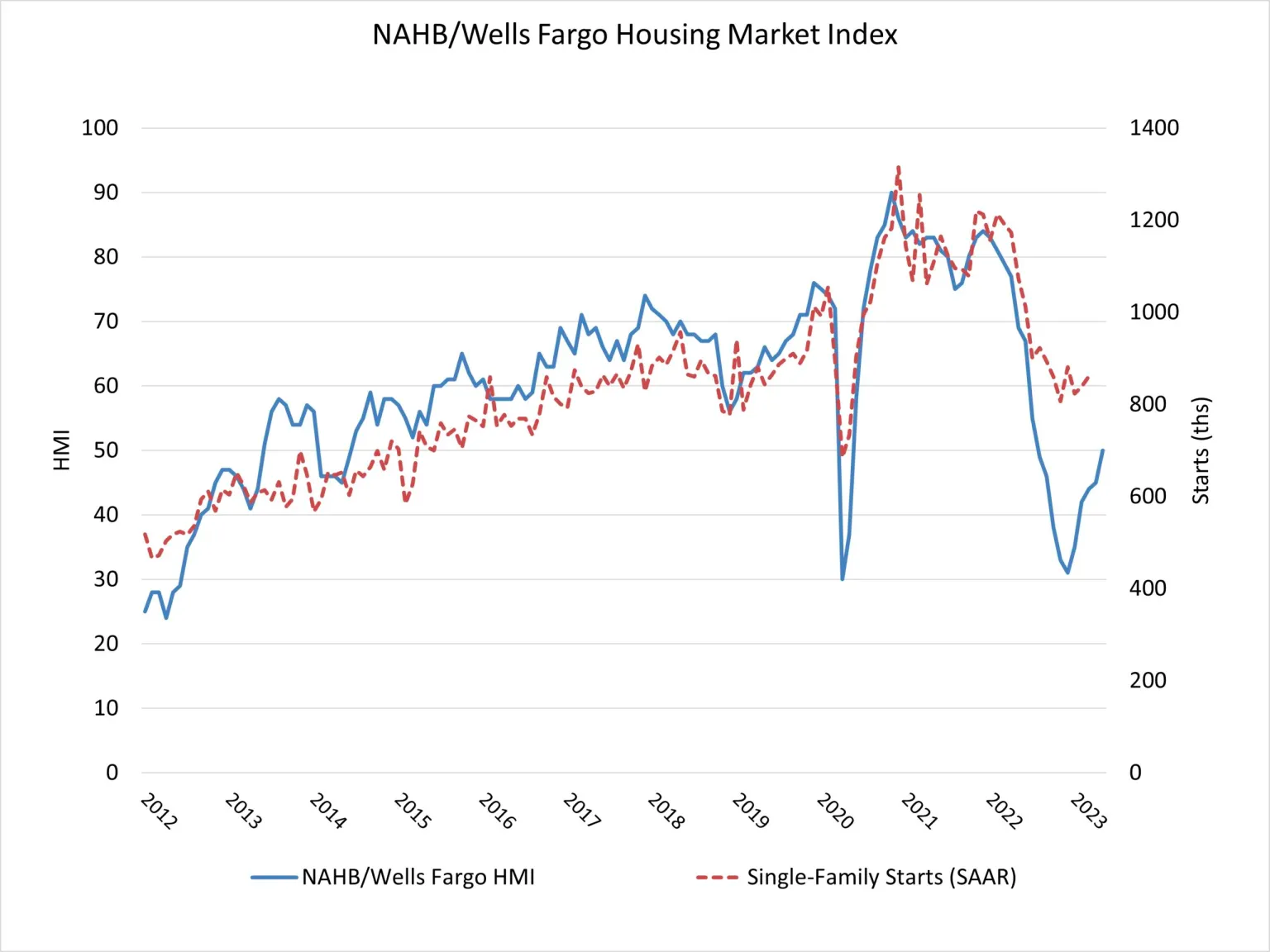

The big bounce we're talking about comes through today in the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) release. Builder confidence reached a milestone after having cratered last year to lows it only saw – briefly – just after Covid arrived, and before that in 2012 or so. The milestone – an index reading of 50 – means that exactly half of survey respondents are confident about business conditions, while 50% are less than confident. Here's National Association of Home Builders chief economist Rob Dietz on what's a big deal for what it presages for housing starts and permits activity in the coming months at a level few might have predicted through the Fall of 2022.

Builder confidence in the market for newly built single-family homes in May rose five points to 50, according to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). This marks the fifth straight month that builder confidence has increased and is the first time that sentiment levels have reached the midpoint mark of 50 since July 2022."

New home construction is taking on an increased role in the marketplace because many home owners with loans well below current mortgage rates are electing to stay put, and this is keeping the supply of existing homes at a very low level. In March, 33% of homes listed for sale were new homes in various stages of construction. That share from 2000-2019 was a 12.7% average. With limited available housing inventory, new construction will continue to be a significant part of prospective buyers’ search in the quarters ahead." – Eye On Housing, National Association of Home Builders

The very high mortgage interest rates many homebuilders rightfully fear and loathe in fact have served as a new home catalyst. This tilt of the playing field in new construction's favor allowed builders to work pricing, concessions, loan buy-down and downpayment accommodations switches and levers at a community by community, customer by customer level to find something for many more buyers in today's market than they would typically talk to.

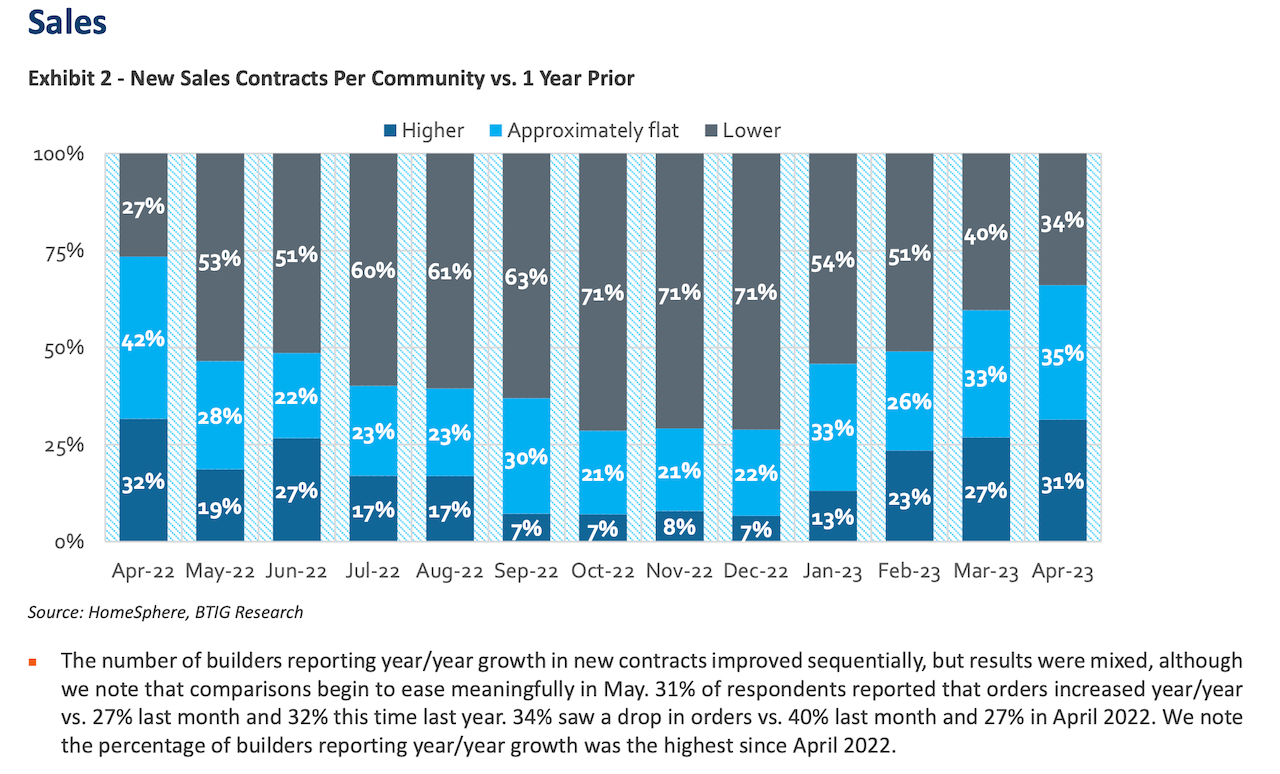

Here's what BTIG research analyst Carl Reichardt highlights from the April BTIG/Homesphere survey, which likely captures a more narrowed universe of mid-sized to large privately held and public homebuilders in its research set:

- Sales & traffic trends continue to pick up sequentially. 31% of respondents reported yr/yr increases in sales orders per community vs. 27% last month and 32% in April 2022. 34% saw a yr/yr decrease in orders vs. 40% last month and 27% for the same month last year. 34% reported an increase in yr/yr traffic at communities; 27% saw a decline vs. 29% and 29%, respectively, last month. We note that year/ year comparisons for both sales and traffic begin to significantly ease in May.

- Sales & traffic performance relative to internal expectations continue to be encouraging. 38% of respondents saw sales as better than expected; 20% saw sales as worse than expected. Last month, 38% of respondents saw sales better than expectations and 18% saw worse. 42% of builders saw traffic as better than expected, while 15% of builders saw traffic as worse than expected (34% and 13%, respectively, last month).

- Builders increased prices sequentially, but both pricing activity and the use of incentives remains mixed. 30% of builders reported raising either "most/all" or "some" base prices vs. 21% last month, while 17% of builders lowered "most/all" or "some" base prices vs. 22% last month. 22% of respondents reported increasing "most/all" or "some" incentives vs. 27% last month, while 7% reported decreasing "most/all" or "some" incentives vs. 10% last month.

Wolfe Research's Truman Patterson echoes a constructive outlook in his take on the NAHB/Wells Fargo HMI data release today, with two caveats, one pointing at a weaker Traffic component of the index, and the other fair point, that even an index of 50 falls short of an expanding housing market:

At 50, the HMI is demonstrating a New Home industry moving back toward expansionary territory. After a few months deceleration in MoM improvement, the HMI’s sequential increase in May was the second-best performance since the market inflected in January. Clearly, the release is a positive for the builder equities appreciating the 5-point gain in “Current” sales to 56 and 7-point gain in “Expectations” to 57 driven, in part, by limited resale inventory. That said, the group is under pressure given the 5-bps move higher in the 10-year yield and weak overall tape. Notably, the “Traffic” reading improved a more limited +2 points MoM to 33." – Wolfe Research

As Patterson points out, higher-for-longer mortgage rates may be a helping wind in a context of scarce existing home inventory, but for how long? And how long before credit tightening and adverse lending among the nation's regional banks pronounce itself as a factor in builders' need to refresh their lot supplies to continue growing? And how long before consumer spending habits – piling up credit and debt, and channeling more resources to services vs. durable goods – start working their way into their wherewithal to come up with down payments and monthly payments?

At the raw data level, the story for the past half a decade has been one of swelling fundamental demand colliding with constrained supply. So for now, the simplest explanation for why homebuilders' sentiment is bouncing upward will have to be this one.

It's complicated."

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.