Leadership

A National Homebuilding Comp Report Details Industry Pay Grades

FTS's new salary survey includes 73 titles across six key functional homebuilding departments, with a geographical cost of living index filter for each major MSA.

- Affordability's sunk to decade-long lows.

- Interest rates are parked in higher-for-longer mode until at least May this year.

- Regulation, zoning, and local barriers lay out minefields of entitlement risk.

Building homes affordably for people – and making money doing it – has long had unappreciated challenges, ones homebuilding and development business leaders have tackled time and again. Now, though, it seems harder than ever, and with higher stakes, to boot. Consider:

Few milestones in life mean as much to the American Dream as owning a home. And millennials have encountered the kind of trouble totally befitting their generation, which largely graduated into the teeth of the disastrous post-2008 job market. Just as they entered peak homebuying and household formation age, housing affordability is at 40-year lows, and mortgage rates are near 40-year highs.

The anxiety this generation feels about the prospect of never owning their own home affects their entire perception of their finances and the economy, says Moody’s chief economist Mark Zandi.

“If they feel like they’re locked out of owning a home it colors their perceptions about everything else going on in their financial lives,” Zandi says.

Millennials have long been dogged by a brutal housing market. They faced not one, but two, cataclysmic economic events—the Great Financial Crisis in 2008 and the pandemic in 2020. Both of which left them reeling financially and struggling to afford a home. The Great Recession decimated the real estate market as the economy nearly collapsed under the weight of tenuous mortgage-backed securities. While the pandemic brought with it a remote work boom that caused millions of citydwellers to flee to the suburbs, sending housing prices soaring."

For homebuilding organizations – like any businesses that bridge real estate, technologies, manufacturing, marketing, distribution, and finance – thriving in the unknown is not a fuzzy cliche, it's a hard fact of business viability. For homebuilders and their partners, the hard reality offsets the unknowns, and volatility of the present moment comes down less and less to lots and more and more to capability.

Days of buying land cheap and letting it appreciate into predictably healthy internal rates of return at a given inventory turn ratio are gone. Today, it's no exaggeration to say that every lot purchased contains multitudes of insights into operational excellence, strategic leadership, competitive intelligence, customer focus, and a business culture of capability.

So, affordability, interest rates, regulatory burden, labor capacity, land, and building materials may seem to define the key challenges to organizations striving to build affordably and make money doing that, but they don't.

Those issues matter secondarily to a root challenge – and opportunity area – for homebuilding organizations. It's not about having the right real estate or deep pockets of capital. It's about having the people it takes to recognize, address, and solve those challenges.

[Get FTS's National Homebuilding Compensation Report]

A recently retired regional president of one of the nation's top 10-ranked homebuilders helped frame this ordering of focus this way.

We've seen a dearth of talented people coming into the business starting with the GFC," he tells us. "At the same time, the ones who were young – in their 20s and early 30s in 2009-2012 are all the more valuable now. They’ve worked through a whole new and different era of asset-lighter, leaner, more-integrated accountability management. And they've learned to navigate and thrive with far fewer layers of staff than in the 2000-to-2008 period. So, it’s meaningful to focus on retention of these 35- to 45-year-olds who’ve been rising in the ranks. They're a lynchpin to surviving and prospering through the next stretch."

They're also the ones who are an organization's best bet of finally attracting that next generation of young incoming, curious, hungry, digitally- and A.I.-savvy team members up and down homebuilding's value chain.

In this context, one of the residential construction and development sector's leading executive recruiting, staffing, and strategic advisory services, FTS – a supporting partner of The Builder's Daily – has introduced a National Homebuilding Compensation Report, including 73 titles across six key functional departments, with a geographical cost of living index filter for each major MSA.

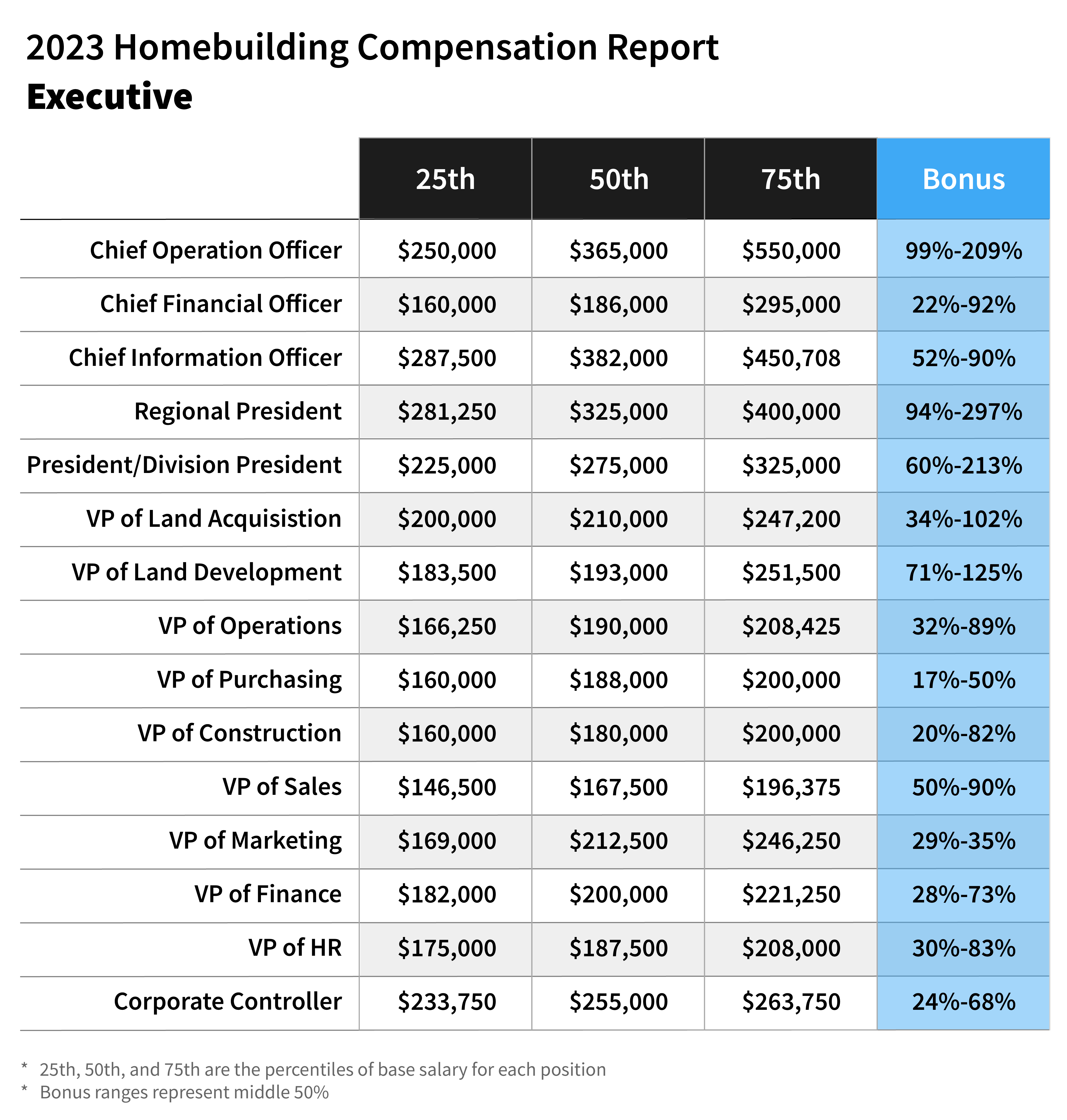

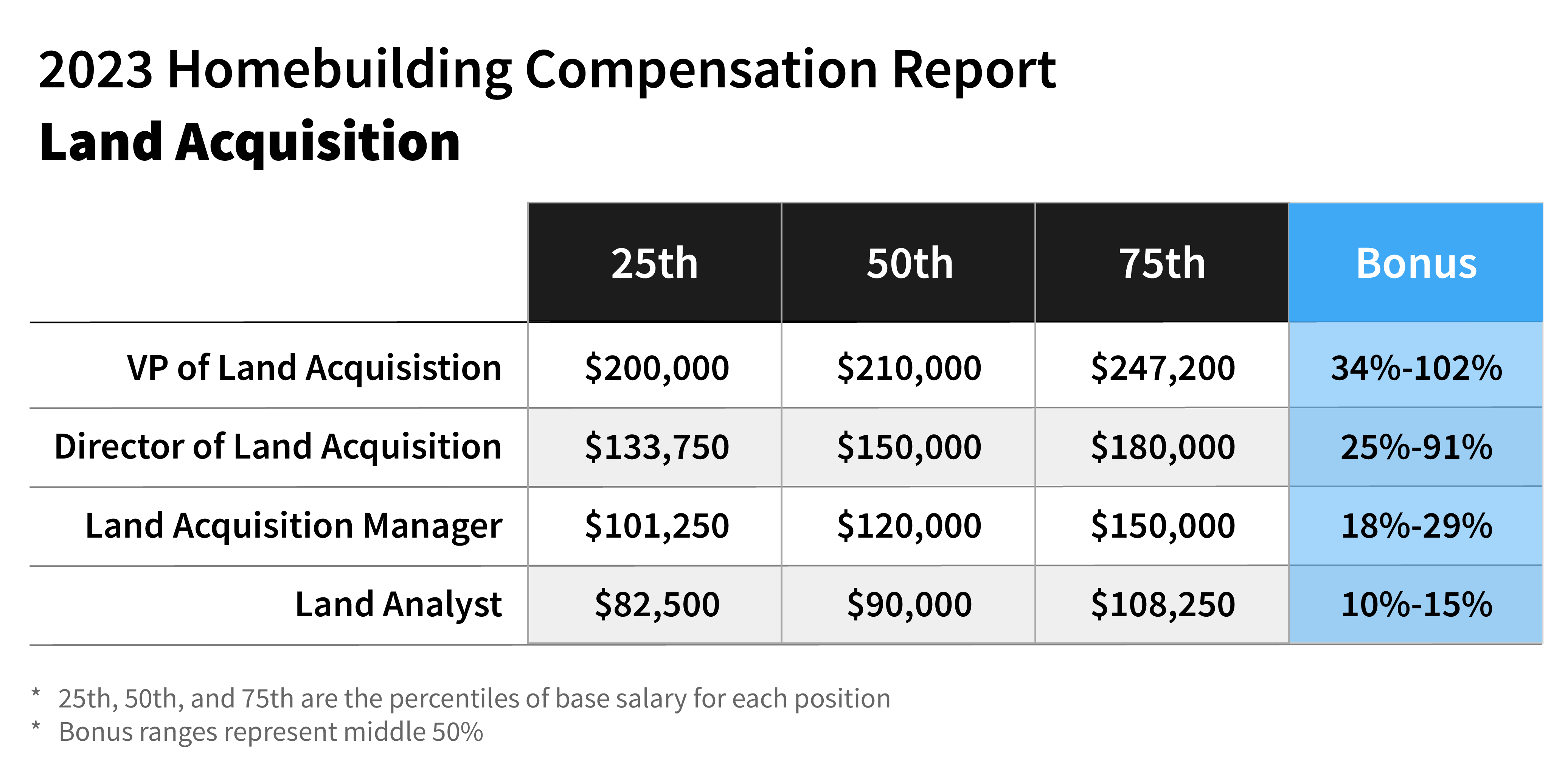

For each of the separate titles, three percentiles describe the base salary ranges, while a fourth column indicates the broad dollar-amount ranges for merit- and performance-based bonus awards.

One thing is clear: in practice, we find our builder clients that typically pay closer to the 75th percentile of the ranges within our report obviously attract more talent," says Thomas Carpitella, CEO of FTS. "Beyond that – the retention rates are significantly higher than those that tend to pay lower than the 50th percentile. The builders that take competitive compensation trends seriously and regularly review these trends are the ones capturing the top talent within the industry and offering long-term homes, which result in the ultimate competitive edge.

Retention – a term that translates into higher-level capability, experience, and adaptability in times of land shortages, financial volatility, labor capacity chokeholds, and unpredictability – is especially key in the land acquisition and development area. Those disciplines intersect directly not only with investment and lending, customer focus on desirable locations, and design and construction, but on local knowledge and relationships with land sellers, municipal officials, and permitting agencies.

Getting recognized as a preferred builder has become an increasingly important strategic, operational, and competitive goal, as market share rivalries have tended to concentrate with ever higher stakes in growing economic centers, mostly in the U.S. "Smile States" girding the Mid-Atlantic, down through the Southeast, and across Texas, up the West Coast to the Pacific Northwest.

The value in this report is the barometer that these numbers should provide on how likely you are to continue to attract new talent and retain your existing talent, as the industry and competitive landscape becomes more consolidated throughout the US," Carpitella explains. "Attracting and retaining talent is multifactorial in that compensation is typically not the only thing most candidates care about. However, we do believe these numbers will continue to rise. For firms' interested in engaging with top talent within the industry, competitive compensation will be tablestakes to even connect with these types of candidates."

Of course, attracting and retaining talent exclusively from within the current pool of team members currently working at America's homebuilding enterprises represents diminishing returns if that pool is not replenished with new, next-generation business, real estate, and construction solutions seekers entering the field out of high-school, college, and graduate schools.

We strongly encourage all builders to accept this regular business practice as a responsibility to the commitment of optimizing your culture and business and positively contributing to the industry," Carpitella says. "We hope this report can be used by the industry at large to also demonstrate to those outside of the industry the wide variety of extraordinary opportunities that exist within homebuilding, not to mention the sheer amount of earning potential one can achieve within this amazing industry, no matter what the career path."

Staffing and recruiting done right. Fast Tracking Solutions specializes in delivering top talent in accounting/finance, construction, and technology operations.

MORE IN Leadership

10 Bold Ideas Tackling Housing Affordability And Access Now

From AI to hempcrete, these 10 ideas show how innovation in design, finance, and policy can open the door to housing affordability.

Sumitomo Forestry Sharpens U.S. Focus With DRB Move

Strategic clarity replaces portfolio sprawl as Sumitomo bets big on U.S. scale and integration.

Homebuilders and Insurance: A New-Reality Cost To Stay Ahead

Exclusive insights from Westwood Insurance Agency’s Alan Umaly and MSI’s Naimish Patel reveal why homebuilders must rethink insurance, resilience, and risk management—or risk losing buyers in an increasingly volatile market.