Capital

A Housing Finance Investment Model Sparks Hope For Black Wealth

A new episode of Ivory Innovations' House Party podcast features Aisha T. Weeks, Managing Director at The Dearfield Fund for Black Wealth, and Catherine Toner, Managing Director for Impact Investing at Gary Community Ventures.

We must accept finite disappointment, but we must never lose infinite hope." – Dr. Martin Luther King Jr.

Hope is not a strategy, but without hope's sustenance, a strategy may be meaningless. And as the legacy of Martin Luther King, Jr. lives and continues to spread its impact, a dream may not be a plan, but without the fuel of a dream, a plan may be empty of motivation and patience it will take to accomplish it.

Within the context of America's chronic housing crisis, strategies minus hope and plans unsupported by dreams practically doom that crisis to run on and on into an indefinite, long future.

Consider four data points from the 2023 State of Housing In Black America report:

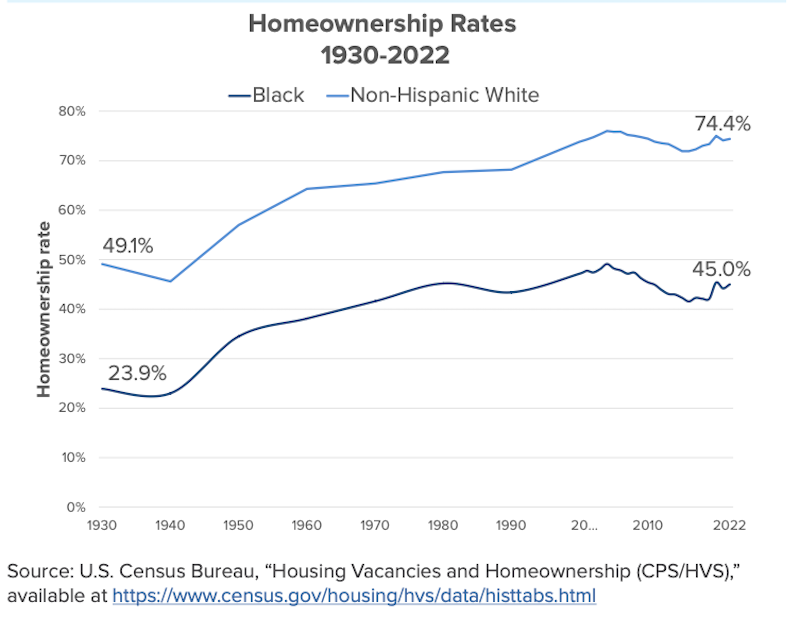

- In 2022, the Black homeownership rate stood at 45 percent, only modestly higher than the level at the passage of the 1968 Fair Housing Act. This disparity in homeownership rates between Blacks and Whites has expanded over the past half-century, reaching 23.8 percentage points in 1970 and nearly 30 percentage points in 2022. Notably, the current Black homeownership rate remains well below its 2004 peak of nearly 50 percent, highlighting persistent challenges in achieving equitable homeownership outcomes.

- The wealth gap between Black and White households widened significantly over time. Today, the median net worth of White households is $250,400, compared to $24,520 for Black families.

- Housing affordability continues to be a particular obstacle for Blacks in 2023. According to NAR, “Less than 10% of the Black renters can currently afford to buy the median price home.”

- In 2022, the Black millennial homeownership rate was 30 percent, which is half the size of the 61 percent homeownership rate for White millennials.

One of the report's conclusions:

Neither improvements in employment nor modest wage gains are sufficient to narrow the racial wealth gap. Asset appreciation contributes more significantly to increasing household wealth than wage gains. Because White households have higher valued assets and more diversified investment portfolios than Black households do, the racial wealth gap between those two populations will continue to grow in the foreseeable future."

Altering that foreseeable future means accepting "finite disappointment" and never, ever losing "infinite hope." To bridge that gap takes a strategy, and a plan both undergirded by that infinite hope and by a dream that strategy and plan can build that bridge despite all odds against it.

[Listen to Episode 1 of the House Party with Ivory Innovations – released in partnership with The Builder's Daily – by clicking here.]

Those four forces converge, for example, in the work of The Dearfield Fund For Black Wealth, which provides up to $40,000 in down-payment assistance to first-time Black and African American homebuyers to help build generational wealth. Launched by Gary Community Ventures, in partnership with Denver's Black community, The Dearfield Fund For Black Wealth aims to close the racial wealth gap and accelerate Black homeownership by generating an average of $100K in net worth for 500-600 Black families, leading to $50-$75M in wealth creation for the Black community in Denver, CO.

The strategy is an investment model that returns its investment partners two kinds of capital – one, financial profit, and the other, impact capital. The plan is to catalyze that capital, and at the same time, raise the motivation and determination among potential borrowers to participate. Add newly kindled hope and the timeless dream to live in a decent home and to build family wealth, and the recipe is complete.

A 2023 Ivory Innovations honoree in the finance category for Innovation In Housing Affordability, the fund seeks to build a community of practice and replication model to assist other cities in deploying this innovative fund model in their markets.

So, how can innovative fund models increase generational wealth? In our inaugural episode, learn about how The Dearfield Fund for Black Wealth got its name, how the fund started, and its impact on Black families in Colorado thus far.

Here's Hannah Gable, director of Strategy and Operations at Ivory Innovations in a brand new episode of our House Party podcast, featuring Aisha T. Weeks, Managing Director at The Dearfield Fund for Black Wealth, and Catherine Toner, Managing Director for Impact Investing at Gary Community Ventures.

Here are a few highlights of the conversation:

Origin Story

Catherine Toner

In 2021, in the wake of George Floyd's [murder], our former CEO Mike Johnston and our current CEO and CIO Santhosh Ramdoss explored ideas about ways to bridge the racial wealth gap using housing as the focus and in particular, homeownership. So it was kind of a nebulous idea, as we began, I joined in 2021 kind of when the idea of a fund had come to light but the implementation of what that would look like was still TBD. I have a background in investment banking and impact consulting, and so was able to dive into the nitty-gritty of what a fund concept would look like on the home buyer and investor side of things and so that’s where it kind of started, and then got into a lot of detail on the legalese and the fund structure of Dearfield.

Aisha T. Weeks

In the wake of the murder of George Floyd gave exposure to racial disparities in our country. Among a lot of people in organizations, there was a lot of soul-searching that went on around the country for how organizations and individuals could positively impact an issue that has been long-standing for decades and centuries. For me, from the work that I was doing in financial services as well as my work in community development, I saw the gaps in access to capital. The carrot we dangle in terms of the Community Reinvestment Act for financial institutions to create products or incentivize them to create products that work for lower to moderate-income communities or even communities of color uniquely just wasn’t there, and in my opinion, wasn’t working in the ways that it should’ve. So to know that an organization such as Gary Community Ventures was really thinking this through, not from a public standpoint or a non-profit in terms of charitable contributions but rather looking at it as an investment. This is something that I believe, and the data show that the black community as well as black households have been denied investment, so I was drawn to this as a model and understanding that we can prove the point here in Denver and knowing that is an opportunity for it to scale nationally was also exciting as well.

Why Dearfield?

Aisha T. Weeks

Dearfield is a town located around 70 miles outside Denver, Colorado. And it was the first black homesteading community in Colorado. It was founded in 1910, by a businessman turned farmer O. T. Jackson, who believed that for black people to have a foothold in the American dream they needed to own property and land. So the name Dearfield came from `these fields will be dear to us,” and embodies the hope that these families had as they came into this unchartered part of the country with the hope of having ownership and agency over their lives. So it's that belief in ownership as the pathway to the American dream and pathway to prosperity that is channeling that dream and mission of those early settlers and the homestead in Dearfield.'

Investment Model

Catherine Toner

The fund itself is two outwardly facing structures. One is on the homebuyer side. It's a shared-depreciation product that is in the form of debt as a community second or silent second mortgage alongside their primary mortgage. The Dearfield Fund, provides up to $40K at the outset and throughout homeownership or up to the point of refi (refinance) the homebuyer pays no principal or interest on that amount. It’s at the point of sale or refi that the homebuyer, or homeowner at that point repays the $40K and just 5% share of the appreciated value of the home. And so it's a way to keep the fund sustainable and in a more traditional private equity product, but it's a silent mortgage, a silent debt product on the back end for them in the homeownership journey. On the investor side it looks a lot like a traditional private equity fund, so there are mission-aligned investors with Gary as the general partner of the Fund, Gary Ventures Inc. Our family office entity and we take in investment dollars and use those dollars to allocate those $40K amounts to homebuyers that qualify according to the program criteria and then repayment of the initial investment and a modest anticipated return comes from the principal amount and the shared appreciation.

The program-related investment is an investment that counts for a foundation toward the 5% that foundations are required to distribute in grants and other charitable activity in a given fiscal year and traditionally that’s been on the debt side, it’s very easy to measure what percentage of a coupon or an interest rate is below market relative to where the fed funds rate is, etc. Equity PRIs are also program-related investments they contribute to the charitable purpose but because it’s equity, investors are just now getting comfortable with really defining what that charitable purpose is upfront and the ongoing reporting that is required to maintain and kind of connect that charitable purpose to the investment on an ongoing basis. There is increased comfort with that. That is the primary mechanism for investors coming into Dearfield. We also have a structure called PRI debt aggregator fund for those that are not comfortable with that, we’ve partnered with a fiscal sponsor that is the equity member and then they facilitate debt investments on the back end. So, we have kind of a dual mechanism for accepting investment dollars based on where different investment committees or boards are and their comfort levels in doing equity PRIs but we hope that Dearfield and similar investments become kind of a standard that increases comfort with equity PRIs because that broadens the asset base that investors can use to advance their charitable purpose."

The Future

Aisha T. Weeks

We’ve received incredible interest thus far, even before my coming on board and during the time I’ve been the Managing Director for a little over a year now. We’ve had folks in markets such as Seattle, Philadelphia, Minneapolis, and folks around the country who are interested in the model. Because the racial wealth gap doesn't just exist in Colorado or Denver Metro (laughs) it's a national issue.

So I think that the fact that we’re reaching out but also that those other entities around the country are saying like “Hey, we’re interested how can we partner?” So part of our goals is really to create a community of practice and also think about identifying other markets and anchor institutions that we could potentially partner with to be able to replicate the model around the country. So replicating the model is one, so that’s obviously super important but we also as I mentioned about the black wealth playbook we’re wanting to peel back, fly open the curtain in terms of those key pieces that need to be implemented. A lot of times information is passed from one generation to the other at the dinner table, right? Those conversations just happen organically. Some communities don’t benefit from the dissemination of that, and so wanting to build that and then share it nationally is also a part of our goals. Not just replicating the fund, but also the models and the pillars for wealth so that it can be deployed across the country and we can see the same type of benefits and impact that we have in Denver Metro, we can see it around the country as well."

Action Item(s)

Catherine Toner

Number one is an anchor institution. It needs to live somewhere and needs to be driven out of a singular entity or person. Then, understanding the investable landscape. We did a lot of modeling to understand [property] appreciation historically in Colorado. What did that look like, conservatively, to make sure that the model worked here in Denver Metro and then the quantum of investment dollars that would be required to show that track record and that product market fit. Having those lending partners. We partnered with First Bank, as our anchor mortgage lending institution. They were critical in being open to an innovative model and structuring something alongside us. We work with Impact Development Fund which is a fiscal sponsor that does a lot of the admin so that the burden is not built out in a full fund structure. It’s creatively dispersed along the entire value chain while also integrating into more traditional mortgage lending practices. Then, making sure that there’s investor capital – if there’s interest in supporting black wealth and black wealth creation and buy-in to the model which is building wealth alongside families, all of the wrap-around services are critical to that wealth creation. There needs to be structure and support for the entire model."

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.