Capital

A Private Builder's Survival Guide For A Bumpy, Choppy '24

Ten critical strategies and tactics to take on 'Higher-For-Longer' and come out of it better and stronger.

What’s exactly the same in late 2023 as it was 12 months and two years and five years ago? It's simple: Structural demand for homes is large, and accelerating. So too are constraints on new supply.

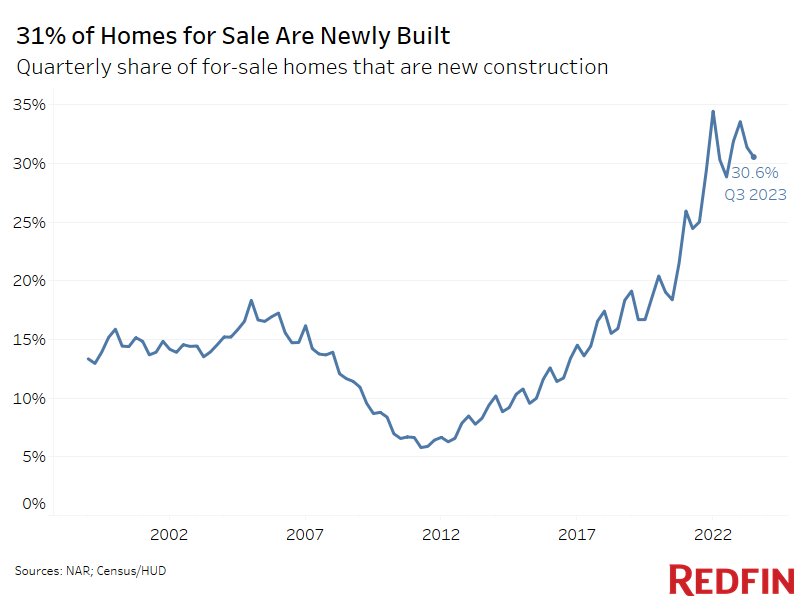

The good news in this for new-home real estate and construction companies has been that interest rates’ more-than-doubling in the past 20 months effectively froze out their biggest source of competition: the existing homes market. A Redfin analysis this week notes that 31% of homes for sale in Q3 2023 were ground-up new construction, up from 28.9% a year earlier, and from 25% in the same period in 2021.

"The only game in town," right?

What’s lost on many observers, however, is that being the “only game in town” vs. a depleted and altogether uninspiring crop of resale homes doesn’t actually make a homebuilding operator truly the “only game in town.”

Not by a long shot. Unless, of course, no other homebuilders – especially the larger ones whose stock symbols trade on Wall Street’s stock exchanges – do business anywhere near where your firm operates.

The not-so-good news, particularly for a privately-capitalized homebuilder operating in markets and submarkets where other bigger and more financially powerful competitors plant their flags is that these heftier, deeper-pocketed rivals have made it known they’re gunning right for everyone else's business – customers, vendors, land-sellers, etc. – of any and all players, large, medium, and small, in each of those operating arenas. What’s more, as a privately-held new-home builder – for-sale or for-rent – you’re truly not only not “the only game in town,” but rather, you’re the game others are coming directly after.

In that context, strategic and tactical bright lines have emerged that will shape how well privately capitalized homebuilding firms may fare as the new-home real estate market itself undergoes further stresses, shocks, volatility, and uncertainty during 2024, and perhaps beyond.

There are multiple pain points for builders of all sizes and scale during this truly unique time in our industry,” says Brad David, Executive VP of development and construction at Snap.Build, a partner of The Builder's Daily. “Most have accepted the ‘higher-for-longer’ reality when it comes to the rate environment. As a private lender, Snap.Build is uniquely suited to help our clients adapt and thrive through the challenges. Not only have credit boxes tightened, but the availability of credit in the spec and BFR space continues to be harder to find. Our ability to continue to put runway in front of our clients is a differentiator in our space.

We still have a significant inventory shortage across the country. Our builders that have been prudent and run their business efficiently are in a position to provide that missing inventory. I hate to use too many cliché’s but the reality in our business is you have to have 'rainy day' money for times like this. As capital costs rise and margins erode (some might say margins are actually correcting), builders need to have the ability to operate lean and be more efficient in their processes. All of those dollars go the bottom line and will ultimately allow them to build inventory as we cycle out of this period. The builder that can put product on the ground at the right price point will have a significant advantage in the coming months.”

Operators with lower debt and financial risk tied to upfront land and development costs are likely to find themselves with greater runway, even through a period of rougher-sledding. So, too, will be homebuilders whose operations meet and improve on standards of excellence for strong customer matching and buyer-incentive programs, diverse product sets, high-velocity inventory turns, and nimble options for on-demand lot pipelines – an asset-light, even-flow starts-sales-settlements operational model to meet the needs of buyers in both more-affordable and more discretionary price tiers.

Chances are, as big public nationals battle to swipe share by any and all means, you're going to have to dig deep on pricing and work every tool in your tactical tool-box to crush expenses out even as you maintain volume and velocity.

Anyone that has been in this industry for an extended amount of time understands the true cyclical nature of what we do," says Snap.Build's Brad David. "However, one consequence of these challenges is that the cream will rise to the top. The builders that accept the realities of higher rates and subsequent margin erosion and choose to identify solutions rather than focusing on the negatives will come out of this better and stronger."

Here are ten “survival guide” practices that every operator should already be well into considering, preparing for, and adapting to future-proof themselves for a higher-for-longer near future for capital costs, coupled with an ongoing scenario for weaker economic conditions.

- Become a net land seller to add capital resources to build through adversity

- Capture back construction cycle time

- Renegotiate terms with suppliers based on right-sized pace and volume outlooks for 2024.

- Double-down focus on your talented team members, and on builder-of-choice trusted trade relationships.

- Centralize field and office data into single-source-of-truth operations, finance, procurement, pricing, etc. systems

- Tune pricing, concessions, incentives, etc. to steady and stabilize pace on a subdivision level in real-time.

- Access real-time data to keep pace with target homebuyer customer profiles as they evolve in light of changing economic conditions.

- Balance product diversity to serve both entry-level, first-time non-contingent buyers, as well as higher-end discretionary buyers are less price- and mortgage-rate sensitive; also diversify as a build-to-rent construction platform.

- Balance spec with build-to-order for efficiency/velocity on entry-level product, and to access greater margin opportunity on the build-to-order offerings

- Focus on a strong customer shopping and purchase journey and experience

All builders have to take a hard look at their operations, processes, and systems during these challenging times," Snap.Build's David adds. "Now more than ever is the time to ask the hard questions. 'Do I have the right people in the right seats on the bus? Do I have the right capital partners that can not only help me survive, but thrive?' I see a lot of builders that built their businesses post GFC, and the next 18-24 months will truly challenge them. The builders that have been through challenging times will also need to marshal that experience and put to work those hard lessons learned."

Snap.Build provides builders with funding for residential construction projects. Snap.Build offers a non-recourse loan structure, competitive rates, and efficient loan closing.

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.