Leadership

A S.W.O.T. For Homebuilding In 2023 Might Look Like This

Real demand and its plain as day causes has reset a 2023 talk-track from a playing-on-defense to one that's -- cautiously -- driving toward more rapid growth on offense, with more production and more investment to feed the machine of future growth.

Mixed signals, tricky, fickle conditions, crosscurrents, and conflicting opinions among long-experienced experts.

Real demand and its plain as day causes has reset the 2023 narrative from a playing-on-defense posture to one that's cautiously driving toward more rapid growth on offense – with more production and more investment to feed the machine of future growth.

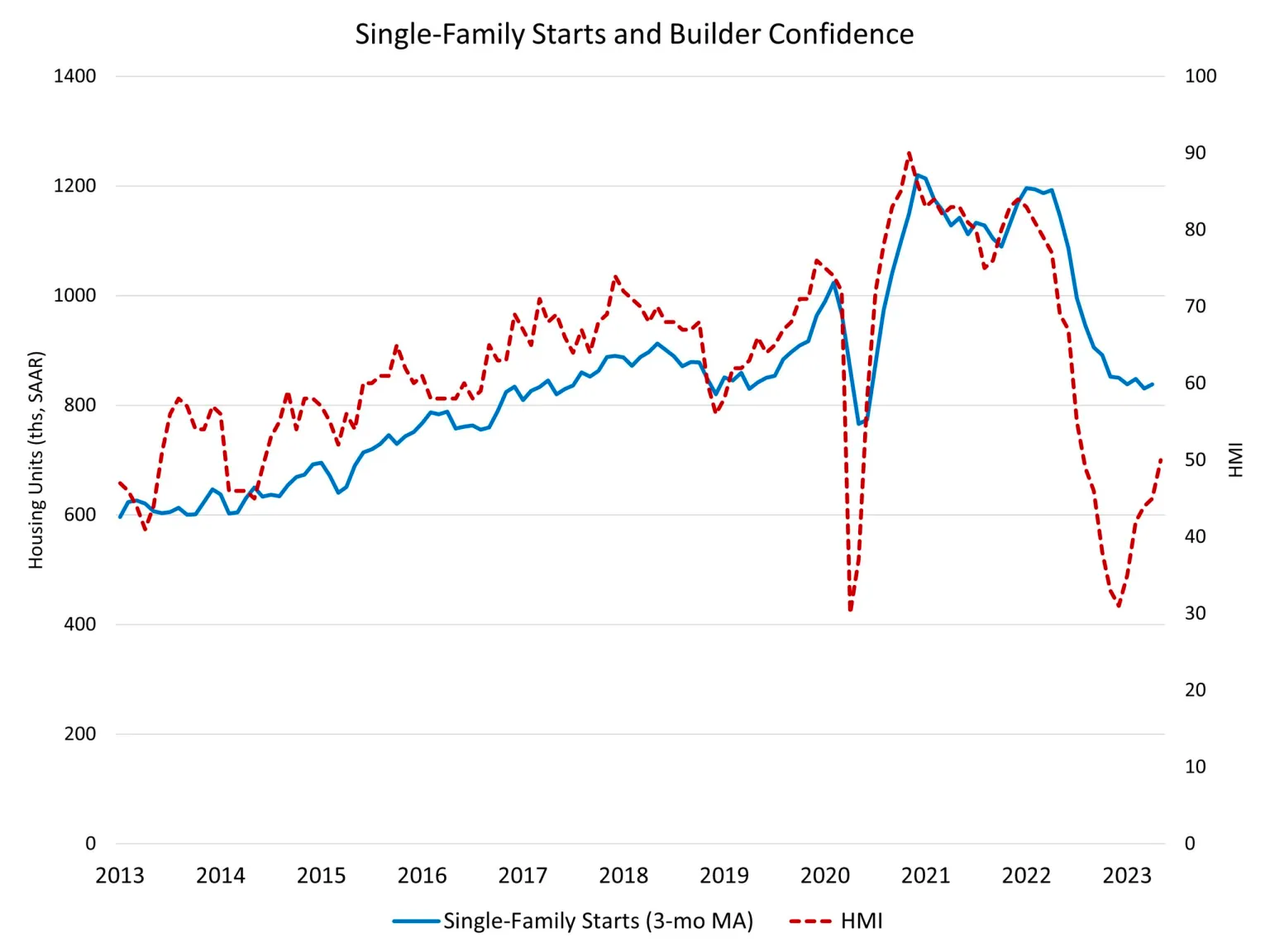

Housing starts have now built on four months' showing of a sturdy floor below ongoing upward gains.

Says National Association of Home Builders' chief economist Robert Dietz:

The April reading of 1.40 million starts is the number of housing units builders would begin if development kept this pace for the next 12 months. Within this overall number, single-family starts increased 1.6% to an 846,000 seasonally adjusted annual rate. However, this remains 28.1% lower than a year ago.

Thing is 20% to 30% lower than Q1 2022 falls within the "normalizing" ballpark many homebuilding enterprises can tolerate. Homebuilders – public, private, national, multi-regional, regional, local, and single-market – mostly put themselves in a position to absorb a quick, deep blow to pace and pricing levels everybody knew were unsustainable.

They did that by being smart with money and land risk, agile when market dynamics demanded that they use their accordion-like balance sheets to rid them of as many variable costs as possible, and make sure that all costs reset to a per-new-home profit margin that could give the company staying power through at least a stretch – perhaps seven to 12 months – of harsh times.

Further, many pivoted practically overnight from managing demand to generating it, and they did it with neighborhood by neighborhood, practically customer by customer tactics and tool sets aimed at catalyzing wins and mitigating negative outcomes among backlog customers that felt they bought last year at a price they'd regret.

Let's do an experiment that, if you participate, will generate value. Why? Because, whether you're sweet or sour on the broad business outlook for new home construction over the next six to 18 months, a consensus on which factors – both external and internal – will make the most difference during that time period is important to recognize and learn from.

So, if you were doing a simple, concise S.W.O.T. analysis today – not just for a single company, but for the new residential construction and real estate complex and business community – how would it bullet out?

For starters (and we hope you'll tear this apart and give us your take on what should be noted and why) we'll take a shot. Remember, this is a broad-strokes take on big, medium, medium-small, and small production-style builders and their operational and business partners.

2023 Strengths:

- Improved professional business balance sheets, with low debt/leverage and gains in SG&A productivity

- Agile organizational structures that can accordion-down on variable costs and focus on per-square-foot and per-home margins to subsist through adversity

- A business model that can make money at scale, and, if necessary, at reduced scale

- Team-centric operational approaches

- Product set that fills a market need, i.e. move-in-ready spec homes vs. low- to no-resale inventory

- More repeatable and standardized products and construction processes than in prior eras

- Evolved appreciation of homebuying and renters' needs, values, attitudes, preferences, options to go elsewhere, and willingness to pay

- Cycle tested negotiation teams, local intelligence, and relationships at work in land acquisition and purchasing

- Data-powered and integrated operating teams

- Character and culture proven through hard times

2023 Weaknesses

- A broken people development chain – i.e. older experts and highly skilled talent, and junior-level highly inexperienced team members with little to no natural internal learning and achievement systems

- Affordability impasses – predominant focus on taking marketshare versus developing products and processes to expand the market

- Focus distortion – industry-wide view that everyone's need for shelter means builders' capability, not consumers' needs, should drive product investment, development, and design

- Entitlement risk – almost universal local struggle on the process of bringing new housing development to reality.

- Capital risk – Imbalances of short-term priced borrowing and investment capital for long term returns.

- R&D averse – research and development, including on fundamental new construction technologies is inevitably vulnerable to reduction in variable costs during cyclical downturns, exposing sector to operational stagnation

2023 Opportunities

- Value re-engineered products and property locations that price-in an expanded buyer universe

- Data-enabled "digital thread' matching of specific customers with homes designed and featured with what they value, minus any feature they do not value

- Building out hybrid live-work communities that balance access to work-centers and access to outer-ring places people can afford and enjoy

- Rebuilding firms that leverage business success around both customer and team member-centric cultures

- Proving out use-cases in building technologies that improve resiliency, energy and water performance, and total-cost-of-ownership value

2023 Threats

- Regional banking instability

- The future of work – influenced by AI and changing economic drivers – arriving ahead of schedule, impacting jobs, income, and wherewithal

- Geopolitical instability, impacting resources, economics, supply chains

- A skilled construction labor capacity collapse

- A debt default

- A growing local regulatory resistance to affordably priced new development

Strengths, from our point of view, outnumber all the other force factors here, and the No. 1 strength is the character of the community's leaders. Help us out. What would your S.W.O.T. analysis of homebuilding writ large look like right now?

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.