Land

'23 Plans That Bet Too Heavily On Hybrid Work May Need A Rethink

The future of hybrid and remote work may have arrived ahead of schedule, thanks to COVID-19, but it's not as pretty, buttoned-up, or the sure bet many in residential real estate investment and development are making it out to be.

What a difference a day per week could make.

Stick with me a moment here. If your customer's hybrid home-office set-up is three days in the office and two at home, what's the time and distance he or she will tolerate for a commute?

If reality turns out to be four days in the office and one either at home or elsewhere, it's a shorter leash, no?

Like images in your vehicle's side view mirror, nearer-term opportunity to kick-start new home sales demand may be closer [in] that it seems.

The future of hybrid and remote work may have arrived ahead of schedule, thanks to COVID-19, but it's not as pretty, buttoned-up, or the sure bet many in residential real estate investment and development are making it out to be.

For builders and residential developers, this dilemma complicates an already-tricky next 12 to 24 months in terms of where to focus resources, how to price, what products with which densities to lean on in an effort to re-ignite homebuyer excitement and momentum.

On the one hand, it should be clear as a strategic pathway and motivating as a priority focus area to wire together millennial households, affordability, and a two-off-three-on hybrid-home-office as a bet-able land and community development scenario for the near-future.

The case-in-favor for doubling down on that alignment – seen through the lens of consumer household motivators and some economic benefits to employers – is strong.

- Millennials are still forming families and households, and, largely, still in apartments

- Drive-times – saving 130 to 400-plus hours a year – and costs savings would be a win-win for outer-ring residential development.

- Urban downtown-based organizations could reduce space requirements and costs with more flexible hybrid work policies.

- Too, companies could access deeper, more committed talent pools by tapping more geographically distributed team members.

- Technology platform evolution has accelerated, improving productivity and collaborative capability.

- And, closer to home, as John Burns tweets here below, the impact of the benefit of more space, given that more time is being spent at home, working, playing, eating, relating, and resting goes hand in hand with less expensive square footage, both indoors and out.

Burns' comment complements a Business Insider piece that 'Zoomtowns' ascendance will evolve as an increasingly impactful housing affordability driver – a reimagined "drive-til-you-qualify" for the 2020s.

... a new analysis from the Economic Innovation Group, a bipartisan public-policy organization, argues that, eventually, the shift to working from home may turn into the antidote for the price spikes that we've seen. That's because the places where remote workers are flocking — the Sun Belt region in the Southern US and suburban areas outside big coastal cities — are exactly the kinds of locations that are best-equipped to build cheap housing to absorb the flood of newly remote workers.

"People are able to consider affordability more, while putting less weight on, 'I need to be near the office,'" Adam Ozimek, the chief economist at the Economic Innovation Group and one of the authors of the paper, told me.

If the hybrid work trend were fully baked – i.e. two days at home vs. a more tentative one day, or possibly a discretionary 'earned day' policy, or an even more draconian full-five-days-a-week in the office regime – a doubling-down on tertiary market cities and towns, and farther-out commutes would be a directionally clear signal to put more new product in the path of that trend.

It's the not-baked yet parts that trouble us.

For one, the economy is on a downward trajectory, one that has meaningfully targeted professional and high-income earners in its early-stage disruptions, which means that some of the same households counted in surveys about their plans to stand up to their bosses and demand a work-from-home or flexible hybrid schedule are now losing their jobs.

In that business and economic climate, employers are clamping down on employee-driven discretionary work schedules.

Disney’s boss has told employees who are working from home to return to the office four days a week from the start of March, according to reports.

Bob Iger, the chief executive, said hybrid workers will be asked to treat “Monday through Thursday as in-person workdays”, according to an email seen by CNBC, which first reported the news. – The Guardian

Further, it looks from the data, as though some of the strong reflexive impetus toward flight – the deadly and devastating coronavirus and its highly transmissible nature – seems to have run its course.

Check out this new analysis from Core Logic economist Thomas Malone, who asks, is the flight to the suburbs spurred by the pandemic over?

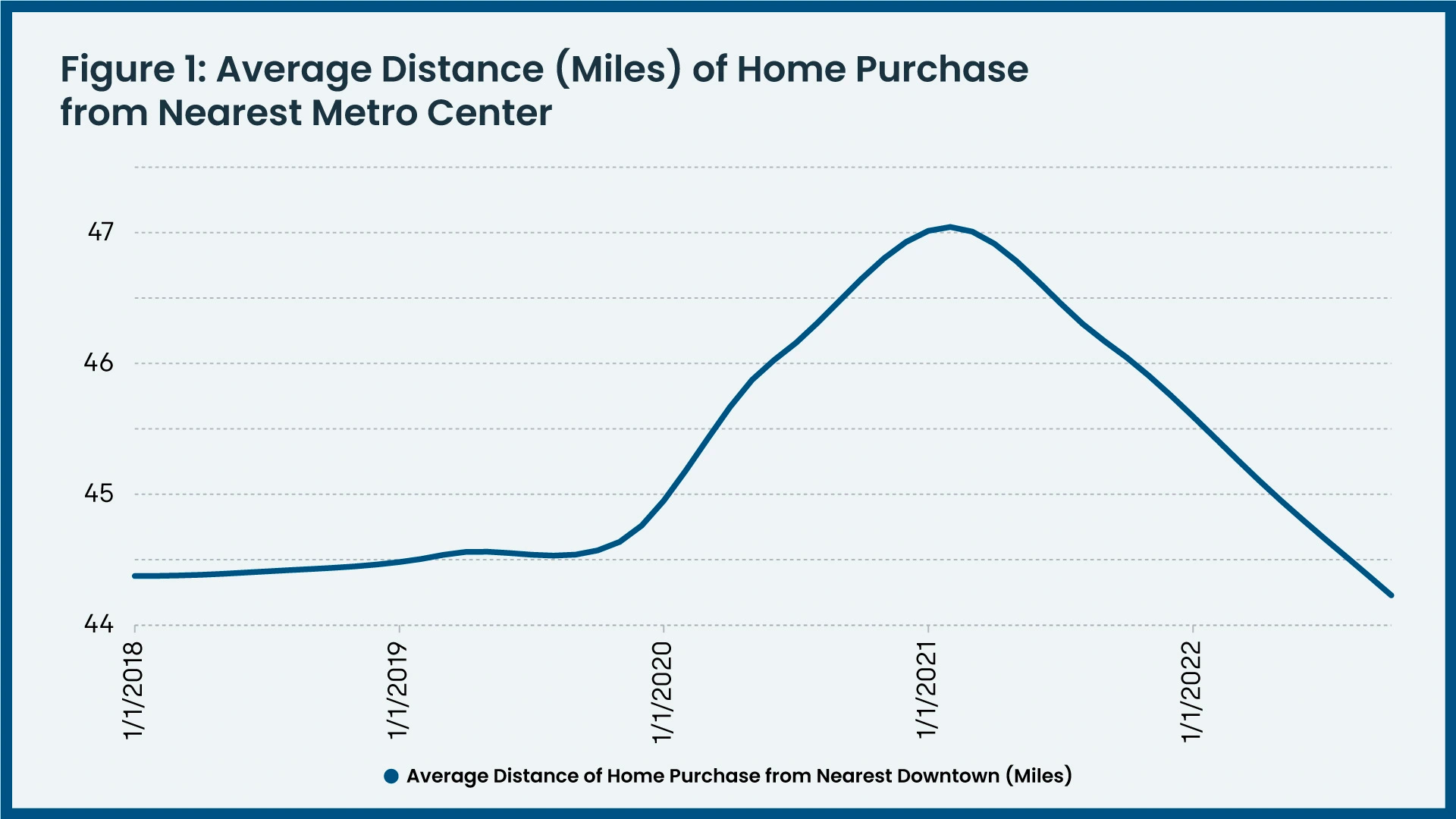

He makes a convincing, evidence-based case that a two-or-so-year blip has blipped out. He writes of the chart below:

Figure 1 shows the average distance (in miles) of a home purchase from the closest downtown metro area from January 2018 to September 2022. From 2018 to early 2020, the average home purchase was around 44 miles from downtown areas, but by December 2020, the average home purchase peaked at 47 miles from downtowns. This outward movement is the product of Americans’ reluctance to visit densely populated areas throughout most of 2020.

The big exodus, says Malone, has begun to peter out.

It is possible that the preference for remote living that the pandemic caused is beginning to fade."

Malone takes care to note that migration and mobility trends that preceded the pandemic era – including a slow rise in remote work, a migration to Sun Belt metros, a magnetic pull of affordability, etc. – are still chugging along and may continue to support some of the manifest destiny expansion of residential markets in the past 24 months.

Here's Malone's wrap-up:

The preference for more far-flung locations may not have changed. Home prices increased at all-time levels between 2018 and 2022. This may mean that preferences for large suburban and exurban homes still exist but that many buyers can’t afford such properties and must choose smaller homes closer to urban centers.

Furthermore, the timing of migration from dense areas dovetails with a rise in first-time homebuyer activity. It is very possible that many Americans bought suburban homes, given that they knew interest rates were as low as they might ever be, and thus made the move to outward-lying areas that many people make as they age. If this is true, we would expect to see an absence of younger, first-time homebuyers in the next few years who reorient purchase patterns closer to downtown areas.

The X-factor here, and one that builders and developers navigating an especially treacherous demand outlook in the next year or two, comes in two big questions. One, is will the Great Resignation flip into the Great Termination, in which case employers who are struggling to find talent today may have far deeper pools of candidates in fairly short order?

The other is the actual end-game for Remote Work as it settles out over a longer stretch of years. Will it be one-day per week at home or away? Or two? Or more?

It's a little early for builders and developers to bet that employees – while they'd benefit for both affordability and quality of life with a 3-day workweek in the office – will wind up with that kind of sway.

MORE IN Land

Steel, Skeptics, And The Real Innovators In U.S. Homebuilding

TBD MasterClass contributor Scott Finfer shares a brutally honest tale of land, failed dreams, and a new bet on steel-frame homes in Texas. It's not just bold — it might actually work.

Home At The Office: Conversion Mojo Rises In Secondary Metros

Big cities dominate an emerging real estate trend: converting office buildings into much-needed residential space. Grand Rapids, MI, offers an economical and urban planning model that smaller cities can adopt.

Rachel Bardis: Building A New Blueprint For Community Living

A family legacy in homebuilding gave Rachel Bardis a foundation. Now, as COO of Somers West, she’s applying risk strategy, development grit, and a deep sense of purpose to Braden—an ambitious new master-planned community near Sacramento.