Capital

A $33 Million A&D Loan Propels A 494-Home NJ Deal Into High Gear

This transaction, particularly during economic turbulence and constrained traditional credit, underscores the resilience and adaptability required to navigate the current market conditions.

They say hope is not a strategy.

Nor will a flicker of hope — sparked this week by a good inflation report that may open the door to a September Fed rate cut — go far as a needed adrenaline shot in the arm for homebuilders and developers currently locked out of access to credit.

For builders and their increasingly critical developer and land-bank partners, there's no alternative strategy for not having access to land they need to keep growth, operational planning, trade commitments, and homebuyers synched.

A case study in "what works" may serve – instead of mere hope – to illustrate an opportunity for more decisive and immediate action.

For instance, last week, Builder Advisor Group announced that its Avila Real Estate Capital affiliate arranged a $30-million plus land acquisition and development loan for a builder developer in Mt. Olive, N.J. Here are details of that transaction, what homebuilders and developers need to know, what it all means, and why it matters as so many players continue to hold their breath awaiting that first Fed rate cut.

The $33-million loan arranged by Builder Advisor Group (BAG) and its affiliate Avila Real Estate Capital for Princeton, N.J.-based JAS Group Enterprise Inc. is a testament to the critical role of private capital in the residential development market. This transaction, particularly during economic turbulence and constrained traditional lending, underscores the resilience and adaptability required to navigate the current market conditions.

- We wrote earlier about Avila Real Estate Capital's role in a $362 million loan to acquire the remaining assets of Northern California masterplan gem Mountain House. This loan – and the Mt. Olive, N.J. deal announced last week – are part of more than $800 million in land acquisition and development loans that make AREC one of the largest lenders by dollar volume in the U.S.

The Project

The JAS Group Mount Olive project involves acquiring and developing 110 acres of land to build 494 units, including both market-rate and a complement of locally-required affordable workforce housing. The funding supports various aspects of the project, from land acquisition from the Rockefeller Group, to site improvements like roads, utilities, and storm sewers. With development underway starting in February of this year, and homebuilder NVR now awaiting a cadenced schedule of lot take-downs, the deal came at a critical moment in a project timeline that dates back to a 2017 genesis. The inclusion of affordable housing magnifies the importance of this development, addressing a crucial need in the community.

Why This Story is Important Now

As homebuilders and developers know only too well, the credit market is exceptionally tight. This, sadly, occurs precisely when the demand for affordable and attainable housing has never been more intense. Credit is the lifeblood of the residential real estate and construction business, which requires large upfront capital commitments and investments, with returns often materializing months or even years later.

Several factors have led to the massive reduction or abdication of U.S. banks' roles as debt providers to homebuilders and developers:

- Bank Failures: In March and April 2023, the U.S. experienced its most significant bank failures since 2008. This resulted in a dramatic reduction of credit availability as deposits flowed from regional to national banks.

- Debt Maturities: Over $2 trillion of commercial real estate loans are expected to mature from 2024 to 2027, with significantly higher debt costs compared to when the loans were originated. This situation places additional pressure on the residential real estate and construction sectors.

- Higher Interest Rates and Tighter Lending Standards: These create challenges for borrowers and simultaneously offer opportunities for private capital to step into the credit market.

The impact on residential real estate and construction is evident:

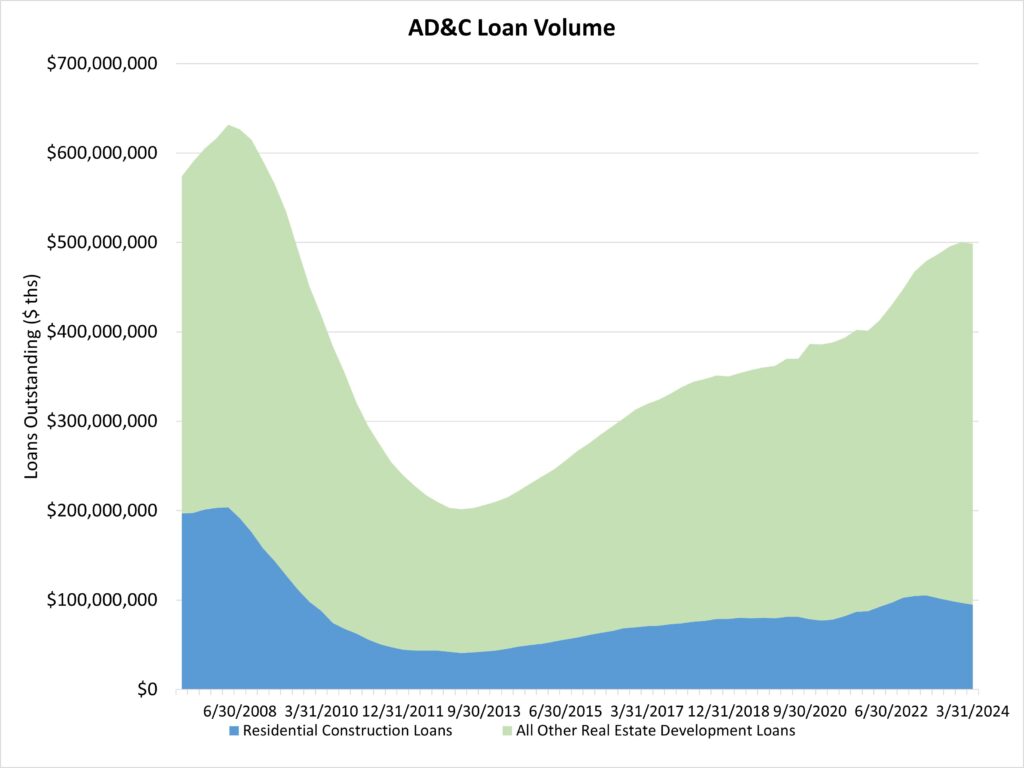

- The volume of total outstanding acquisition, development, and construction (AD&C) loans posted a significant decline during the first quarter of 2024.

- This retreat places the total stock of home building construction loans at $95 billion, a $10 billion decrease from the post-Great Recession high of $105 billion, set in Q1 2023.

To compound those factors, public and private builders are transitioning to a land-light strategy that enhances capital efficiency, creates higher balance sheet returns, and achieves superior valuations. The transition puts pressure on developers as they need capital to support this strategy, opening a big new door of opportunity for private capital to answer that capital need.

The Role of Private Capital

Tony Avila, founder and CEO of Builder Advisor Group and Avila Real Estate Capital, highlights the strategic importance of the Mount Olive project and the role of private capital in facilitating it.

There's an acute shortage of vacant developed lots in the country, and with limited means of capital to develop those lots, our institutional arm provides first mortgages to acquire land and develop lots," Avila says. "This approach simplifies the financing process for developers, eliminating the need for multiple funding sources and reducing the complexity of capital finance."

Avila explains the current market conditions, emphasizing the withdrawal of commercial banks from lending activities:

Banks have pulled back for AD&C lending by 10% year over year. This has created a significant gap in capital availability for land acquisition and development loans." In this context, BAG's ability to offer a one-stop-shop solution becomes increasingly vital. Avila adds, "We figure out how much equity our developer has, the builder puts up a deposit, and we fill the gap, making the process straightforward and efficient."

JAS Group Enterprise Inc.'s Perspective

Michael Sawyer, founder, president, and CEO of JAS Group Enterprise Inc., shares his experience and the impact of the loan on the project. Sawyer highlights the challenges faced in securing traditional bank financing due to high interest rates and regional banks' reluctance to lend for large-scale projects.

Most of my usual sources of funding have been regional banks. Given the constraint on lending, especially in developments of this size, they're unwilling to or don't have the facility to take this on right now," Sawyer notes.

The loan from Avila Real Estate Capital provided the necessary capital to move forward with the project.

Working with the Avila team and getting that source of funding, instead of multiple sources, has been very gratifying," Sawyer says. "It allowed us to get the project moving along in a market that is so needed." He emphasizes the project's importance in addressing the housing shortage, stating, "This project adds a lot of new market-rate and workforce housing to this neighborhood, which is invaluable given the current market conditions."

Adding to the significance of this venture is the personal story of Sawyer, an immigrant and minority business owner with 23 years of experience as a real estate developer and builder in New Jersey.

We're also doing a 200-unit single-family project in Charlotte, NC," Sawyer says. "We've been swamped and active in New Jersey, but geographically, we're beginning to work in other states that we find easier to and more business-friendly."

Broader Market Context

The broader market context underscores the importance of private capital in sustaining residential development activities. The significant pullback of banks from AD&C lending, coupled with the high demand for new housing, creates a critical need for alternative financing solutions. Private capital advisors and investment organizations like BAG and Avila Real Estate Capital are crucial in filling this gap, ensuring that projects continue progressing despite the challenging economic environment.

Tony Avila sums up the strategic importance of their approach:

In the past, developers would need to go to a lender and an equity partner, often resulting in complex and fragmented financing structures. Our one-stop-shop model simplifies this process, providing developers with the capital they need to move forward efficiently."

MORE IN Capital

Tariff Shock Tests Homebuilders M&A Pipeline, Capital Access

Despite market volatility and policy whiplash, key homebuilding deals continue to close. Builder Advisor Group doubles down on financing muscle as banks pull back.

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Housing’s High-Stakes Year: Six New Home Market Shifts To Watch

A massive liquidity crunch is reshaping homebuilding’s financial landscape. M&A is accelerating as builders chase capital and growth.