Leadership

A Homebuilder's Dilemma: Attainable Or Sustainable?

In the latest analysis of meaningful "drivers" of buyer-behavior, John Burns Real Estate Consulting's New Homes Trends Institute flags them both. Are they either/or or both/and options?

Laws of supply and demand apply in homebuilding, of course, as does an unwritten cardinal rule of nature, physics, and economics, that everybody needs a home.

So, too, do laws of friction.

The first rule set is chiefly why those who're the most knowledgeable and experienced about the business predict 2022 and beyond will be a solidly strong market. Low supply, high demand, and the quantitative measures that underlie each bode well for an active macro new-home development market.

The second set of forces, governing friction, can hide their impacts to supply and demand in plain sight. Supply and demand models purport predictability. Friction's forces can mess with both the horizon, and what's around the next corner. Further, supply and demand may be drivers of the economy, but friction works as a more important determinant of a given business's success or failure.

Which is why whether it's a rip-roaring, high-volume transactional dynamic, as so many forecast, or, whether the twin menaces of average-selling-price inflation and rising interest rate impact to monthly payment power, the business leader's challenge – for 5,000 firms that account each year for nine of every 10 new homes in America – has a common denominator: don't take friction for granted.

Put another way – understand that those building-block assumptions about demand may be susceptible to friction that can stress and shock your business, or the inverse, free it to thrive where others don't.

Demand may remain strong if either spiraling home prices or rising interest rates stressed the household wherewithal and payment power of the pool of buyers. We've yet to see the impact – on pent-up, current, and pulled-forward demand streams – when both of those frictional forces define the climate of homebuying opportunity. That sets up a winners and losers eventuality, one we're looking at now.

Here are friction points principals and strategists of homebuilding firms regard as the ones requiring the most vigilance and day-to-day navigation focus.

- Inflationary costs and their impact inputs and, ultimately, what they can pass through in sales prices

- Interest rate increases, impacting both their own borrowing and capital costs as well as the thickness of the pool of households that can qualify for mortgages

- Supply chain disruption and intensifying skilled-labor constraint

Factor those fanning forces of friction into the economic moorings of supply and demand, and the outlook – despite scarcity, aging housing stock, new macro migratory and hybrid work patterns, generational cohort-household formation trends, 2020s family formation, etc. – obscures somewhat.

Add in one more, less appreciated, point of friction – a foundational, evolving sea-change in what we know as consumer motivation and buying behavior – and the future of demand becomes downright opaque.

Let's look at an example of how this form of friction takes shape, and explore how it may work in the next three to five-year period for those organizations whose primary focus in calculating future business opportunity springs from sheer supply versus sheer demand readings and ratios.

The idea here is primal. People home in – by nature, and these days, as consumers in an experience-based economy – on their well-being, safety, health, privacy, and peace-of-mind. That unconscious code fires its set of instructions, powerfully fused with priority, preference, need, and attitude on location, price, and product features and functionality. Why he or she or they will become your buyer will come from what they know to be benefits and – importantly – what they feel to be values.

Consider what some believe to be the first expression of both building code and consumer friction, the Code of Hamurabi, from sometime between 1792 BC and 1750 BC, in Babylon.

229 ... If a builder builds a house for someone, and does not construct it properly, and the house which he built falls in and kills the owner, then that builder shall be put to death."

Fast-forward to now. In its deep-dive analysis of 22 Trends for 2022, the New Home Trends Institute at John Burns Real Estate Construction illuminates the importance of shifting consumer motivation – both pre- and intra-pandemic – as having an increasing impact on what people purchase, even among new-home options.

Purchase behavior – a nesting-doll-like array of attitudes, preference, demographic and financial markers, educational attainment, livelihood choices, values, principles, access to information – is on shifting ground, JBREC's NHTI analysis suggests.

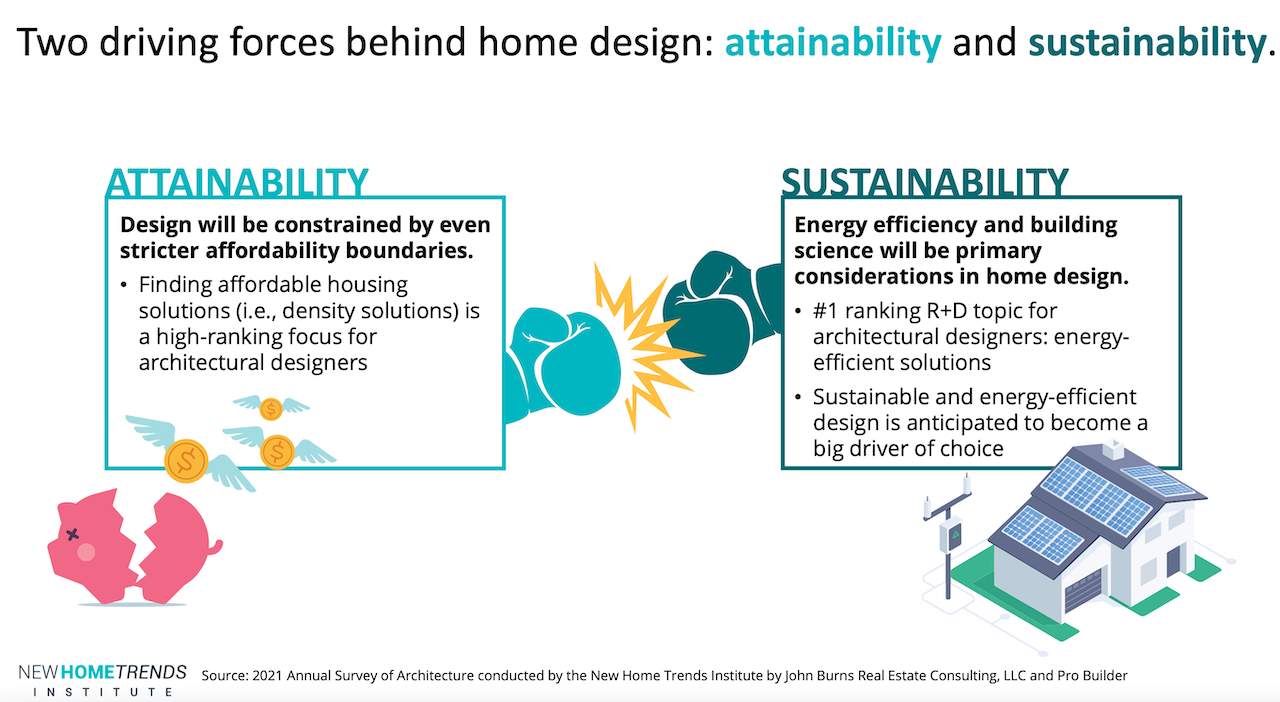

Among active and increasingly important "drivers" of decision and purchase are two bulwarks of consumer value that builders often consider to be mutually exclusive, a clash: Attainability and Sustainability.

NHTI analysts highlight opportunity areas and caveats around efforts to keep new homes within the payment power zone prospective buyers need to operate within:

- Density -- Affordability constraints and land prices result in continued densification in production homebuilding.

- Eat-in Kitchens – Designers make better use of kitchen space to achieve attainability.

- Lowering Costs via Trade-offs – Designers and homeowners reduce costs through value-based material choices.

At the same time, NHTI analysts registered a new seismic shift they reckon will figure consequently in why a consumer will ultimately decide to buy from one source versus another, impacting both the choice and the business of the seller.

That is, being held to account, not just for the basic features and functionality of a home, but for its spread of impacts – environmental, social, etc. – as part of a bigger bucket of value.

They're new to the litany of "drivers" most builders would regard as high-priority areas of customer focus. Further, most homebuilders would probably tell you that when it comes to attainability or sustainability, you can have one or the other, but not both.

Very likely, the next 12 months to five years will serve as housing's learning and discovery lab as to how well homebuilding firms will perform under the assumption that attainability and sustainability are either/or pathways.

As a point of unappreciated friction, however, – and one that may be on par with the sheer forces of supply and demand as business opportunity measures – we view the attainability and sustainability challenge to be a both/and value measure in the minds of more, younger, and ultimately "deciding" consumers of every manner of consumer durable or service.

It's one of those 2022 trends likely to flow through the better part of the decade ahead, starting small, spooling up, and ultimately, becoming how things work.

Join the conversation

MORE IN Leadership

Century Communities’ Jim Francescon Bridges Legacy and Future

At Focus On Excellence, Century Communities’ next-gen leader explores how trust, tech, and team culture are shaping the builder of 2030.

The Digital Thread Is The Next Frontier For Homebuilders

At Focus On Excellence, homebuilding’s innovation vanguard demonstrates how system alignment, credible data, and cultural change can future-proof and spark accountability across all functions.

UHG Fallout: Board Exodus Follows Review Decision

A failed sale, a leadership standoff, and a mass board resignation leave United Homes Group exposed—at a critical moment of macro volatility.