Leadership

A Pivot To A 'Hearts And Minds' Mentality Can Alter Labor's Arc

People's "emotions and reasoning" would need to evolve before a solution to the No. 1 business risk for all organizations – tiny, small, medium, large, and giant -- doing business in the residential construction space can surface.

With a pairing of terms, Merriam-Webster defines an almost universally assumed requirement for success – or reason for failure -- in any endeavor involving others.

hearts and minds, plural noun: people's emotions and reasoning"

The pairing goes beyond what each term means, and as a blend of one-plus-one in capital and coin of the realm, the result of the synchrony is an exponential force factor, a driver of outcomes, of consequence.

Capturing the plain language power of the blend as it relates to a close-to-home topic we'll talk about 'til we're blue in the face, one of The Builder's Daily original Dream Team advisors, architect Marianne Cusato put it like this:

That was two years ago, almost to the week. Cusato's ultimatum-like declaration to leaders in construction and related-fields businesses is none other than a "hearts and minds" challenge.

People's "emotions and reasoning" would need to evolve before a solution to the No. 1 business risk for all organizations – tiny, small, medium, large, and giant -- doing business in the residential construction space can surface.

We've phrased the challenge in a framework not dissimilar to one looming as a menace over the U.S. economy right now, the debt-ceiling crisis, as "the builders' cliff."

It’s said that for every newcomer to one of homebuilding’s key skilled construction trades, five experienced, highly qualified, site-trained tradesmen and women retire out of the field.

The squeeze – such as we are experiencing in the imbalance of skilled construction workforce members, compared with increasing demand — today causes cost-inflation, inefficiency, and a loss of predictability in timing the delivery of new homes.

But, when that same trend accelerates, logarithmically, and you, further add other shocks and stresses to the trend — (immigration outflows impact to workforce, and impact of re-flow into other fields, and reduced flow into building).

The scenario gets darker, faster.

Risk becomes an almost certain threat. A systemic freefall in capacity breaks not only an individual firm’s ability to take-on and complete construction work. It can cripple the entire building sector’s capability at developing, producing, and benefiting from new homes and communities. That affects everybody." – The Builder's Daily

The follow-on effects of this structural destabilization in building capability include paralysis in addressing the housing business, technology, capital investment, and real estate community's biggest challenges. They're also the defining opportunities of this century, and they stem from a "hearts and minds" issue around attracting, engaging, and empowering an influx of frontline, back-office, and corner office talent:

- Affordability

- Sustainable homes and communities

- Resilient houses and neighborhoods in light of greater natural hazard risk

- A weakened economy

That mathematical reality is and has been a known, and many, many business people recognize its gravity. They experience it first-hand, in the morning, noon, and evening – and tossing-and-turning night-times, too – of their operations. They manage amidst a cascade of impacts this reality sets off.

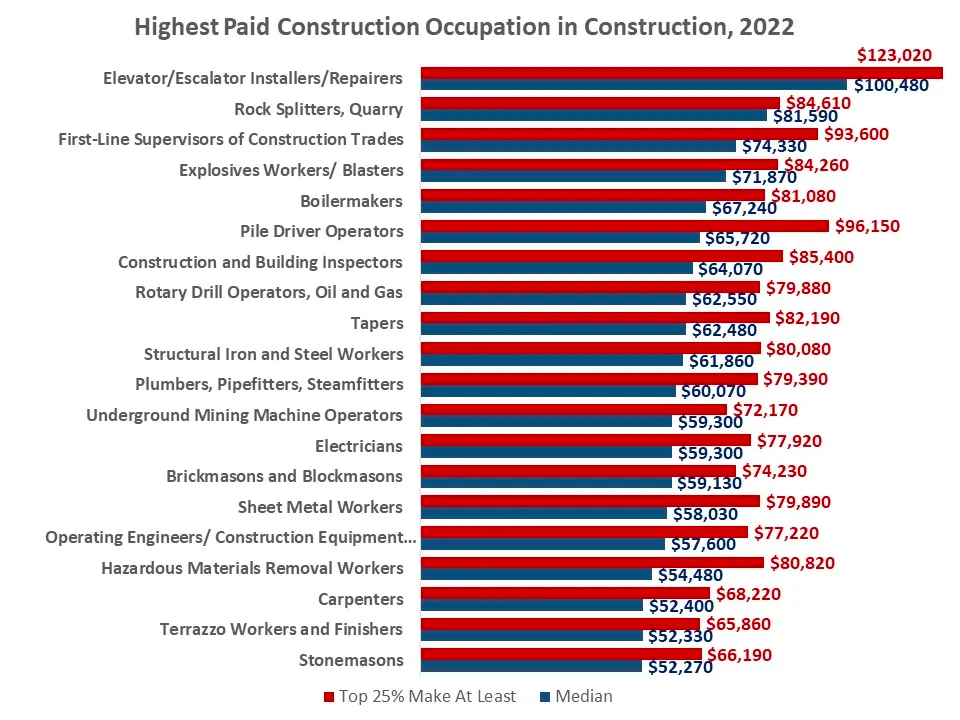

In this context, have a look at this chart from the National Association of Home Builders, which focuses on the "highest paid" construction occupations in the construction sector from 2022 Bureau of Labor Statistics data.

NAHB assistant vp for Housing Policy Research Natalia Sianavskaia writes:

In general, construction trades that require more years of formal education, specialized training or licensing tend to offer higher annual wages. Median wages of construction and building inspectors are $64,070 and the wages in the top quartile of the pay scale exceed $85,400. Half of plumbers in construction earn over $60,070, with the top quartile making over $79,390. Electricians’ wages are similarly high."

Carpenters are one of the most prevalent construction crafts in the industry. The trade requires less formal education. Nevertheless, the median wages of carpenters working in construction exceed the national median. Half of these craftsmen earn over $52,400 and the highest paid 25% bring in at least $68,220."

Making a case among those in their formative years as young and adolescent kids that jobs in the building trades pay pretty well amounts to table stakes in our future of work and livelihoods era.

Further, despite the BLS data, reality for frontline workers may be starkly different than those statistics indicate:

More than 51% of the Russell 1000 are not paying their employees a living wage. Why not? Because companies are pressured to reduce costs in order to return more money to shareholders and labor is the biggest “cost” for most companies. – Fortune

The good news for firms of all sizes in residential building and related trades is they're not starting on this issue from square one. Rather, they've got a jump start. That's because although the sector is still largely unconsolidated, local, and hyperlocal by nature there's no shortage of entrepreneurs, owners, managers, executives, and invested stakeholders who've gotten, internalized, practiced, inspired, motivated, and empowered a "hearts and minds" business when it comes to their homebuyer and home renter customers.

The next big leap for business leaders is to begin to recognize team members with the same sense of value they've always done with buyer- and renter customers.

When those people – those business owners and leaders, fathers and mothers alike – are connecting socially with friends or neighbors and can honestly celebrate that their young child as chosen construction as a livelihood, and as architect Marianne Cusato says "brag about it," the hearts and minds battle will be won.

MORE IN Leadership

Leadership Transformation, Not Just Another Industry Event

At Focus On Excellence, Chris Ertel and Johanna Buurman will lead a hands-on, transformative journey for homebuilding business leaders ready to move beyond analog operations.

Where Homebuilding Wisdom And AI Talent Build What's Next

Focus On Excellence 2025 is where hard-won insight meets next-gen fluency—in one room, for two days, to build what’s next.

Certainty Sells Homes: Simplicity As A Spring Lifeline

Buyers are nervous—and uncertain. Builders who embed clarity, trust, and insurance upfront gain an edge. Exclusive insights from Westwood Insurance Agency’s Christine Geeslin show why radical simplicity is no longer optional.